Invert, Always Invert

🇲🇽 Happy Cinco de Mayo!

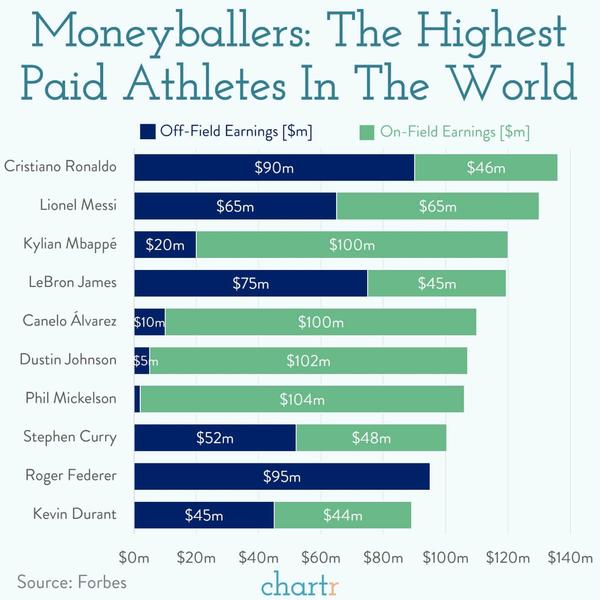

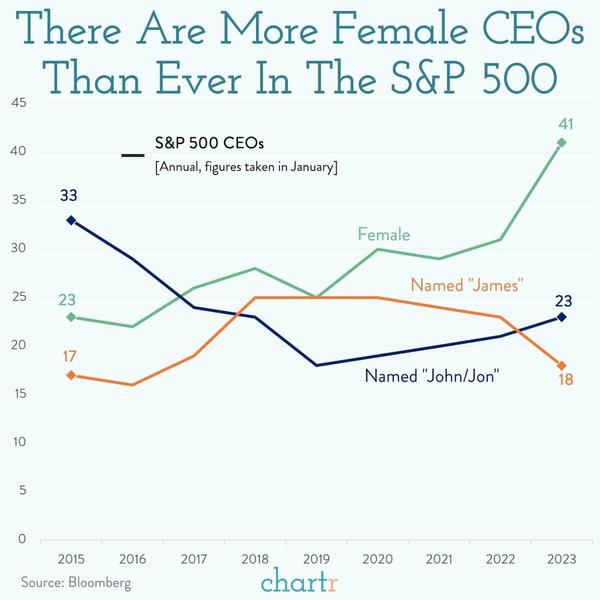

Shawn and I just landed in Omaha for the Berkshire Hathaway annual meeting, so there’s no news coverage today. Instead, we present not one but two charts: How much top athletes earn on and off the court, and the growing number of female CEOs in the S&P 500.

Women now hold 41 (8.2%) of CEO positions at S&P 500 companies.

In other news, Gold flirted with an all-time high this week 💰

-Matthew

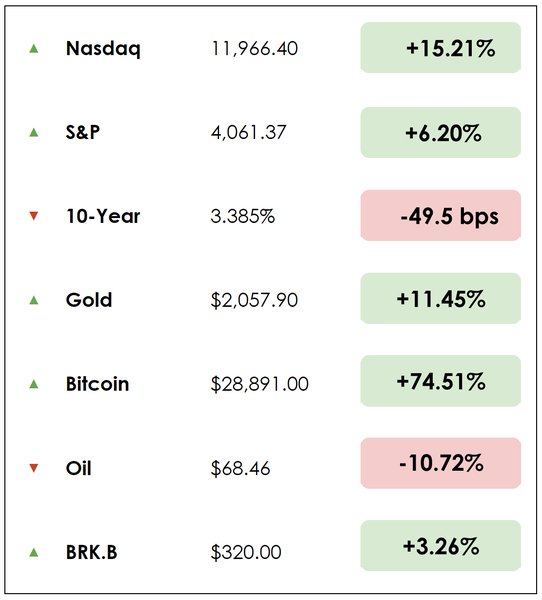

Here’s the rundown (all figures YTD through Thursday):

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss one big idea:

- Our main story on Charlie Munger’s inversion mental model

All this, and more, in just 5 minutes to read.

Today’s trivia: For how many years has Charlie Munger been Warren Buffett’s right-hand man at Berkshire?

(Scroll to the end to find the answer!)

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Introduction

Facing a large problem or decision? Or simply looking to improve an area of your life? Consider heeding sage advice from Charlie Munger: invert, always invert.

Munger has popularized the mental model of inversion because it’s worked wonders in his investing life, helping make him a billionaire. But it’s also worked for him outside of investments – with relationships, life, and finding meaning.

Rather than ask, “How can I achieve success?” Munger advises asking, “What are the ways in which I could fail?” By considering the negative outcomes and potential pitfalls, one can better identify and address the factors that could lead to failure.

The inversion mental model involves turning a problem or question upside down and thinking differently.

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent,” Munger has said.

“Turn a situation or problem upside down. Look at it backward. What happens if all our plans go wrong? Where don’t we want to go, and how do you get there? Instead of looking for success, list how to fail instead. Tell me where I’m going to die, that is, so I don’t go there.”

Background

Munger, 99, is Buffett’s long-time business partner and vice chairman of the world’s greatest compound interest machine: Berkshire Hathaway. In the words of Buffett, Munger, “Marches to the beat of his own music, and it’s music like virtually no one else is listening to.”

Trained as a meteorologist during World War II and as a lawyer at Harvard before devoting himself to business, Munger has drawn heavily from the study of psychology, economics, physics, biology, and history, among other disciplines, in developing his system of “multiple mental models” to cut through difficult problems in complex social systems. It is a system like no other.

His thinking on inversion was inspired by the German mathematician Carl Gustav Jacob Jacobi, famous for his work on elliptic functions. Jacobi often solved difficult problems by following a simple strategy: “man muss immer umkehren” (or loosely translated, “invert, always invert.”)

“(Jacobi) knew that it is in the nature of things that many hard problems are best solved when they are addressed backward,” Munger said.

How to invert

Inversion often forces you to uncover hidden beliefs about the problem you are trying to solve. “Indeed,” says Munger, “many problems can’t be solved forward.”

Say you want to improve innovation at your organization. You could consider the projects to foster innovation, but you could also invert by thinking about what you could do that would discourage innovation. Then avoid those things.

Another example: Rather than think about ways to improve your health, think about ways in which you could damage it. It can be easier or more natural to note what not to do or avoid.

Inverting the problem won’t always solve it, but it can help you bypass trouble.

Invert investing

If you have a stock position, it would be wise to invert your argument and consider what would make the investment go wrong. What are the scenarios that would cause the intrinsic value of the company to decline?

For a business or creative project, consider what would prevent people from buying your product, listening to your podcast, or investing in your business.

Take Buffett, famous for his wariness of the downside of his investments. His two rules for investing read:

“Rule number one: don’t lose money. Rule number two: don’t forget rule number one.”

He’s inverting the problem. If he can avoid losing money, he’s bound to make some.

Then there’s Marc Andreessen, a prolific Silicon Valley investor and the co-founder of Netscape, who has an inversion system for stress-testing investment ideas.

Andreessen uses a “Red Team” that takes the other side of an investment argument. This team comes in and tries to dismantle the investment idea. They may go forward if Andreesen and his team still believe the investment is worth it.

As Warren Buffett says: “The difference between successful people and really successful people is that really successful people say no to almost everything.”

Dive deeper

For more on Munger and his philosophy for life, check out a pair of great books: The Tao of Charlie Munger and Charlie Munger: The Complete Investor.

Enjoy reading this newsletter? Forward it to a friend.

SEE YOU NEXT TIME!

Enjoy reading this newsletter? Forward it to a friend.

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!