How to invest like Ray Dalio

11 July 2022

Hey, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

We are in the dog days of summer, but don’t let that stop you from learning more about financial markets.

If you didn’t hear, Elon Musk made some headlines this weekend in seeking to terminate his deal to purchase Twitter. He had a few jokes to share too, of all places, on his Twitter account.

Today, we’ll be discussing the risk of a housing market downturn, what to watch out for this week, Ray Dalio’s All-Weather portfolio, and much more, in just 4.5 minutes to read.

Read on 📖

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

In The News

📝 Big week ahead: June inflation report plus the start of earnings season (CNBC)

Explained:

- Some weeks are just more important than others for investors, and this is likely one of those weeks. Markets will be paying close attention to this week’s June CPI report on Wednesday for insights into whether higher interest rates have had an effect yet on prices. And with earnings season starting, that is, the time of year when companies report their financial results from the past quarter, there’ll be lots of company-specific data for us to dig through.

What to know:

- Inflation has been a hot topic lately, so of course, another monthly data point will be important for investors to update their ongoing inflation expectations. With PepsiCo (PEP) kicking off the first major earnings report of the season tomorrow, we’ll also get better insights into how inflation and interest rate uncertainty is impacting companies directly. Expect a choppy few weeks as markets digest rolling earnings reports from major companies across the economy.

🔨 Will the housing market downturn match 2008 levels? (Newsweek)

Explained:

- There are some grumblings that the housing market is due for a major correction, perhaps even a crash as homebuyers contend with rising home prices, increasing mortgage rates, and high inflation. Most experts in the housing industry are not expecting today’s market to be anything like 2008 and are calling it “a different animal” altogether.

What to know:

- During most recessions, the housing market falls by two percent to four percent. The Great Recession of 2008 saw home prices fall by roughly 20 percent on average. So why is today’s market different? While there are fewer bidding wars, and competition for homes has cooled as rates have increased and prices have soared, there is still a significant housing shortage in the U.S. Some estimate between 1-3 million homes need to be produced to meet demand. Mortgage delinquency rates in May also fell to a record low of 2.75%. Delinquency peaked at 11.36% in the 2008 crisis. Many new homeowners are locked in at low rates and can afford their payments, unlike in 2008, where many buyers got crushed with risky subprime loans from adjustable-rate mortgages (ARMs). Some lost their jobs as the recession took hold and became underwater on their mortgage. At the moment, there doesn’t seem to be a crisis looming on the horizon for real estate though. Credit has become more expensive, but demand has continued in a market lacking housing options for many.

😷 Chinese stocks drop on renewed fears of Covid lockdowns (FT)

Explained:

- A highly contagious Omicron variant was found in mainland China which has investors panicking about another round of harsh lockdowns. China has held to a strict ‘zero covid’ policy in the country which has contributed to some of the most stringent lockdowns in the world. Given the country’s dense cities, sizable elderly population, and less effective vaccines than in the West, government officials have gone to extreme efforts to enforce testing and isolation, in hopes of preventing the virus’ spread.

What to know:

- Mass quarantines do not particularly mix well with vibrant economic activity, as many of us experienced directly in early 2020. Unlike in much of the U.S. though, these sorts of lockdowns have continued for millions of Chinese since the start of the pandemic. While Chinese equities will certainly be quite vulnerable to continued lockdowns from Covid outbreaks, as business activity is forced to slow, the rest of the world is likely to be affected as well. With the prospect of a global recession looming, a strong Chinese economy would be quite helpful in offsetting economic weaknesses in other countries, though each time investors become hopeful about a reopening of the Chinese economy, a fresh outbreak has seemingly dashed their optimism. Additionally, with China being the world’s manufacturing base, Covid lockdowns are not helping ease supply chains, and consequently, are fueling the higher prices for goods that have driven inflation.

Sponsored By

How do you make sure that you are investing with a “good” operator?

Dan Handford and his wife are currently invested in 54 different passive real estate syndications with 16 different operators in 10,000+ doors.

They use this exact list when deciding whether or not to invest with a particular group. Get access to the “7 Red Flags for Passive Real Estate Investing” to be confident in your next investment!

Dive Deeper: Ray Dalio’s All-Weather Portfolio

Have you ever wanted to build a supremely durable portfolio that can last the test of time, not just decades, but centuries?

If you’re Ray Dalio, founder of Bridgewater, the world’s largest hedge fund, then the answer is yes, and he calls it the “All-Weather Portfolio.”

Dalio has reflected publicly about his inspirations for designing such a strategy dating back to his early days working in the world of finance in 1971. At this time, Richard Nixon had just announced the United States’ intentions to separate from the Bretton Woods system by suspending the dollar’s convertibility into gold, thus marking the beginning of the ‘fiat’ era (we discussed this last week).

As the market rallied 4% the following day, Dalio puzzled at how this implicit government default on its liabilities had triggered a positive reaction from investors, leading him to study centuries of currency debasement.

He found that while infrequent, such deviations in currency pegs were hardly unprecedented, which prompted the natural yet deceptively simple question, “what kind of investment portfolio would you hold that would perform well across all environments, be it a devaluation or something completely different?”

Dalio has a very unique way of thinking about investing that, in part, relies on breaking down assets into the fundamental components that drive their returns.

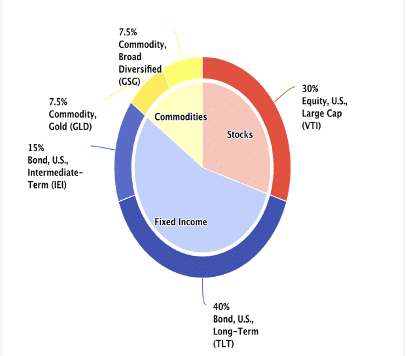

He and his colleagues at Bridgewater propose comparing asset classes to seasons in a year, during certain environments some types of assets will perform better or worse than others, so the trick is effectively balancing different types of asset classes (stocks, bonds, commodities, real estate, cash, etc.), such that they complement each other’s strengths while offsetting weaknesses. As Dalio has said, “knowing how to diversify well is more important than almost anything.”

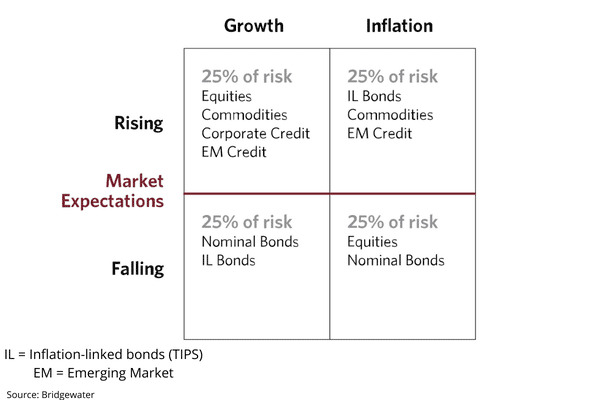

They divided the possible economic environments into 4 quadrants – shown below – based on the relationships between economic growth and inflation, “because the value of any investment is primarily determined by the volume of economic activity (growth) and its pricing (inflation).”

The hope was to design the ultimate passive portfolio that one could set aside for many years and still achieve satisfactory returns, though Dalio compares the process to being more like, “inventing a plane that’s never flown before.” Despite its unproven track record, a number of institutional investors, particularly pension funds, loved the idea for this strategy given their distant liabilities.

The portfolio owes its lasting success to the Bridgewater team’s ability to effectively map various types of asset classes onto these quadrants of economic environments. They also helped pioneer the institutional use of Treasury Inflation-Protected Securities (TIPS), which are U.S government bonds with their value tied to an inflation index.

Here’s what Bridgewater has to say, “inflation-linked bonds (TIPS) do well in environments of rising inflation, whereas stocks and nominal government bonds do not. As a result, the bonds filled a diversification gap that existed (and continues to exist) in the conventional portfolio. Most investors do not hold any assets that perform well when inflation surprises to the upside outside of commodities, which tend to comprise a tiny fraction of their overall portfolio.”

While the All-Weather strategy is by no means a get rich quick scheme, the logic is quite effective, instead, for wealth preservation.

The takeaway?

Of course, Bridgewater isn’t keen to give away its secret sauce to tell you exactly which assets in these broad classes and quadrants it owns and how it does so, but the purpose and logic of the all-weather portfolio ought to be our takeaway.

Especially if we are investing not just for ourselves, but for our loved ones generations into the future, it’s worth considering how durable our portfolio allocation really is.

We should ask what our true investment time horizon is then, and whether our current investments are structured to survive the passage of time and range of economic environments until that horizon point.

So, how would you design your all-weather portfolio? Reply to this email to let us know.

For more on all the all-weather portfolio, listen to our Millennial Investing podcast episode 189 breaking it down further.

And if you want to hear from Ray yourself, William Green did an excellent interview with him just a few months back in We Study Billionaires episode 410.

Quote of the Day

“When it comes to investing, doing ‘less’ is often ‘more.'”

— Joel Greenblatt

Meaning

Joel Greenblatt is the author of the best-selling book, The Little Book that Beat the Market and is one of the greatest hedge fund managers of our time. His fund, Gotham Capital, had 40% annualized returns over 20 years which means that $1 million turns into an astounding $836 million!

It probably makes sense to listen to Joel’s ideas on investing. His point here is that the greatest investors share some key traits, but a crucial one is the ability to pick solid businesses with great management and sit on your hands and do nothing. Year after year after year. If you enjoy watching paint dry, as Mohnish Pabrai says, you can be a fantastic investor.

This is exactly what Warren Buffett and Charlie Munger have done with their holdings within Berkshire Hathaway. They simply rarely sell and allow the power of compounding to work its magic, eliminating the burden of capital gains tax further enhances their long-term returns.

In the art of investing it pays to be patient and delay gratification, sit on solid companies, and hold them forever. While maybe this isn’t as exciting as frequently placing new trades, it’s hard to argue against the results of investors like Greenblatt.

For more on Joel Greenblatt, check out William Green’s interview with him on Richer, Wiser, Happier episode 3.

Retirement Accounts: Roth vs Traditional

Individual retirement accounts (IRAs) are powerful tools in saving for your future, so if you’re not using them, or perhaps just don’t understand the nuances between the two types (Roth and Traditional), we’re here to help.

Choosing between the two types of IRAs may seem arbitrary, but in reality, this decision can have very significant tax consequences. Luckily, the breakdown is quite simple:

- Roth plans are known as ‘post-tax’ meaning that contributions are not deducted from your taxable income today, so your total tax bill will be higher at present.

- Traditional plans defer this tax liability, so they’re referred to as being ‘pre-tax’ because their contributions are deducted from your taxable income, leaving you with a lower tax bill today but a potentially larger one in the future.

What to know

The strategy essentially boils down to your age and your expectations for your future tax rate. Here are two basic scenarios:.

1. If you’re young and anticipate your tax rate will be higher in the future, it’d be best to utilize a Roth account, which enables you to pay your taxes today, while receiving payouts in retirement tax-free, when you are expected to have a higher tax rate than you have today.

2. For those with high tax rates today and who plan to make or live off less in retirement than you do today, a Traditional plan is preferable, so that you can defer tax payments on the money withdrawn, until retirement when your tax rate is lower.

Be sure to consult with a financial advisor for more details relative to your specific situation.

See You Next Time!

That’s it for today on We Study Markets!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.

We’ll see you back here again tomorrow – same place, same time 😉

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!