Time and Space

13 December 2022

Hi, The Investor’s Podcast Network Community!

Brace yourselves, folks. We got November’s CPI inflation data this morning and…it was good news! 🎊

Economists are calling it a “downside surprise,” as core CPI, which is the Fed’s preferred metric and strips out volatile food/energy costs, rose only 0.2%.

Some quick mental math tells us that’s an annualized rate of 2.4%, pretty darn close to the norms of our pre-pandemic world.

Inflation data is notoriously erratic, so it’s premature to declare victory. However, it lends some credibility to the Fed’s expected decision to reduce the size of rate hikes starting tomorrow ✔️

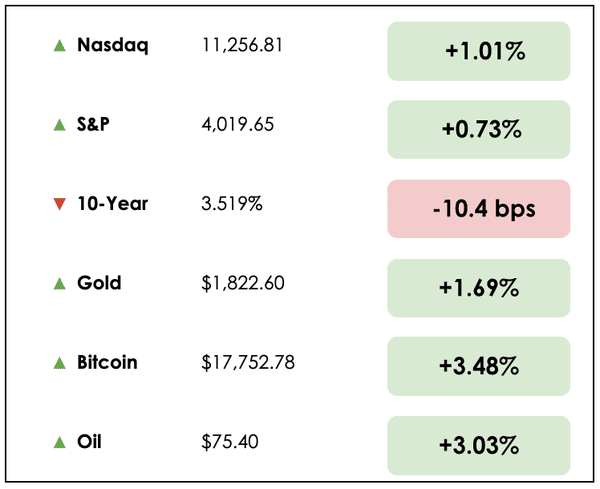

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: The rocket company that boasts an enormous valuation, and a breakthrough in skin cancer treatment, plus our main story on the role that money plays in society.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💉 Cancer Vaccine Shows Early Promise (WSJ)

Explained:

- A new vaccine from Moderna (MRNA) has been shown effective against melanoma, the deadly form of skin cancer, when used in conjunction with a second cancer drug, made by Merck (MRK). That’s according to preliminary study results released Tuesday.

- After surgery and as long as a year on the pair of drugs, melanoma patients in the trial saw a 44% reduced risk of recurrence or death compared with patients who received Keytruda alone (Keytruda is Merck’s cancer immunotherapy drug).

- The trial involved 157 patients with Stage 3 or 4 melanoma that had spread to a lymph node and who faced a high risk of recurrence. The American Cancer Society estimates that more than 7,000 people die from melanoma in the U.S. annually.

Why it matters:

- Moderna, the pharma and biotech company based in Massachusetts, became a pandemic darling as shares soared about 22-fold from its pre-pandemic high to its all-time high share price of roughly $450 in September 2021.

- While Moderna became widely known for its COVID-19 vaccines, the company has been around since 2010, with dozens of treatment and vaccine candidates for everything from cancer to HIV to influenza.

- Not only is the cancer trial news a big step forward toward potentially saving lives, but it’s also good for shareholders: Moderna stock, which is down about 50% from its high, rose more than 20% on Tuesday.

🚀 SpaceX Apparently Valued At $140 Billion (Bloomberg)

Explained:

- Elon Musk’s rocket company SpaceX is rumored to be selling insider shares for $77 apiece, which would give the company an astounding $140 billion valuation.

- While it’s unclear whether SpaceX will try to raise capital at these prices, such a valuation for a speculative space launch company would be impressive in the current environment.

- The company dominates the market for commercial space launches and helps NASA by transporting astronauts to and from the International Space Station.

Why it matters:

- With Tesla (TSLA) stock down nearly 60% year-to-date, and Musk’s controversial yet undeniably expensive takeover of Twitter ($44 billion), SpaceX is a quieter pillar of his wealth.

- Evidenced by its other-worldly valuation, SpaceX is doing some pretty cool stuff, including building a constellation of thousands of Starlink satellites to beam broadband internet coverage worldwide. Musk has entertained spinning off Starlink into its own company, though he suggested it would need to invest an additional $20 to 30 billion to maintain its competitive positioning.

- With Musk’s attention disproportionately consumed by Twitter of late, Tesla investors have voiced their discontent by selling the stock. Since SpaceX is a private company, that’s not as easy to do. However, early investors here appear less concerned.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: WHAT IS MONEY?

Overview

We use money every day in various forms, from cash payments to swiping our credit and debit cards to venmoing friends, or perhaps in saving for the future with money market funds, gold, or, more controversially, Bitcoin.

Money can assume several roles, and our relationship with it has evolved.

But what is money, though, and what purpose does it fundamentally serve?

To ponder this, we turned to Jim Crider.

Time and space

He explains, “money is a means of communicating, storing, and transferring value.” Money enables us to store energy across time and space.

With money, I can travel anywhere (space) and purchase the fruits of others’ labor (expended energy and time) to receive value.

But what is “value”?

Well, that’s subjective. Crider uses an example with a glass of water’s value.

Sitting in your home, it might be worth only a few cents.

While traveling through an airport, a water bottle may be worth a few dollars.

If you were stuck in the desert, though, that same water would have a vastly different value — You’d probably pay any price to quench your thirst.

Money and prices in economics

Price, then, is a signal of perceived value. Presumably, you won’t pay the price for anything that exceeds the anticipated value that it will generate for you.

And someone won’t normally sell you something unless that price captures the perceived value of their energy expended in producing or acquiring it.

Money is the neutral medium to reconcile these disparities in subjective value determinations and agree on a price.

The history

Early civilizations recognized that a neutral store of value that’s supply isn’t easily manipulated is the best way to settle such transactions, rather than relying on a barter system.

Gold and silver became famous for fulfilling this monetary role. They’re good at preserving their purchasing power, the amount of value you can acquire with your money, across time because of their scarcity.

Today’s paper currencies and forms of money aren’t as good at preserving their purchasing power because it’s easy to grow their supply since they’re not pegged to real-world exchange rates like a fixed dollar ratio to gold.

For evidence, consider how much $20 at the store would’ve bought you two decades ago compared to now.

The dollar removed said peg to gold in 1971, which rippled through the rest of the world’s currencies that were primarily tethered to the dollar and indirectly to gold. This moved us all into the “fiat” era, where governments’ full faith and credit back money.

Faith and credit is just a government promise, and our currencies today are only recognized as money because governments mandate it by law.

Inflation costs

Since money serves as a vehicle for exchanging value and preserving purchasing power over time, rampant inflation — as we’ve seen over the past year — inherently distorts these economic signals.

It adds inefficiency by blurring people’s ability to determine whether the offered price in a transaction fairly captures the value they expect to receive in exchange for their money, which is a reflection of their energy spent working to earn that money.

On top of this, it shifts our perspective toward the present, away from the future. If high inflation reduces your spending power, you’ll surely be less inclined to save toward the future.

Instead, you’ll spend more today to maximize the value received in exchange for your money.

Today’s system

In part, central banks like the Federal Reserve target 2% inflation annually because this moderate level of price increases tilts society toward consuming more today and powering the economy forward without increasing prices at a rate that discourages most from still saving for the future.

Crider continues, “the better the form of money, the clearer those signals of communication are because, again, money is a means of communicating value over time and space.”

Compared to others, a better form of money fosters stability in its purchasing power, allowing prices and economic activity to reflect more accurate information.

For decades, fiat money, particularly in the U.S., has broadly yielded stable prices and rapid economic growth.

However, this year’s inflationary surge is causing people globally to question whether their money should be linked to assets with real economic uses or a history of preserving value across time (commodities, precious metals, oil, etc.).

It’s a debate unlikely to go away anytime soon, but it’s important to understand how money impacts society.

We’ve only just begun to touch on this topic.

Dive deeper

To learn more about the history of money and how to think about its influence on society, you can listen to Jim Crider’s full interview on Millennial Investing.

And check out our past write-up on how the world could move to commodity-based money.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.