Gimme Shelter

05 October 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

❗Stocks traded sharply lower this morning following the best two-day trading period since 2020, but the major indexes staged a decent comeback to close slightly down.

There is once again optimism that the Fed will pivot from its rate hiking plans, despite the central bank reiterating that it would do no such thing.

🚫 And oil prices continued an impressive rally higher after OPEC+ confirmed that it will cut production of nearly 2% of the world’s total oil supply today.

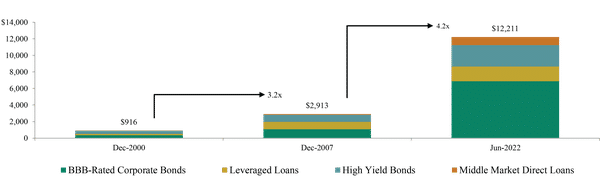

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss Elon Musk’s agreement (for the second time) to buy Twitter, Micron’s plans to invest billions in U.S. semiconductor production, Nasdaq delaying its cryptocurrency exchange plans, and our takeaways from Oaktree Capital’s quarterly letter.

All this, and more, in just 5 minutes to read.

Let’s go! ⬇️

IN THE NEWS

🤔 Elon Musk Agrees To Buy Twitter — Again (FT)

Explained:

- If you haven’t heard by now, Elon Musk has once again made headlines the last two days, and this time it’s because he appears to be reversing his efforts to back out of purchasing Twitter (TWTR) for $44 billion.

- Less than two weeks before a trial was scheduled to begin to determine whether Musk could renege on the deal that he originally agreed to back in April, Musk’s lawyers announced that he intended to close the purchase after all which sent Twitter’s stock shooting over 20% higher.

What to know:

- While Musk has agreed to purchase the company at $54.20 a share, the stock drifted considerably below that level, as it looked increasingly uncertain how Musk’s court endeavors to exit the purchase would unfold.

- Some are speculating that it became clear to the well-known entrepreneur and eccentric billionaire that he wouldn’t win the case, yet he appears unbothered after tweeting about a new “everything app” called “X” that he implied he would use Twitter to create.

💻 Micron To Spend $100 Billion To Build Computer Chip Factory In New York (CNBC)

Explained:

- Micron (MU) plans to spend up to $100 billion over the next two decades building a new computer chip factory in upstate New York which could create an average of nearly 50,000 jobs per year over its lifetime.

- This comes after the passage of the CHIPS and Science Act of 2022, a new Federal law that uses $52 billion to incentivize greater domestic semiconductor chip production.

What to know:

- Semiconductor chips are used in a variety of modern technology ranging from cell phones to cars and medical devices, and the U.S. government is increasingly looking to reduce dependence on foreign supply chains for these products.

- When the CHIPS act first became law, Qualcomm (QCOM) pledged to buy an additional $4.2 billion worth of chips from GlobalFoundries’ (GFS) plant in New York, and Intel (INTC) also announced a $100 billion chip manufacturing investment in Ohio.

- Senate Majority Leader Chuck Schumer has called Micron’s investment, “transformative for upstate New York but also for America, because we’re going to regain the lead in manufacturing probably the most important commodity or product for the 21st century.”

🖐️ Nasdaq Waits For Regulatory Clarity Before Launching Crypto Exchange (Bloomberg)

Explained:

- Nasdaq Inc. (NDAQ) has said it will wait for greater regulator clarity and institutional adoption before proceeding with plans to launch a cryptocurrency exchange.

- Tal Cohen, the company’s executive vice president and head of North American markets said in regards to launching an exchange “Those are discussions we are happy to have. But right now, on the retail side, the market is fairly saturated…There’s a number of exchanges servicing the retail customer base.”

What to know:

- The company intends to remain focused on its crypto custody services instead, where it has cited “massive” demand and opportunity. Nasdaq also hopes to strengthen its ability to facilitate the movement and transfer of digital assets safely.

- Last month, the firm announced that it would offer custody services for both Bitcoin and Ether to its institutional investors.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: How to become a millionaire — a review of The Millionaire Fastlane by Weronika Pycek.

👂 LISTEN: Proof of work versus proof of stake — Bitcoin Fundamentals with Jason Lowery.

📖 READ: 15 timeless investing principles (visualized) — a Twitter thread by Brian Feroldi.

DIVE DEEPER: TAKEAWAYS FROM OAKTREE’S QUARTERLY LETTER

Oaktree Capital, the highly regarded investment firm co-founded by the legendary Howard Marks that manages almost $160 billion in assets, shared its portfolio managers’ thoughts on markets and the economy.

And when they share their expert insights, we make sure to read them, and, of course, we pass along what stands out to you.

In this regard, we have four points to highlight.

For investors to “tilt the odds in their favor,” as Marks has been known to say, it’s crucial to identify where we are in the market cycle, so that we can adjust our strategies accordingly.

So let’s look through the investing world from Oaktree’s eyes.

1. Risk Posture: It Depends

Blanket advice to buy or sell stocks isn’t particularly useful, and it never has been, because pundits’ sweeping analysis, by definition, fails to account for how you are already allocated, your risk tolerance, and your available liquidity.

Oaktree focuses, then, on what has happened in the macro environment and what is already happening. What we cannot know is what future conditions will be like, and how much expectations for the future are already reflected in current prices.

Although, just because the outlook collectively is quite pitiful, this doesn’t mean it’s a bad time to be investing, especially if prices already reflect pessimistic expectations.

So in short, if you follow Oaktree’s advice, your posture for risk-taking in this environment depends on these assumptions, ranging from your personal circumstances to your beliefs about what’s priced into markets and what isn’t.

What shouldn’t be a part of this analysis, though, are sweeping generalizations about now being the “right or “wrong” time to buy.

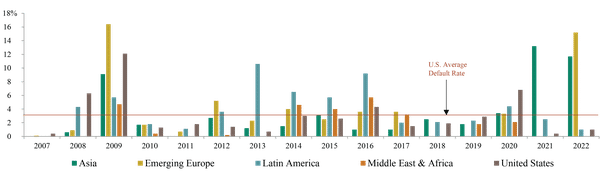

2. Distressed Credit: Expansion of the Universe

One of Oaktree’s signature strategies is to invest in distressed credit. That is, to buy the bonds of troubled companies approaching bankruptcy trading at an excessive discount relative to the possibility of a turnaround or effective restructuring.

In 2022, with rates rising (higher financing costs) and a weakening global economic environment, the universe of distressed credit has expanded considerably, as more and more companies find themselves under financial strain.

According to Oaktree, the number of high-yield bonds and leveraged loans that hit distressed levels in the U.S. reached a two-year high in June at $140 billion.

Due to the massive growth in corporate debt since the Great Financial Crisis, should an economic downturn become extended, the distressed credit world is likely to expand significantly further, with opportunities to find diamonds buried in the rubble (bonds that trade at too steep of a discount relative to the asset values that could be recovered in a bankruptcy).

Oaktree notes that default rates are still very low historically due to limited upcoming debt maturities (companies are in default if they can’t re-finance or pay down their debt when it comes due), but these default rates have begun to increase of late.

And for companies that have issued debt with floating interest rates, they’ll be particularly vulnerable, as opposed to companies that issued their bonds at fixed interest rates.

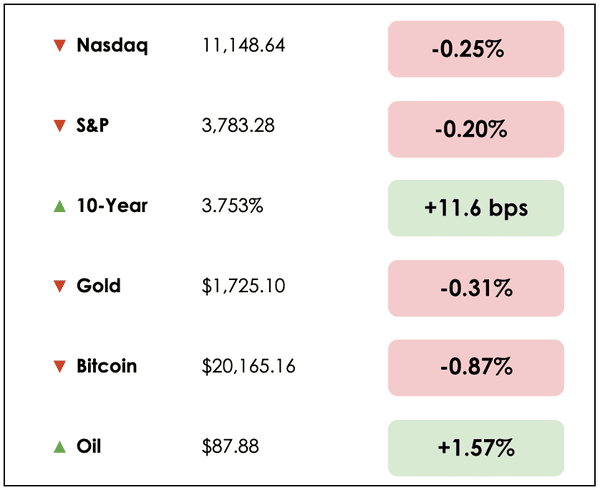

3. Emerging Markets Debt: Past Isn’t Always Prologue

So far this year, high-yield bonds (bonds from companies seen to be a greater credit risk) from emerging market countries have had their worst year since 2008.

In other words, the most sensitive businesses in the most fragile economic markets, are, unsurprisingly, in a desperate state.

Until the onset of the Covid pandemic, many of these countries, and the companies located there, had benefited from a decade of falling interest rates, robust economic growth, strong capital inflows, and globalization.

Oaktree warns that over the last two years, these trends have largely reversed.

Despite this, emerging markets are more resilient than ever.

Such economies now “drive 40% of global exports, generate half of global GDP and have been responsible for two-thirds of global GDP growth in the last decade…and typically have access to large domestic capital pools as well as the $4 trillion emerging market bond market.”

With these advances in mind, unlike in past economic crises where contagion quickly spread from one country to another, Oaktree believes this time is different.

Recently, for example, default rates have spiked in China and in Eastern Europe due to the war in Ukraine, yet defaults in other regions remain relatively low.

Oaktree is cautious about investing in emerging markets, particularly in companies showing financial strain, but the prospect of a sweeping emerging markets financial crisis looks limited at this point in time.

4. Real Estate: Give Me Shelter

Commercial real estate has endured a number of headwinds in 2022 relating to higher interest rates, work-from-home trends that have reduced demand for office space, and generally less interest in financing these sorts of projects.

In light of this, a few segments in the space have held up well, like multifamily properties (duplexes, townhomes, apartments, condos, etc.).

This is because, while companies negotiate office space leases for many years, leases for multifamily properties are typically one year. In a highly inflationary environment, multifamily properties can more quickly adjust rental rates higher to remain profitable.

Even so, Oaktree doesn’t expect multifamily rents to stay on the rapid trend upward that they’ve been on in the last year, though they may remain abnormally high over the short to medium due to a shortage of housing in the U.S.

And this shortage could be exacerbated by continued cost increases for labor and materials that constrain new construction.

Wrap up

Oaktree brings a focus on capital markets that’s very much defined by credit and debt, which we love to read for better contextualizing the broader financial system so that we can make decisions grounded in a clearer picture of reality.

Their expertise in credit and debt markets is unparalleled, and we are only capable of brushing over their work here.

To read the full list of Oaktree’s third quarter takeaways, you can do so here.

To learn more about investing strategies based in finding value in debt markets, check out this high-yield master class.

DO YOU WANT TO READ MORE?

Imagine it’s 2023…

Inflation has peaked. The Fed stops raising interest rates. Markets have finally bottomed and a new bull market starts.

Over 36,000 investors will be ready since they read The Average Joe — one of the most engaging and concise investing newsletters — filled with market insights trends and ideas.

Here’s how one reader feels: “I enjoy the humor including memes, the info rich one liners, the more in depth articles and the interesting charts. Thanks! A nice job in a short form that I like.”

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.