Losing $1 trillion

10 November 2022

Hi, The Investor’s Podcast Network Community!

It’s Thursday, folks, but on Wall Street, it was inflation day.

And to investors’ and the Federal Reserve’s relief, the data came in lower than expected, indicating that perhaps inflation was beginning to respond to interest rate hikes.

Relief is the understatement of the year, though. Markets were elated by the report 🥳

Why?

🤞 Well, the sooner inflation comes under control, the sooner we can return to the loose monetary policies that powered stocks higher over the last decade. At least, that’s the hope.

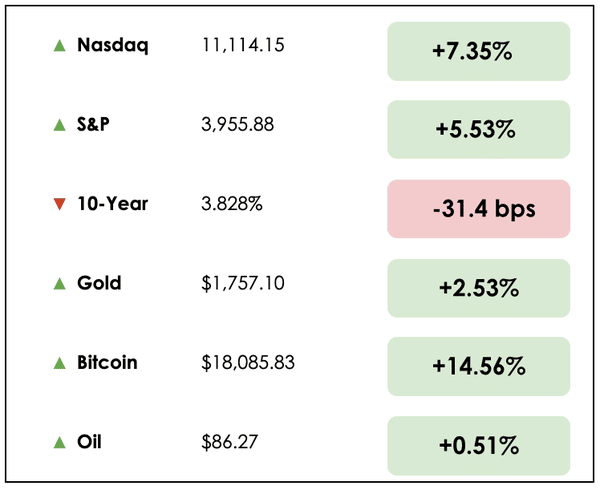

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two things in the news: A billion-dollar art collection goes for sale and Amazon breaks a new record (but not in a good way), plus our main story on how technology is changing property investing.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🎨 Microsoft Co-Founder’s Art Collection Tops $1.5 Billion (FT)

Explained:

- The art collection of Paul Allen, the late co-founder of Microsoft (MSFT), which consisted of 60 masterpieces spanning 500 years, sold for over $1.5 billion.

- The sales total shattered the previous record for the most expensive collection ever auctioned by over $500 million. Five paintings broke the $100 million mark, and several works sold for three or four times their estimates.

- Allen left Microsoft in 1983 due to health problems and a deteriorating relationship with his partner, Bill Gates. At the time of his death, he had a net worth of $20.3 billion, according to Forbes.

Why it matters:

- The record-breaking sale suggests that the global rich still view masterpiece art as a hedge against inflation and, perhaps, a safer store of value than increasingly volatile stocks.

- Before his death, Allen had stipulated that all the proceeds from the collection would be donated to charity.

📉 Amazon’s $1 Trillion Loss (Bloomberg)

Explained:

- Amazon (AMZN) became the first public company to lose a trillion dollars in market value after its shares fell 4.3% on Wednesday, dropping its market value to roughly $879 billion from its high in July 2021 of $1.88 trillion.

- A combination of rising inflation, tightening monetary policies, and disappointing earnings reports prompted a historic selloff in the stock this year.

Why it matters:

- The world’s largest online retailer has been adjusting to a significant slowdown in e-commerce growth as consumers resumed pre-pandemic habits.

- Amazon projected the slowest revenue growth for a holiday quarter in the company’s history as shoppers are expected to reduce spending in the face of economic uncertainty.

- While technology and growth stocks have been punished this year, fears of recession have further reduced sentiment in the sector. By revenue, the top five U.S. technology companies have seen nearly $4 trillion of market capitalization wiped out.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: SILICON VALLEY TECH MEETS REAL ESTATE

Overview

We sat down to listen to Robert Leonard’s interview with Andrew Luong, co-founder and CEO of Doorvest. He hopes to use technology to enable everyone to invest in the $3 trillion single-family rental market.

Luong’s firm is a venture capital-backed startup with a mission to advance financial security for all. He explains that growing up during the 2008 recession and seeing how personal finances could tear families apart made him obsessed with financial security.

This led Luong, like so many others, into the world of real estate investing when he bought his first home for $96,000 in California in his early twenties.

He soon learned that buying the cheapest property in a city wasn’t a formula for success since turnover was high and break-ins remained a persistent issue.

But he had accumulated four properties, now, that he managed on the weekends, which were all still lower in quality.

Lessons learned

Rather than quitting after buying in the wrong areas, as he saw how his properties could provide solid rental income, he focused on investing in nicer neighborhoods that made for less of a headache.

This led him to Texas, where he found several growing yet reasonably priced property markets. As friends and family took note of his success, people increasingly approached him and asked how to get started in real estate, so he made a basic 15-point checklist that went over how to find an agent, evaluate different property markets, and analyze a home’s value.

Despite telling people exactly what they needed to do, when he’d catch up with them later on, they often had bailed on doing it themselves and even would ask if they could give him the cash to do it on their behalf.

And that’s what inspired him to start Doorvest, so he could help people buy single-family-rental properties while following his strategy of investing in high-quality neighborhoods in growing areas.

The process

First, they work with customers to determine their investment preferences, find compelling properties, buy them, renovate, and lease them out. With everything in place, they return to the customer with a finished product that they can buy as an investment.

As a customer, for Doorvest to do this, you must sign a contract upfront agreeing to purchase the house from Doorvest after they’ve completed their end of the deal.

Doorvest gets a cut of the transaction and manages the property on the customer’s behalf. Once the title transfers in the customer’s name, the company earns revenue via a management fee for its ongoing property management services.

With over 70% of its customers being first-time property investors, Doorvest appears to be living up to its mission.

What to know

As opposed to other “turnkey” property companies, Luong sees Doorvest as a modern alternative that embraces tech, particularly in matching customer preferences with properties. On top of this, due to their size and network, they can purchase exclusive “off-market” homes.

In other words, they use their connections to buy desirable properties not listed for agents and other investors to see.

For those who use the service, returns are lower than they would be if they did it all themselves since they’re paying property management fees to Doorvest and buying the property at a higher price. But the time-savings and reduced stress are considerable enough that it makes sense for these people to do anyways.

Investors who have always wanted to get into rental properties and just haven’t found the courage to leap into a first deal alone will probably find this offering pretty attractive.

Risks for Doorvest

It is a cyclical business, though, and one could imagine how quickly Doorvest’s business model would come under pressure in a market that turns down.

On top of this, its profit margins are narrow, and the prospect of hitting scale is restricted by focusing only on single-family properties.

But working with them as a customer to make your first rental property investment is more appealing, especially because the company guarantees the first year of rental income.

Takeaways

Since you do take ownership of the home, and Doorvest acts as an intermediary to locate a desirable investment property, rehabilitate it, and then continue to manage it as a landlord (finding tenants, making repairs, etc.), presumably, the primary risk to you would be that if they go under you just have to assume a more active management role for your property.

And, obviously, the risk that the property itself proves to be a poor investment.

For Luong, he says, “the hope and dream is to build a multi-decade company that transforms the way people think about financial security.”

Dive deeper

To get the full story on Doorvest, you can listen to the rest of the interview here.

And to learn more about turnkey properties and real estate investing, check out Robert Leonard’s interview with Antoine Martel.

RECOMMENDED READING

The Life-Changing Concepts newsletter makes you more successful in life with mental models and actionable ideas.

Get a summary of 20 useful mental models when you join. It’s free.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.