Spending Spree

20 December 2022

Hi, The Investor’s Podcast Network Community!

🇯🇵 Our piece yesterday on a Japanese monetary policy pivot was pretty spot on timing-wise — to our and the world’s surprise.

Shortly after we delivered that newsletter to your inbox, the Bank of Japan rattled financial markets by implicitly hiking rates. This came as an announcement to increase the range of interest rate fluctuations tolerated before interfering.

The prospect of higher rates today with actual policy increases next year set the stage for the yen to meaningfully recover its value 💴

The yen moved 4% higher, though it’s still down over 12% this year against the U.S. dollar.

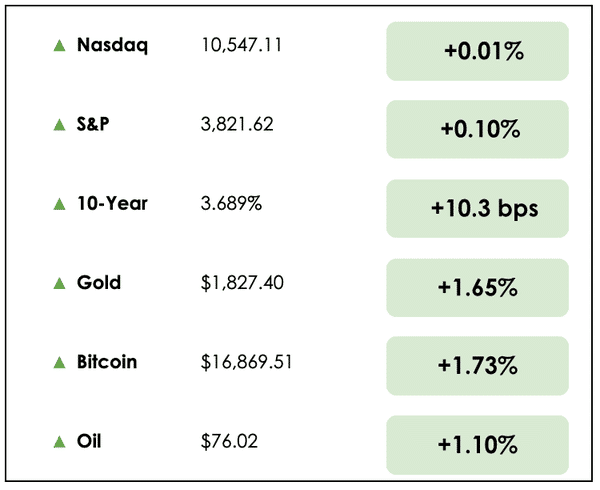

Here’s the rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: FTX’s efforts to claw back political donations, and an end-of-year spending spree from the federal government, plus our main story on being a “focus investor.”

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

IN THE NEWS

🚔 FTX Tries to Claw Back Political Donations (FT)

Explained:

- As the FTX crisis continues, the bankrupt crypto exchange aims to recoup millions of dollars in donations to U.S. politicians by the company’s former CEO, Sam Bankman-Fried, presumably made using customer deposits.

- It’s believed that Bankman-Fried and other executives funneled more than $70 million to American politicians or fundraising groups. This would make him the second-largest supporter of Democratic-leaning groups in the recent midterm elections.

Why it matters:

- With the Securities and Exchange Commission pushing forward on civil fraud charges against Bankman-Fried, including the misuse of customer money to fund donations, pressure is now on recipient politicians to respond.

- Some suggested they’ll donate this money to charity. However, FTX’s new management cautioned against doing so, as they’ll still seek recovery of the funds in court, which they believe are owed to FTX’s customers and creditors.

- The mess at FTX gets uglier each day. With a web of political connections interwoven into the bankruptcy, there’s sure to be no shortage of related controversy in the coming weeks.

✍️ Lawmakers Reveal Huge End-of-Year Spending Bill (Bloomberg)

Explained:

- This week, Congress is poised to ram through compromise legislation for a $1.7 trillion funding plan until September 2023 to avoid a government shutdown.

- The bill would include $858 billion for national defense — a $76 billion increase from the current budget — while providing $45 billion in aid to Ukraine. Funding for veterans programs would see a 22% increase as well.

- The plan would expand a program for hiring police officers by 32% while also boosting grants toward child care by 30%, along with more money for the National Institutes of Health, the Environmental Protection Agency, and the National Park Service.

Why it matters:

- There are countless other programs, grants, and nuances contained in this package, and stocks tend to love government spending since much of these funds will spur spending more widely across the economy.

- What’s left out of the deal is also notable. From new corporate tax breaks around expensing research and development costs to a revival of 2021’s child tax credits to billions in coronavirus funding. Additionally, an increase to the nation’s $31 trillion debt ceiling was excluded, setting the stage for partisan clashes next year.

- The huge spending bill was framed as a way to tame inflation’s burden on Americans. Increased deficit spending, though, stands at odds with the Fed’s efforts to cool inflation by driving down consumer demand with higher interest rates.

A MESSAGE FROM PERSONAL CAPITAL

Personal Capital helps users take control of their finances by blending world-class technology with human advice.

Pair industry-leading financial tools with licensed advisors and full-service planning experts across all 50 states.

Personal capital offers a free Investment Checkup tool to evaluate the health of your portfolio, a free Net Worth Calculator, personal finance guides, and so much more!

THE MAIN STORY: FOCUS INVESTORS

Overview

Today, we bring you the highlights from an illuminating conversation between Millennial Investing host Rebecca Hotsko and Robert Hagstrom a few months back.

A New York Times bestselling author, Hagstrom is the Chief Investment Officer at Equity Compass. He’s written multiple books on Warren Buffett including, “The Warren Buffett Way” and his latest, “Warren Buffett: Inside the Ultimate Money Mind.”

Hagstrom is a brilliant writer and researcher uncovering many details about Buffett, who bought his first stock at age 11 and read every book on investing in the Omaha libraries.

They discuss Buffett’s trademark investing style, what has made him so successful over such a long period, the criteria he uses to value businesses, stock picks, and much more. The conversation is full of gems, investing nuggets, and practice advice for investors of any level.

Let’s get to it.

The Buffett difference lies in market orientation

Hagstrom begins with a simple synopsis of what distinguishes the Oracle of Omaha: His orientation around the stock market is different from nearly everybody else.

Rather than obsess over earnings reports, quarterly profits, what the Federal Reserve will do next month, or how a stock price moved last week, Buffett focuses nearly all of his energy on the economics of the businesses he owns.

He focuses not on external conditions but exclusively on what he can forecast with accuracy: the health of an individual business. Then he maintains a decades-long time horizon.

His ideal holding period is “forever,” not days, months, or even a handful of years. While many investors try to time the next trend, Buffett is studying the underlying workings of great businesses.

“He just doesn’t spend a whole lot of time thinking about markets, stock prices, sectors, things like that,” Hagstrom says. “He just wants to be a business owner and isolate some really great businesses for his portfolio, and that’s where he spends the vast majority of his time: being a business investor, not a stock picker.”

Focus investing is the way

Index funds are an excellent option for many investors, but for the best in the world, focus is critical.

Buffett might look for reasons not to invest in a business, looking to rule out the thousands of publicly-traded companies so that only a few excellent businesses emerge.

His portfolio consists of a few companies that he knows extraordinarily well. He concentrates his bets on high-probability investments to excel over the long haul.

Buffett wants to hold about a dozen stocks across a few sectors and let them compound.

“When I talked to him about the book, and this was 1998, he said, ‘Robert, we’re just focus investors. We just focus on a few stocks,'” Hagstrom says, adding: “If you had great businesses, you’d want to hang onto them because that’s growing your net worth over time.”

Other tidbits

Hagstrom notes common mistakes among investors of all levels lie in chasing popular stocks and selling stocks that have fallen out of favor. He says it’s a slippery slope, and a lot of trading not only means a lot of tax consequences, but it’s also difficult to outperform when you’re frequently entering and exiting positions.

Buffett has made mistakes — airlines, IBM (IBM), to name two — but he admits his errors and moves on, waiting to pounce on new opportunities with his enormous cash pile. He knows the market will always be there with opportunities for patient investors who conduct in-depth research.

Buffett is a thoughtful reader, writer and speaker known for his blunt musings on markets and life. One of Hagstrom’s favorite Buffett sayings is, “I don’t know time, I know price.” The point: Buffett is less concerned about whether he’s made a perfectly-timed entry point. He’s content finding undervalued businesses that’ll deliver over many years.

Buffett thinks of himself as a business analyst, not a market analyst, stock predictor, or even securities analyst. He considers a business’s profitability, management team, price, and overall financial health, rather than the macro environment, which changes often and can be very unpredictable.

The next opportunity: Big tech stocks

Hagstrom says he believes big tech stocks such as Apple (AAPL), Amazon (AMZN) and Alphabet (GOOGL) are mispriced and due for a rebound after a rocky 2022. ServiceNow (NOW) and Salesforce (CRM) also fit the bill.

“The mispricing in the growth market is so severe right now, there’s no doubt that’s the market of the highest excess returns going forward.”

Dive Deeper

This is not a comprehensive overview of Buffett or Hagstrom’s book. But the conversation left us with many notes and highlights that we’ll revisit again and again.

For more, here’s the full conversation with Hagstrom.

And here’s our summary of Buffett’s 12 investment principles based on Hagstrom’s book.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.