Phantom Debt

Hi, The Investor’s Podcast Network Community!

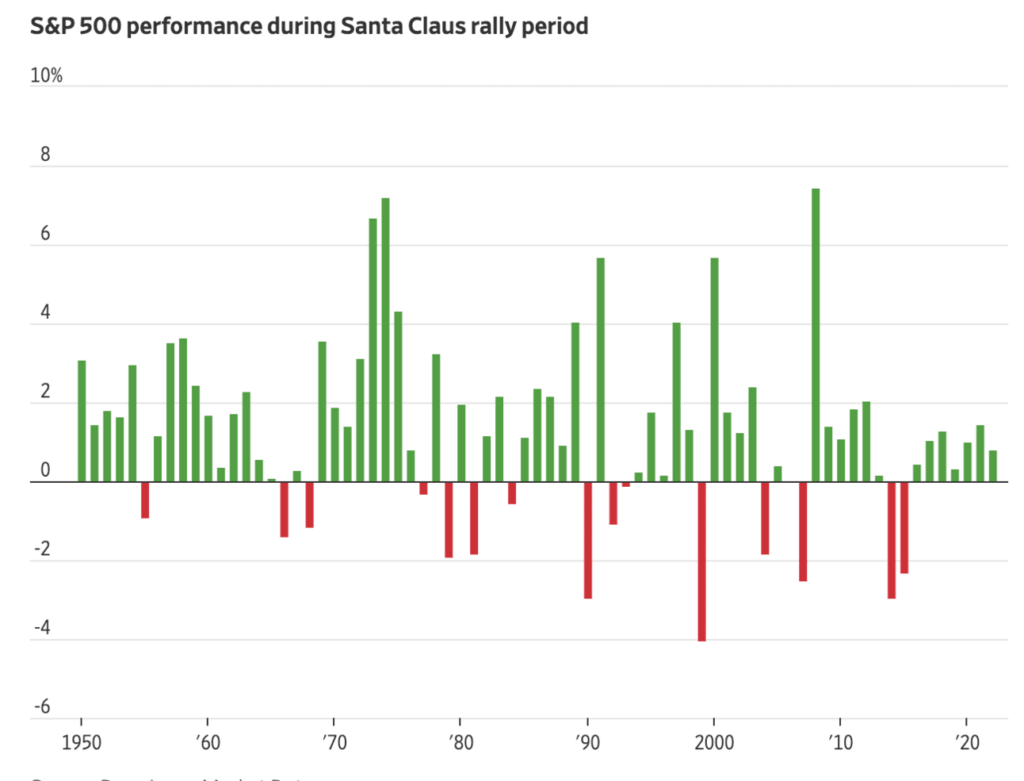

Barring a big selloff Friday — knock on wood — the S&P 500 is on track to finish its monster comeback in 2023 with a Santa Claus rally 🎅

It’d be the eighth consecutive year in which stocks have ended on a Santa, which hasn’t happened since the last eight-year streak ended in 1976.

💭 Santa coming to town is usually a sign of further gains. The year following a Santa rally is positive about 72% of the time, with an average gain of 10.2%.

— Matthew & Shawn

Here’s today’s rundown:

POP QUIZ

Lots of people will be returning Christmas gifts over the next few days — How much stuff, measured in dollars, will shoppers return to stores? (The answer is at the bottom of this newsletter!)

Today, we’ll discuss the three biggest stories in markets:

- The stock that quintupled on the buy now, pay later boom

- Bad news for chocoholics

- Breaking down the spending at a top public university

All this, and more, in just 5 minutes to read.

*By the way, have you filled out our reader survey? If not, make sure to do so to be entered to win a $50 Amazon gift card. Click here to get started.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

From Affirm.com

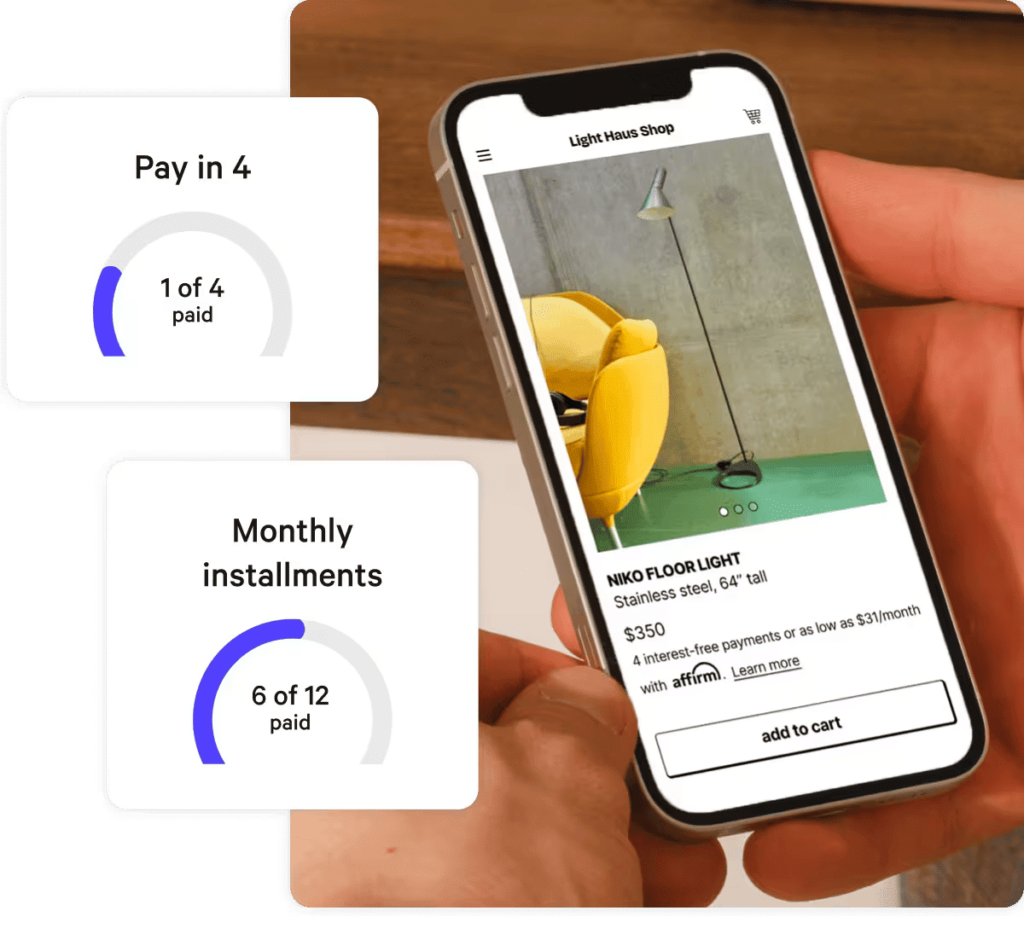

One stock crushed its peers this year, quintupling in market value and beating out every other major U.S. tech company (worth $5 billion or more.)

Any guesses? No, not Nvidia, Alphabet, or anyone even directly connected to AI, for that matter.

It’s Affirm, the buy now, pay later — “BNPL” — giant that’s taken the world by storm, bouncing back from a terrible 2022 when its stock plunged 90%.

- Known as a ‘point-of-sale lender,’ the company enables people to finance and break up payments for various things.

- New microwave? BNPL for it with Affirm. Same for any electronics, really, as well as apparel, jewelry, furniture, gift cards, make-up, or supplements — few things fall beyond the reach of BNPL.

Times change: The prospect of higher interest rates driving less consumer spending fueled existential fears about Affirm’s future this time last year.

Flash forward to today. With rising interest rates in the rearview mirror and partnerships with big retailers like Amazon and Walmart secured, investors are as bullish as ever on Affirm.

Affirm was launched in 2012 by PayPal’s co-founder Max Levchin, but it’s by no means the only kid on the block in the BNPL biz. In fact, Block (formerly Square) is one of its biggest rivals, alongside Klarna, Afterpay, and Zip.

Why it matters:

BNPL firms often make money by charging interest on payment installments, though these interest charges usually don’t compound — a big reason some prefer it over credit card financing.

However, BNPL terms can vary widely, with some charging late fees, insufficient fund fees, and rescheduling fees.

- BNPL companies also typically have much lower standards to qualify for financing than credit cards, reaching a wider range of potential spenders.

- Affirm makes money on any interest, of course, but also on the fees it charges retailers for its service. For retailers, BNPL is yet another tool in their toolbox for incentivizing shoppers to splurge on big-ticket items (and medium & small-ticket ones, too.)

By the numbers: Affirm’s stock is up roughly 456% year-to-date. The company has over 266,000 merchant partners and claims 16.9 million folks have used its services.

- Whether Affirm can maintain momentum as it increasingly competes with more established payments companies in BNPL like PayPal and Block, in addition to credit card companies, will be top of mind for investors.

Cause for concern: Some are troubled by the rise of BNPL lenders, with three U.S. senators recently urging the Consumer Financial Protection Bureau to monitor BNPL usage more closely.

- Wells Fargo calls BNPL loans “phantom debt” that trick “consumers into a false security in which many small payments add up to one big problem.”

- Because these loans aren’t tracked by major credit reporting agencies, either, it’s hard to know what risk they pose to the broader economy.

Get Smarter about Private Market Investing

Private markets are confusing. And they move fast. For the latest news and insights from the world of alternative asset investing – from real estate and venture to art, collectibles and more, Vincent’s weekly newsletter Spotlight has you covered. Trusted by 70,000+. Direct to your inbox. And free forever. Subscribe now.

Photo by Sigmund on Unsplash

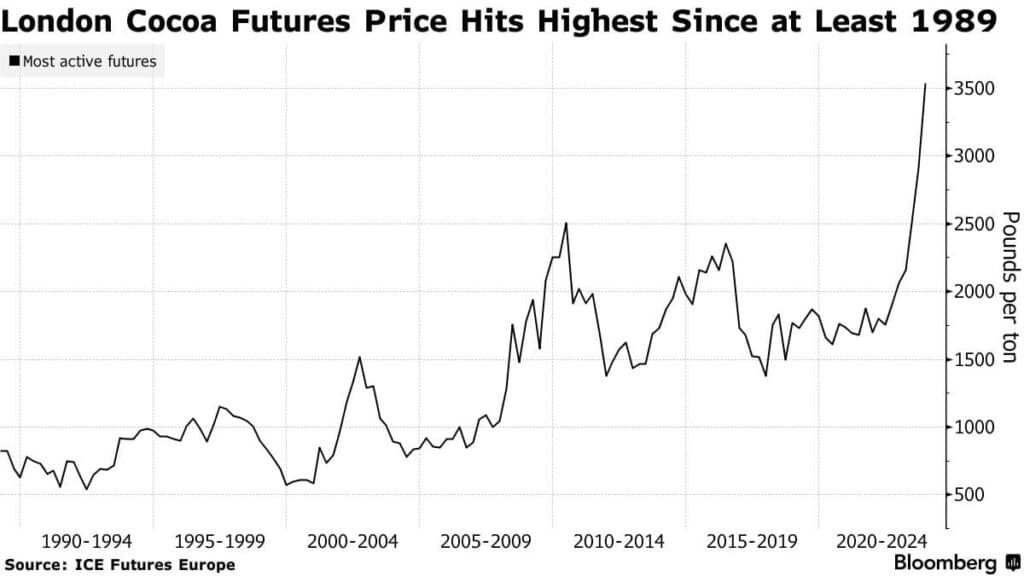

You’ve probably eaten a lot of it over the holidays, but you should have been investing in it: Cocoa.

Cocoa futures prices have seen their largest annual increase this year in three decades, thanks to harvest roadblocks in West Africa.

The result? Costlier chocolate — a disturbing prospect for sweets lovers worldwide.

- Extreme rain alongside crop disease crippled cocoa supplies, and dusty winds from the Sahara desert are threatening further tumult for producers.

- In London, the main cocoa bean trading hub, prices jumped 72% in 2023.

- What does a ton of cocoa even cost? Good question — about 3,500 British pounds (~$4,457.)

Analysts at Rabobank believe that production is roughly 160,000 tons short of consumption.

Why it matters:

As Bloomberg reports, “Cocoa’s climb bucks the overall trend for agricultural commodities this year, with the Bloomberg Agriculture Spot Index poised to fall for the first time since 2018” — Grains like corn and soybeans are set to end 2023 at a loss.

- Many commodities are fairly price elastic, meaning demand drops off as prices rise, driving people to substitutes. For chocoholics, substitutes aren’t exactly an option, and demand for cocoa may be able to endure higher prices.

Backward markets: For signs of stress in the cocoa market, just look at the futures curve – the range of prices to acquire bulk orders of cocoa at various points in the future.

In recent months, the market has been in ‘backwardation,’ commodity trading lingo for cocoa prices being higher today than in the coming months.

- That usually happens when there’s a shortage that crunches markets and causes investors to pay a premium to acquire cocoa today, with prices falling off to receive the commodity down the road, when supply and demand may be more balanced

- Normally, the cost of securing a commodity would be higher in, say, six months than it is today due to storage costs in the meantime and opportunity costs (money invested in cocoa contracts that deliver the commodity in six months can’t be invested elsewhere during that time.)

MORE HEADLINES

🗞️ The New York Times sues OpenAI for training chatbots on its stories

🔻 Global mergers and acquisitions hit lowest level in a decade

😵💫 The five most bizarre moments in tech in 2023

💸 U.S. dollar heads for first negative year since 2020

⌚️ Apple can resume selling its watches stuck in a patent dispute after emergency appeal

💬 80% of Americans think presenting AI content as human-made should be illegal

🎓 Breaking Down the Spending at a Pricey Public College

Auburn.edu

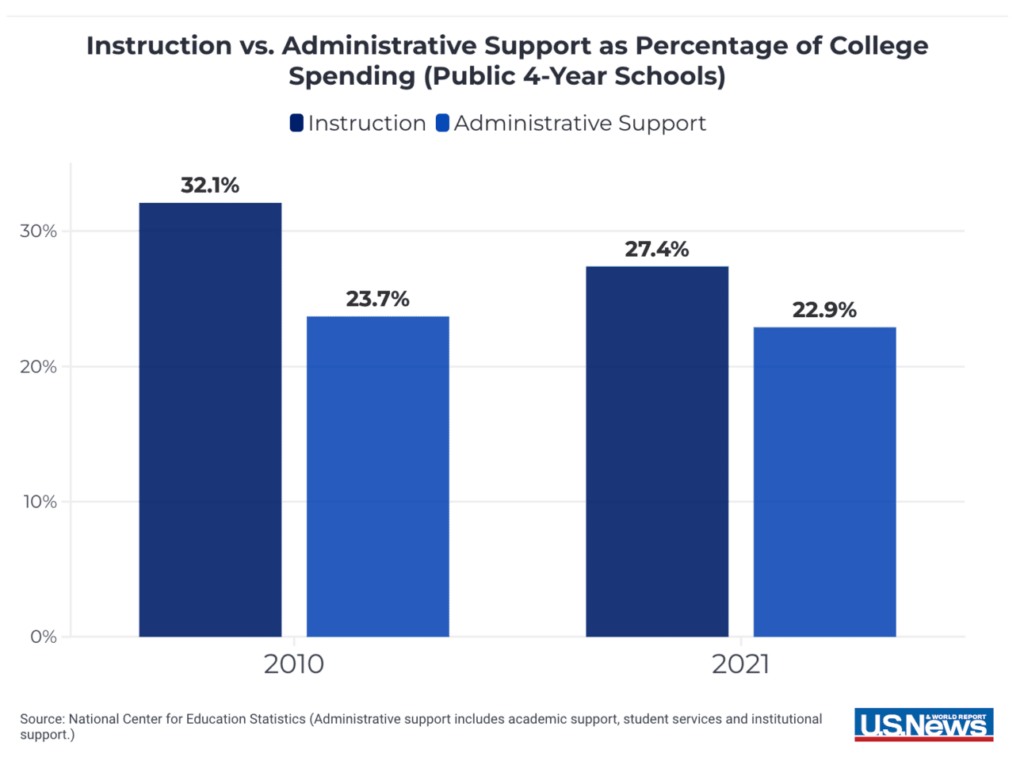

The soaring cost of college, accounting for inflation, is difficult to ignore. As colleges raise tuition and other costs, where does all the money go?

Take Auburn University, one of the country’s priciest public universities. As it raised tuition — which has jumped 60% in the last 15 years, adjusted for inflation — it kept spending.

Arms race: Auburn is among dozens of big schools charging students more money to finance their ballooning budgets.

- The Alabama school has added hundreds of millions of dollars to its budget. As you can probably imagine, that money didn’t go to the English or science departments. Very little went to scholarships for students, either.

- Most money goes to buildings, administrators’ salaries, and athletics, like a $74 million rec center, $84 million basketball arena, and a $51 million dorm.

- It hired hundreds of administrators. Spending at the president’s office surged.

- “In a lot of places, it’s an arms race—for new scientific equipment, for new athletic facilities, for upscale, inviting dorms,” said a former Auburn president. “It never seems to end.”

No college recession: Auburn’s budget in 2016 totaled $1.2 billion in today’s dollars, a jump of 82% over the past two decades.

Auburn opened eight dormitories in 2009, totaling about $118 million. There’s a $16 million indoor practice facility for athletes. And, in 2016, Auburn spent about $60 million paying down its debt, much of which was related to buildings. That’s roughly triple what it spent in 2002.

Why it matters:

Colleges are on a hiring spree, mostly in administration.

In 2016, Auburn spent $574 million for salaries, wages, and benefits. And while the number of faculty grew 10%, the number of (mostly) well-paid administrators grew by 73% from 2002 to 2016, reflecting a national trend.

- The budget for the board of trustees jumped from $100,000 to $1.4 million, while athletics spending jumped to over $100 million yearly, mostly financed by bonds to be paid with athletic department funds.

- “You don’t get much pushback at all on expenditures in athletics,” said the former president.

The bottom line: The growth in non-teaching positions at major American universities has concerned some onlookers, who say it distracts from a college’s core mission — education — while worsening the student debt problem.

Across most industries, businesses can do more today with fewer workers. Higher education is an outlier.

As one education policy expert commented, “The core mission of a school is teaching and research, so those should be the priorities, as well as limiting the cost to families and taxpayers. But that’s not their priority. Their priority is to expand empires.”

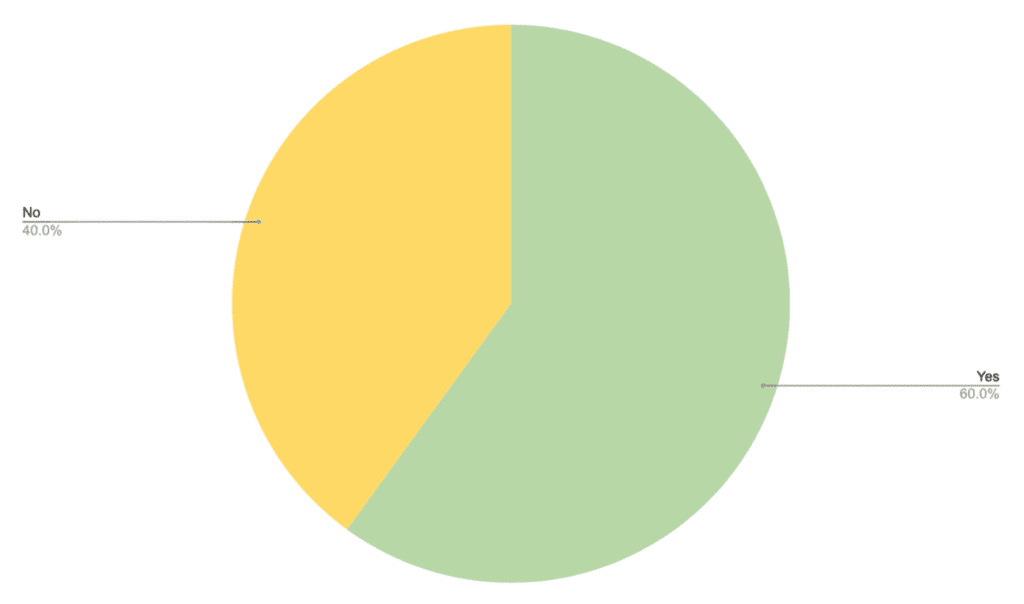

— One reader commented that I “no longer feel the need to do them.”

— Another on team “No” said, “New Year’s resolutions are only different from other resolutions in that their timing and genesis are inorganic.”

TRIVIA ANSWER

Between Thanksgiving and the end of January, U.S. shoppers are expected to return some $173 billion worth of goods, as reported by the Wall Street Journal.

See you next time!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

All the best,

P.S. The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more!

Join our subreddit r/TheInvestorsPodcast today!