Dalal Street

08 November 2022

Hi, The Investor’s Podcast Network Community!

☑️ To our American readers, happy election day, and we hope you voted.

If you’re looking to buy a used car, prices have likely peaked after five months of declines, so you can start looking into that 2017 Camry. One index for used cars is down over 15% since its peak.

Of course, financing costs will be a lot more expensive…

In other news, you might know Hims as the Telehealth drug company that offers hair-loss and anxiety meds, but today, it was one of the biggest winners on Wall Street, surging nearly 20% after reporting an excellent quarter 📈

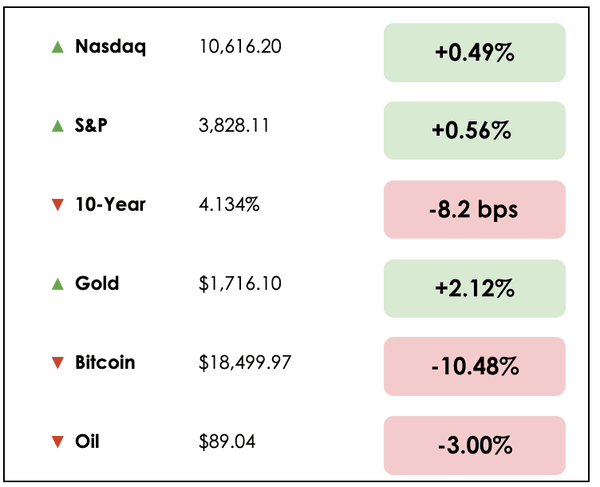

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A huge development in the crypto world between two billionaires and one electric vehicle maker’s bleak future, plus our main story on opportunities on “Dalal Street.”

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💰 Major Crypto Exchange Binance To Acquire Its Peer FTX (Reuters)

Explained:

- Binance Chief Executive Changpeng Zhao (also known as CZ) signed a non-binding agreement to purchase its rival, FTX, to help cover the firm’s “liquidity crunch.”

- A bank run of sorts emerged recently, as FTX’s customers feared that the digital asset exchange lacked the available funds to back their deposits fully.

- This came as rumors spread online about the company’s dire financial situation, while CZ added to the panic by tweeting that he would be dumping his holdings of FTX’s crypto token FTT.

Why it matters:

- FTX’s founder, Sam Bankman-Fried, has been called “the next Warren Buffett” by Fortune, while others have referred to him as the “Crypto King.” Now, his empire appears to be crumbling.

- Bankman-Fried quickly reassured customers that teams are working urgently to clear out the backlog of withdrawal requests and emphasized that all assets were covered 1:1.

- This saga indicates how quickly fortunes can change in the crypto asset world, and the consolidation of two major exchanges will reshape the burgeoning industry.

⚡ Rivian’s Troubles Mount One Year After IPO Bonanza (Bloomberg)

Explained:

- After a disastrous first year for the public company following one of the largest IPOs ever, electric pick-truck maker Rivian Automotive (RIVN) is set to continue burning money as a recession looms.

- The company has lost nearly $125 billion in value since its initial public offering (IPO), with shares down 60% from their offering price. Despite this, its stock still trades at a pricey 50x current sales.

- One analyst said,” Rivian’s IPO was done in a very different environment, in terms of general investor enthusiasm, Tesla’s (TSLA) valuation, and broader market conditions.”

Why it matters:

- While enthusiasm erupted in 2021’s euphoric markets for the firm backed by both Amazon (AMZN) and Ford (F), Wall Street’s optimism has waned dramatically. It now serves as another example of the irrational optimism that drove outrageous valuations over the past two years.

- From global supply chain troubles to rising raw material costs and higher financing expenses due to rising interest rates, Rivian faces major headwinds toward reaching its goal of producing 25,000 electric vehicles next year.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

RECOMMENDED READING

The Average Joe newsletter — Imagine it’s 2023…Inflation has peaked. The Fed stops raising interest rates. Markets have finally bottomed and a new bull market starts.

Over 36,000 investors will be ready since they read The Average Joe — one of the most engaging and concise investing newsletters — filled with market insights trends and ideas.

Here’s how one reader feels: “I enjoy the humor including memes, the info rich one liners, the more in depth articles and the interesting charts. Thanks! A nice job in a short form that I like.”

Sign up here (for free)

THE MAIN STORY: REVISITING INDIAN EQUITIES

Overview

On October 25th, we wrote about how India’s strong economic growth prospects and young demographics made it a desirable place for investors to focus on long-term.

Little did we know, though, that we have an expert on the topic in our audience.

Rajeev Agrawal, CFA, is a fund manager and managing partner at DoorDarshi India Fund, who has employed a value investing framework inspired by Warren Buffett in the U.S. and Indian markets for over 15 years.

He’s also a former technology executive who has worked at the likes of Goldman Sachs, Bank of America, and JPMorgan.

He wrote in to let us know that he continues to see tremendous opportunities in the country, so we checked out some of his recent interviews to learn more.

Breaking it down

In his talk with Edelweiss Wealth Management, Agrawal explains, “the first rule of fishing is to fish where the fish are, and there are a lot of fish in the Indian equity market.”

He says that this stems from the fact that over the next few years, India will have the largest working-age population on earth, enabling it to be among the most rapidly developing economies for decades.

Additionally, because the Indian economy is working from such a lower base, where the GDP per person is just above $2,000, as opposed to nearly $70,000 in the U.S., the runway to catch up with richer countries is tremendous.

And as India moves from a sustenance phase, where many Indians consume based just on their needs, to a more aspirational phase, a middle class will form that fosters massive discretionary consumption.

Geopolitics

This story isn’t just about demographics, though, or rising standards of living for 1.4 billion people, but also India’s unique geopolitical positioning.

Agrawal says, “over the last two decades, China was the factory of the world. However, given the growing trust deficit between China and the world, many more opportunities are emerging for India.”

The thinking is that, as major corporations globally seek low-cost alternatives to China, given the rising political risks there, India can fill the voids created for various industries.

Plenty of opportunities

There’s no shortage of Indian stocks, either.

With more than 5,000 publicly traded companies on India’s Wall Street equivalent (“Dalal Street”) and over 1,200 with market capitalizations in excess of $60 million, there’s a substantial investable universe to consider.

At Agrawal’s fund, rather than focusing on the top 100 or 200 stocks that most mainstream investors consider when viewing India, he concentrates on the other 1,000 investable (sufficient liquidity) companies being overlooked.

He emphasizes that most investors neglect Indian assets, so just by digging beneath the surface a bit, it’s possible to find truly deep value opportunities.

Low allocation to stocks

Another boon for the Indian stock market, suggests Agrawal, is that less than 15% of Indians’ net worth, on average, is in equities.

So as the country grows, becomes richer, and Indian savers realize the wealth creation possible by participating in owning these businesses, a wave of new domestic capital will support stock prices over time.

Long-term growth

In considering what’s necessary for India to achieve its full potential, Agrawal notes that the country must continue to improve its physical infrastructure.

While its digital systems have become robust, infrastructure like roads, railways, airports, bridges, etc., must attract greater investment to facilitate sophisticated economic activity.

This requires the government to transition from being an obstacle to an enabler of growth. On this front, he’s optimistic.

The government has increasingly divested its holdings in recent years in businesses such as Air India so that free markets can better allocate capital at scale.

If the government can step out of the way and allow private businesses and markets to work their magic, Agrawal anticipates a “golden age” of economic growth for India.

Takeaways

As we’ve now written about twice in recent weeks, we think India is a very intriguing place to look for stocks as a value investor or just to increase your allocation broadly with targeted ETFs.

The country has incredible prospects for growth, so we’ll continue to track developments there and emerging opportunities.

If you have any insights to add about investing in India, or questions and comments, just reply to this email to share with us.

Dive deeper

It was great to hear from Rajeev Agrawal and learn more about his fund, and if you want to dive into his strategy further, you can do so here.

And if you missed our last post on India where we discussed ETFs that focus on the country, you can get caught up with this link.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.