Sugar, Money, and Dirt

09 December 2022

Hi, The Investor’s Podcast Network Community!

In a shocking upset, Croatia booted Brazil out of the World Cup earlier today 🥾

How’s that for a start to the weekend, huh?

In other news, apparently there’s a glut of yoga pants out there because Lululemon’s (LULU) stock got hammered today — down over 13% — after projecting a weak sales outlook, reporting lower than expected gross margins, and revealing an 85% surge in unsold inventory 😬

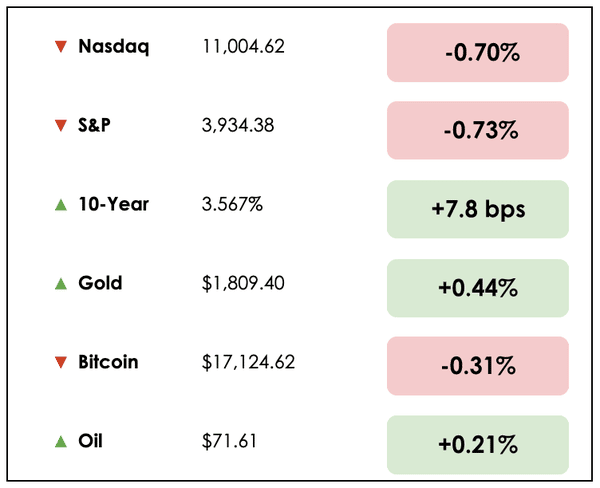

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A major pension fund bailout, and new developments in virtual reality, plus our main story on the company run like a mini-Berkshire Hathaway.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🗣️ Biden Reveals $36 Billion Pension Bailout (Bloomberg)

Explained:

- President Biden announced a $36 billion bailout for the Central States Pension Fund, one of the nation’s biggest multi-employer plans.

- Despite a remarkable bull run in financial asset prices over the last decade, the fund is apparently still underwater, with the money infusion helping “prevent drastic cuts to workers’ hard-earned pension benefits scheduled to occur within the next few years.

- 350,000 union workers and retirees faced up to 60% cuts in benefits.

Why it matters:

- The move is largely seen as an effort to ease tensions with labor groups after the President forced freight-rail workers to accept a contentious compensation scheme.

- This is the “largest-ever award of federal financial support for worker and retiree pension security,” according to the White House.

- Critics see the bailout as a way to buy union loyalty while setting a dangerous precedent for mismanaged pension funds to expect government help.

🥽 The Metaverse Meets Sports (Bloomberg)

Explained:

- Infinite Reality Inc., which aims to “build metaverse experiences,” is expected to merge with a SPAC known as Newbury Street Acquisition Corp. over the next few weeks as the transaction details are finalized.

- The company announced in October a multi-year partnership with Warner Bros Discovery (WBD) to create immersive virtual experiences between fans and athletes in sporting events.

- The arrangement will be showcased in the upcoming UCI Track Champions League, a series intended to boost track cycling into a “thrilling spectator experience.” Infinite Reality says it’s “empowering fans to engage with sport in new and exciting ways.”

Why it matters:

- The company recently acquired e-sports firm ReKTGlobal, whose CEO argued, “We believe that the future of business, entertainment, socializing, and learning will be conducted in digital environments and that Infinite Reality is the company that will bring it all to life.”

- While many remain skeptical of these sorts of bold claims, companies like Infinite Reality are pioneering a new industry and proving that, even in a higher-interest environment, it can attract new financing to fund its endeavors.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: An overview of the last 30 years of Warren Buffett’s career, from our YouTube channel

👂 LISTEN: How to run your own private equity portfolio, with Darin Soat

THE MAIN STORY: THE MINI-BERKSHIRE HATHAWAY

Overview

William Green, in his book Richer, Wiser, Happier, describes Tom Gayner as the patron saint of steady progress and says, “The best investors build an overwhelming competitive advantage by adopting habits whose benefits compound over time.”

While many investors jump from one promising stock to the next much like yo-yo dieters trying the next fad, Tom Gayner has adhered to a stock-picking strategy based on four principles that haven’t changed in over 30 years.

Gayner considers his four pillars of investing like guardrails to prevent stupidity. They’re his North Star, and consistently sticking to them has allowed him to produce annual investment returns in the high teens.

Who is Tom Gayner?

It’s not surprising that as a boy, Gayner’s idea of a fun Friday night was to watch Wall Street Week with Louis Rukeyser on PBS with his grandmother.

That same boy grew up to become the Chief Investment Officer and CEO of Markel Corporation (MKL). Mr. Gayner worked as an accountant, a stockbroker, and an equity analyst before joining Markel in 1990.

Markel is a Fortune 500 holding company for insurance, reinsurance, and investment operations worldwide and is structured like a mini-Berkshire Hathaway. Gayner likes to describe the company as a publicly-traded family office.

The company currently manages over $21 billion in stocks and bonds, oversees 17,000 employees, and operates 19 fully-owned companies.

The Four Pillars

We love a simple methodology for investing, and Gayner’s four-point plan for investing in stocks is logical, easy to understand, and profitable.

Here’s what Gayner is looking for in a company:

- Sound financials — Companies with great long-term profitability, high returns on capital, and low debt levels.

- Management with integrity and talent — Gayner will not compromise on integrity. Management must be talented, but a lack of integrity will kill you even if you get everything else right.He said, “My father used to tell me that you can’t do a good deal with a bad person.”

- Compounders — Gayner looks for businesses with attractive reinvestment opportunities.He wants consistently high returns on capital, compounding earnings, and ample cash flow. He likes compounding machines that are steadily growing their intrinsic value over time.

- Valuation — Finally, Gayner is patient and doesn’t want to pay too much for these compounders. Paying a fair price for an outstanding business is essential.

Circle of Competence

When asked what his circle of competence is, Gayner likes to say, “Sugar, money, and dirt.”

The sugar component includes businesses that produce food, candy, chocolate, and alcohol. Products that human beings love and use regularly.

These businesses are generally understandable and produce regular cash flows.

Gayner also likes companies involved with money, including banks, brokerage firms, insurance companies, financial advisory businesses, and investment management.

Finally, the dirt aspect of his circle of competence includes companies with real estate or tangible assets you can touch and feel. They also tend to produce predictable cash flows.

Gayner is continually trying to expand his circle of competence. He said, “the world keeps spinning, and things don’t stay the same, so you always need to be working and learning and studying to make sure that your circles of competence are relevant.”

Lessons from Buffett

Gayner has been heavily influenced by Warren Buffett and was once asked what the main lesson he’s learned from the Oracle of Omaha is.

He said one lesson wouldn’t be able to do justice to Buffett.

Still, he argued some key ideas would include “Remembering that investing is based on underlying businesses, constantly working to learn as much as you can about as many things as you can, telling the truth, remembering that you are a steward and that people are depending on you to do your best, and working as many hours of the day as you can stay awake.”

On Reading

Gayner is a bibliophile and, like many investment legends, reads widely in history, psychology, human nature, technology, and scientific thought.

He once stated, “The world is a fascinating place, and you’ll never run out of rich material if you want to keep understanding more and more.”

Security Analysis and The Intelligent Investor have stood the test of time as investment classics, but he also recommends Mark Twain for garnering insights into both human nature and money.

Twain was both broke and very wealthy several times in his life, and his writing carries an undertone of his struggles with money.

Gayner says, “You get a twofer with Twain. You can laugh and learn at the same time.”

Dive Deeper

To learn more about Tom Gayner and his investing strategies, check out We Study Billionaires interview with him.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.