Non-Physical Economy

09 August 2022

Hey, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Ray Dalio put out a chilling piece yesterday on the current Taiwan crisis, and his prognosis is bleak: the U.S. and China are engaging in risky tit-for-tat escalations that have historically preceded military conflict. You can read the full post here.

Right or wrong, markets aren’t panicking about this yet…

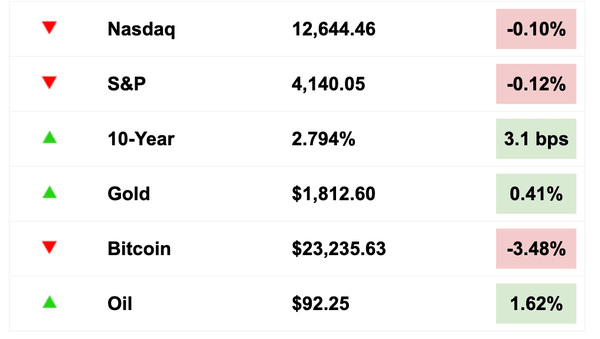

In fact, they were mostly flat yesterday. Oil prices have bounced a bit off of what many traders think is a price floor around 90$.

*Equities as of 4pm EST on prior day’s close, Bitcoin, bond, and oil prices as of this morning

Today, we’ll discuss the dominance of the digital age, the return of the meme stock craze, the Kelly Criterion, the U.S. chip industry, and the raid on Trump’s estate

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

🚗 Chip And Carmaker CEOs Meet Ahead Of Biden Signing (Reuters)

Explained:

- The heads of semiconductor chip making companies GlobalFoundries and Applied Materials met with leaders from Ford and General Motors, alongside President Biden, in a closed-door meeting on Monday.

- Correspondingly, Biden is expected to sign legislation today that provides a massive boost to the chip making industry that’s sorely needed, as the U.S. seeks to compete with China in this area while reducing reliance on Taiwan.

- The bill is set to provide $52 billion towards chip manufacturing and research, while also offering tax credits for chip plants worth around $24 billion.

What to know:

- Semiconductor chips have been a hot topic the past two years, as many of us learned just how important they are to the devices and tools we rely on everyday when shortages arose out of Covid supply chain disruptions. For the U.S. government, this is more than just a matter of convenience and high prices for new cars (which were famously hard to get a hold of in the Covid economy), it’s actually a question of national security.

- Everything from cars to washing machines to the military’s weapons rely on semiconductor chips, and the largest producer in the world by far for these is based in Taiwan.

- In case you missed the intro and have been living under a rock, Taiwan is under serious threat of occupation by China, and the U.S. government is working desperately to boost chip makers domestically that can offset a potentially crippling reliance on external producers.

😳 Is the Meme Stock Craze Back? (CNN)

Explained:

- We’d like to say it isn’t so, but meme stock mania exploded back onto the scene yesterday. Shares of struggling home furnishings retailer Bed Bath & Beyond (BBBY), video game retailer GameStop (GME), and movie theater chain AMC (AMC) soared in trading Monday, extending gains from last week.

- AMC was up 16% and has rocketed 70% in just the last five trading days, while Bed Bath & Beyond spiked 40% Monday and has more than doubled in the past week. GameStop climbed 12% and has gained 30% in the past week 😅

What to know:

- What’s going on? All three consumer stocks continue to have a loyal following among retail investors on Reddit and other social media sites. The “apes,” as they call themselves, hope to punish hedge funds who are short-sellers of these stocks, and they’re increasingly galvanizing support for their efforts again following the events of early 2021 that brought this movement to our attention.

- All three companies expect to lose money this year and next. AMC shares, which had a 1,200% pop in 2021, are down 5% for the year. GameStop, which soared 700% last year, is up 20% for the year. Let us know if you think this round of meme mania has any legs!

👮 Trump’s Mar-a-Lago Home Gets Raided (WSJ)

Explained:

- FBI agents searched former President Trump’s home at Mar-a-Lago to investigate his handling of classified information. Trump said, “nothing like this has ever happened to a president of the United States before,” and he said further that the raid was “not necessary or appropriate.” Hours after the raid, Trump supporters gathered outside his home, flying Trump flags and blaring the song, “We’re Not Gonna Take It.”

- The search, which included breaking into his safe, started Monday morning and lasted all day. To conduct such a search, the FBI would have needed to convince a judge there was reason to believe there may be evidence of a crime to be found at that location.

What to know:

- The search marked an escalation of the Justice Department’s investigation into Mr. Trump’s final days as President.

- Officials can face up to five years in prison for removing classified materials to an unauthorized location which is what he is suspected of doing. While it’s unknown what federal agents found at Trump’s home, the big question is whether incriminating evidence was seized, and if their findings will lead to charges against the former President. As much as we try to avoid politics, it’s certain that investors globally will be watching how this unfolds.

FEATURED SPONSOR

Why do you follow superinvestors like Buffett, Pabrai, Munger, and Greenblatt?

Because they have a proven track record for finding great management teams.

Get access to the 7 Red Flags for Passive Real Estate Investing to learn what to look out for in a deal’s management team.

DIVE DEEPER: TRIUMPH OF INTANGIBLE ASSETS

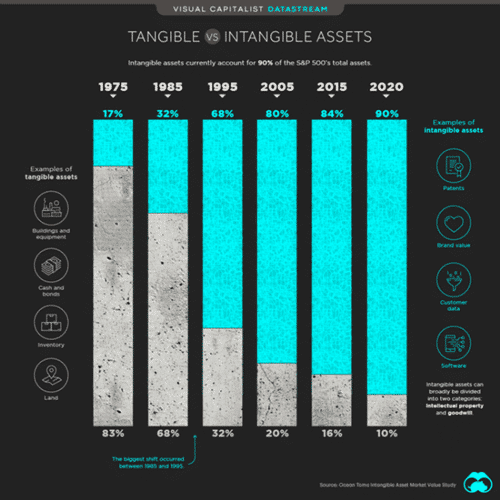

Recently, our colleague and friend Clay Finck, host of Millennial Investing, showed us a chart highlighting the changing composition of S&P 500 companies over time, from primarily tangible assets to now almost entirely intangible assets.

We are, of course, all likely familiar with the transition towards a digital economy over the past few decades, but the change in balance sheet compositions is truly striking for the largest companies.

See for yourself below:

In the 1970s, tangible assets made up around 83% of total assets for companies in the S&P 500 at the time, and the trend towards intangibles became particularly accelerated in the 1990s, with intangible assets rising to 68%.

In 2020, the number is approximated at 90% for intangibles, and it has probably trended higher in the past two years.

So what should we make of this?

Explained

Tangible assets are much more intuitive to understand. These include things like real estate, equipment and machinery, buildings, inventories, etc. whereas intangible assets are by definition more abstract.

These could be intellectual property like patents, trademarks, and copyrights, or it could even be the value of your brand in terms of consumer recognition or network effects.

The other defining part of intangible assets is known as goodwill. This only originates on companys’ balance sheets from mergers and acquisitions, and it happens when a purchasing company pays a price above the identifiable net asset value of the target company.

In other words, if company A buys company B for $1 billion, even though the book value of company B is $900 million, then that $100 million differential reflects the so-called ‘goodwill’.

Company A may pay a premium, because company B has an excellent corporate culture, great leadership, strong relationships with suppliers, sophisticated internal software, valuable customer data, or years of effective research and development, among many other non-tangible factors.

What to know

Today’s economy and stock market are profoundly different than in past eras. For investors, accounting for the value of tangible assets in valuing companies was a much more straightforward process than it is today, as one could clearly estimate the value of a company’s buildings or factories.

Famous investors like Warren Buffett don’t deny this either. Stock picking in past decades was just easier due to less convoluted business models, simpler technologies, and less efficient financial markets.

Example

Part of the reason stocks like Tesla are so controversial, is that it’s incredibly difficult for engineers, nonetheless Main Street and Wall Street investors, to determine just how valuable its intangible assets are.

While one person might tell you that Tesla’s designs for a self-driving system is the future of automobiles, others say it’s deeply flawed, or that its battery technology is inferior to competitors.

And the reality is that these values remain deeply uncertain even to those with a deep understanding of the technology, given the range of possible future outcomes for emerging innovations.

Takeaway

It’s okay to admit that you don’t know. For Buffett, who by the way is 91 years old, not investing in things he doesn’t understand has become a golden rule.

On the other hand, famed value investors like Bill Miller, have built on the Buffett legacy and used his values to effectively pick tech stocks like Amazon in their early years.

There was a time when tangible-asset heavy railroad companies were at the forefront of ‘tech’ and innovation, yet these have come to epitomize 20th-century “old economy” stocks to many now.

And many of today’s high-flying tech companies like Amazon and Alphabet (Google) may become stodgy old firms in just a few decades, epitomized in more recent years by stocks like IBM, Microsoft, and Cisco.

Even for seemingly non-tech companies though such as Coca-Cola, intangible assets are a huge source of value on their balance sheet in 2022. The influences of the non-physical economy are unrelentingly pervasive.

For investors today, even those not explicitly making bets on companies known for their technology, understanding the accounting behind intangible assets is a minimum for valuing most stocks.

Tell us – How do you account for intangible assets when calculating a stock’s value? (Just hit reply to this email!)

WHAT IS THE KELLY CRITERION?

Have you ever been perplexed about how much you should invest in a stock? Or wondered the best way to allocate the capital you have?

Wonder no more, because today, we’ll learn how to calculate this yourself using The Kelly Criterion.

What is it?

The Kelly Criterion is a mathematical formula used to determine what percentage of an investor’s capital should be allocated for each investment to maximize long-term growth. It’s also known as “Fortune’s Formula,” defining the maximum threshold of how much you should invest in a given stock.

The Kelly Criteria was created by John Kelly while working at AT&T’s Bell Labs. Gamblers first adopted it to determine how much to bet on horse races.

It was later adapted by some well-known investors, including Warren Buffett, Charlie Munger, Mohnish Pabrai, and Edward Thorpe. And famously, Thorpe applied the criterion to win at blackjack, which worked so well for him, that he was permanently banned from casinos in Las Vegas. Here’s his book on it.

We like to clone what smart investors do with their portfolio, and learning the Kelly Criteria is a great tool to optimize your long-term capital growth.

So What?

Let’s look at how we could use the Kelly Formula through a simple game of heads and tails where you have $1 to bet.

Here’s the scenario: If the coin comes up heads, you win $1.50. If it comes up tails, you lose $1.

In this bet, do you put all of your money on the coin flip?

Of course not, because you have a 50/50 chance of losing your entire stake in just one flip. However, the win would be bigger than the loss while the odds are 50/50.

How do we work out how much to bet then?

The Kelly Formula tells us what to do.

How much to bet?

The Kelly Percentage = W – [(1-W)/R], where W is the win probability, and R is the ratio between profit and loss in the scenario.

So, in our coin toss example, we’ve got the following formula:

K% = .5 – (1 – 0.5) /1.5 = 0.167 or about 17% of your available balance

So, in this case, it would be wise for your first wager to be .17 cents.

If you lose, you still have the bankroll to try several more times again.

One thing to keep in mind, the Kelly Criterion only works if you have a profitable opportunity. It doesn’t work in a game like roulette, where the casino has greater odds of winning over time.

Takeaway

We can also apply the formula to the world of investing.

As value investors, we may only have 10-20 great opportunities in a ten-year period.

So, how would it work for us? Unlike a coin flip, it’s much harder to predict the probability of winning with a stock, but we have to give it our best guess. We are trying to be mostly right and not terribly wrong in our estimates.

Take your best educated guess, using past returns you’ve experienced for your probabilities and expected returns, and plug in the values.

Try not to be put off by all the numbers. There are calculators and spreadsheets to help you. We like this nifty calculator here to play with to determine what the Kelly Criterion would suggest is your ideal allocation.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.