Lovin’ It

Hi, The Investor’s Podcast Network Community!

📈 It was a good day to be Mark Zuckerberg. Meta’s 38-year-old CEO grew $10.3 billion richer amid a surge in its share price Thursday after an earnings report that smashed analyst expectations for profit and revenue.

Since its November low, Meta’s stock is up nearly 150%. We’ll have more below on how ‘Zuck’ is reining in costs and refocusing the company’s bread-and-butter advertising business.

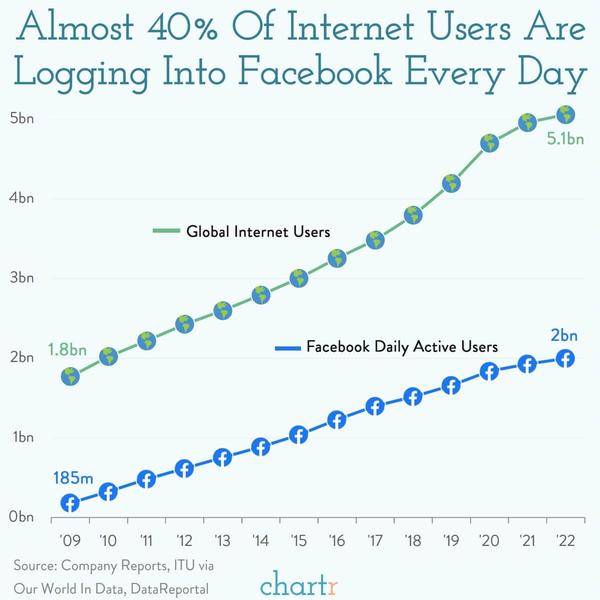

As you’ll see in our chart of the day, nearly 40% of global internet users log into Facebook every day 🤯

In other Big Tech news, Amazon continued a much better-than-feared earnings season with a revenue beat thanks to resilient demand for its online shopping and cloud services businesses.

Its stock jumped 8% after hours the same day the S&P 500 rose nearly 2%, its biggest single-day gain since January.

–Matthew

MARKETS

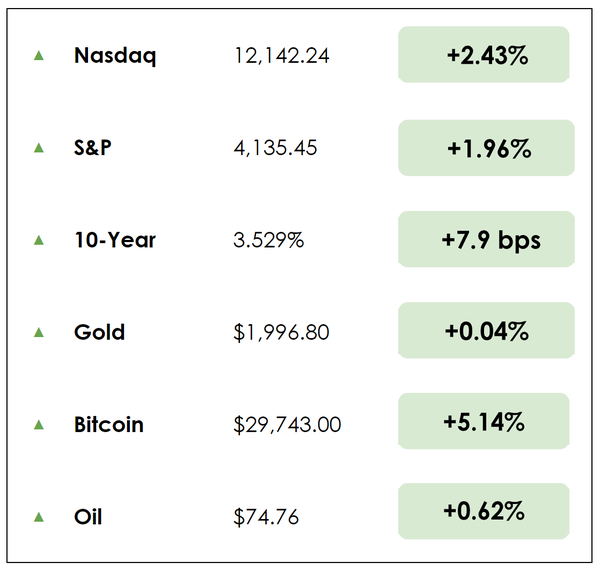

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- NYC, Jersey City rents stay high

- Meta’s latest earnings report that crushed expectations

- Plus, our main story on the “junk food” economy

All this, and more, in just 5 minutes to read.

Trivia question — How many McDonald’s locations are there in the world?

Read to the end of the newsletter to find the answer.

BROUGHT TO YOU BY:

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🏠 NYC Retains Highest Rents but Jersey City Narrows the Gap (Bloomberg)

Jersey City, New Jersey, has the fastest-growing apartment costs in the U.S., with only neighboring New York City across the Hudson River surpassing it.

Experiencing a nearly 28% surge from the previous year, Jersey City’s rents saw the largest annual growth among 100 U.S. cities assessed by the apartment listings website.

- The City also reached its highest position in Zumper’s one-bedroom rent ranking for the first time. A year ago, it wasn’t included in the analysis; however, it would have placed seventh, the company states.

With a median one-bedroom rent of $3,000 in April, Jersey City matches San Francisco but remains more affordable than New York’s $3,570, as per a Zumper report.

Why it matters

While rent growth has slowed nationally, Jersey City is an exception. The U.S. median one-bedroom rent was $1,495 this month, a 6% increase from the previous year, yet rents had been experiencing double-digit growth for much of 2021 and 2022, according to Zumper.

Jersey City’s appeal stems from its comparatively affordable prices and accessibility, being only a brief train or ferry trip from Manhattan.

Value-seeking renters have expanded into New York’s peripheral boroughs and nearby urban areas like Hoboken and Jersey City, often dubbed “Wall Street West” due to the influx of finance jobs relocating there.

- “We’re seeing record numbers of applications for apartments there, as more people are priced out of the five boroughs, they’re turning to spillover cities…and Jersey City is especially attractive thanks to its ample public transportation and waterfront area,” said Zumper CEO, Anthemos Georgiades.

🥽 Meta Sees First Sales Increase in Nearly a Year (WSJ)

Facebook’s parent company, Meta Platforms, reported its first sales increase Wednesday in almost a year, thanks to improvements in its advertising business. Meta’s CEO Mark Zuckerberg attributed the gains to Reels, its short-video TikTok alternative, for boosting overall app engagement on Facebook and Instagram.

- Saying, “We’re increasingly doing this work from a position of strength” after being blindsided by TikTok’s popularity (which reached 150 million monthly users in the U.S. in February) while struggling to excite users with Reels.

- Facebook alone boasts over 2 billion active daily users worldwide, citing a 40 million increase from the previous quarter.

Meta reported a whopping $28.6 billion in revenue, up 3% from last year and snapping a streak of three quarters of declining sales. Even better, it projected that revenue might reach $32 billion next quarter.

- Its stock jumped 14% today on the news.

Why it matters

A weaker economic environment, increased regulations, and fallout from changes Apple made in 2021 limiting personalized ads have hurt the digital-ad market, Meta’s core business.

- This all contributed to a selloff last year that wiped out over $600 billion in market value as its stock fell by two-thirds.

The company’s investments in AI tools to improve its ad-target systems are seemingly paying off, though. And Zuckerberg thinks AI will boost its business in other ways, helping marketers create more advertisements, powering chatbots for businesses on Messenger and WhatsApp, and enabling Metaverse users to more easily craft avatars and virtual worlds.

Still, investors remain fixated on the company’s troubled Reality Labs division. The unit, which makes Meta’s Quest virtual-reality headsets, posted a 51% decline in revenue from last year and a $4 billion operating loss.

- Yet, Zuckerberg emphasized, “Building the Metaverse is a long-term project…the rationale for it remains the same, and we remain committed to it.”

MORE HEADLINES

🏰 Disney alleges that Florida’s Governor DeSantis initiated a “targeted campaign of government retaliation” against it

🤖 JPMorgan creates AI model to analyze 25 years of Fed speeches

🐌 U.S. economy grows slower than expected last quarter at 1.1%, down from a 2.6% in the 4th quarter

Buffett’s appetite

Warren Buffett says he’d give up an extra year of his life to be able to eat anything he wants. A big fan of junk food, the 92-year-old investor drinks five cans of Coke and eats McDonald’s daily.

“I always tell people: I found everything I like to eat by the time I was six,” he told CNBC this month. Once, the Oracle of Omaha stated: “I checked the actuarial tables, and the lowest death rate is among 6-year-olds. So I decided to eat like a 6-year-old. It’s the safest course I can take.”

Many Americans are right there with him. In a recent article, health writer Philip Pearlman pointed out that “junk food” companies benefit tremendously from the country’s love affair with fast food. Despite recent health-conscious pushes, their stocks are hitting new all-time highs.

It’s great for shareholders but not so great for the overall health of Americans. The higher the “junk food” companies’ share prices rise, the more Americans gain weight.

The behemoths

Who said America is becoming more health conscious? It could be true amid the rise in veganism, health apps, gyms, and “fitness culture” on social media. But you wouldn’t know it by looking at the big brands making billions of dollars off (mostly) junk food and drinks.

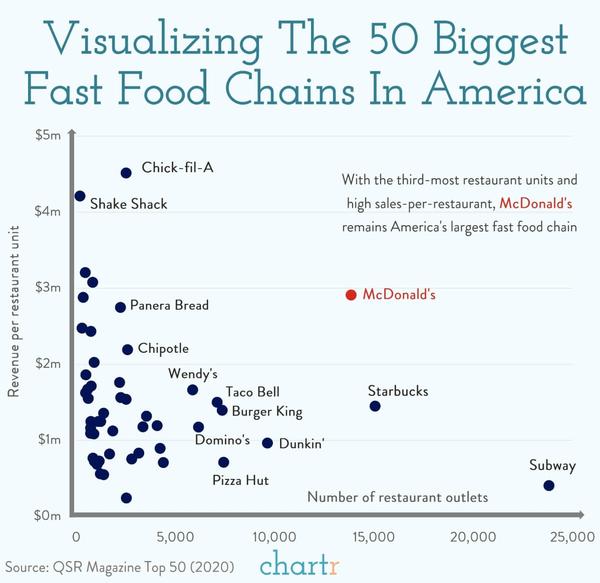

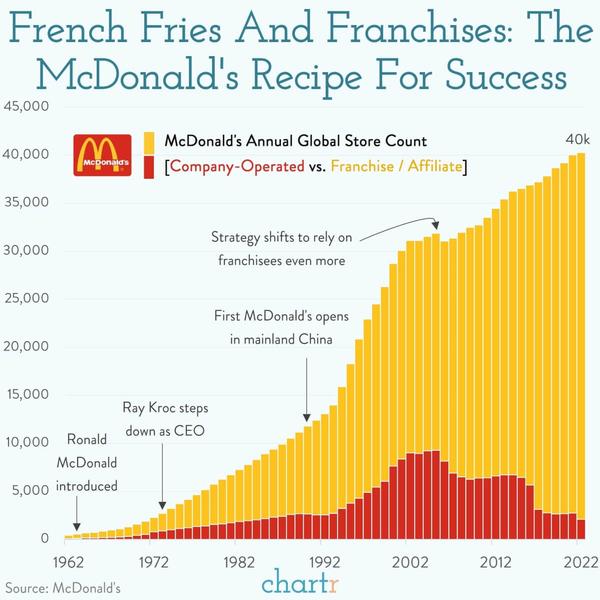

McDonald’s: The original fast food giant has a $200 billion market cap. One Big Mac meal, including fries and soda, has 149 grams of carbs and 1,100 calories.

PepsiCo: Pepsi, Mountain Dew, Lays Potato Chips, Fritos, Cheetos, Doritos. The junk food behemoth has a $260 billion market cap, just made a new all-time high, and has been investing in A.I. for its daily operations, including developing new products, analyzing sales, and increasing safety at warehouses. Its stock rose this week on positive guidance.

General Mills: The large cereal producer makes Cheerios, Cinnamon Toast Crunch, Cocoa Puffs, etc. The stock has doubled in the past five years, outpacing the S&P 500.

Hershey: The $50 billion company makes candy such as KitKat, Mounds, Twizzlers, and Reese’s Peanut Butter Cups. The stock has jumped nearly 200% over the past five years to reach new all-time highs. The company said strong demand despite price increases had boosted profits, just like the other brands on this list.

Why?

Fast food and sugary breakfast cereal are relatively cheap options amid high inflation. While fast-food prices have risen since the pandemic, it’s still less expensive to feed a family of four at McDonald’s than at Sweetgreen or by loading a shopping cart with fresh vegetables and fish from Whole Foods.

Roughly a quarter of Americans eat fast food daily. It’s cheap, it’s fast, it’s easy. And it’s everywhere.

In addition to convenience and affordability, these brands spend billions of dollars annually on advertising and marketing, promoting their products as delicious, fun, and satisfying. They’re ubiquitous in the U.S., making them accessible to nearly every American.

Their food is engineered to be highly palatable, with high levels of fat, sugar, and salt, making it difficult for people to resist.

And then there are the cultural factors: Fast food has long been a key part of American culture.

Economies of scale

These chains operate on a large scale, which allows them to benefit from economies of scale. They produce and sell their products at a lower cost per unit than smaller businesses, boosting their profit margins.

They also benefit from standardization to streamline operations and reduce costs, large marketing budgets, and franchising, which allows them to expand rapidly without incurring the full costs of opening and operating new locations. Franchises pay fees and royalties to the parent company (say, McDonald’s), which provides a steady revenue stream.

Then there’s something more subtle but powerful: Fast food chains use menu engineering techniques to maximize profits. They might use “combo meals” to encourage customers to buy more items. It’s a prime example of the power of upselling as a sales strategy.

The problem

Fast food consumption has been linked to various health problems, including obesity, diabetes, and heart disease. There are unquestionably outliers, like Buffett, who is still as sharp as a tack.

But, according to Harvard’s School of Public Health, roughly one in three American adults is overweight. Obesity rates are higher in Black, Hispanic, and Mexican American adults than in White adults.

If U.S. trends continue unabated, by 2030, estimates predict that roughly half of all men and women will be obese.

Additionally, there are concerns about the fast food industry’s social and environmental impact, including labor practices, animal welfare, and sustainability.

A Harvard study concluded: “Slowing the increases in obesity and turning around the epidemic will take large-scale, multifaceted efforts, within individual countries and across the globe, to improve people’s food choices and increase physical activity. These efforts cannot begin in earnest soon enough.”

Dive deeper

Here’s Harvard’s in-depth Obesity Prevention page with resources, research, and statistics. And here’s Our World In Data’s report on obesity.

Enjoy reading this newsletter? Forward it to a friend.

TRIVIA ANSWER

There are about 40,000 McDonald’s locations across the globe in over 100 countries. There are nearly 14,000 in the U.S. alone.

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

All the best,