Fusion Energy

12 December 2022

Hi, The Investor’s Podcast Network Community!

Stocks certainly aren’t coasting into the holidays with little news to consider 🎄

This week, we have CPI inflation data dropping tomorrow and the Fed’s final rate hiking decision of the year coming on Wednesday.

🎅 Santa is prepping to deliver millions of toys while Wall Streeters revise their Excel models with this new data shaping investors’ outlook for 2023.

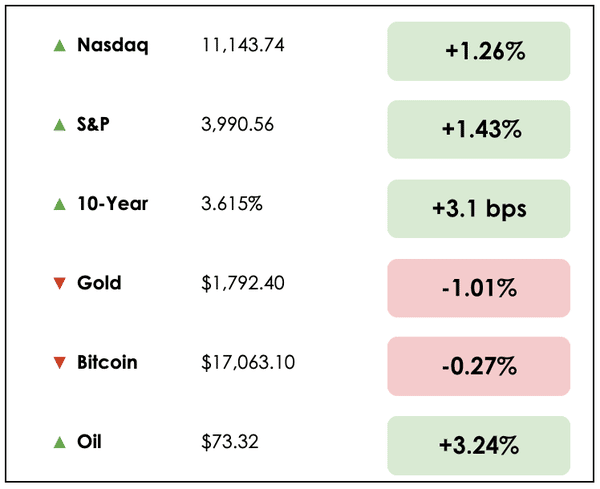

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: How an energy breakthrough is spawning hopes of a de-carbonized future, and why the White House is calling hesitancy to drill more oil “un-American,” plus our main story on what’s happening in Silicon Valley.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

☢️ Fusion Energy Breakthrough By Scientists Boosts Clean Power Hopes (FT)

Explained:

- Since the 1950s, physicists have sought to harness the type of nuclear fusion reaction that powers the sun on earth, but no one has ever been able to produce more energy than the reaction consumed. For the first time, a team of U.S. government scientists generated a “net energy gain” from a fusion experiment.

- This revolutionary technology could theoretically power unprecedented amounts of energy with no carbon emissions, though scientists caution that those developments are, at best, decades away.

- This type of research has historically been government-backed, though private investors are increasingly providing funding. Through June, private investment reached nearly $5 billion, according to the Fusion Industry Association.

Why it matters:

- The breakthrough has renewed confidence in a technology with incredible potential while the Biden administration plows nearly $370 billion into subsidies for low-carbon energy sources.

- Physicist Dr. Arthur Turrell says, “If this is confirmed, we’re witnessing a moment of history.” Scientists are still combing through the data to validate their findings.

- The chair of the bipartisan Congressional Fusion Energy Caucus, Don Beyer, added: “Fusion has the potential to lift more citizens of the world out of poverty than anything since the invention of fire.”

🤔 Wall Street Opposition To Shale Drilling Is “un-American” (FT)

Explained:

- The White House’s chief energy advisor, Amos Hochstein, called hesitancies to fund new drilling projects from U.S. shale investors “un-American.”

- Oil companies are under pressure to direct record profits back to investors this year, despite calls from the President to expand oil production as a matter of national security in light of the West’s ongoing struggle with Russia.

- The advisor suggested that companies can “pay dividends…pay shareholders…get bonuses. You could do all of that and still invest more. We’re asking you to increase production and seize the moment.”

Why it matters:

- These comments come just after an embargo from the European Union on seaborne Russian oil imports and a price cap on Russian oil sales. Such messaging from Washington stands at odds with much-publicized decarbonization plans.

- In reality, governments would like to have their cake and eat it too. The U.S. shale sector has complained about these mixed messages complicating their decisions to invest in greater future oil production capacity.

- However, Hochstein denied any contradiction in arguing that the U.S. must “do two things at the very same time, ensuring we have enough (oil) supply for a strong global economy, while accelerating the energy transition.” So far, companies and investors don’t seem to be taking the bait.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: Why nations succeed and fail, an overview of Ray Dalio’s book The Changing World Order

👂 LISTEN: How to be happy, with Tsoknyi Rinpoche & Daniel Goleman on Richer, Wiser, Happier

📖 READ: What’s happening in private real estate funds is more important than FTX, a thread from Phil Bak

THE MAIN STORY: WHAT’S HAPPENING IN SILICON VALLEY?

Overview

As financial markets adjust to rising interest rates this year, some pockets of the financial system are more impacted than others.

For the highly speculative venture capital (VC) space, 2022 has been a sobering reminder that there are real consequences for malinvestment.

To learn how it’s going in the VC world and to better understand how VC funding works, we turned to our friend James Lavish.

What to know

In a post on the topic, Lavish explains that venture capital is a segment within the broader private equity space.

VC firms are structured as limited partnerships, which serve as managed pools of capital to invest in early-stage businesses.

In this process, venture capitalists use their expertise to help these companies with growth, finances, organization, and risk management.

These firms don’t usually become profitable (if ever) until they ‘hit scale,’ meaning when they reach much of their target market.

Early rounds of funding

Along the way, they raise capital in several rounds to stay functional and undergo new initiatives.

Angel funding, as it’s called, is the first stage where entrepreneurs raise money from friends and family as they take a leap of faith with their new idea.

If the business gets some traction but has tapped its angel investors of available capital, Lavish explains that founders typically turn to wealthier, non-institutional sources in what’s known as a “pre-seed” round.

These first two fundraising efforts are periodically completed as a Simple Agreement for Future Equity (SAFE).

Basically, rather than getting equity in the company directly at this early stage, a SAFE converts to equity ownership down the road (or the right to purchase equity), such as when the company is big enough for venture capital firms to become interested.

Seed financing

As they move into the official “seed” rounds of funding, institutional investors like venture capitalists dip their toes in and try to calculate an equity price valuation for the business, typically $1-3 million.

Next comes the Series A round, where companies are a bit more established. They use this new capital to hire more people and solidify their growth plan.

You’ll often see multiple investors involved at this point with a lead investor who puts up the most money, says Lavish

From here, there are the Series B and the Series C rounds for companies in the $50 to 100 million range or higher as the businesses look to really accelerate growth.

Ownership math

With all of these different fundraising rounds, how do VCs account for what everyone owns and choose where to invest?

Lavish says, “this is more of an art than a science,” especially in the earliest rounds.

The math is relatively straightforward, though. The terms to know are “post-money” and “pre-money” valuations.

If a company gives away 25% equity ownership for $1 million, its post-money valuation would be $4 million ($1 million / 25%).

Pre-money takes this implied valuation and subtracts the newly added investor money, so in this case, the pre-money valuation is $3 million ($4 million – $1 million).

In each round, earlier investors may see their percentage ownership stakes get diluted, but they end up owning a smaller piece of a bigger pie. As long as that pie’s valuation keeps growing meaningfully, for the most part, everyone is happy.

The downside of fundraising

In years like this, unfortunately, those pies don’t always keep growing.

One technical nuance is that venture capital firms usually receive a form of preferred equity, meaning they’re placed above common equity holders, which may be the company’s founders and early employees.

If a company raised, say, $100 million of capital at a $300 million valuation from VCs amidst last year’s financial euphoria, that same struggling company now might need a bail-out, probably at a lower price.

If they get bought out at a lower level (< $100 million), the employees and founders could be left with nothing since VCs would get paid first.

Lavish argues that founders frequently make the mistake of “raising too little money upfront and needing to do subsequent or larger rounds that end up severely diluting their ownership. Sometimes down to a level that’s no longer an attractive incentive to do everything they can to ensure the company’s success.”

Takeaways

As has already happened, we expect many founders and VCs to incur considerable losses in upcoming fundraising rounds. Higher interest rates must force valuations down compared to their peaks in 2021.

Silicon Valley will be feeling the effects for years to come.

Dive deeper

Check out James Lavish’s full post for more details.

We love his weekly newsletter, which provides deeply insightful and understandable write-ups like this, and we’d firmly encourage you to add his work to your

To learn more, you can listen to this podcast on whether Warren Buffet would invest in venture capital.

RECOMMENDED READING: WEB3 DAILY

Web3 Daily is a (free) newsletter where you can find the most important and interesting Web3 and crypto news, written in a way that everyone can understand.

Get it straight to your inbox, Monday to Friday.

[ Sign Up Now ]

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.