In Search Of…

24 August 2022

Hi, The Investor’s Podcast Network Community!

Happy Wednesday, and welcome back to We Study Markets!

We want to thank all our readers who have taken the time to provide feedback on the newsletter. Keep the thoughts, questions, and comments coming! (Just hit reply)

Also, if you are a fan of our podcasts, please let us know how we could serve you better by taking a few minutes to fill out this listener survey.

Good news for your wallet! Gas prices have declined 70 days in a row, the second longest record since 2005.

Stocks were treading water as investors eagerly await the start of the Federal Reserve’s annual economic policy symposium in Jackson Hole tomorrow. Jerome Powell is set to speak Friday.

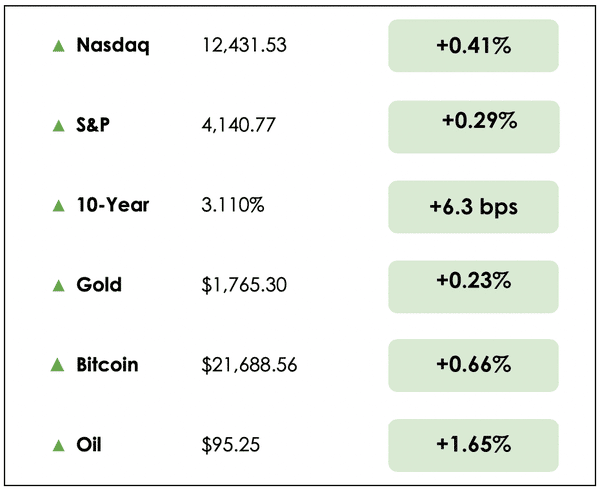

Here’s the market rundown for today:

*All prices as of today’s market close at 4pm EST

Today, we’ll discuss falling U.S. home values, Biden’s student loan forgiveness program, Andreessen Horowitz’s blockchain bets, and Charlie Munger’s The Daily Journal Corp.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🏚️ U.S. Home Values Fell For First Time Since 2012 (MarketWatch)

Explained:

- The housing market isn’t 2008-style crashing, but it’s starting to feel the pain a bit. After a pretty busy two years, things are beginning to cool down, as reflected by a 0.1% decline in home values in July according to Zillow.

- The typical U.S. home lost about $366 in value, and the average home price, as determined by the Zillow Home Value Index, is $357,107.

- Zillow is now revising down significantly its estimates for home value growth over the next year, but with values increasing by 44.5% since July 2019, such a small pullback hardly seems concerning yet.

What to know:

- Following this spike in housing prices over the last two years, a little softening will likely help to make home purchases more affordable for many Americans.

- Reports of long lines at open houses or listed homes receiving multiple offers, appear to be a thing of the recent past, which means that buyers should have greater leverage in their negotiations

- San Jose, Phoenix, San Francisco, Austin, and Raleigh saw the sharpest declines in home values per Zillow.

💸 $10,000 In Student Loan Forgiveness (WSJ)

Explained:

- In a move that’ll provide unprecedented relief for borrowers while surely drawing political and legal challenges, President Biden is set to cancel $10,000 in federal student loan debt for individuals making less than $125,000 per year. For those with federal Pell Grants in this same income bracket, the forgiveness could be extended up to $20,000

- Loan forgiveness is expected to apply to both undergraduate and graduate programs, and the move comes after more than a year of debate within Biden’s administration. In addition to the loan forgiveness, a loan payments freeze generally for borrowers will likely be extended through the end of this year, an initiative that originally aimed to provide relief during the covid-19 lockdowns.

What to know:

- This forgiveness plan is expected to benefit the vast majority of the forty million people who currently hold student loan debt while making nearly fifteen million borrowers free of student loans altogether.

- Americans remain divided on the topic, though the move will surely provide much-needed aid to millions of young Americans who’ve faced ballooning tuition costs in recent years.

- At the same time, reducing debts will remove financial obstacles for some, while also increasing many Americans’ capacity to spend. Such a boost to demand and spending over the coming months complicates the Biden administration’s and the Federal Reserve’s battle with inflation.

👨💻 Andreessen Horowitz Bets On The Blockchain To Break Up Tech Monopolies (FT)

Explained:

- The well-known Silicon Valley Venture capital group, Andreessen Horowitz, is making bets on crypto companies to disrupt internet monopolies held by the likes of Facebook and Twitter. Chris Dixon, founder of the firm’s crypto investing arm, explains that such concentration of tech company power over the internet is bad for both business broadly and society.

- Dixon argues that developments in blockchain technology will offer safeguards against anti-competitive behaviors amongst big tech giants through the use of smart contracts and rules written into the fabric of computer code.

- He says, “What we can do to create a better internet is create new systems where the network effects accrue to the community instead of to companies.” This focus on community value, as opposed to the enrichment of corporate shareholder value, has come to be associated with what’s known as the “Web3” movement more generally.

What to know:

- Since 2018, Andreessen has invested over $7.6 billion in the blockchain space, but instead of receiving equity, the firm has at times received digital asset tokens.

- Despite railing against internet monopolists, the firm invested early on in both Twitter and Facebook, while its co-founder sits on Meta’s (Facebook’s owning company) board.

- The so-called Web3 movement that Dixon describes has taken a hit over the past few months, as many companies and crypto assets in the space have seen their value drop dramatically. For Dixon though, he sees this only as an opportunity to invest in new start-ups and entrepreneurial talent at a discount.

FEATURED SPONSOR

You follow superinvestors like Buffett, Munger, Pabrai, and Greenblatt because they have a proven track record of outstanding investment returns. When investing passively in real estate, you’re looking for those types of investors to lead your deals. Learn what to look out for with the free 7 Red Flags For Passive Real Estate Investing Guide.

DIVE DEEPER: MUNGER’S MINI BERKSHIRE

We love to study the lives of great investors in search of investing clues and recently decided to dig deeper into Charlie Munger’s career. We knew that Charlie owned a publicly traded company called The Daily Journal Corp., but we didn’t know much beyond that.

The Daily Journal Corp. (DJCO) is a little-known publishing company that’s traded on the NASDAQ since 1987 with a market cap of a mere $353 million.

The company has no investor relations department and isn’t widely followed by analysts. We turned to value investor, Matthew Peterson, who has deeply researched what’s going on behind the scenes at The Daily Journal for our analysis.

Munger purchased the newspaper in 1977 for $2 million and built it into a group of newspapers and websites that provide information on the legal industry, real estate, and general business through a series of acquisitions. The company publishes ten newspapers in California and Arizona.

On the surface, it’s hard to get excited about a company that boasts a subscription base of 3,600 paid readers for its Los Angeles operations and just 2,100 for San Francisco. Still, there must be a good reason value investors such as Guy Spier and Matthew Peterson hold The Daily Journal in their portfolios.

It may seem foolish to invest in a company involved in the dying newspaper industry, especially with these meager subscription numbers. While this may be true, The Daily Journal isn’t just a newspaper company. It has three components that comprise the business — the newspaper, a SaaS (software as a service) software subsidiary called Journal Technologies, and a sizable portfolio of publicly traded stocks.

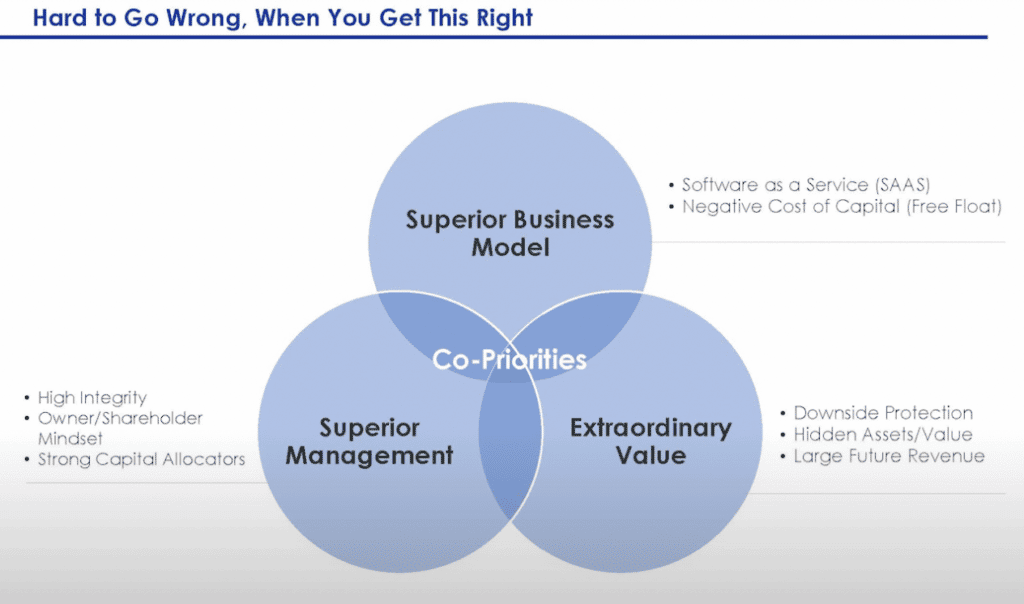

In analyzing a company, we like to see superior management with a strong business model available at a great price. Let’s see how The Daily Journal checks out:

Management

Munger has recently stepped down from operations, but as Peterson says in this video, he has built a strong Board and an outstanding management team. One concern surrounds what happens when Mr. Munger passes away, but as with Berkshire Hathaway, a succession plan with an excellent team is in place. This stacked, high-integrity team of just 300 hand-picked employees has an owner/shareholder mindset and are strong capital allocators intent on growing the software business.

Business Model

The basic newspaper business has historically thrown off decent cash flows, but that has been drying up as the industry gets displaced by new forms of media. The newspaper’s operations generate a modest $11 million in revenue. However, this part of the business is not relevant to the company’s long-term future, which confuses some potential investors as many view it simply as a newspaper stock.

The Cloneable Portfolio

The portfolio that Munger has built piques our interest. Investors seeking to clone Munger widely study The Daily Journal’s 13F when it is released each quarter.

Currently, the portfolio is worth at least $175 million, according to the latest 13F filing. However, the total value may be much higher due to cash assets that are not required to be disclosed, such as fixed income, real estate, or cash equivalents. Matthew Peterson estimates the net assets to be $220 million.

The financial statements are somewhat misleading (which we’ll discuss), making the company a bit of a mystery to investors and difficult to value accurately. But as Peter Kaufman said, who is on the Board and the author of Poor Charlie’s Almanac, “Where there is mystery, there is margin.”

The concentrated portfolio is made up primarily of just four stocks — Bank of America (BAC), Wells Fargo (WFC), Alibaba (BABA), and U.S. Bancorp (USB). Nearly 80% of the portfolio is in banking, while Alibaba makes up the remaining 20%. Cloners of the portfolio were thrown for a loop when The Daily Journal sold 50% of its position in Alibaba in the first quarter for tax-loss harvesting.

We thought this chart from a recent Matthew Peterson presentation was very helpful in understanding the value proposition of The Daily Journal:

Journal Technologies

Journal Technologies provides case management software and related services to courts and other justice agencies worldwide. This aspect of the business made up 70% of revenue and 80% of profits last year.

The contracts with municipalities generally last ten years and provide large, sticky recurring revenue. It takes four to seven years to implement the software, and the municipalities aren’t billed until the software goes live, which can be several years after the contract has been signed. This can complicate its financial statements and requires investors to dig beneath the surface to better understand its performance.

Peterson estimates that DJCO has over 100 contracts that are not reflected on the books ranging from $2 million to $89 million. While the revenue has not been booked, all the embedded costs for the software start-up are included in the current financial statements, making the company appear far less profitable.

Takeaway

The stock is currently trading at $258 per share, down from a 52-week high of $415.66. Peterson thinks DJCO could easily be a billion-dollar company in the next ten years as they continue to grow Journal Technologies.

The Daily Journal may combine the best worlds of both Ben Graham (with the stock portfolio) and Phil Fisher (with the technology company). According to Peterson, The Daily Journal Corp. is misunderstood and undervalued. He says that investors can buy the company below its current liquidation value and are also able to buy a company that could grow and compound nicely due to the SaaS part of the business.

For context, we are not directly invested in The Daily Journal, nor would we recommend that you invest without doing your own research and considering your specific financial circumstances.

Let us know what you think.

Is The Daily Journal Corp. on your radar? Is it a stock you’d consider adding to your portfolio?

To analyze this stock further, check out our resources for doing so here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.