Indian iPhones

26 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

By the way, if you like our podcasts and newsletters, why not join our community subreddit?

It’s a great place for fans of The Investor’s Podcast Network to come together, ask questions to our hosts, talk investing, and more!

You can join here 😉

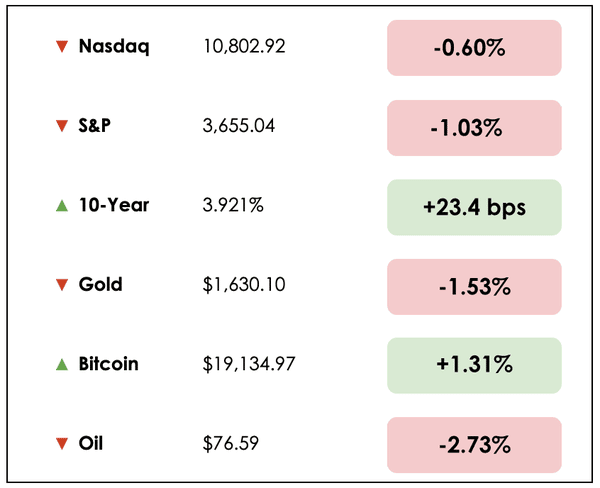

It was another rough day on Wall Street, as the S&P 500 closed at its lowest level since December 2020 and moved lower for the fifth consecutive day.

Bonds sold off, pushing their yields dramatically higher once again, with the 10-year now just a stone’s throw from 4%.

All eyes, though, are on the British Pound which was under even more pressure and fell to an all-time low against the dollar, as officials doubled down on tax cuts that first sent the currency collapsing last Friday.

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss a $2.8 trillion hit to global economic output, Apple’s pivot to India, complications for Trump’s SPAC deal, and a deep dive into the rules for navigating bear markets.

All this, and more, in just 5 minutes to read.

Here we go! ⬇️

IN THE NEWS

🤯 Russia’s War In Ukraine To Cost Global Economy $2.8 Trillion (WSJ)

Explained:

- According to the Organization for Economic Cooperation and Development (OECD), the war in Ukraine will cost the global economy $2.8 trillion in lost output by the end of next year.

- The biggest conflict in Europe since World War II has spurred an energy price surge, destroyed consumer and business confidence, and significantly dislocated supply chains around the world, among many other costs.

What to know:

- While the OECD still expects the global economy to grow 3% this year, it had forecast 4.5% growth before Russia’s invasion.

- The OECD also lowered growth projection for the U.S., with 2023 estimates falling to 0.5% from 1.2%, though they warned that this slowdown would be worse if inflation doesn’t decline significantly.

- The group’s chief economist noted that we were collectively facing the lowest growth environment since the 1970s.

📲 Apple To Make iPhone 14 in India (Reuters)

Explained:

- In an official company statement, Apple (AAPL) said, “the new iPhone 14 lineup introduces groundbreaking new technologies and important safety capabilities. We’re excited to be manufacturing iPhone 14 in India.”

- JPMorgan (JPM) analysts expect the company to move about 5% of its iPhone 14 production to India by the end of this year. One in every four iPhones could be produced in India by as soon as 2025.

What to know:

- As a pandemic shut down the world in the last two years, and now a war in Europe inspires existential geopolitical tensions broadly, companies like Apple are seeking to diversify their supply chains, particularly in reducing their exposure to China.

- Tech companies have been at the center of an economic struggle between the U.S. and China, so it comes as little surprise that the iPhone maker would seek less politically-sensitive locations to source production, though the move symbolically reverses decades of increasing reliance on China by the rest of the world for manufacturing.

❌ Investors Back Out Of Trump SPAC (Reuters)

Explained:

- The special purpose acquisition company (also known as a SPAC), Digital World Acquisition Corp. (DWAC), is finding great difficulty in closing its deal to purchase former President Trump’s social media company, Truth Social.

- Digital World said that it has seen private investors submit termination notices for almost $139 million of the $1 billion provided via a structure known as a PIPE, which stands for private investment in public equity.

What to know:

- Investors signed the PIPE agreement about a year ago and are now able to move their money elsewhere after the deal failed to close by September 20th.

- This means that over the coming weeks, more investors are expected to back out, though some are waiting to see whether DWAC will try to sweeten the deal terms for those who remain.

- The SEC is continuing to review the deal between the SPAC and Trump Media and Technology Group, which has been surrounded by both civil and criminal probes.

WHAT ELSE WE’RE INTO

👂 Listen: A masterclass in market cycles, featuring David Stein

📺 Watch: How to become 1% better every day — Explained by Weronika Pycek

📖 Read: Why is the the British Pound collapsing? From The Economist

DIVE DEEPER: BEAR MARKET RULES

In Stig Brodersen‘s Q3 mastermind podcast on We Study Billionaires with Tobias Carlisle, Carlisle made a comment about bear markets that we found quite intriguing.

What to know

In referencing one of famed investor Ken Fisher’s four rules for bear markets, Carlisle says, “it’s the first two-thirds in time that leads to one-third of the losses. And then the last third in time is two-thirds of the loss.”

He explains that the average bear market lasts about 18 months to two years (Fisher’s second rule), but most of that period is defined by a slow and painful grind lower marked by occasional spurts of volatility that send the market higher.

Breaking it down

So bear markets hardly ever start with a bang, but rather, they go for so long that they lull investors into a sense of complacency.

When the declines drag out far longer than most expect and are willing to endure, the markets decline hugely and rapidly over the last third of the bear market. This dramatic selloff punctuates the lowest sentiment point, after which, investors step back in and can power the next bull market.

To connect this with our current environment, Carlisle states, “the reason I say this is just that you need to be mentally prepared for another 18 months of carnage here.”

Two more rules

In response, we turned back to Ken Fisher, founder of Fisher Investments, to learn his other two rules for bear markets.

**For context, we do not typically advise trying to “time the market” for most investors, though, if you’re going to to do so, you might as well have some strategies backing your execution.**

The 2% Rule: “U.S. bear markets, top to bottom, decline irregularly but at an average rate of about 2% per month. If a decline exceeds that, you can soon count on a pullback and a better chance to get out.”

Of course, this isn’t a hard-and-fast rule, but it does represent what to expect generally. If it’s early in a bear market, and you see more than a 2% monthly decline, it may mark a great opportunity to sell into the following counter-rally, especially if your extended outlook is gloomy.

At the end of a bear market, this could just as easily mark a buying opportunity, though.

Bear markets tend to, as we’ve said, painstakingly work their way lower, so relatively rapid selloffs convey information and opportunity to keen investors, one way or another.

Three Month Rule: This rule emphasizes never prematurely calling a bear market peak.

Basically, if you think the market has reached its top, and it’s mostly downhill going forward, the logic here would recommend waiting at least three months before taking any actions.

Since bear markets last a long time typically, this still provides you plenty of chances to sell or short stocks, while providing you with more data points for your decision and hedging against the possibility that your assessment is wrong.

It’s far costlier to guess in these situations than simply waiting for a pattern to form, such as 2% average declines over several months.

After three months, should a bear market really be transpiring, the trend would likely be much clearer, and you can act accordingly.

One more thing

Building on the Three Month Rule, the point is to avoid falsely calling for a bear market. Sometimes, there are short-term corrections of 10-20% in the midst of very healthy bull runs that fake investors out.

Trying to track the market over narrow time periods is like a roller coaster — It’s full of surprises and ups and downs.

To avoid conflating a bear market with a regular correction, Fisher says to look out for a few things.

Note excessive pessimism in the media about, say, a regional geopolitical conflict or natural disaster that’s hyped up to be “doomsday” during a time when the economy is fundamentally strong.

On top of this, downturns that are extremely sudden and sharp, as opposed to a rolling decline over time, are more often associated with corrections than bear markets.

Tread with caution and do not exit the market simply based on emotion or gut feeling. Doing so can be one of the most costly decisions in investing if wrong.

That said, even for long-term investors planning to wait out downturns and bear markets, these rules add some context that makes it easier do so.

Bear markets are a whole lot less intimidating when you have a feel for their nature.

Wrapping up

For the full breakdown of the four rules, you can find them here.

And don’t miss Tobias Carlisle and Stig Brodersen discussing bear markets in their Q3 mastermind podcast.

Tell us readers — Do you agree or disagree with any of these rules for bear markets?

What are your personal guidelines for navigating them?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.