Insider Knowledge

Hi, The Investor’s Podcast Network Community!

🧨 French protestors took “4/20 blaze it” a bit too literally: pension reform protestors stormed the Paris Stock Exchange and set off flares. Jokes aside, it was a surreal scene.

It wasn’t a great day for AT&T, either. Its stock fell over 10% after warning that businesses and consumers are paring back spending.

The company saw its operations generate $1 billion in free cash flow last quarter, down 64% from the year before ☎️

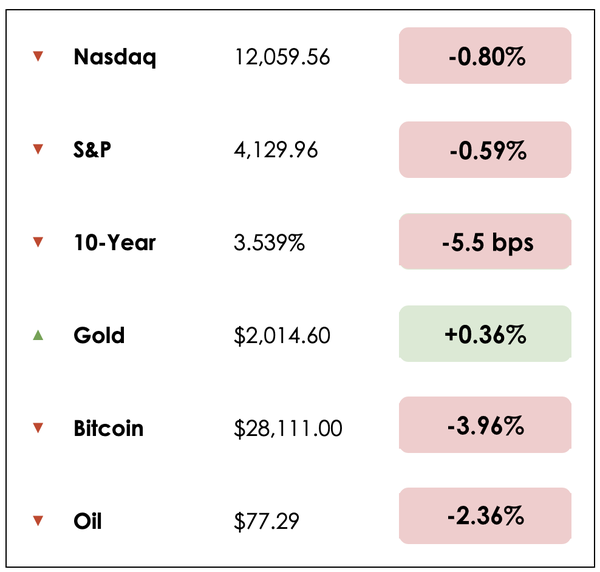

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- The latest instance of Congress members’ ethically questionable stock-trading habits

- Ikea’s big pivot to the U.S.

- Plus, our main story on one island nation’s unique economy

All this, and more, in just 5 minutes to read.

Today’s trivia: Over the last 40 years, what percentage of the time has the S&P 500’s total annual return been positive?

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

PRESENTED BY

Do you want to break into the lucrative world of private equity where salaries start above $300k?

Well, you can take the best recruiting course out there: Private Equity Course by the Overheard on Wall Street team (taken by 500+ investment bankers, with many receiving PE offers)

Normally priced at $1,500, for a limited time they’re offering FREE ACCESS to this game-changing course when you sign up for their Insiders membership. Cancel anytime, no strings attached.

Jumpstart a career in private equity and get access to the best Private Equity course today.

IN THE NEWS

💬 Congress Sells Bank Shares Before Chaos (NYT)

Explained:

As fears of the banking crisis surged, members of Congress sold bank shares — a flurry of transactions that highlights how Congress members buy and sell stocks in industries that intersect with their official duties.

- For example, an account belonging to Representative Jared Moskowitz’s children sold shares of Seacoast Banking Corporation as fears of a banking crisis rattled investors. After they sold, the stock fell more than 20%.

- Several other members sold shares before the substantial drop in bank share prices in March.

At least eight members of Congress or their close relatives sold shares of bank stocks in March, according to an analysis by Capitol Trades, a project of the data firm 2iQ — a number that could rise as lawmakers make additional disclosures of trades.

Why it matters:

Though broadly legal, stock trading by members of Congress has become a flashpoint. Lawmakers are sometimes privy to closely held information about the companies and industries they oversee.

- An eye-opening New York Times investigation last year showed that during a three-year period, nearly a fifth of federal lawmakers or their immediate family members had bought or sold stocks or other securities that could have been affected by their legislative work.

Said Sherrod Brown, Democrat of Ohio: “As the Silicon Valley Bank was closed, even during that period, there were reports that members of Congress were trading bank stocks. I mean, imagine that — that members of Congress, we have more inside information,” he said, adding, “members of Congress are able, because of our jobs, to know more about the economy.”

🛋️ IKEA’s Big Move (WSJ)

Explained

Ikea is making its largest investment in the U.S., with plans to open 17 new stores over the next three years.

- The furniture retailer’s $2 billion-plus investment will also modernize stores and boost delivery capacity. It’s counting on strong U.S. demand for its flat-pack furniture.

- Ingka Holding BV is the biggest owner and operator of IKEA stores. The company said this move is the first of several expansion phases the company plans to make in the U.S. over the coming decade.

- “The U.S. is one of our most important markets, and we see endless opportunities to grow there,” said Tolga Öncü, Ingka’s head of retail. “More than ever before, we want to increase the density of our presence in the U.S.”

There are 51 IKEA stores and two plan-and-order points in the U.S., not counting two new locations due to open in San Francisco and Arlington, Va. this summer.

Why it matters:

IKEA’s U.S. push comes as it seeks to boost profits amid high inflation and shaky consumer confidence globally. But U.S. demand for IKEA products has been strong this year, thanks to easing global supply-chain blockages.

- Economic uncertainty can bolster demand for brands like IKEA, which is focused on affordable products.

- Economic uncertainty also plays into the hands of IKEA, as a private company focused on affordable products. While rising material and logistics costs have cut profits, it believes “there is an opportunity for IKEA, more than ever with the circumstances that the world is in, to double down on our investments,” Öncü said.

The U.S. is Ingka’s second-largest market after Germany, though it will likely become the biggest due to the coming expansion.

MORE HEADLINES

🚀 SpaceX Starship rocket explodes midair minutes after launching

📰 BuzzFeed News is shutting down amid 15% workforce reduction

📈 U.S. airlines about to be hit with pilot retirements

The Caribbean Paradise

Cuba, the largest island in the Caribbean, is known for its rich cultural heritage, the finest cigars, vintage cars, and for originating Salsa dancing.

Since it offers white sandy beaches, stunning colonial architecture, and nine UNESCO World Heritage sites, it’s used to being an enchanting getaway for travelers.

It also has one of the most bizarre economies in the world.

In theory, the country is in quite a good position. It has a well-educated workforce, huge reserves of oil, and a climate conducive to tourism and agriculture.

Yet, despite all of these advantages, Cuba’s economy illustrates how national prosperity relies on more than winning a natural resource lottery.

Cuba and its citizens are struck by poverty. The average working citizen earns around $25 per month, yet the country still maintains a relatively high quality of living among developing countries.

Pearl of the Antilles

Cuba was claimed by Christopher Columbus for Spain in 1492 and soon became the Spanish Empire’s main source of raw sugar in the 18th century. The country even earned the nickname the “Pearl of the Antilles.”

At the beginning of the 20th century, it was a land of freewheeling capitalism, with arguably a more liberal market than in the U.S.

Following the Cuban Independence Movement, which secured independence from Spain, the Cuban economy experienced a significant boost. With help from the U.S., the country developed an industrialized agricultural sector, concentrating its efforts primarily on sugar production.

In the 1950s, Cuba ranked among the top three sugar producers. It was the largest exporter, with almost 90% going to the U.S. This trade benefited both nations since Cuba helped stabilize U.S. sugar prices by managing market fluctuations in exchange for quota rights on future U.S. sugar market growth.

Cuba was also a famous stop for American tourists, who’d not only visit to spend a relaxing holiday on the beach sipping Cuba Libre but also to gamble in Havana before cities like Las Vegas or Atlantic City were established.

Happiness doesn’t last forever

These businesses, however, drove even more inequality within the Cuban nation, as they primarily benefited Americans. The vast majority of the farmland, sugar-refining factories, hotels, and casinos were American-owned, so the profits returned to the U.S. rather than reinforcing the Cuban economy.

The tipping point occurred as oil production companies, including foreign giants like Shell and BP, expanded in the region. They claimed oil fields and generated massive profits, which, ultimately, didn’t reach Cuban citizens.

The pain of utopia

In 1959, after years of long and bloody revolutionary war, the Cuban Communist Party was calling the shots and aimed to return wealth and prosperity to the people of Cuba. It started by nationalizing its oil refineries and farmland, and by the 1960s, almost every industry in the country was controlled by the government.

Unsurprisingly, this plan started to crumble. Cuba’s economy depended largely on trade with the U.S., and nationalizing American-owned businesses on a large scale was an affront to the U.S. government.

As a result, President Dwight D. Eisenhower banned all imports of Cuban sugar, cutting financing for Cuba’s communist government.

Along the way, Cuba found a new ally in the Soviet Union, destroying the Cuban-American relationship and severely damaging the economy through trade limitations.

Between 1989 and 1992, Cuba’s GDP dropped over 45% based on its government’s own, likely generous, figures. This left Cuba bleeding dry as the country faced widespread unemployment, poverty, and starvation, along with a heightened military presence and reliance on debt.

The Cuba of today

Ultimately, Cuba tried to turn everything around by legalizing the U.S. dollar and opening up to tourism and private-sector businesses, slowly reviving its economy and becoming a more attractive tourist destination.

Over the years, things have been heading in the right direction. Fast forward two decades, the country’s tourism sector generated 10% of its GDP in 2022 and contributed almost $8 billion to GDP in 2021. It also holds the title of one of the most visited islands in the Caribbean.

Today, its top sectors, besides tourism, are sugar, tobacco, pharmaceuticals, and refined fuels. The industrial sector accounts for about 37% of the country’s GDP and employs 24% of the population.

While Cuba appears to be embracing globalization, it’s a country of contradictions and economic imbalance, where waiters and doormen with access to U.S. dollars often outearn doctors earning $30 monthly working in public healthcare.

Dive Deeper

To learn more, listen to this Economics Explained podcast.

TRIVIA ANSWER

Over the last four decades, the S&P 500 has ended the year with a positive total return (price return plus dividends) 33 out of 40 times, or 82.5% of the time.

SEE YOU NEXT TIME!

Enjoy reading this newsletter? Forward it to a friend.