Surviving Winter

06 December 2022

Hi, The Investor’s Podcast Network Community!

Stocks aren’t the only thing coming back down to earth: The hard seltzer revolution is fizzling out, at least for companies’ bottom lines ☠️

Just when it seemed that every beer and liquor company on Earth was launching a seltzer brand, it appears that supply has outpaced demand ~shocker~ 🤥

Boston Beer (SAM), which owns the likes of Samuel Adams, Angry Orchard, Dogfish Head, Truly, and Twisted Tea, saw its stock downgraded to “Sell” by Deutsche Bank (DB), with hard seltzer sales declines expected well into 2023 due to competition.

More on that below.

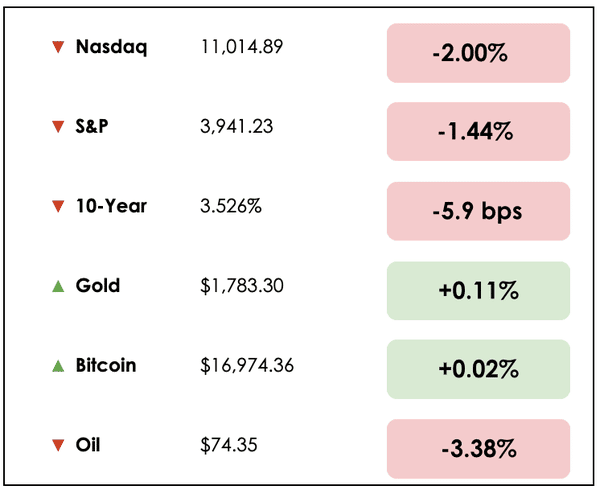

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A record-breaking investment in the U.S., and Facebook pushes back against Congress, plus our main story on how the European energy crisis is going.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

📱Cashing In On Chips (FT)

Explained:

- President Joe Biden will join the founder of Taiwan Semiconductor Manufacturing Co. (TSM) to announce the opening of a second chip plant in Arizona, raising the company’s investment in the state from $12 billion to $40 billion. It will mark one of the largest foreign investments in U.S. history.

- The company will also announce greater production for more advanced chips than originally planned. However, a spokesperson for the company indicated that chip fabrication in the U.S. would remain one technology generation behind the most advanced production in Taiwan.

Why it matters:

- Biden’s Chips and Science Act was passed this summer, providing $52 billion in subsidies for chipmakers based in the U.S. and countering China’s massive investments in its own chip sector.

- The pandemic shined a bright light on U.S. dependence on Chinese manufacturers as lockdowns led to a global shortage of high-tech chips.

- Industry experts commented that the added investment in the U.S. could provide only minimal supply chain security given the immense risks incurred if China were to attack Taiwan, where TSMC is headquartered and maintains most of its production capacity.

📰 Facebook Threatens To Remove News From Its U.S. Platform (WSJ)

Explained:

- Meta Platforms (META) threatened to remove news from Facebook in the U.S. if Congress passed a proposal forcing big tech groups to systematically pay publishers and broadcasters for carrying their content.

- The warning came Monday after a long-debated bill to empower American newsgroups was attached to the National Defense Authorization Act, which significantly increased its chances of being enacted.

Why it matters:

- Meta has spent hundreds of millions of dollars on journalism in recent years, reaching deals with dozens of newsgroups worldwide. But it has resisted regulatory moves that mandate payments.

- Meta spokesperson, Andy Stone, commented that the proposal fails to recognize that publishers and broadcasters put content on the platform because “it benefits their bottom line — not the other way around.”

- The News Media Alliance, a trade group representing newspaper publishers, is urging Congress to add the bill to the defense bill, arguing that “if Congress does not act soon, we risk allowing social media to become America’s de facto local newspaper.”

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: UPDATES ON EUROPE’S ENERGY CRISIS

Overview

You’ve probably heard a lot about a pending energy crisis in Europe this winter.

Fortunately, an unusually mild winter has lessened concerns that electricity demand for heating homes will create blackouts.

We shouldn’t forget, though, that Europe’s energy landscape has fundamentally changed since Russia invaded Ukraine, with flows of natural gas now being weaponized against the continent.

At a “Carbonomics” conference in London last week, senior leaders across Goldman Sachs shared their perspectives on how Europe’s energy crisis is unfolding.

Breaking it down

Gonzalo Garcia, co-head of Goldman’s Investment Banking units in Europe, the Middle East, and Africa, says that the war in Ukraine “has brought to the forefront Europe’s critical, decades-long dependence on abundant, stable, and cheap energy.”

That cheap energy, which powered Europe’s industrialization during the 20th century, has chiefly come from Russia’s abundant natural gas reserves.

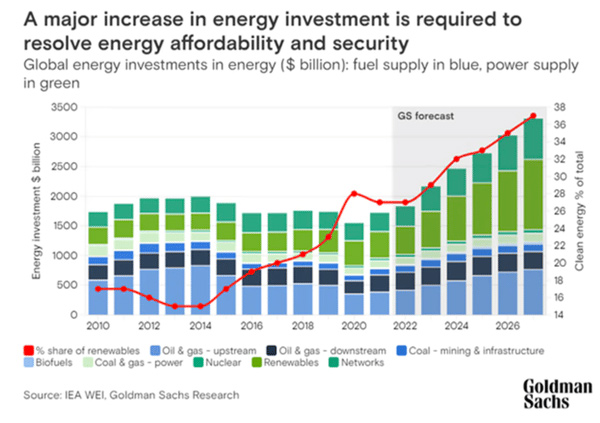

As oil and gas companies have come under tremendous external pressure while the world seeks to rein in carbon emissions, investment in fossil fuels fell 57% between 2014 and 2020, according to Michele Della Vigna, who is Goldman Sachs’ head of Natural Resources Research.

However, investment in renewables to offset these declines hasn’t kept pace, leading to a 22% fall in total energy investment in Europe.

Investing in the future

This, combined with Russia’s moves to cut off its natural gas flows to Europe in response to sanctions and military support for Ukraine, leaves European countries scrambling to ensure their energy security.

Della Vigna states that to address this energy shortage and also achieve net zero emissions targets, “we need to unlock an extra $1 trillion per annum of global investment in energy over the next five years.”

To fully transform Europe’s energy infrastructure, it’s thought that $10 trillion will need to be invested by 2050. According to Goldman Sachs’ estimates, this would cut the continent’s dependence on energy imports from 58% to 15%.

Happening now

This winter, efforts to stockpile natural gas alongside mild weather may enable Europeans to avoid the worst-case scenarios with entire energy grids seizing up.

Shifting our time horizon forward, though, is when things get more concerning. As energy strategist Samantha Dart explained, it’ll take three to four years before any new gas project come online.

She says, “Our view is that Europe can get through this winter without blackouts because of how much natural gas storage was built. The problem is when we get to spring, we must do it all over again.”

What comes next

And this is a good point. Next winter, Europe won’t have had several months to refill its gas storages with Russian gas, and new renewable or carbon-based energy projects will not be ready at scale to fill this void.

Dart continues, “it’s going to be a couple more years of big challenges for Europe.”

At the same time, higher energy prices will only fuel inflation further and push Europe deeper into recession.

Additionally, these dynamics make its industries structurally less competitive since they have higher energy input costs than competitors in North America and Asia.

Takeaways

It’s a complicated picture. The abbreviated conclusions from Goldman Sachs’ experts are that Europe is in good shape to survive this winter, but there are no obvious solutions to its energy crisis until at least 2025.

The real question, then, is what steps countries can take to prepare for next winter when electricity demand will once again surge to heat homes with even less Russian gas available than there was this year.

If you know the answer, write in and let us know.

If these bleak assumptions prove true, the ramifications are significant, ranging from a weaker euro for the foreseeable future to an environment where European companies are fundamentally less competitive due to higher energy costs for business activities.

And that is to say nothing about the geopolitical dynamics, such as how rising social tensions from a weak economy and inflation could weigh on governments’ willingness to maintain sanctions on Russia.

Dive deeper

To learn more, check out this article on how Europe can replace Russian gas while still achieving emissions goals.

Or you can listen to Lyn Alden’s recent interview with Stig Brodersen on current conditions in energy markets.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.