House of Cards

Hi, The Investor’s Podcast Network Community!

The Powerball is making history.

🍀 The lottery’s jackpot has soared to about $1.73 billion, the second-largest prize in its history and the first time that consecutive jackpots have reached billion-dollar prizes.

The current lump sum payout would be about $750 million before taxes. The odds of winning it all? About 1 in 292.2 million, per the lottery 🤞

— Matthew

Here’s today’s rundown:

POP QUIZ

What is the most money ever made on a single trade? (Read to the bottom to find out!)

Today, we’ll discuss the three biggest stories in markets:

- Wall Street legend warns about geopolitical risks for U.S. stocks

- Behind Walmart’s big healthcare bet

- A big default threatens to worsen China’s property market crisis

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🌩️ Paul Tudor Jones Highlights Geopolitical And Debt Risks for U.S. Stocks

Paul Tudor Jones is a Wall Street legend and billionaire hedge fund manager. Like many, he’s worried about how escalating geopolitical tensions and the U.S. government’s spending will hurt stocks.

Who? Jones’ superstardom began after successfully predicting and profiting from the 1987 stock market crash — he’s been in the game for a while.

- On a recent TV appearance, Jones commented, “It’s a really challenging time to want to be in…U.S. stocks right now.”

- Adding, “You’ve got the geopolitical uncertainty…(and) the United States is probably in its weakest fiscal position since certainly World War II with debt-to-GDP at 122%.”

Global conflicts are bad for business: Similar to the pandemic’s massive economic disruptions, mounting conflicts and tensions in places like Ukraine, Israel & Palestine, and Taiwan each have their own distinct economic impacts, which, in sum, degrade global productivity and economic efficiency.

- For example, Ukraine was one of the world’s largest grain and fertilizer producers before the war. Now, other places must offset those lost supplies or face shortages.

- Same with oil coming out of the Middle East – war zones are a tough place to transport supplies.

- A Chinese invasion of Taiwan could be even more consequential, particularly if Taiwan Semiconductor — the world’s biggest computer chip producer, cannot keep operating.

Why it matters:

Debt-to-GDP: Jones’ comments are two-pronged — geopolitics and government spending. On the latter point, remember that governments primarily fund themselves with tax dollars derived from how big their country’s economy is (bigger economies = more potential tax revenue.)

- So, debt-to-GDP ratios like the one Jones referenced contrast how much outstanding debt the government has relative to the size of the economy.

The spending adds up: At a debt-to-GDP ratio of 122%, America’s government has 22% more total debt than the current size of the U.S. economy — as measured by GDP.

- Of course, that debt pile doesn’t come due this year (or even soon!). Those liabilities are spread out over the coming months and years, up to 30 years out.

- And the government can bring in more revenues to pay off debt by raising taxes (at the expense of economic growth and companies’ profits.)

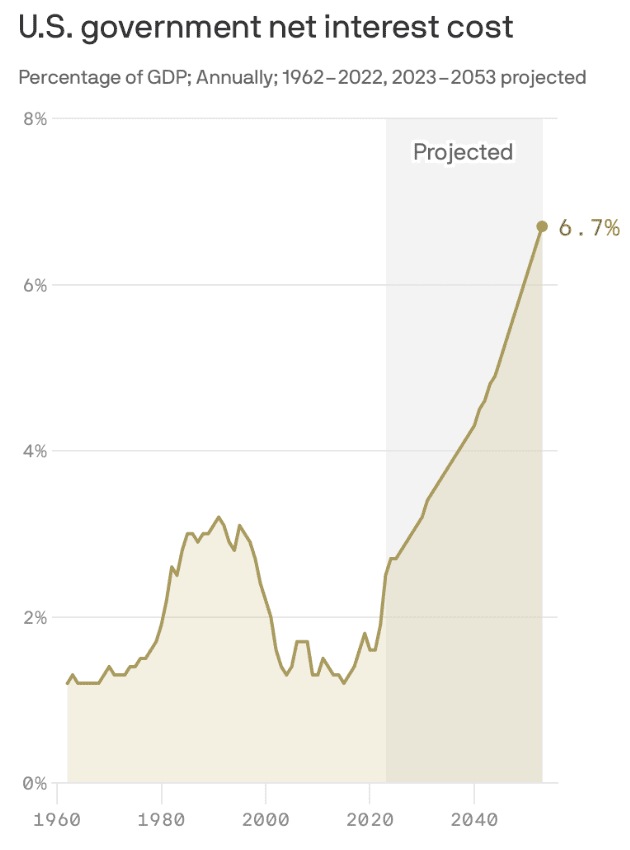

As Jones highlights, the U.S. and many governments have historically large debt balances relative to their economies. As interest rates continue to rise, refinancing those debt piles becomes increasingly expensive, and even just paying off the interest becomes challenging.

- That financial burden will be spread across American workers and businesses (i.e., higher taxes, inflation), ultimately a headwind for U.S. stocks.

The Assist is a free weekly email that makes becoming a better professional actually enjoyable.

Think of us as that one go-to friend — the one you always text for advice about work and other life stuff. 4x a week, we send our newsletter full of actionable tips to thousands of problem-solving go-getters.

And we do it in a fun way because we don’t take ourselves too seriously (tip #1: you shouldn’t either).

Walmart, the world’s largest retailer, is dipping deeper into healthcare, offering online primary care doctors to about 1 million people on its employee health insurance plan.

The goal? Lower medical costs and better outcomes. It will also serve as an indication of how much medical treatment can realistically go digital.

- Walmart, the largest U.S. private employer, has partnered with Included Health to give its workers and families online access to doctors starting this week.

- They say medical costs should be about 10% less under the new arrangement, and early results from Included Health show better health outcomes, including diabetics lowering their blood sugar.

This isn’t merely about minor coughs and earaches. Walmart hopes the ease of virtual visits makes medicine easier, more affordable, and more convenient.

- For example, you can be treated for numerous issues from the comfort of your home or on your phone while waiting in line to pick up your children.

We’ll see how this works in the coming months because questions remain:

To what extent will patients still need to see doctors in person? And how much care can be provided virtually?

- What we know is this: Under the plan, people with high blood pressure have seen improvements, they’ve visited hospitals less, and there’s been a reduction in a common screening measure for depression.

Why it matters:

Corporate America will keep an eye on the new program, which could set a precedent for how big employers handle healthcare in the coming years. Healthcare is big business for pharma, but it’s also a big deal for corporations’, especially those with many employees and high costs.

- Walmart says the plan will lower expenses and help patients avoid emergency room visits and hospital stays, which can easily run in the thousands (or more).

- Walmart said its health plan spent over $6 billion last year on claims, premiums, and administrative costs, so the new arrangement could lead to big savings — nearly $700 million.

We see you, rural: The plan could also be particularly helpful for patients in rural areas, where healthcare is less convenient and there are shortages of primary care doctors. (Walmart has over 5,300 stores nationwide, many far from hospitals.) Most virtual visits will cost Walmart employees nothing, per the company.

- The company also said that before 2020, about half of its employees and their families weren’t receiving primary care, mostly due to lack of access to providers.

- Another example: Nearly 90,000 Walmart workers live in areas with a shortage of primary care doctors, per Bloomberg, and 200,000 Walmart workers live in areas with too few mental health providers.

MORE HEADLINES

✌️ RFK Jr ditches the Democratic party to run independent.

🛍️ The best Amazon Prime Day deals for October.

🧠 ChatGPT’s mobile app hit a record monthly revenue of $4.58 million but growth is slowing.

🏠 Housing industry urges Jerome Powell to stop raising interest rates.

💰 Top 1% of U.S. households now hold 26.5% of the wealth.

The Chinese property market saga has been a long one. For two years, investors have waited for this house of cards to suddenly collapse. But it’s been more like a slow-motion explosion in a movie.

- Still, many continue to watch for signs of acceleration in the crisis or how it may be resolved.

Debt woes: After months of flirting with default, Country Garden (formerly) China’s largest real estate construction firm, warned investors in a filing on Tuesday that it’ll have to default.

- That is, the company, with some 70,000 employees and 3,000 housing projects, will be unable to pay its debts, specifically those borrowed from international investors, which must be paid back with U.S. dollars.

Like its peer China Evergrande (who, if you recall, brought China’s real estate crisis mainstream when it defaulted in 2021), Country Garden’s future lies in the hands of creditors and government officials.

Why it matters:

Due to the dim prospects of being fully repaid, Country Garden’s bonds trade at just pennies on the dollar.

- Put differently, for creditors to pawn off their holdings of Country’s Garden’s debt, they must do so at an extreme discount to investors willing to take the risk of not being repaid.

- Prospective homebuyers aren’t exactly diving head over heels into purchasing projects from the troubled developer, either. Contracted sales for Country Garden plunged 81% from last year.

The issue is nationwide: Daily new home sales were recently down 17% year-over-year in 35 major cities. As Bloomberg puts it, Country Garden “has become a symbol of China’s broader property debt crisis.”

- Worse, Country Garden has $187 billion in total liabilities, making it one of the world’s most heavily indebted developers.

- Now, it’s hiring advisors, a move often taken by distressed companies to help navigate debt restructurings and forced sales of assets.

QUICK POLL

Where do you get most financial news?

Yesterday, we asked readers: What topics should we cover more?

— Many of you shared love for the existing blending of news coverage, while others requested more focus on stocks generally and individual companies.

— We will continue trying to cover the 3 biggest stories in markets daily while being mindful of the topics you all are most interested in!

— (Have more to add? Hit reply to this email and share your thoughts about the topics we cover.)

TRIVIA ANSWER

To some extent, the “greatest trade” ever is up for debate, depending on how you define it, but one answer, according to Finance Monthly, is David Tepper’s bet on beleaguered banks at the bottom of the 2008 Financial Crisis, which netted him over $7 billion. As a result, he was named Hedge Fund Manager of the Year in 2009.

See you next time!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

All the best,

P.S. The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more!

Join our subreddit r/TheInvestorsPodcast today!