Investing For Freedom

14 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Yesterday was the worst day for stocks since June 2020.

While President Biden was quick to dismiss the selloff following another concerning inflation report, others are calling for the Federal Reserve to respond with a 100 basis point (bps) hike instead of just a 75 bps move.

According to Factset, markets now see a 34% chance of the Fed opting for a mega 100 basis point (1%) hike this month.

Equities were sluggish this morning following their beating on Tuesday before staging a modest relief rally after another key inflation metric, the Producer Price Index, showed that wholesale prices declined slightly month-over-month.

And in good news for coffee drinkers, Starbucks is investing $450 million to revamp its North American stores ☕

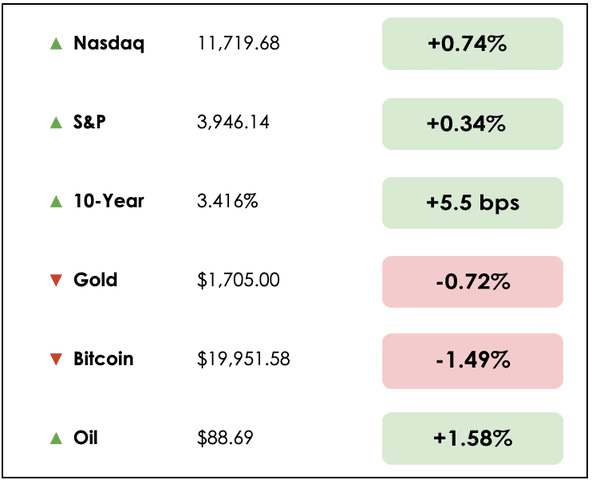

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss efforts to stop an invasion of Taiwan, crackdowns on tech monopolies, surging mortgage rates, and “Freedom investing.”

All this, and more, in just 5 minutes to read.

Read on 📖

IN THE NEWS

U.S. Weighs China Sanctions To Deter Taiwan Invasion (Reuters)

U.S. Weighs China Sanctions To Deter Taiwan Invasion (Reuters)

Explained:

- The U.S. is considering a sanctions package against China to deter it from invading Taiwan. The European Union is also getting diplomatic pressure from Taipei to do the same.

- Growing fears of a Chinese invasion have been mounting as military tensions rise in the Taiwan Strait. China claims Taiwan as its own territory and last month fired missiles across their unofficial sea frontier after Nancy Pelosi’s visit to Taipei.

- Chinese President Xi Jinping has vowed to bring Taiwan under Beijing’s control and has not ruled out the use of force.

What to know:

- The U.S. and the European Union are in the early stages of deliberation in determining the extent of the sanctions. Initial thoughts would be to restrict trade and investment with China in technologies such as computer chips and telecom equipment.

- The idea of sanctions on the world’s second-largest economy and one of the global supply chain’s biggest links raises questions about feasibility.

- “The potential imposition of sanctions on China is a far more complex exercise than sanctions on Russia, given the U.S. and allies’ extensive entanglement with the Chinese economy,” said Nazak Nikakhtar, a former U.S. Commerce Department official.

📱 Google Fined $4.12 Billion (WSJ)

Explained:

- The European Union’s campaign to rein in alleged anticompetitive conduct by big tech companies notched a victory yesterday. Alphabet Inc.’s (GOOG) Google lost most of its appeal to overturn the largest antitrust fine it has ever faced.

- The European Union’s General Court in Luxembourg largely upheld a 2018 ruling that fined Google $4.3 billion. This was for, reportedly, abusing the market dominance of its Android operating system on mobile phones to promote and entrench its Google search engine and Chrome browser on mobile devices. The court reduced the overall fine by just 5% to $4.12 billion 😲

What to know:

- The Android case was the biggest of three antitrust cases lobbied against Google, totaling more than $8 billion since 2017.

- The ruling is a vote of confidence for the European Commission, the bloc’s antitrust enforcer, which has been aggressively targeting U.S. tech companies over concerns of anticompetitive behavior.

- Last week, the Commission also blocked Illumina’s (ILMN) $7.1 billion proposed merger with cancer-test developer Grail Inc., two U.S. companies.

🏠 U.S. Mortgage Rates Top 6% (Reuters)

Explained:

- The average interest rate on a 30-year mortgage rose to just above 6% for the first time since 2008 and is now more than double what it was just one year ago, according to the Mortgage Bankers Association (MBA).

- Rising mortgage rates are weighing heavily on the interest-rate-sensitive housing industry, as the Fed continues to wage its war against high inflation. The central bank has raised its overnight lending rate by 225 basis points (2.25%) since March. Another rate hike of 75 basis points is expected this month.

What to know:

- The yield on the 10-year note acts as a benchmark for mortgage rates and currently sits at 3.44%.

- The MBA said its Market Composite Index, which measures mortgage loan applications volume, is down 64% from a year ago, while its Refinance Index dropped 83.3% during the same period.

- The impact of higher mortgage rates is being felt across the housing industry. New home sales plummeted to a six-year low in July. However, house prices remain elevated, and a lack of supply of affordable housing makes a housing collapse unlikely.

DIVE DEEPER: FREEDOM INVESTING

Overview

While investing dogma, of course, encourages diversification, this comes today at a time particularly sensitive to geopolitical risks.

Many hold in their retirement accounts allocations to stocks in emerging markets that yield profound uncertainties.

For example, we’ve issued warnings previously about investing in Chinese stocks listed in the United States, due to the commonly used variable interest entity (VIE) structure.

To summarize, these shares aren’t fungible with listings of domestic companies like, say, Apple (AAPL).

The Chinese shares from VIEs represent ownership in shell companies based outside of China that, supposedly, are entitled to a share of the underlying company’s profits, though in reality, there are essentially no legal guarantees in China that validate this for foreign investors.

The issue

Although these developing countries, like China, surely offer high economic growth prospects, and correspondingly, temptingly higher potential equity returns, many of these places lack the traits so commonly taken for granted when investing in places like the U.S. & Canada, western Europe, and Japan.

Actually, these societies may have quite significant structural differences altogether.

Do we need to remind you that Chinese companies operate under the Communist Party’s authority?

Issues in emerging markets can range from weak rule of law to rampant corruption, from surface-level democracies mired in election fraud to poorly regulated capital markets, from dictators to mass human rights abuses, to oppression of women and minorities, and social beliefs that strongly oppose capitalism as its known to most of us.

What to know

These are broad generalizations not true of the entire emerging markets complex, and obviously, every country has deeply idiosyncratic circumstances that define its economic environment, but the above concerns shouldn’t be disregarded either.

Especially for investors participating in these markets as foreigners, as the world becomes increasingly divided into spheres of influence split between the competing superpowers that are the United States, China, and Russia.

Unequivocally, America’s relatively strong rule of law, culture of entrepreneurship and free markets, empowered regulatory agencies (comparatively — we recognize these agencies have been deeply flawed), and an independent central bank, have all contributed to the development of its massively robust and prosperous financial markets.

And the same can be said for most of its allies.

Takeaway

Again, the hope here isn’t to divide the world between “good” and “bad,” or to make sweeping and inappropriate assessments of regions that we have never even visited.

But rather, the aim is to recognize candidly that there are investing risks everywhere, though certain countries, and even continents, offer far more acute challenges to investors comparatively.

Considering this, what then should the average investor, who hopes to diversify globally and avoid over-concentration in any single country, do?

While investing in Western economies has been a fruitful and stable bet generally since the end of World War II, this is by no means guaranteed going forward.

To address this, we must ask who will be the winners of the 21st century?

We can guess, but we do not know.

A possible solution

In response to some of these questions and concerns, an interesting ETF (ticker: FRDM) has emerged that aims to invest in emerging markets that score high on human and economic freedom metrics.

The premise being, that, authoritarian and deeply restrictive countries fail to produce the conditions and stability that are conducive to generating attractive returns on capital over time.

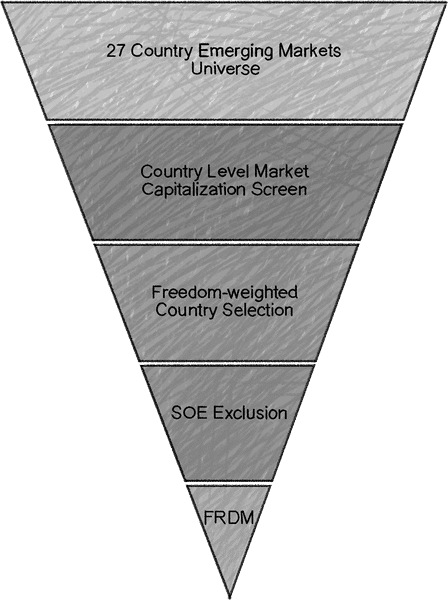

So, they’ve created a “Freedom 100 Emerging Markets Index” that the fund seeks to track.

Country inclusion and weights are, therefore, determined by 76 different variables sourced from third parties that have assessed relevant human rights and economic conditions in developing countries around the world.

According to the firm that manages the ETF, Alpha Architects, these metrics include the absence of terrorism, due process, rule of law, freedom of the press, freedom of religion, human trafficking, access to international trade, marginal tax rates, business regulations, sound money, government size, and more.

How it works

Countries in the index are first weighted by their freedom scores, and then companies within those countries are weighted by market capitalization, in constructing the ETF’s portfolio.

On top of this, the fund excludes substantially state-owned enterprises (SOEs), more than 20%, from its universe of potential investments.

The belief is that freer countries will better promote innovation, sustainable growth, and efficient use of capital and labor.

By country, its top holdings are based in Chile, Taiwan, South Korea, Poland, South Africa, Brazil, Malaysia, Indonesia, Mexico, and Thailand.

You’ll notice that China, which typically dominates emerging market ETFs with a 30% or more allocation, is notably absent, alongside other troubled and less free countries like Turkey, Russia, Saudi Arabia, and Pakistan.

Wrapping it up

It’s a compellingly novel approach to asset management, and we find the fund’s structure to be quite appealing given its potential effectiveness in mitigating political risks while capturing the upsides of rapidly growing economies. However, we do not currently hold positions in the fund.

The ETF is relatively new, so not enough data yet exists to confirm the strategy’s validity, and there may be considerable bias in the “freedom-weighting’ that distorts returns relative to other emerging-markets-based ETFs.

Not to say anything of the reality that, in addition to this, even countries that score high in the Freedom Index will still face troubling economic and political challenges at times.

For investors, who, like us, are deeply concerned by the geopolitical risks unfolding around them today, FRDM may offer an effective approach to international diversification that reduces these risks.

We’ll leave that up to you to decide for yourselves.

Let us know — What do you think of the FRDM ETF and managing risk when investing globally?

For more, check out Clay Finck’s Millennial Investing podcast from earlier this year discussing whether emerging market stocks are cheap.

WHAT ELSE WE’RE INTO

- 🗞️ News: “The Russians are in trouble,” says U.S. military officials.

- ✉️ Newsletter: “Anyone calling for inflation to fall somewhere near 6% is actually calling for deflation over the next five months”.

- 📺 Video: Building a second brain (With Tiago Forte).

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.