Prime Day

Hi, The Investor’s Podcast Network Community!

The unemployment rate remains remarkably low, yet housing affordability is around its worst levels in over two decades — prices have largely stayed flat while interest rates have risen.

So people have jobs, but that doesn’t necessarily translate to being able to afford homeownership 😵💫

What gives? Rates will probably keep rising, making housing even less affordable in 2023, or the bottom could fall out for prices, which seems unlikely anytime soon with unemployment so low.

💭 Or, perhaps, we’ll reach the Fed’s mythical promised land (a “soft landing”) where inflation cools to 2%, interest rates can fall or at least stop rising, and the economy doesn’t enter a recession (a bunch of people losing their jobs).

Our charts of the day visualize this conundrum.

— Shawn, Weronika & Matthew

Here’s the rundown:

Today, we’ll discuss the three biggest stories in markets:

-

The genius behind ChatGPT is taking a nuclear startup public

-

America’s banks need more capital

-

Amazon offers travel discounts for Prime Day

All this, and more, in just 5 minutes to read.

POP QUIZ

Since 1982, how many years has the S&P 500 posted a negative annual return? (Scroll to the end to find the answer!)

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

QUICK POLL

Which of the following courses would you be most interested in taking?

IN THE NEWS

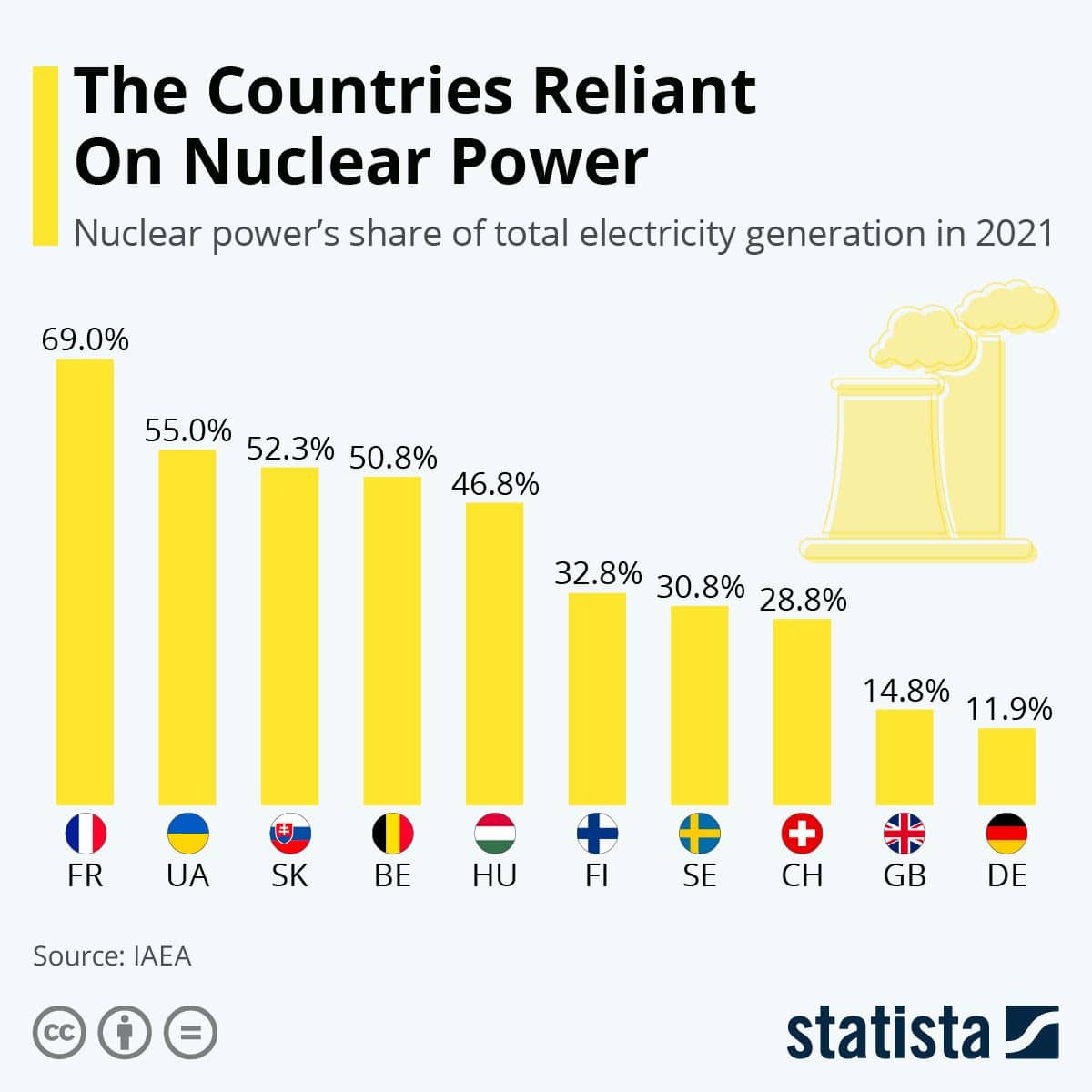

💡 Sam Altman’s Next Big Idea: Nuclear Energy (WSJ)

Sam Altman, the genius behind OpenAI’s ChatGPT, is backing another big idea: nuclear energy.

Oklo, a nuclear-fusion startup backed by Altman, plans to go public through a merger with his special-purpose acquisition company (SPAC). Altman, who was very early to revolutionary technology like crypto and artificial intelligence, has said the nuclear-energy industry can make electricity that’s “a way better deal than anything else out there.” It’s valued at about $850 million.

-

Clean-energy startups surged in 2020 and early 2021 before falling out of favor. Now, companies like Oklo are trying to build smaller nuclear power projects that deliver on time and budget as economies seek to run on cleaner energy.

Nuclear’s process of splitting atoms in nuclear-fission power plants provides about 20% of U.S. electricity, and energy leaders believe it could be a large-scale solution to worldwide energy efficiency. In other words, it could one day supply much more than 20% of electricity.

-

Altman, who met Oklo’s founders in 2013, recruited them to startup accelerator Y Combinator in 2014 and began investing in the firm, which plans to deliver its first reactors in Idaho and Ohio.

Roadblock: It must navigate a rigorous licensing process with the U.S. Nuclear Regulatory Commission. Oklo also is developing nuclear-fuel-recycling tech with the U.S. Energy Department and national laboratories.

Why it matters:

It hasn’t been an easy road for SPACs since their pandemic boom. At their peak, SPACs accounted for 70% of all IPOs, with $95 billion raised. The market has since dried up, and shares of companies that did SPAC deals have crashed.

The merge: Altman said the goals of making artificial intelligence (ChatGPT) and energy both cheap and abundant are tied together.

-

“The A.I. systems of the future will need tremendous amounts of energy and this fission and fusion can help deliver them,” Altman said.

-

He noted that A.I. could be used to create nuclear-system designs in the most efficient ways possible while reducing energy costs.

The world’s moving faster than ever, and there’s no sign of things slowing down.

Luckily, there’s a way to stay ahead of the curve: TheFutureParty newsletter dissects the business of entertainment and culture – all in a quick and witty package.

Join 200k+ driven professionals and learn how industry trends shape the future.

💰 America’s Banks Are Going to Need More Capital (WSJ)

While most have already forgotten about the banking drama from March and April of this year, where four U.S. banks imploded — Silicon Valley Bank (SVB), Silvergate Bank, Signature Bank, and First Republic Bank — regulators haven’t.

And they’re shifting from the picking-up-the-pieces phase to the enacting-new-reforms phase.

One big takeaway? It’s not just the too-big-to-fail banks that can pose destabilizing risks to the financial system. After 2008, it was clear to many lawmakers and regulators that the biggest banks (think Bank of America, JPMorgan, Wells Fargo, etc.) had to be protected at all costs in a crisis, meaning they should be the most tightly regulated before crises.

-

But comparatively smaller “regional banks,” often not small and not necessarily regional, could have more leniency. All four banks that failed this year fell into this bucket.

Regulators expect to subject these firms to the toughest requirements reserved formerly for the too-big-to-fail banks, at least for regional banks with more than $100 billion in assets, which would’ve applied to Signature, SVB, and First Republic before they failed.

-

And this week, the Federal Reserve’s regulatory chief, Michael Barr, outlined plans to strengthen the banking system.

-

The plan would increase capital requirements for big banks by an extra two percentage points, meaning an additional $2 of capital for every $100 of risk-weighted assets.

Why it matters:

In English: Capital is the buffer banks set aside to absorb losses. For example, profits kept by banks (not paid out as dividends) from past years can offset losses.

Big banks would have to set more capital aside against the riskier parts of their portfolios, making their balance sheets “safer” but reducing their capacity to lend. And in our fractional-reserve banking system, bank lending is a primary driver of economic growth.

-

The head of the banking group Financial Services Forum doesn’t love the proposal, saying, “Capital isn’t free.” He added, “Further capital requirements on the largest U.S. banks will lead to higher borrowing costs and fewer loans for consumers and businesses.”

-

But Barr claims the capital requirement increases would be covered by bank profits in less than two years, which, ironically, hit a record high in the first quarter of 2023.

Other proposed changes: Banks would be subject to more difficult stress tests — simulations gauging their ability to weather recessions, bank runs, tighter regulations, and other challenges.

-

The Fed is also considering closing a loophole that allows certain midsize banks to mask paper losses on their investments deemed “held-to-maturity,” something SVB did. Without the loophole, the bank would likely have had to respond to mounting losses sooner.

MORE HEADLINES

🙃 Bank of America fined $150 million for fake accounts and bogus fees.

🇬🇧 The UK wants to use its pension system to juice its economy.

🤝 Microsoft-Activision deal moves closer to reality.

🛍️ Amazon Lures Shoppers with Travel Discounts for “Prime Day” (Reuters)

Happy Prime Day.

America’s favorite shopping spree, second only to Black Friday and Cyber Monday, Prime Day (from today through tomorrow) is a testament to Amazon’s considerable brand power.

- And Amazon’s discounts are significantly steeper than in previous years, according to analysts at CFRA Research, with deals such as 60% off Gap clothing, 50% off Sony headphones, and 40% off Peloton bikes.

Something new: This year, Amazon is also rolling out its first-ever exclusive travel discounts by partnering with the travel booking site Priceline.

- “We want to meet customers where they are. We know travelers are shopping on Amazon and booking travel with Priceline,” noted a Priceline executive.

To enhance the full shopping experience, Amazon offers an extra 20% discount on Priceline’s Hotel Express deals.

Last year, Prime Day sales soared to nearly $12 billion, marking an 8.5% increase from the previous year, and Bank of America expects the value of merchandise sold this year to rise another 12% year-over-year.

Why it matters:

As inflation impacts mortgage rates, rents, and food prices, consumers face increased costs of living — enough pressure to cause measurable anxiety across the country.

- Consequently, many Americans, mindful of post-pandemic shopping fatigue and exercising financial prudence, approach Prime Day cautiously, but the deals, especially on household essentials, and the convenience, often prove too hard to ignore.

- “They are looking to spend more on experiences, travel, and entertainment,” one chief investment officer said.

U.S. government data indicates that overallservices spending surged by 8% in May compared to the previous year, outpacing the 2% increase in goods spending.

TRIVIA ANSWER

The benchmark S&P 500 has registered only seven negative return years since 1982, two of which have come in the last five years alone (2018 and 2022).

See you next time!

That’s it for today onWe Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

All the best,

P.S. The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more!

Join our subreddit r/TheInvestorsPodcast today!