Tech Moats

25 August 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

If you’re feeling some anxiety about higher electric prices, you’re not alone.

One report suggests that around twenty million households, that is, one in six homes in the U.S., are behind on utility payments. Ouch 🤕

In other news, China announced nineteen new stimulus measures worth around $146 billion in hopes of stabilizing its deeply troubled property market.

At the same time, a huge drought across the country is causing energy shortages and blackouts while important rivers for shipping cargo remain too low to navigate which poses further threats to global supply chains.

And in response to greater geopolitical tensions with China, Taiwan’s government has proposed a 15% increase in defense spending for next year.

No shortage of crises to keep track of on this side of the world…

In the U.S., a new estimate of second quarter GDP showed that the decline was marginally less worse than feared.

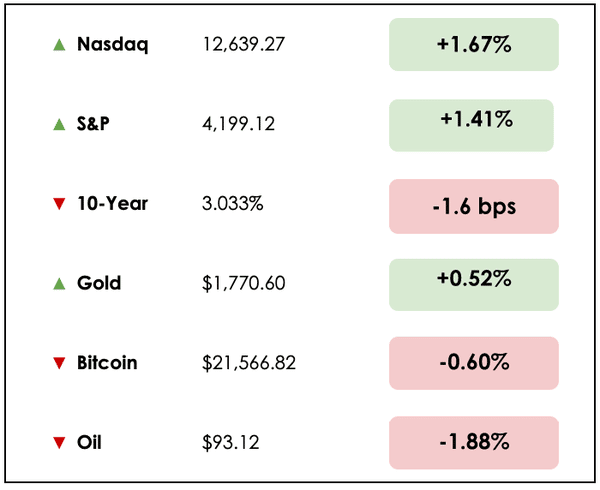

Here’s the market rundown for today:

*All prices as of today’s market close at 4pm EST

Markets remain choppy, and there was no clear driving logic underpinning the equity rally. All eyes on Powell’s Jackson hole speech at 10am EST tomorrow.

Today, we’ll discuss the bounce in Chinese stocks, hedge fund bets against Italy’s sovereign debt, the Fed’s dilemma, and the durability of tech moats.

All this, and more, in just 5 minutes to read.

After you read today’s newsletter, please take a moment to fill out our reader survey — this helps us better create content for you.

Let’s go! ⬇️

IN THE NEWS

Why Are Chinese Stocks Bouncing? (Fool)

Explained:

- Shares of the largest e-commerce company Alibaba (BABA), jumped nearly 8% in morning trading today, while shares of JD.com (JD), China’s biggest retailer, soared nearly 9% as news spread that the U.S. and China were nearing an agreement that would let U.S. auditors have access to the records of New York-listed Chinese stocks.

- Chinese stocks struggled earlier this week, with Hong Kong’s Hang Seng index down about 3.6%, as the country’s economy continues to slow after COVID-19 lockdowns.

- After receiving worse-than-expected sales and industrial production data, China’s central bank lowered key interest rates on Monday to boost the economy.

What to know:

- Lower interest rates tend to favor high-growth tech companies, because they often have distant (expected) future positive free cash flows which are discounted at lower rates thus raising their present value. In addition, investors tend to become more optimistic and aggressive when rates are cut from the momentum of corresponding stock price increases.

- This year, shares of Alibaba have taken it on the chin. The stock is down 19% year-to-date, while news of both Charlie Munger and Ray Dalio dumping the stock, along with threats of being delisted from U.S. exchanges by the SEC, have given investors the jitters and put downward pressure on its price. We’ve shared our thoughts on Chinese equity risks in the past.

- It may take time for Chinese tech stocks to recover. To do so, they will need some favorable global macro tailwinds along with favorable regulatory guidance from the Chinese authorities.

Powell’s Dilemma: Are The Drivers Of Inflation Here To Stay? (WSJ)

Explained:

- There’s concern among central bankers that the recent surge in inflation may not be “transitory” as once thought, but instead, may represent a transition to a new, lasting reality. The Fed’s target of 2% inflation may seem a long way off to consumers, but Jerome Powell says the Fed’s commitment to successfully battling inflation is “unconditional.”

- Mark Carney, former Bank of Canada and Bank of England governor, said, “The global economy is undergoing a series of major transitions. The long era of low inflation, suppressed volatility, and easy financial conditions is ending.”

What to know:

- This new era could mark an abrupt change after a decade in which central bankers worried about too-low inflation and used monetary policy to fuel expansions and investors became accustomed to “easy money.”

- Several Fed officials expect Powell to err on the side of raising rates too much in his quest against inflation which may cause weaker economic growth, higher unemployment, and a more painful recession.

- We’ll find out more tomorrow morning on Powell’s plans as news unfolds from his talk at the Jackson Hole Economic Symposium.

Hedge Funds Betting Big Against Italian Debt (FT)

Explained:

- Political turmoil in Rome and Italy’s dependence on Russian gas imports is incentivizing hedge funds to take large bets against the country’s government bonds. The IMF warned that a Russian gas embargo would lead to an economic contraction of more than 5% for Italy.

- According to S&P Global Market Intelligence data, the total value of bonds borrowed by investors wagering on a fall in Italian bond prices hit its highest level since 2009 at more than 39 billion euros.

What to know:

- Italy is considered among the most vulnerable countries to the European Central Bank’s decision to unwind its stimulus programs by raising interest rates and halting bond purchases which have propped up the country’s debt market worth 2.3 trillion euros.

- Hopes of smooth political seas were dashed for Italy when former ECB chief Mario Draghi resigned in July and his administration unraveled. Early elections to select his replacement are slated for September.

- Betting against Italian debt has previously been a lucrative trade resulting from the country’s political woes. Still, many traders remain hesitant due to the ECB’s newly announced transmission protection instrument, which is a tool designed to keep borrowing costs in highly indebted eurozone countries from rising too far above stronger nations such as Germany.

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the red flags from PassiveInvesting.com.

QUOTE OF THE DAY

“If you have a strong business with a strong customer value proposition and a moat to protect that business, you are going to win, period. And that’s really how I approach the market”

Seessel is a new school value investor whose sought to embrace Warren Buffett’s teachings while adjusting them for the digital age.

(We’ve written about him before, but we’re big fans and just can’t get enough, so bear with us.)

In his pursuit of understanding tech companies, he’s found that there are certain universal truths that cannot be overlooked.

As explained above, these relate to the value that a business offers to its customers, and its ability to sustain that business into the future without deterioration due to new entrants in the space.

What to know

While Seessel explained to Trey Lockerbie in a recent We Study Billionaires podcast that most tech stocks aren’t immune to having their excess profits arbitraged away by new competitors, there are a few that he highlights with seemingly insurmountable moats and tremendous customer value, such as Amazon, and Alphabet (Google), which we did a deep dive on last Thursday.

For him, the rise in technology is unequivocally a sweeping macroeconomic trend, yet there’s a simplistic beauty to how he narrows his focus amidst this broader revolution to the core digital advantages that certain businesses possess.

This focus on moats, which is a timeless investing principle, also defines Seessel’s new era investing approach. If a digitally-based business has no visible technological moat, he suggests not to even bother owning it.

And to judge just how good a company’s moats are, he likes to consider the quality of businesses who have tried to compete with them previously.

For both Alphabet and Amazon, this is an extensive and impressive list.

These companies are great examples of how continuously reinvesting cash flows into productive research and development (R&D) projects feeds into attracting the best talent and ultimately beating out competition through impenetrable moats.

Breaking it down

Due to outdated GAAP accounting principles, though, much of this R&D investment is expensed for tech companies, which distorts their earnings and leaves them looking expensive on traditional valuation metrics, explains Seessel.

In other words, when more traditional companies invest in, say, a new warehouse, this becomes an asset on their balance sheet that can be slowly depreciated over many years.

So the depreciation costs may have a relatively negligible impact on earnings in any given year, but when tech companies invest in their intellectual property, which he calls the “lifeblood” of their businesses, they typically must expense the cost immediately, thus dramatically reducing earnings on a surface level.

For example, Facebook (META) has invested heavily in virtual reality and also in smaller projects like predictive AI chatbots.

These are examples of R&D expenses that create lasting value for the company and more likely serve as lasting assets to be depreciated than a cost that should be recorded as soon as it’s incurred.

Understanding differences in income reporting, then, is paramount to properly valuing companies on the cutting edge of innovation with respect to more conventional stocks.

Wrapping it up

Let us know — Which stocks do you follow with the best moats?

Do you agree with Seessel that Alphabet and Amazon are great businesses to own?

As we said at the top, we did a deep dive on Seessel a few weeks back which you can find here.

For finding stock picks with great tech moats, we love perusing the expert commentary on Seeking Alpha’s platform. We have an amazing new partnership with them where you can earn a $140 discount on their annual premium plan 💰

Check it out here for yourself!

ONE MORE THING

🍲 One thing Shawn loves: Vietnamese Pho. A good bowl of this stuff cleanses the soul. I’ve been a big fan of the traditional dish ever since a trip to southeast Asia in January, 2020 (great timing, right?).

Seriously though, it’s phenomenal with a little added garlic and a slice or two of lime. Even during the summer heat, I find myself consuming the soup. I spent this past weekend moving apartments, and after a long day of lifting boxes, carrying couches, and all the other associated joys of relocating, nothing hit the spot better than a bowl of hot Pho.

Readers: Tell me — What’s your dish of the summer?

Anything you just can’t get enough of? 🤔

You can also connect with me directly on LinkedIn or Twitter.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.