Prediction Machine

Hi, The Investor’s Podcast Network Community!

Welcome to the weekend, folks 🍹

Fun fact: Americans drove 29 billion miles more last year than in 2021 but still drove less than before the pandemic.

Markets closed out the week on a positive note after an important measure of the services sector showed the most strength since June.

Thirteen service-related industries reported growth in February, including agriculture, utilities, finance & insurance, entertainment & recreation, and accommodation & food services, while just four reported a contraction.

💪 These signs of economic resilience seemingly trumped concerns about the Fed having a stronger case for keeping rates “higher for longer.”

Here’s the rundown:

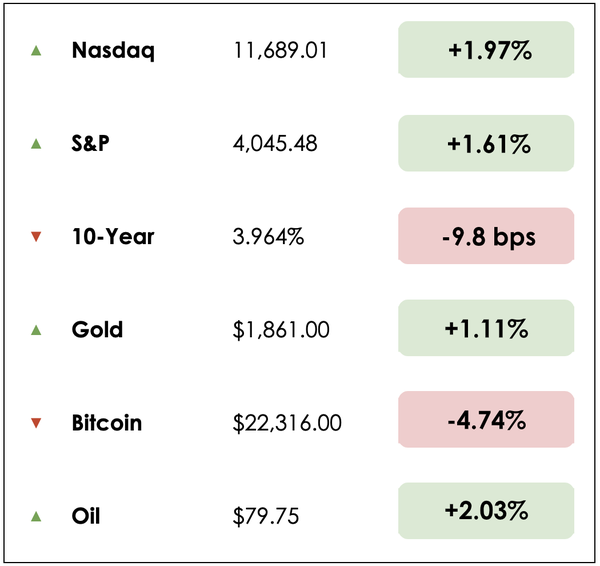

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- A disturbing gap in homeownership

- Price pressures in Europe

- Plus, our main story on designing an environment for success

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

🏡 Black-White Homeownership Gap (WSJ)

Explained:

- The pandemic-era housing boom made headlines for its bidding wars and soaring home prices. But the gap between Black and White homeownership rates grew to its widest in a decade in the first two years since Covid-19 hit.

- A report by the National Associations of Realtors released Thursday showed that homeownership among all races increased between 2019 and 2021, while homebuying by Black households lagged.

- The homeownership rate for White households rose to 72.7% from 69.8%, while Black homeownership rose to 44% from 42%, making for the widest homeownership gap since at least 2011. (Researchers downplayed stats from 2020, which was affected by data collection problems amid the pandemic.)

Why it matters:

- “The American dream of home homeownership has not been dampened by the pandemic, but the Black homeownership rate has not kept pace with increases in the other racial and ethnic groups, making even larger the gap between the White and Black homeownership rate,” said Nadia Evangelou, senior economist and director of real estate research at the NAR.

- The report shows the increasingly unaffordable housing market, especially for Black families. Experts say reasons for why the Black homeownership rate is nearly 29 percentage points below White households include: lower average income, a lower marriage rate, and a greater likelihood of being first-time buyers.

- The data shows 46% of Black households consist of a married couple vs. 60% of White households. “Married households typically have higher household incomes, and more financial assets,” Evangelou explained.

💼 Eurozone Price Pressures (NYT)

Explained:

- As winter ends, European inflation levels have eased, though stubbornly high prices could pressure central bankers to keep raising interest rates. The annual inflation rate was 8.5% in February, down from 8.6% a month earlier, among countries using the euro.

- Year-over-year rates have been declining since peaking at 10.6% in October. But core inflation rose to a record of 5.6% in February, from 5.3%.

- In France, inflation hit 7.2% in February, its highest point in over two decades, while in Spain, inflation grew at an annual rate of 6.1%. Germany, Europe’s largest economy, reported that the annual rate crept up to 9.3%.

Why it matters:

- Fears of a deep recession this winter in Europe turned out to be overblown, and high energy prices fell thanks partly to a relatively warm winter.

- But food prices remain high, and the war in Ukraine has squeezed the global food supply because Russia and Ukraine are notable exporters of energy and agriculture. Droughts in Europe, China, the Horn of Africa and the United States caused by climate change have also contributed to smaller harvests and higher food prices.

- Rising rates could add financial strain to governments already struggling with massive public debt, noted Eswar Prasad, a trade policy professor at Cornell. “Recent inflation data and the likely policy responses put a damper on the eurozone’s growth prospects for 2023, which had brightened somewhat earlier in the year.”

ATOMIC HABITS

“Environment is the invisible hand that shapes human behavior…

It’s not easy to work from your living room couch, where you binge-watch Netflix, and it’s not easy to go to a gym when your workout clothes are tucked away in the closet…

Fortunately, you don’t have to be a victim of your environment — you can be the architect of it.”

Overview

Making changes and creating new habits is difficult because it’s hard to get motivated time after time.

Productivity expert, James Clear, says we don’t have to be motivated or incentivized to take action — we need to design our environment to work in our favor and surround ourselves with the right cues.

Most people live in a world others have created for them, but you can change the spaces where you live and work to increase your exposure to positive cues and reduce your exposure to negative ones.

Clear says, “a small change in what you see leads to a big shift in what you do.” In other words, tiny changes in designing your environment can lead to large changes in your behavior.

Make it obvious

The first step in creating a good habit is to make it obvious. When we make it obvious, we don’t need to be aware of the cue for a habit to begin.

Every habit is initiated by a cue, and we’re more likely to notice cues that catch the eye. If you want a habit to become a big part of your life, make it a visible cue of your environment.

By placing the right cues in your surroundings, you increase the odds of thinking about your habit throughout the day. The most persistent behaviors tend to be triggered by multiple cues.

Train your brain

The most powerful human sense is vision since about half of the brain’s resources are used on it.

Given that we’re more dependent on vision than on other senses, it makes sense that visual cues are the greatest behavioral catalyst, as they draw attention toward a desired habit.

Clear argues our brain is a “prediction machine,” which begins noticing the highlighted cues and learning them quickly with practice. Eventually, we no longer have to analyze things when they’re automatic.

The context of the objects and the settings surrounding us are crucial for our brain to create a relationship with. This allows us to create new cues automatically, intentionally setting our behaviors within a specific context.

Studies prove visual cues work

In 1936, the psychologist Kurt Lewin came up with a formula stating that “Behavior is a function of the Person in their Environment“, or B=f(P,E).

Soon after, in 1952, the economist Hawkins Stern tested it in real life. He uncovered a phenomenon called Suggestion Impulse Buying, which explains how customers sometimes buy products not because they want them, but because of how they’re presented to them.

This is why when you go shopping, you’ll find the most expensive brands featured in easy-to-reach locations on store shelves, because they drive the most profit, while the cheaper alternatives are tucked away in harder-to-reach spots.

When you walk into a common kitchen at the office and see a plate full of cookies on the counter, chances are that you’ll grab one or two, even if you hadn’t previously expected to eat sweets.

Recognize what holds you back

Behavior change always starts with awareness. Knowing how often our choices are influenced by the setting we were assigned to makes it easier to spot when it happens.

Three steps to start with —

- 1. Recognize bad habits: Look for cues in your surroundings that hold you back and bring negative outcomes.

- 2. Break the vicious cycle: Stop following a default environment that reduces productivity, health, or happiness.

- 3. Make it obvious: Improve your surroundings by adding multiple positive cues, helping you create and automate new habits.

Design your environment for success

Think about your environment in relation to the number of steps it takes to perform a habit.

To make good habits easier, reduce the number of steps to do them.

To make bad habits harder, increase the number of steps between you and the habit.

Here are some examples of the most common cues you can introduce to improve your daily routine:

- 1. If you want to be more productive, put away your smartphone and turn off notifications.

- 2. If you’d like to eat more nutritious food throughout the day, place fresh fruits and water bottles each morning in common locations around your home.

- 3. Want to read more books? Put your bookshelf in the center of the living room, and read for 30 minutes every evening before sleep.

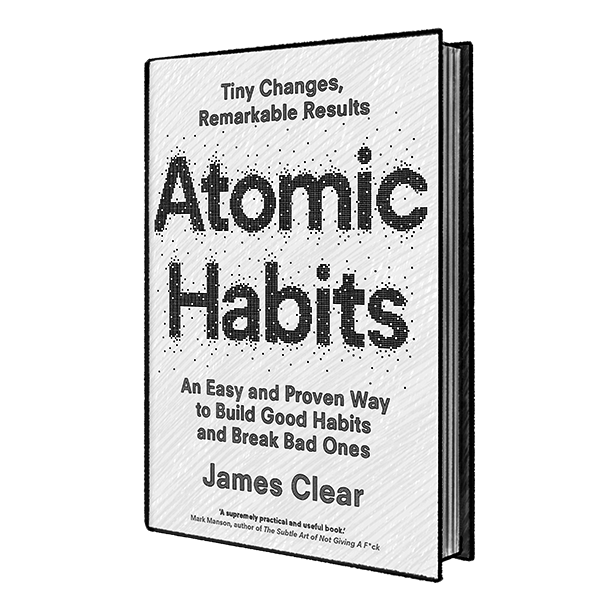

Dive deeper

If you want to learn more about productivity and environment design, read Atomic Habits by James Clear.

And a special thank you to our colleague, Weronika Pycek, for writing this piece.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.