Properly Venturesome

22 August 2022

Hi, The Investor’s Podcast Network Community!

Hope everyone had a good first day of the week!

Just a reminder that We Study Markets will be arriving in your inbox at 6 pm Monday through Friday from now on. This will allow us to provide you with the latest news and market data of the day.

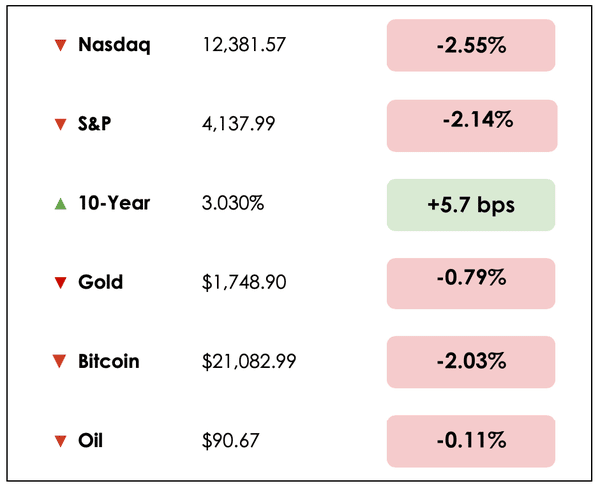

Speaking of which, the S&P 500 dropped 2.1%, and the Nasdaq tumbled more than 2.5% as investors turned skittish ahead of Jerome Powell’s planned speech regarding the future of interest rates.

Bed Bath & Beyond (BBBY) shares continued to get pummeled and fell 16% after S&P downgraded the retailer’s credit rating.

Here’s the market rundown for today:

*All prices as of market close of 4 pm

Today, we’ll discuss the timeless investing truths of Bernard Baruch, building Wall Street on blockchains, Turkey doubling down on Russian oil, and one reason global food prices are rising.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🚀 Goldman Sachs Aims To Construct A Wall Street Built On Blockchain (WSJ)

Explained:

- While digital assets like Bitcoin are in what some call a “crypto winter”, in light of the bear market since last fall in the space, behind the scenes Wall Street banks are increasingly utilizing the underlying blockchain technology that underpins cryptocurrencies.

- Goldman Sachs has used the Ethereum network for trading some bonds and other debt securities, while also building out its own blockchain-based trading platform. The bank’s peer competitor, JPMorgan, already has an existing platform like this known as Onyx.

- Last year, Goldman arranged a bond issuance for a European investment bank in the order of $100 million for a two-year bond that was settled on the Ethereum network.

What to know:

-

- These banks hope that innovations in blockchain technology will spur cheaper, more efficient, and more transparent trading systems for many markets of securities and commodities. Unlike Bitcoin and Ethereum, though, which are more globally decentralized, these blockchain networks for Wall Street would be quite centralized, permissioned systems operated by a consortium of banks between each other.

- Walmart has also used blockchain technology to help manage its supply chain, while in real estate, title companies have used it for recording home ownership.

- International laws and regulations are still catching up to the space, though, particularly for banks, as it remains unclear how governments will enforce rules relating to collateral requirements, risk management, custody, and more while using digital assets and blockchain networks.

🥖 The Other Reason Global Food Prices Are Spiking (CNBC)

Explained:

- Last week, we shared some dire thoughts on the global food and energy crisis, and we wanted to follow up with more context. The UN projects that, in its worst-case scenario, global food prices will rise an additional 8.5% by 2027. This is, in part, due to dramatically more expensive fertilizer. Some fertilizers have spiked by more than 300% since the fall of 2020.

- Meagan Kaiser, director of the United Soybean Board, says she’s seen prices rise from $270 a ton last year to $1,400 in 2022, and this, “turns my stomach a little bit to think about the amount of risk that our family farm is taking right now.”

What to know:

- As vital input costs like fertilizer rise, farmers are forced to raise prices of their crop yields to remain in business, which pushes up prices at the grocery store. Per Morgan Stanley, Russia and Ukraine are responsible for about 28% of global fertilizer exports, so the war has introduced tremendous uncertainty into global agriculture.

- Additionally, fertilizer production is hugely energy-intensive, so spiking natural gas and oil prices substantially raise production costs, which jeopardizes the viability of crop production broadly.

Turkey Doubles Its Imports Of Russian Oil (Reuters)

Turkey Doubles Its Imports Of Russian Oil (Reuters)

Explained:

- In stark contrast to its fellow Nato countries, Turkey has been far more hesitant to draw a hardline on relations with Russia following the country’s invasion of Ukraine.

- In August, Turkey’s President actually met with Putin to discuss expanding their trade and business relationships, presumably to replace many of the businesses based in the EU who’ve cut ties with Russia in the past few months.

- Correspondingly, Turkey has boosted its current purchases of Russian oil to 200,000 barrels per day from just 98,000 in 2021.

What to know:

- Because Turkey hasn’t sanctioned Russian oil, Turkish refiners are able to purchase the oil at a discount relative to other global benchmarks and boost their profit margins.

- It appears, then, that Turkey’s controversial authoritarian President, Recep Tayyip Erdogan, is using the conflict opportunistically to secure favorable economic arrangements with Russia, instead of working with his Western allies to punish Putin. This highlights a glaring hole in Nato unity while extending further lifelines to the Russian war machine.

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the red flags from PassiveInvesting.com.

BERNARD BARUCH’S TIMELESS INVESTING TRUTHS

Over a rainy weekend morning, we settled in with a cup of coffee and listened to one of our favorite podcasts that our own, William Green, recently released on Richer, Wiser, Happier.

He interviewed Jim Grant, the editor of Grant’s Interest Rate Observer, which is considered required reading among the world’s most successful investors. Loaded with investment wisdom, one of our favorite parts of the interview was a discussion about Jim’s book, Bernard Baruch: The Adventures of a Wall Street Legend.

Bernard Baruch (1870-1965) was the son of a South Carolina physician whose family moved to New York City when he was eleven years old. By his mid-twenties, he bought a seat on the New York Stock Exchange for $19,000. He began speculating in the sugar market, and by age 30, he was a millionaire known as “The Lone Wolf of Wall Street.”

In the interview, William mentions a memo we were unaware of, which Baruch wrote to himself in the spring of 1930. Baruch was fabulously wealthy and worth roughly $30 million at a time when gold was $20.67. He had over 30 years of investing experience then and sat down to codify a list of rules on how to invest successfully.

As William says in the interview regarding Baruch’s memo in Grant’s book, “those two pages are worth the price of entry for the entire book. They’re pretty amazing.”

Given such high praise, we decided to delve deeper and read Baruch’s investing rules for ourselves. Let’s go through our takeaways.

Baruch’s Timeless Investing Rules

- Don’t speculate unless you can make it a full-time job.

- Beware of barbers, beauticians, waiters, or anyone bringing gifts of “inside” information or “tips.”

- Before you buy a security, find out everything you can about the company, its management and competitors, its earnings and possibilities of growth.

- Don’t try to buy at the bottom and sell at the top. This can’t be done, except by liars.

- Learn how to take you losses quickly and cleanly. Don’t expect to be right all the time. If you have made a mistake, cut your losses as quickly as possible.

- Don’t buy too many securities. It’s better to have only a few investments which can be watched.

- Make a periodic reappraisal of all your investments to see whether changing developments have altered their prospects. Stubbornness as to opinion, or “cockiness” must be entirely eliminated.

- Study your tax position to know when you can sell to the greatest advantage.

- Always keep a good part of your capital in a cash reserve. Never invest all of your funds.

- Don’t try to be a jack of all investments. Stick to the field you know best (circle of competence).

Admittedly, Baruch was reluctant to put this list together. He was skeptical of its effectiveness. As he put it, people either lack the discipline to follow it or think they’re the exception that can outsmart the game Baruch played for decades.

Simply put, most people need to make the mistakes themselves before the painful lessons sink in.

Baruch was a perpetual student and sought to understand how market psychology influenced asset prices. He was highly influenced by Charles Mackey’s Extraordinary Popular Delusions and the Madness of Crowds.

Baruch went on to say, “What we can try to do perhaps is to come to a better understanding of how to reduce the element of risk in whatever we undertake. Or put another way…our problem is how to remain properly venturesome and experimental without making fools of ourselves.”

For more on Bernard Baruch, we’d recommend checking out his memoir Baruch: My Own Story.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow at 6 pm.

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.