Stay the Course

03 January 2023

Hi, The Investor’s Podcast Network Community!

Much has changed in the past year of markets 😦

A year ago today, the S&P 500 hit its all-time closing high of 4,796.56.

But stocks fell for most of 2022 and picked up right where they left off to begin the new year.

Tuesday marks the index’s 251st trading session without a fresh closing high, the longest streak without a new record since a 285-session stretch ending in July 2016.

Barring a massive rally this month, that streak will snap.

Elsewhere, Croatia has joined the Eurozone (🇪🇺), replacing its historic kuna with the euro. It’s the 20th country to join the currency bloc.

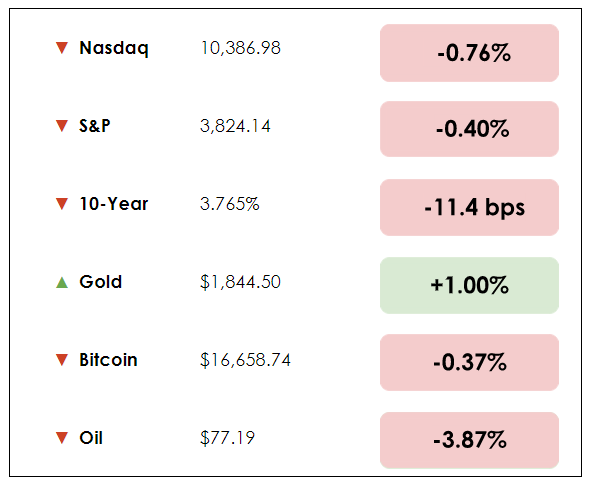

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: GE continues to break apart its businesses and Japan offers families money to leave Tokyo, plus our main story on the importance of staying invested over the long haul.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

- General Electric Co. (GE) will kick off 2023 by splitting off its healthcare unit as it pushes forward with a slow-motion breakup of the iconic industrial giant.

- The new company, GE HealthCare Technologies Inc., will begin trading publicly this week, leaving the previously sprawling conglomerate with three main divisions: jet engines, natural gas-powered turbines, and wind turbines. The gas and wind turbine units are expected to combine with other GE energy businesses into a new company called GE Vernova that will split off early next year.

- GE’s current CEO, Larry Culp, will lead GE Aerospace, the biggest and most profitable unit, with a projected enterprise value of $94 billion. GE HeatlthCare is expected to fetch a $48 billion valuation, with GE Vernova under $13 billion.

- The Boston conglomerate’s three-way split follows years of restructuring, sales of entire business divisions, and a remake of the famous brand’s management philosophy. The spinoffs hope to simplify each unit’s operations while making the underlying assets more attractive to investors when structured independently.

- David Giroux, the chief investment officer of T. Rowe Price Investment Management, believes that after the GE HealthCare split, “There is a very powerful recovery story in the core aerospace business over the next five years.”

- For GE Vernova, some investors are concerned about merging carbon-burning natural gas-powered turbine assets with its portfolio of renewable energy investments. One said, “As an investor, I think the idea of having a pure play renewables company is easier to swallow…How do you own a potential enabler of decarbonization like GE (when) owning it will also increase your portfolio’s carbon intensity significantly?”

- As the Japanese government works to reverse decades of demographic decline, officials hope to tempt families to relocate crowded Tokyo for surrounding municipalities. If the families leave, they’ll receive one million yen ($7,600) per child.

- It’s a well-known phenomenon that families in cities tend to have fewer children, especially in developed countries, which is perhaps why Japan is eager to push young families out into the countryside and smaller cities.

- Additionally, the mass migration of past years has hollowed out countless rural towns and villages. It’s estimated that there are nearly ten million unoccupied homes abandoned intentionally across the country.

- While Japan is a decade or two ahead of many developed countries, it has plenty of peers across Europe and Asia who also face structural societal challenges as birth rates stagnate near or below replacement levels.

- As seen in Japan, if a shortage of new births persists, you ultimately get a demographic structure where most people in society are elderly, and there aren’t enough young workers to support them or the broader economy.

- For the country’s latest baby cohort, forecasts for the first nine months of 2022 fell below 800,000, the first time since the 19th century that new births dropped that low in Japan.

Overview

Warren Buffett once said, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.”

Unless something fundamentally changes with a business or industry (it happens), he keeps short-term events from distracting him from long-term goals. It often does more harm than good.

For years, investors of all experience levels have tried to time the market and avoid painful bear markets. Wouldn’t that be more lucrative? Unfortunately, it’s not that easy.

2022 was a rough year for many investors, with nearly every corner of the market in the red, from stocks and bonds to crypto and even gold.

In today’s piece, we welcome the new year with a reminder about the value of staying invested, assuming you’re a long-term-minded investor. Some of the largest market drops precede the biggest gains, and staying the course is often an investor’s best bet.

What to know

Professional traders and hedge fund managers look at charts, reports, and trends all day long to try to time the market, yet many underperform the S&P 500 over the long haul.

If you do exit the market, you’ll likely miss big gains. For example, if you started with $10,000 and stayed invested through the past 15-plus years, you would have earned $24,753 more than someone who missed the market’s 10 best days, according to research from Putnam Investments.

Trying to time perfect entry and exit could prove costly, given some of the market’s best days happen fast and without warning.

Say you invested $10,000 in 1980 in an investment that tracks the S&P 500 index. Had you stayed invested through March 2020, you would have endured several difficult periods, including in 1987, 2000-02, 2008, and March 2020, the fastest bear market in history.

Yet that initial $10,000 would be worth around $697,421 in mid-2022, according to Fidelity.

But if you’d missed out on just the five best days over the same period, you’d have much less: $432,411. Miss out on the 10 best days? $313,377.

And if you had missed out on the best 30 days over the period, you’d only be sitting on $115,481, which is $581,940 less than you’d have had you stayed invested.

Patience is often rewarded

During volatile markets, it’s easy to fall into the short-term thinking trap, where news headlines, tweets, and constant price updates cause fear and anxiety.

But it can be punitive to be out of the market on its best days. “Stay the course” is cliché, but it’s true: Over the past 73 years, there have been 13 bear markets with declines averaging 25.8% before markets recovered.

Remember, the market retreats about 10% yearly, 20% every five years, and 30% every decade or so (2008 and 2020 being the latest examples).

Each time, the market has recovered to hit new all-time highs, and 14 bull markets have transpired since 1949, lasting an average of 50 months and gaining 136%.

A portfolio to stick with

Why are so many gains locked in the best days? About three-quarters of the stock market’s best days occur during a bear market or the first two months of a bull market.

Just glancing at a chart of the S&P 500 from April 2009 or April 2020 proves how violently stocks can rally once they’ve bottomed.

The U.S. stock market has been resilient throughout its history. And market recoveries can come fast and furious. On average, the market has recovered about 30% in the first 30 days of a new bull market.

The rest of a bull market is often a more gradual climb, with plenty of red days included. But staying disciplined and avoiding the temptation to re-enter after public sentiment has improved is a tricky game to play.

Stay the course

High-quality stocks can become lucrative investments, but only if you give them time to do what they do. Almost always, that process involves enduring relentless bear markets.

Take the period from September 2008 to March 2009, when the S&P 500 fell 38%.

But seven out of 10 of the market’s best days over the past two decades also happened over that time. (Late March 2020, after the market bottomed, also saw remarkable gains of 7.03% and 9.38%. Investors who panic-sold would have missed them, though.)

Dive deeper

For a visual view, check out this piece from Putnam Investments.

And here’s our interview with Morgan Housel from 2021 on the magic of staying in the game for the long haul.

Readers, we wish you a year of continued learning and growing!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.