The October Effect

19 October 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Anyone remember what happened 35 years ago today?

💣 Sadly, I’m (Patrick) old enough to recall exactly where I was when Black Monday unfolded and the Dow Jones dropped 22.6% in one day. To put that in context, it would be the equivalent of a 7,000-point slide based on the Dow’s current levels.

The 10-year Treasury was just under 10% at the time, the inflation rate was 3.6%, George Bush (the first one) was the Republican presidential nominee, and a gallon of gas cost just 89 cents.

Rules have been put in place since then, so-called circuit breakers and trading halts, that would prevent a sell-off of that magnitude from ever occurring again.

👻 This month has historically had some of the worst market corrections, but we’re hoping the scariness of the “October Effect” and a plunging stock market skips us.

In other news, We Study Markets is holding a Stock Pitch Competition and we invite our readers to submit their best ideas and get a chance to win a $1000 gift card, 1-year membership of TIP Finance, and a customized personal TIP-style sketch.

Check out the guidelines and send us your submissions!

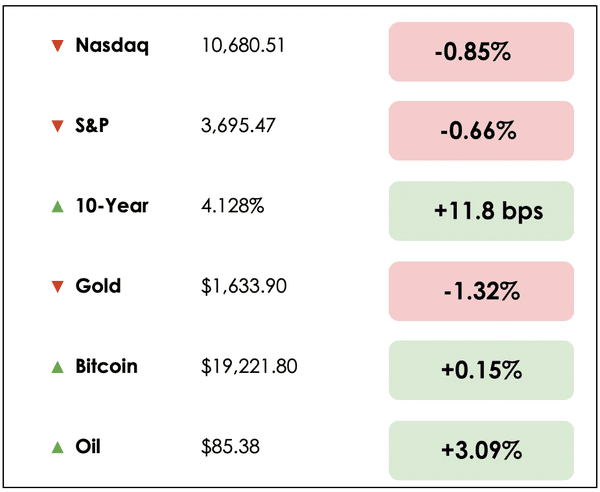

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss what happened to the army of retail day traders, the shriveling IPO market, surging revenues at United Airlines, and attempt to distill the highlights from the last 30 years of Warren Buffett’s career.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💼 Day Traders Go Back To Their Day Jobs (WSJ)

Explained:

- This year’s tumultuous stock market has seemingly zapped retail traders’ enthusiasm.

- The average daily number of retail trades at Charles Schwab (SCHW) fell to its lowest level in two years and was down by nearly three million from a 2021 peak, and Morgan Stanley (MS) saw a 16% decline from last year as well.

What to know:

- Robinhood’s (HOOD) CEO, Vlad Tenev, said that in “2020 and 2021, people were really interested in investing in stocks…there was widespread participation in the stock market. Now people are talking about gas prices and inflation.”

- While speculative options and stock trading have, unsurprisingly, declined with falling markets, so-called “meme” stocks like Bed Bath & Beyond (BBBY) and AMC Entertainment (AMC) showed us in August that such euphoria can be revived at any time after surging dramatically.

🚙 Intel’s Self-Driving Spinoff Seeks Reduced IPO Valuation (Reuters)

Explained:

- Intel’s (INTC) Mobileye is now targeting a $16 billion initial public offering, which is a third of what was previously expected, given elevated stock market volatility and higher interest rates that have crushed demand for new stock listings

- The self-driving unit plans to offer 41 million shares of common stock between $18 and $20 per share with hopes of raising over $800 million.

What to know:

- Jared Camel, a managing partner at Manhattan Venture Partners, said, “the IPO market has been dead, and to revive it, you need a Facebook, Uber, or DraftKings moment to bring others back to the market… Most companies don’t have the grit needed to blaze a trail with all this public market volatility.”

- IPOs by tech companies in the U.S. have fallen to their lowest levels since the Great Financial Crisis in 2008, raising just $507 million in total.

- Notable companies like the Greek yogurt maker Chobani and Reddit have withdrawn or delayed their plans to go public this year.

🛫 United Airlines Shrugs Off Recession Fears (CNBC)

Explained:

- In a remarkable turn of events, following two years of covid-related punches to the gut for airlines, United (UAL) said its revenues were up 25% from pre-pandemic levels in 2019, and the airline remains upbeat despite inflation and recession concerns.

- Shares in the company shot higher on Wednesday, as United’s CEO Scott Kirby emphasized that flexible workplaces were enabling new travel patterns, “hybrid work allows every weekend to be a holiday weekend.”

What to know:

- Kirby said further that “it wasn’t money that constrained people from travel. It was time…(now) they’re untethered from the desk.”

- United posted a third-quarter profit of $942 million, and, adjusting for one-time items, earnings per share came in significantly higher than analyst estimates of $2.28 at $2.81.

- The company also boasted its first double-digit operating margin since the pandemic’s beginning, marking an impressive turnaround for the firm and the sector more broadly.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

DIVE DEEPER: THE GREATEST INVESTOR

Yesterday, we discussed Clay Finck’s excellent review of the life of Warren Buffett on We Study Billionaires, but a 1,200-word newsletter article can’t give the Oracle of Omaha the justice he deserves.

Today, we’ll attempt the impossible feat of covering the last 30 years of his career, but we suggest you check out Part 1 and Part 2 of Clay’s recent podcast, “The Greatest Investor to Ever Live.”

Buffett began the 90s laser-focused on finding the next company for Berkshire to buy. At this stage, he had spent $1.3 billion on Coca-Cola (KO) stock, bought a shoe company called Dexter, and had been buying more shares of American Express (AXP), as well. He had also negotiated to buy 52% of the remainder of Geico for $2.3 billion, giving him 100% control of the company.

By early 1996, Berkshire’s stock had rocketed to $34,000 per share, valuing the company at $41 billion and making Buffett’s net worth surge to $16 billion.

Dangers of Debt

Throughout the 90s, Buffett saw how having too much debt could lead companies to ruin. Several large companies, including the investment bank Salomon Brothers, found themselves in serious financial trouble due to leverage, which had the could potentially cause market contagion. One firm failing can potentially lead to many other firms failing,leading to a financial crisis if public or private bailouts don’t occur.

When companies handcuffed themselves with too much debt and got into trouble, Buffett would come in with plenty of cash and pick up assets and businesses that were trading for pennies on the dollar.

A Strategy for Today

As Clay mentions, today’s financial climate is very similar. There’s tremendous uncertainty in the financial markets. One year ago, the 10-year Treasury was yielding 1.5%, and today it’s just shy of 4%, while the CPI is over 8%. The potential risk of a contagion unfolding in the financial markets is very real.

According to Clay, the best way to position yourself is to carry low levels of debt and hold plenty of cash to take advantage of assets at bargain prices if the opportunity arises. Likewise, those with little to no cash flow and high debt levels may need to sell off assets to meet their obligations, a situation to be avoided.

Dot-com Bubble

At the end of the 90s, Coca-Cola was up 14 times over the decade, which made Berkshire’s stake worth $13 billion. By 2000, the stock had a P/E ratio of 40, and although he knew the stock was overvalued, he refused to sell any shares. Many questioned whether Buffett still had the magic touch as he owned zero technology companies while tech was soaring through the roof.

As Buffett prepared to enter the new millennium, the Dow Jones was up 25%, the NASDAQ was up 86%, and Berkshire’s stock was down 20%. Although criticized for not keeping up with the times, Buffett remained true to himself and stuck to the investing principles that had made him a billionaire many times over. Those principles included:

• Buying with a margin of safety

• Staying within his circle of competence

• Remaining patient while the Mr. Market’s moods shifted.

While other investors were chasing the latest hot tech stocks, Buffett remained rational and said, “when it comes to Microsoft or Intel, I don’t know what the world will look like ten years from now, and I don’t want to play a game where the other guy has the advantage.” As Buffett sat out the dot com mania, other money managers made and quickly lost fortunes. As Buffett knew, prices would eventually revert to the mean, and by October 2022, the NASDAQ had 53% of its gains wiped out.

Biggest Mistakes and the 20-Slot Rule

Buffett gave a speech in 2001 to students at The University of Georgia where he discussed the biggest investing mistakes he had made. Ironically enough, purchasing Berkshire Hathaway and spending 20 years trying to revive a failing textile mill was at the top of his list.

He also mentioned mistakes of omission and missing out on big winners such as Fannie Mae (FNMA) and Walmart (WMT). These mistakes were due to his cautious approach to investing and only making a purchase if he had a high conviction on it turning out profitably.

Buffett also explained to the students his “20 punches approach to investing.” He said, “I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches — representing all the investments you got to make in a lifetime.”

Key point: Your odds of success improve when you are forced to direct all your energy and attention to fewer investments or tasks.

The Wisest Investment

Buffett gave another talk at Georgia Tech and was asked what his best investment advice would be. He told the students the best investment they could make in life was in themselves, encouraged them never to stop acquiring knowledge, and to go to bed a little smarter each day.

Buffett said the mind is the most powerful weapon to succeed in investing, which is why he spends 80 percent of his working day reading and thinking. He also urged them to refine their communication skills which “can improve your value by 50 percent.”

Buffett pro tip: “Do work you love and work for whom you admire the most, and you’ve given yourself the best chance in life you can.”

Apple

One of Buffett’s most notable investments was his purchase of Apple (AAPL) shares. For years, he had been known as the guy who never invested in technology, even though the world was becoming dominated increasingly by tech companies. Buffett stated that he didn’t view Apple as a tech stock. Like Coke, he made his purchase in the company based on the brand’s durability, likely to persist well into the future.

Berkshire first started purchasing Apple in 2016 after the stock had a sizable pullback due to slowing sales of their iPhones. Buffett saw millions of people were using Apple products daily, loved them, and bought new products every couple of years.

According to the 2021 annual report, Berkshire owns 907 million shares of Apple at a cost basis of $31 billion, which now has a market value of roughly $161 billion. The company has been a home run for Buffett and has grown to be approximately 46% of Berkshire’s stock portfolio.

Not only is Apple a cash-generating machine, but they also are a proponent of share repurchases — two items Buffett loves to see. In 2021, the company repurchased $85.5 billion of its own shares and paid out $14.5 billion in dividends to shareholders.

Final Lessons

Alice Schroeder rightfully named her book covering Buffett, The Snowball. His snowball of wealth started at a very young age when he started selling packs of gum and cans of soda to his classmates and bought his first stock at age 11.

He learned the magic of compounding early and knew that he would one day be incredibly wealthy. He continued to invest over the course of his lifetime and found great mentorship in books and people like Benjamin Graham.

He was always extremely frugal, knowing that $10 today would eventually become a much bigger sum if he successfully invested it. He also was a learning machine and was singular in his devotion to mastering the art of investing.

Finally, he let compounding do most of the heavy lifting for him, as today he is 92 years old and has accumulated over $96 billion in wealth. Most of us will not acquire this kind of wealth, but we can apply the life lessons and investing strategies to clone the world’s greatest investor to ever live.

Go Deeper

Frankly, we had to leave out a lot due to space considerations, so please listen to Part 1 and Part 2 of Clay’s podcast on We Study Billionaires for a much more in-depth discussion of Buffett’s career.

Readers — Let us know. What’s your favorite Buffett biography?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.