Landlord Golden Age

Hi, The Investor’s Podcast Network Community!

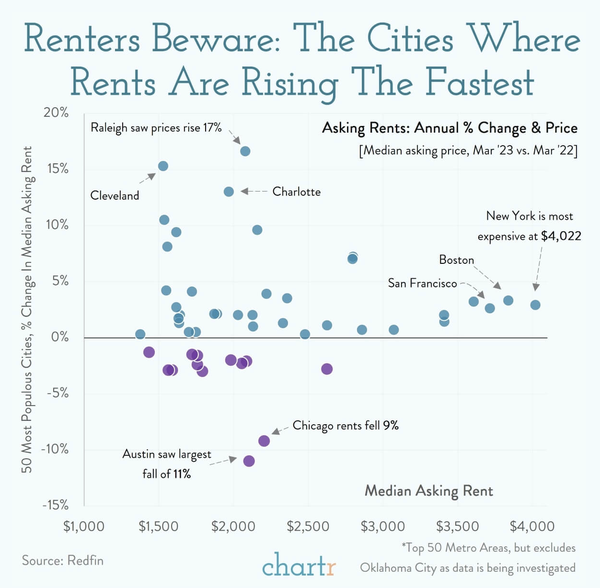

🏡 Today’s newsletter is heavy on real estate. Comparing March 2023 to March 2022, cities like Austin and Chicago saw 11% and 9% declines in asking rates for rents, respectively.

While others, like Raleigh, North Carolina, saw a 17% jump (scroll down to our chart of the day to see this all visualized).

And the good times of being a landlord may be ending — more on that in our main story.

Oh yeah, happy Tax Day, too.

—Shawn

Here’s the rundown:

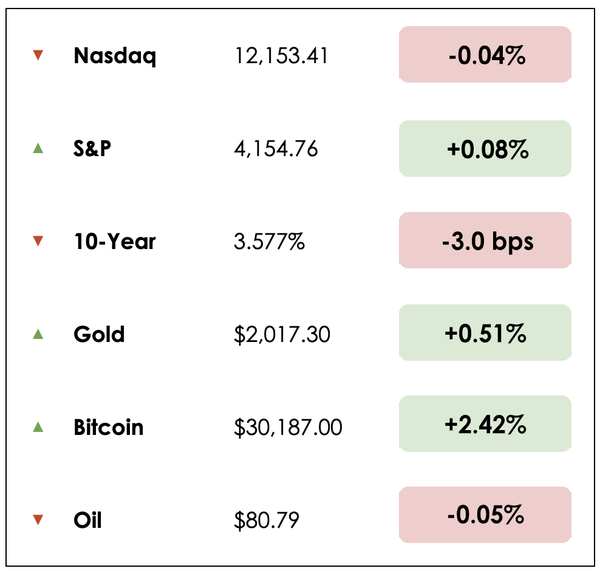

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Goldman Sachs’ quarterly earnings

- Updates on Miami’s hot real estate market

- Plus, our main story on why the golden age of being a landlord may be over

All this, and more, in just 5 minutes to read.

Today’s trivia: In a survey of 1,000 homeowners across the country, what percent sold a house due to paranormal activity?

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

💵 Goldman Sachs Stumbles in Q1 (NYT)

Explained:

Goldman Sachs (GS) reported lower profit in the first quarter, with results were hurt by a slowdown in deal-making and a sizable loss on the sale of part of its Marcus personal loan portfolio.

- Meanwhile, peers such as JPMorgan Chase, Citigroup, and Bank of America all reported higher profits despite chaos in the industry.

Goldman’s miss demonstrates its challenge in moving into consumer lending. The bank also announced the transfer of the rest of the Marcus loan portfolio from held to maturity to held for sale.

- The result is a $470 million loss on the portion already sold and the transfer of the remaining personal loan portfolio to available for sale.

- Consumer loan losses are expected to worsen across the industry, and personal loans are among the riskiest consumer loans because they’re often unsecured. Customers tend to deprioritize paying them compared with other loans when their finances take a hit.

Why it matters:

Goldman’s deal-making also slowed dramatically after a blockbuster 2021. It was brought down by the uncertainty caused by Russia’s war in Ukraine, but mostly by the Federal Reserve’s aggressive rate increases.

- Investment bankers looking for a rebound in 2023 might be out of luck. The latest banking crisis, continued rising interest rates, and uncertainty in the economy have threatened to prolong the slowdown.

- Some bankers see deal-making opportunities in midsize categories, for companies valued in the single-digit billion-dollar range to below $20 billion. Plus, the latest banking crisis could help increase M&A activity among smaller banks with more of an appetite to be bought after the collapses of Silicon Valley Bank and Signature Bank.

Goldman is focusing more on its asset and wealth-management division, a key part of CEO David Solomon’s strategy to make the bank’s results stronger and more reliable.

- He hopes the unit will shore up profits whenever investment banking and trading take a hit. Sure enough, revenue in asset and wealth management was a bright spot, up 24% from a year ago.

😎 Miami Stays Hot (WSJ)

Explained

It feels like everyone knows someone who moved to Florida during the pandemic. Warm weather, looser business regulations, remote work, and lack of a state income tax continue to draw residents to Florida long after the pandemic began.

- Miami home-price growth slowed but continued its ascent in the first quarter, fueled by persistent demand even as higher mortgage rates pull down housing prices across the U.S.

- Miami posted the country’s fastest year-over-year home-price growth at 15.9% in 2022, per the S&P CoreLogic Case-Shiller Index.

Residents and businesses continue to flock to the Sunshine State—and South Florida in particular. Florida gained more residents than any other state in 2022, per the U.S. Census Bureau data, while Miami’s housing inventory is down by about half compared with the first quarter of 2020.

Why it matters:

Headwinds include higher insurance premiums due to high litigation costs and growing catastrophe losses as the climate changes.

- “Insurance premiums are creating a big issue for the middle-class home buyer,” one real estate expert in Florida commented. “It’s a real struggle.”

Even so, some economists forecast that Miami’s housing market will hold its price gains better than most elsewhere. The lack of inventory and Miami-Dade County’s strong job growth mean that home values in the area are more likely to remain stable or increase at a single-digit pace rather than decline, argued the chief economist at the Miami Association of Realtors.

- Said one Miami real estate veteran: “Our market has caught up and exceeded some of the strongest markets in the country. I think it speaks to the transformation of the city.”

MORE HEADLINES

👨⚖️ High-stakes Fox-Dominion defamation trial kicks off

🏡 New construction falls in March, building permits down 8.8%

✍️ The four biggest banks wrote off $3.4 billion in bad consumer loans last quarter, a 73% increase from a year earlier

The golden age

Being a landlord in a major city has been a good gig for years: Laws are generally favorable to owners over renters, and interest rates have been trending down for decades, pushing up the value of financial assets.

One New York City landlord, Ben Carlos Thypin, thinks the good times might be ending, at least for residential properties.

To answer whether the landlord golden age is winding down, he paints the context that preceded it:

- “There’s this great paper by Professor Katharina Knoll that looks at housing prices over time from 1870 to the present, and she studies 14 countries, including the U.S. What she found is that until around 1950, depending on the country, housing prices were relatively flat. And then after that, they’ve exploded.”

What changed in the mid-20th century, he suggests, was the subsidization of homeowners and single-family homes in the suburbs.

Simultaneously, less was invested in public housing in favor of private solutions, while land use controls restricting new developments were frequently implemented to protect homeowners’ investments.

Enter the golden age for landlords.

Two decades later

Thypin argues that by the late ’70s, homeowners, and the businesses surrounding them, had formed a powerful coalition that successfully lobbied to “pare back rent regulations where they existed, ban them where they didn’t exist, and generally implement a set of policies that discriminated against renters.”

Because homeowners were less transient than other groups, they formed a potent political block due to their higher propensity to vote. It was almost like a “Ponzi scheme because (they were) protecting their investments by putting up barriers to entry.”

In other words, the next generation of prospective home buyers were the losers, buying in at higher-loan-to-value ratios for properties with “arguably inflated” values or opting to rent indefinitely.

He compares the dynamic to enabling Enron to run wild with deregulated energy markets in the early 2000s, “except we’ve been doing it all over the country for decades” in local property markets.

Varying business models

With that backdrop, Thypin remarks that landlords typically have two business models, depending on the city. New York City landlords rely more heavily on property price appreciation to drive returns than yield from rents. In contrast, in the Sunbelt, things are much more yield-focused.

The differences lie, perhaps, in that the U.S. is one of the few developed countries with vast unregulated rental markets, at the same time that the business of multifamily real estate became institutionalized.

Institutionalization

He adds, “This has happened in a particularly acute way in multifamily because of just how big the market is, how long-standing of a business it is, and how relatively homogeneous the product is.”

Saying further, “It’s become a business where everyone is getting their cut.” And corporations like Blackstone are much better at organizing to push for favorable political changes than classic mom-and-pop landlords.

Essentially, beginning in the 1950s, deregulation and institutionalization of the rental market fundamentally made landlording more profitable, at least according to Thypin.

Technology facilitated more efficient unit pricing and building operations, allowing professional landlords to extract profit out of every part of the business, not necessarily to the benefit of the public.

But demographic change and technology are reversing this golden age.

Shifting tides

While renter groups were often marginalized demographics in the past that politicians more willingly ignored, as renting has become more mainstream, so has the block’s political influence.

Thypin cites the YIMBY movement, standing for ‘Yes In My Backyard,’ which has effectively advocated for building housing in high-demand areas. “In parallel, we’ve seen a resurgence of the rent regulation and tenant protection movements.”

He notes that the U.S. has an unusually low homeownership rate, contrary to what most think. A paper published in the Journal of Economic Perspectives found that in 2015 the United States’ homeownership rate was 63.7%, compared to an average of 69.6% for 18 developed countries and well below countries like Spain, Sweden, Ireland, Finland, Canada, and Italy.

Compared to countries with similar homeownership rates, American cities typically don’t have rent controls. However, “we’ve seen the resurgence of rent regulation not just in places like New York and California, but also in Minnesota and even Orlando.”

Technology is enabling tenants to organize, forming more powerful coalitions to negotiate rent price moderation or new housing construction, increasing supply, and pulling down prices. In New York State, for example, a proposal from the governor aims to build 800,000 homes over the next decade.

Thypin explains that the economics haven’t changed for developers per se, but they do feel emboldened to try and rezone residential communities that were previously very hostile to new development.

What to expect

Institutionalization will likely continue because real estate is a capital-intensive business, and institutions can fund their investments at a lower cost of capital, allowing them to remain profitable in this shifting environment.

That’s why, as a non-institutional landlord, Thypin plans to leave the business, thanks to secular shifts that he expects will empower tenants at the expense of landlords like himself and their profits.

Still, he offers advice to tenants, “you have more leverage than you think, generally speaking. If you leave a landlord, they probably lose a month of rent. So at the very least, you should factor in that month of lost rent and even a broker fee into what you’re negotiating for.”

Dive deeper

To hear the full interview about the end of the golden days for landlords, listen to this Bloomberg podcast.

TRIVIA ANSWER

According to one survey, more than three-fourths of respondents said they had experienced paranormal activity in their homes, and 10% cited it as a reason for selling.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.