Seinfeld-onomics

Hi, The Investor’s Podcast Network Community!

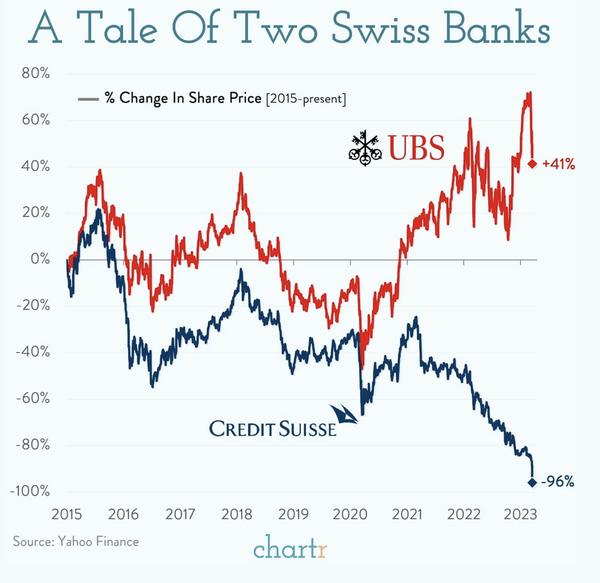

🎢 Shareholders in the troubled bank, First Republic, have endured a bumpy ride — the stock fell 47% yesterday, only to rally 45% at one point today after reports that JPMorgan’s CEO Jamie Dimon is leading a rescue plan for the bank.

Elsewhere, the tech giants Apple and Microsoft have emerged as havens amid the current stock market turmoil. The two companies have seen their weighting in the S&P 500 rise to 13.3%, the highest level on record.

It’s a striking level of dominance over the U.S. stock market 💪

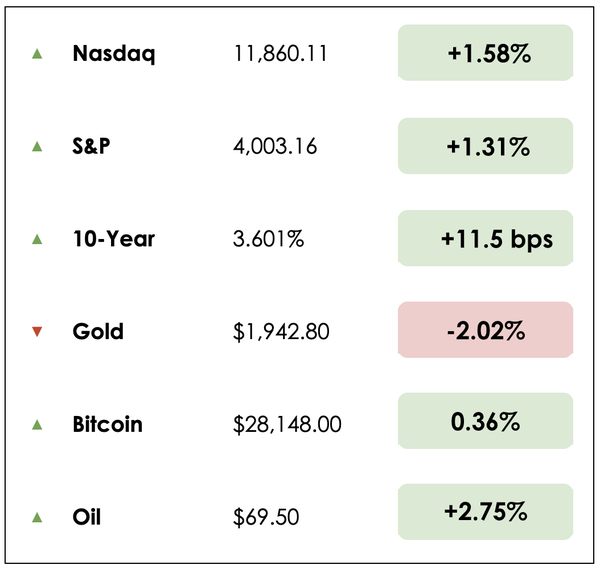

Here’s the rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- The U.S.’s commitment to protecting banks

- The hospitality industry adjusts to chronic shortages

- Plus, our main story on “Seinfeld-onomics”

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ![]()

Advanced features for Bitcoin veterans ![]()

The Bitcoin wallet for your every need ![]()

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

🛡️ U.S. Ready to Protect Banks (NYT)

Explained:

- In prepared marks Tuesday, U.S. Treasury Secretary Janet Yellen pledged that the Biden administration would take additional steps to support the banking system. She expressed confidence in the nation’s banks, seeking to calm nerves as the U.S. financial system faces its worst turmoil in over a decade.

- “Our intervention was necessary to protect the broader U.S. banking system,” Ms. Yellen said in prepared remarks to be delivered to the Washington meeting of the American Bankers Association, the industry’s leading lobbying group. “And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

- Yellen said recent federal actions after the failure of Silicon Valley Bank and Signature Bank were intended to show the Biden administration was dedicated to protecting the system’s integrity and that deposits were secure.

Why it matters:

- The comments come as government officials contemplate additional options to stem the flows of deposits out of small and medium-sized banks. Yellen added: “The situation is stabilizing. And the U.S. banking system remains sound.”

- In the past 10 days, federal regulators have used an emergency measure to guarantee the deposits of Silicon Valley Bank and Signature Bank, initiated a new Federal Reserve program to make sure other banks could secure funds to meet the needs of their depositors and coordinated with 11 big banks that deposited $30 billion into First Republic.

- Despite those efforts, the Fed’s campaign to raise interest rates to tame inflation has exposed weaknesses in the balance sheets of regional banks, rattling investors and raising fears that deposits aren’t safe. We’ll learn on Wednesday whether the Fed intends to push forward with rate hikes or whether the recent bank failures force it to pause.

🎓 Career Growth (WSJ)

Explained:

- Short-staffed hotels are getting creative about filling open roles by offering advancement opportunities for housekeepers and front-desk workers.

- One hotel operator boosted wages for some positions by more than 30% but was still short-staffed. The solution? The company created a career-development program with cross-department training and leadership workshops. Prospective housekeepers appreciated that they could go from cleaning rooms to running housekeeping or managing a hotel. “There’s still a lot of turnover, but it’s been more successful for us this way,” one leader said.

- The percentage of job postings on the online hiring platform Wizehire emphasizing career-development programs has increased to 8% from 2% pre-pandemic.

Why it matters:

- Despite a recent jump in the hospitality sector’s hiring, hotels and restaurants are still understaffed. The accommodation and food services sector had nearly 1.5 million job openings as of January, according to seasonally adjusted numbers from the U.S. Bureau of Labor Statistics.

- Food and hotel businesses must compete with remote jobs, fast-food chains, and delivery companies.

- But the promise of career growth is helping hotels hire. Job postings for entry-level roles emphasizing career development are seeing more applications, and interview and hire rates are 5% to 10% higher, according to Wizehire.

A flight dilemma

Have you ever been tempted to ask the person ahead of you not to recline their seat on an airplane? Probably, but why would they oblige for a stranger?

There’s a price for everything, though, and perhaps you could pay them not to recline, so you can relax or work.

What would that price be, exactly? It’s the sort of comic absurdity premised around mundane daily life that would be right at home on the hit ’90s sitcom Seinfeld, according to Linda Ghent, a professor of Economics at Eastern Illinois University.

The show about nothing

You might be surprised to hear that economists like her think everyone’s favorite “show about nothing” is full of economic lessons.

The show documents the hilarious travails of life in New York City with comedian Jerry Seinfeld and his three friends, George, Elaine, and Kramer.

In one episode, Jerry gives Elaine cash for her birthday. It’s the ultimate functional gift, an ode to the “rational consumer” we read about in textbooks, yet Elaine’s exasperated reaction shows that, in reality, cash gifts don’t work so well.

Seinfeld is defined by characters who constantly weigh the costs and benefits of exceedingly mundane decisions while not shying away from breaking social norms.

Of course, George Costanza best represents this. Ghent argues that George is “probably the most diligent user of cost-benefit analysis I’ve ever seen.”

Cost-benefit analysis

Ghent provides a few episodes with economic takeaways for us to consider.

In one, George is interviewing for a job, and he thinks it’s going well, but right before the employer commits to hiring him, he’s interrupted by a phone call. He never finishes his sentence, and all George hears is, “I want you to have this job; of course…”

George is left wondering what to do, to which Elaine proposes that he just call the guy.

But the problem is that the employer told George that what impressed him most was George’s ability to understand everything immediately, so calling back to confirm he had the job might make him realize that George doesn’t actually understand things well, which could cost him a job he might already have.

Yet, if George doesn’t call, as Jerry says, “You might have the job, but you’ll never know it.”

The situation is ridiculous, but it connects to a tool from economic game theory called a payoff matrix. Essentially, you work through each possible scenario and the expected outcome to find the best decision given the tradeoffs.

In this case, if George assumes the worst and doesn’t show up to work, that would be correct and would save him some time and embarrassment. But if he didn’t show up and they were expecting him, it’s a huge loss for George because he could’ve had the job.

George considers the payoff matrix and arrives at his winning strategy: “I show up. I pretend I have the job. The guy’s on vacation. If I have the job, it’s fine. if I don’t have the job, by the time he comes back, I’m ensconced.”

Sponge scarcity

In another episode, the concept of scarcity comes into play with Elaine and her “sponges.” These sponges are a very specific form of single-use contraception, and when the product goes off the market, she’s left with a finite supply. She must then assess whether potential partners are “sponge worthy.”

She explains to Jerry that she has to “reevaluate (her) whole screening process. (She) can’t afford to waste any of them.”

One economist, Avinash Dixit, devised a formula for Elaine to use. He attempts to quantify the utility, or value, of each sponge that Elaine receives, and how that cost increases as her supply of sponges becomes increasingly scarce.

His formula suggests that if Elaine starts with a supply of 100, so long as a potential romantic partner is in the top 38% of people she might meet, she shouldn’t regret using a sponge.

When her supply falls to just ten sponges, prospective partners must be in the top 13% of all people she could meet, and for the last sponge, a partner would need to be in the top 5% of the distribution of ideal qualities for Elaine to “use” a sponge on them.

Another similar scenario might relate to which dinner guests to use your fanciest bottle of wine on. Your best bottle would likely be for someone very special, whereas your standards may drop for less scarce bottles of wine.

A show about economics?

Seinfeld is a TV show that unusually illustrated life’s tedium and the people making these decisions. As Ghent reminds us, this is basically what the entire economy is.

She explains, “the 19th-century economist Alfred Marshall says economics is the study of mankind in the business of ordinary life. And I love that because I like to teach economics as a discipline about making decisions…We have unlimited wants. And so how do we go about making ourselves as best off as we can in those situations?”

You could even say that the economy as a whole is millions of little Seinfeld episodes unfolding simultaneously. It’s a fun way to think about the world and a new spin on one of our favorite shows.

Readers, what other Seinfeld episodes do you think provide unique economic insights?

Dive deeper

Check out Planet Money’s full podcast on Seinfeld-onomics for more.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.