Get the Memo

Hi, The Investor’s Podcast Network Community!

⌛ Quick — what percentage of fund managers failed to beat the stock market (benchmark S&P 500) over the last 10 years? It might be higher than you think. Read to the end of the newsletter to find the answer.

In earnings, Tesla posted a 24% decline in first-quarter profit, as the EV maker has lowered prices for models in the U.S. by between 14% and 25% this year.

Its operating margin, a measure of profitability, took a hit and fell to 11.4% from 19.2%, though its margin remains about the highest in the auto industry 🚗

Here’s the rundown:

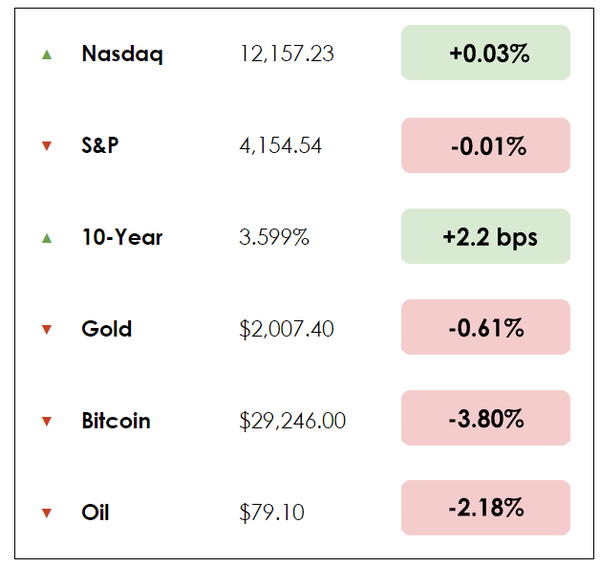

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Why Netflix earnings disappointed, again

- Largest global rice shortage looms globally

- Plus, our main story on Howard Marks’ memo this week

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🎬 Netflix Earnings Disappoint, Again (WSJ)

Explained:

Breathe a sigh of relief — you have a few more months before you have to start paying for your own Netflix. The company expects to implement password-sharing limitations broadly by the end of June, marking the end of an era where we could all use our friend’s brother’s log-in.

- Netflix says stricter rules forcing password-stealers (we prefer borrowers) to pay could become an important new revenue stream, estimating that over 100 million people streamed on borrowed accounts.

A more surprising announcement to us was learning on Tuesday that Netflix still operates a DVD-by-mail business, which generated $145.7 million in revenue last year. That will be ending shortly after 25 years, though.

Netflix closed the first quarter with 232.5 million subscribers, adding 1.75 million from the quarter before.

- Net profit fell 18% to $1.31 billion, while revenue rose 3.7%, just shy of its own projections for 4% growth.

Notably, this quarter was the first under new co-CEOs Greg Peters and Ted Sorandos, after Netflix’s co-founder Reed Hastings stepped down in January.

Why it matters:

After reporting a decline in total subscribers for the first time in a decade last year, prompting its stock to plunge 35% at the time, the streaming giant has responded with bold initiatives to maximize earnings, such as password crackdowns and launching an ad-supported tier for $6.99 per month.

On the bright side, it appears the ad-based service hasn’t cannibalized the company’s premium ad-free plans, citing little evidence of users switching to the lower-cost option.

- Still, investors weren’t impressed by the quarter, sending its stock down over 3% after it reported lower-than-expected subscriber growth.

As Netflix wades deeper into a content war with other streaming platforms, it’s increasingly reaping less of the high-margin benefits typically associated with tech companies. The company is producing more of its own content to stay competitive, but enabling viewers to stream content you license is a very different business than spending to create your own content.

🚧 Largest Rice Shortage in 20 Years Looms Globally (CNBC)

Explained:

Global rice production declines, thanks to volatile weather, has inflated food prices for over 3.5 billion people, notably in Asia-Pacific, which consumes 90% of the world’s rice.

Fitch Solutions expects the global rice market to face a shortfall of 8.7 million tonnes this year, the largest deficit since 2003/2004 (when there was an 18.6 million tonnes deficit).

- China, the world’s largest producer of rice and wheat, has been hit by a double dose of extreme weather: late last year it saw much of its farmland plagued by record monsoon rains. Yet, this year, it’s experiencing one of the worst droughts in two decades.

- Similarly, Pakistan, which accounted for 7.6% of global rice exports last year, saw annual production plunge 31% due to flooding.

Why it matters:

Rice’s emergence as an alternative to other grains, which surged in price following Russia’s invasion of Ukraine, makes the shortage more painful.

Fortunately, analysts predict the rice market will come into balance again over the next year, with Fitch Solutions anticipating as much as a 10% price decline as production normalizes.

- Still, the research provider expects prices to remain structurally higher at “more than one-third above their pre-Covid mean value.”

This shortage, impacting the world’s third-most widely cultivated grain, adds to global inflationary pressures and supply chain disruptions while worsening food scarcity in impoverished areas.

- Major rice importers like Indonesia, the Philippines, Malaysia, and several African countries will feel the pressure most acutely.

MORE HEADLINES

🛒 Bed Bath & Beyond renews bankruptcy talks as rescue stalls

👀 Fox reaches $787.5 million settlement in defamation suit over its 2020 election fraud claims

🏷️ Tesla slashes prices for the sixth time this year ahead of earnings

Introduction

Now that the dust has settled on the banking crisis, the legendary investor Howard Marks has weighed in with another must-read memo.

Marks discusses the significance of the Silicon Valley Bank (SVB) collapse, arguing that it likely doesn’t portend a wave of banking failures. He says it may amplify preexisting wariness among investors and lenders, leading to further credit tightening and additional pain across various industries and sectors.

Marks said social media contagion is a big risk factor for banks. He also described commercial real estate “as one of the biggest worries banks face today” just weeks after Elon Musk said the sector is “by far the most serious looming issue.”

Here are the highlights from Marks.

Big picture takeaways

The 76-year-old billionaire finds baffling SVB management’s decision to put about half of its deposits in hold-till-maturity bonds having ‘pitifully’ low yields. “How could anyone have thought rates that low were more likely to hold steady or fall than rise,” says Marks.

Drawing a contrast to the 2008 crisis, Marks blamed social media for the run on SVB. He said it took several days or weeks in 2008 for problems in some of the banks to reach the masses; thus, the management and regulators had time to prepare. But given that most customers of SVB were tech-savvy and belonged to a tight-knit community, they could exchange information almost instantaneously online.

Further, Marks believes some financial institutions will likely reduce the amount of credit they offer after two banks collapsed, adding pressure to some borrowers. The upshot: Startups might have a more difficult time raising money in the coming months.

Meanwhile, regional and community banks may face increased scrutiny and deposit outflows, as their customers move their funds to money-market funds and larger banks. As such banks are the main financiers of the commercial real-estate market, property owners and developers of office buildings, brick-and-mortar retail stores, and even multifamily properties might come under pressure, Marks noted.

Still, as interest rates have gone up, the current environment may open up opportunities for lenders and bargain hunters.

“When investors think things are flawless, optimism rides high and good buys can be hard to find,” Marks wrote.

“But when psychology swings in the direction of hopelessness, it becomes reasonable to believe that bargain hunters and providers of capital will be holding the better cards and will have opportunities for better returns.”He concludes: “We consider the meltdown of SVB an early step in that direction.”

Commercial real estate risks

Marks highlights that one of the biggest worries facing banks is the possibility of problems stemming from loans against commercial real estate, especially office buildings. Higher rates, a potential recession, tighter credit conditions, and falling demand for offices all bode negatively for commercial real estate.

The significance: U.S. banks are estimated to hold about 40% of the $4.5 trillion commercial real estate mortgages outstanding, or about $1.8 trillion in face value, while total U.S. bank assets stand at more than $23 trillion.

Banks are highly levered, with collective equity capital of $2.2 trillion, or roughly 9% of their total assets. The estimated amount the average bank has in commercial real-estate loans is equal to approximately 100% of its capital, Marks noted. As a result, losses on commercial real estate mortgages could wipe out an equivalent percentage of the average bank’s capital, leaving it undercapitalized.

It also depends on loan-to-value ratios, an assessment lenders use to determine risks they’re exposed to, and the negotiations between lenders and landlords following any defaults.

“No one knows whether banks will suffer losses on their commercial real-estate loans, or what the magnitude will be,” Marks wrote. “But we’re very likely to see mortgage defaults in the headlines, and at a minimum, this may spook lenders, throw sand into the gears of the financing and refinancing processes, and further contribute to a sense of heightened risk.”

Surviving turbulence

Marks argues that SVB’s failure doesn’t suggest widespread problems in the U.S. banking system. But banks can face similar vulnerabilities: asset/liability mismatch, high leverage, and reliance on trust.

Marks comments, “Never forget the six-foot-tall person who drowned crossing the stream that was five feet deep on average. Surviving on average is a useless concept; you have to be able to survive all the time, including – no, especially – in bad times.”

Before the widespread use of social media, depositors wouldn’t have become aware of banking issues as quickly and would have needed to visit branches during banking hours to submit withdrawals, said Marks, a billionaire. “In SVB’s case, word of the bond losses traveled quickly, through unusually interconnected depositors who had the ability to request withdrawals online.”

“All banks have to contend with digital communication and online withdrawals these days, but SVB’s depositors were particularly high flight risks, given the bank’s region and the nature of its clientele.”

Dive deeper

Here’s the full memo, and here’s our handy Twitter thread on the matter.

TRIVIA ANSWER

About 82% of fund managers failed to beat the S&P 500 over the last 10-year period. Many beat the index in a single year, some beat it over a few years, but only about one in five could do it over a decade.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!