Investing Bias

05 January 2023

Hi, The Investor’s Podcast Network Community!

Already, OpenAI is in talks to sell existing shares in a tender offer that would value the company at around $29 billion, per the WSJ.

😮 That would make Sam Altman’s venture one of the most valuable U.S. startups on paper despite generating little revenue.

In markets, the S&P is on pace for its fifth straight negative week. U.S. stocks fell again Thursday after ADP’s December jobs report showed an unexpectedly large increase in private-sector employment.

A day after hawkish Fed minutes were released, it’s the latest piece of evidence the Fed has to stay aggressive 🙁

And many football fans can take a deep breath: Bills safety Damar Hamlin has shown “remarkable improvement,” the team said, three days after he collapsed and suffered cardiac arrest during a game.

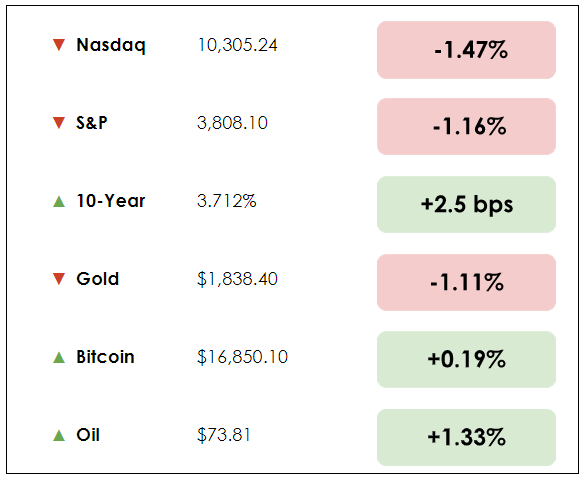

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Blackstone’s property fund gets a bailout and the SEC intervenes on Binance’s acquisition of Voyager, plus our main story on how to recognize and confront behavioral bias in investing.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🏗️ Blackstone’s Property Fund Gets Bail-out (WSJ)

- For those trying to get their money out of Blackstone’s (BX) giant private property fund, the new year brings mixed news. Although quarterly withdrawal caps are still limiting investors, the University of California’s endowment, known as UC Investments, has restored some faith in the fund after investing $4 billion.

- This huge investment into a fund normally meant for small private investors that carries substantial fees (1.25% of assets under management and 12.5% of profits) doesn’t come without strings attached, though.

- In exchange for locking up the capital for an expected six years, if Blackstone fails to earn returns of 11.25% yearly after fees, it will provide a special $1 billion compensation to the endowment.

- Such a great return in a time of weakness is similar to Warren Buffett’s famous deal with Goldman Sachs (GS) at the height of the 2008 financial crisis, where his bail-out $5 billion investment yielded a 10% annual dividend and an option to buy discounted shares.

- UC Investments’ decision provides validation from a team of respected investors and their due diligence efforts, though returns could still prove subpar if real estate markets continue to turn down. And the extra cash will quell fears of a bank run but is unlikely to make it easier for other investors to withdraw money in the short term.

- According to financial journalist James Mackintosh, the deal is significant because “at a time of rising interest rates, liquidity is a premium. The University of California just put a price on that premium: $1 billion to underwrite 11.25% was their demand in return for a six-year lockup. That’s expensive.”

❌ SEC Intervenes on Binance’s Acquisition (FT)

- The Securities and Exchange Commission (SEC) has intervened in a deal that would see Binance U.S. buy assets from the now-bankrupt crypto lender, Voyager Digital. The SEC’s objection to the $1 billion acquisition comes after Voyager’s collapse last summer, which left depositors’ money up in the air, similar to the more recent FTX crisis.

- While some saw FTX’s former CEO, Sam Bankman-Fried, as a “J.P. Morgan” figure for his industry bailouts after digital assets prices imploded last year, it’s now clear much of that was done fraudulently using client deposits.

- Like FTX, Binance is also a major digital asset exchange, but this time around, regulators are much keener to investigate things. In this vein, the SEC noted there was insufficient information to indicate that Binance’s U.S. division could “consummate a transaction of this magnitude.”

- In just a few days last month, Binance’s main global exchange saw unprecedented withdrawal pressure that hit $6 billion. This comes at the same time that the crypto Broker Genesis owes $900 million to customers of Gemini, another major exchange.

- The company’s chief executive Changpeng Zhao (known as “CZ”), was quick to provide reassurances about Binance’s ample liquidity. However, its accounting firm, Mazars — which previously produced “proof of reserves” reports for Binance — has said it will pause activity in the digital asset sector due to “the way these reports are understood by the public.”

- In other recent industry news, Coinbase (COIN) reached a $100 million settlement with New York regulators for anti-money laundering failures and use of social media profiles to verify customers’ identities. There’s no shortage of controversy in crypto these days, and regulator oversight is only expected to increase.

Overview

Last year, at the Daily Journal’s annual meeting, Charlie Munger expressed how common it is to become envious of others.

We see a neighbor’s new car or gadget. Or we overhear a co-worker talking about their stock market gains in the past month, and we feel we’re missing out.

“The world is not driven by greed,” Munger said. “It’s driven by envy.”

No matter how much some people have, others will always have more. This is the essence of the “never enough” fallacy.

“I have conquered envy in my own life,” Munger added. “I don’t give a damn what someone else has. But other people are driven crazy by it.”

Let’s expand on Munger’s point about envy’s dangerous consequences and what investors can do about it.

The psychology

One of the most intriguing components of investor psychology lies in its counterintuitive nature. For example, investing in a drawdown typically has the highest potential to pay off.

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait,” Munger has said, meaning sometimes the best action in investing is none at all.

Author, philosopher, and angel investor Naval Ravikant has said, “Don’t take yourself so seriously. You’re just a monkey with a plan.”

He means humans aren’t as rational as they think. We say we’ll buy low, sell high, be patient, and stick to our plan, yet these simple ideas are much harder to practice when there’s panic on the streets.

Greek Stoic philosopher Epictetus, who started his life as an enslaved person before opening his school of philosophy, taught that all external events are beyond our control.

But we’re responsible for our actions. The financial parallel: While we can influence others, we can’t control how our neighbors or competitors think or act. And we can’t control markets.

But we can control how we internalize what happens, the thoughts and beliefs we hold, and the lessons we learn.

Understanding bias

Munger hinted at envy as a driver. A few others are common in the investing landscape:

- Anchoring, where a particular reference point influences an individual’s decisions, often includes placing too much importance on the short run.

- In the short run, stock prices over-compensate in both directions. In the long run, they tend to revert to the mean.

- Action bias describes our tendency to favor action over inaction. Sometimes, we feel compelled to act, even if there’s no evidence that our effort will lead to a better outcome than doing nothing.

- Author Morgan Housel describes this bias well: When markets move lower, the human inclination to act (usually sell) settles in.

- Choice overload, known as over choice, choice paralysis, or the paradox of choice, describes how investors get overwhelmed when presented with many options.

- When a friend recommends we buy several stocks, it can be difficult to decipher through the noise and make a sound investment decision.

- The bandwagon effect, similar to herd mentality, aligns with Munger’s idea of envy. It relates to our habit of adopting certain behaviors or beliefs because many others do the same.

- Wall Street Bets popularized this concept in 2020 and 2021, pushing up the share price of meme stocks.

- Cognitive dissonance describes what happens when we avoid conflicting beliefs and attitudes. Humans often reject, debunk, or avert new information.

- In investing, we can become attached to a particular stock or theme, which makes it hard to internalize new information. It can also create blind spots. Having your views confirmed is a powerful drug.

What to do about it

We can start by learning about these biases and where they might play out in our investment decisions.

Many sound investors keep detailed journals of their investment beliefs, feelings, and attitudes toward markets, companies, and sentiment.

Others rely on trusted partners to keep them in check and minimize the potential for blind spots or bias. Trust is a powerful currency.

Regardless, it’s critical to recognize that any number of probabilities can occur, and nearly every human can be susceptible to these powerful biases.

Consider a lesson from the book On Anger, in which Seneca draws on Fabius, one of Ancient Rome’s great generals, to teach a lesson from war:

“Fabius used to say that the basest excuse for a commanding officer is, ‘I didn’t think it would happen,’ but I say it’s the basest case for anyone. Think everything might happen; anticipate everything.”

Dive deeper

Morgan Housel’s bestseller The Psychology of Money addresses many of these common biases quite well.

Here’s Trey Lockerbie’s We Study Billionaires interview with Behavioral Finance expert Gary Mishuris.

Investors, we’d love to hear from you. How do you manage behavioral biases?

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.