EV Boom

06 January 2023

Hi, The Investor’s Podcast Network Community!

💬 With Bed Bath & Beyond (BBBY) warning of bankruptcy over the next few weeks, the beloved “meme” stock fell over 22% today and is down almost 50% in the last week.

Conversely, Costco (COST) jumped roughly 7.5% after reporting considerable sales growth, as Americans shop in bulk to hedge inflation 🛒

And approval of a promising new Alzheimer’s drug from Biogen (BIIB) sent its stock higher, though the treatment is “far from a cure.”

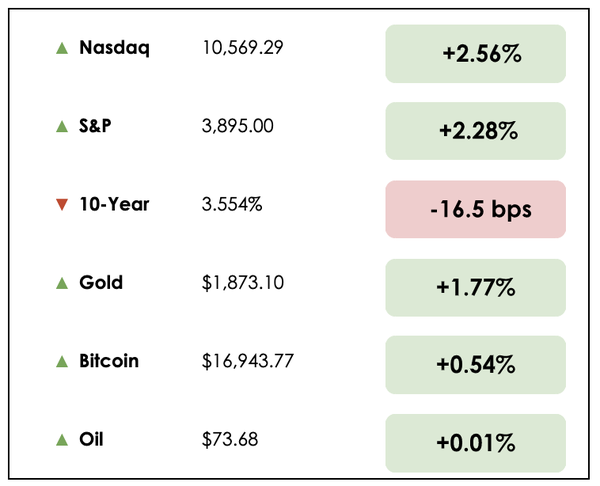

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Booming electric vehicle sales and Barnes & Noble’s impressive recovery, plus our main story on a year in review.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🚗 EV Sales Jolt Higher (WSJ)

- Electric vehicle (EV) sales in the U.S. leapt by two-thirds in 2022 as the broader market contracted. New models from traditional automakers have cut into Tesla’s (TSLA) lead.

- Automakers sold 807,180 fully EV vehicles in the U.S. last year, or 5.8% of all vehicles sold, up from 3.2% a year earlier. Overall, total U.S. auto sales fell 8% in 2022.

- Tesla dominates the EV market, accounting for 65% of total sales last year, down from 72% in 2021. Ford Motor (F) jumped into the No. 2 position in EV sales, accounting for 7.6% of the U.S. market for fully electric vehicles.

- Electric vehicles remain a small slice of the broader car market, but it’s widely seen as a major growth opportunity. Experts say companies who can roll out EVs in large numbers now can attract early EV adopters, stealing some of Tesla’s market share.

- But obstacles have emerged in the past year, including the rising cost of lithium and other battery minerals. Thus, car makers have raised prices, which could lessen demand. The average price paid for an EV in the U.S. hit about $66,000 last summer, up from about $51,000 a year prior.

- With consumer appetites for battery-powered cars soaring, analysts say the EV market looks ripe for growth this decade. Car makers are racing to spend hundreds of billions of dollars on battery-cell plants and factory upgrades to churn out more EVs.

📚 Barnes & Noble Expanding (Axios)

- As some brick-and-mortal retailers struggle, Barnes & Noble committed to opening more than 30 new stores in 2023.

- Founded in 1886 in New York, Barnes & Noble was taken private three years ago by Elliott Management, which has cut layers of corporate management and other costs (such as office space).

- The new openings include locations abandoned last year by Amazon (AMZN), which closed all of its Amazon Books stores. There’s a striking irony here, as Amazon is often viewed as the enemy of physical booksellers.

- For the past two decades, Amazon, which started as an online bookstore, has dominated the industry. Now, Barnes & Noble is taking a contrarian approach by leaning into the benefits of physical stores.

- Barnes & Noble is letting local store managers have greater say in what books to sell, ending publisher promotions that displayed unpopular books in prime locations and eliminating many extraneous products sold at B&N (gifts, stationary, etc.).

- The pandemic hurt B&N’s top line in 2020 and part of 2021, but the company used the shutdowns to refurbish stores, reorganize layouts, and reassess inventories.

TradingView is where the world charts, chats, and trades markets.

It’s a supercharged super-charting platform and social network for traders and investors.

WHAT ELSE WE’RE INTO

📺 WATCH: The monster of Wall Street, a Bernie Madoff documentary

👂 LISTEN: Are the FANG stock dead? With Lance Roberts

📖 READ: Ancient DNA paints new picture of the Viking Era

RECOMMENDED READING

“Like Tim Urban and Morgan Housel had a baby” — One reader’s description of Jack Raines’ finance blog, Young Money.

Every Tuesday and Thursday, Jack uses stories, anecdotes, data, and drawings to craft the most interesting articles you’ll read all week.

From finding a career that you actually like, to meme stock hysteria, to losing $150k in a day, nothing is off-limits.

If you want to read some interesting content with personality, you should check out Young Money!

Overview

We Study Markets began on July 1st, 2022, and we’re so incredibly thankful to each of our loyal readers who’ve stuck with us through it all.

To highlight a few topics we covered last year for our newer readers or to re-visit popular pieces for others, we’ve crafted a curated list of our favorite newsletters from 2022 as we wrap up the first work week of 2023 — enjoy!

New World Order

On September 22nd, we wrote about the dollar’s future and how one famed Wall Street analyst, Zoltan Poszar, believes the world may be dramatically changing.

Poszar called the tectonic shifts in finance “Bretton Woods 3.0.”

In this vein, he argues that the war in Ukraine has unleashed a pivot towards commodity-based currencies that will weaken the U.S.’s control over the global financial system while fueling chronic inflation.

On the flip side, we broke down esteemed professor Perry Mehrling’s view that the U.S. dollar would emerge stronger in this global crisis as it has in every other significant crisis since World War II.

You can read the full newsletter to better understand their arguments here.

A Tale of Turkeys and Swans

In honor of Thanksgiving, we wrote about an iconic metaphor from Nassim Taleb for a turkey’s lifecycle and risk in global financial markets.

The basic idea is that risk is non-linear.

A Thanksgiving turkey has no idea if or when it’ll be slaughtered. As each day passes by, though, they may increasingly trust that the farmer providing them food and shelter is truly caring for them.

In fact, as they near their slaughter a few weeks before the holiday, they perhaps have hypothetically convinced themselves that they’re safe on the farm.

Unfortunately for the turkey, while its paranoia is fading, it’s actually getting closer to the end of its life or point of catastrophic risk.

The takeaway was to say that in investing, we may not even realize when we’re the turkey. With each day that an investment doesn’t blow up in our faces, we may delude ourselves into thinking we made a good choice.

Until suddenly, one day, our world gets flipped upside down.

From turkeys to the 2008 Financial Crisis, the story helps us internalize that we may be incredibly vulnerable to risks that we can’t even fathom.

Dive into the full write-up here for more.

Settling The Debate

In late October, after listening to several podcasts from co-founder of The Investor’s Podcast Network, Preston Pysh, on Bitcoin and its proof-of-work consensus mechanism, we felt inspired to explain why we believe Bitcoin is fundamentally different from other “cryptocurrencies,” specifically the second-largest, Ethereum.

Blockchains and transaction validation are admittedly nerdy topics, but the two approaches, proof-of-work and proof-of-stake, are materially different.

Although we’re in a so-called “crypto winter,” and digital asset prices are down, we don’t think the technology, or Bitcoin, in particular, is going away anytime soon.

Dive into the weeds of digital assets here.

Freedom Investing

While we’re often told that emerging markets offer the greatest potential returns on investment, such advice typically understates the huge jump in risks one is taking by allocating capital to assets in these often unstable economies.

In an increasingly de-globalizing world, tensions between regional powers and superpowers, like the U.S. and China, are ramping up.

Meanwhile, with rising interest rates weighing heavily on businesses and governments, we feel increasingly uneasy about many emerging market investments.

At least, we don’t feel comfortable lumping these diverse countries into a single category. Instead, we argued that developing economies likely offer better potential returns than the U.S. or Europe, though we must be extraordinarily careful about which rising economies we invest in.

The point of so-called “freedom investing” was to divide countries with tremendous growth prospects by their social and political stability, rule of law, freedom of speech, etc.

In this way, we can optimize for investing in regions and businesses where prospects are the brightest while minimizing the plethora of associated social, political, economic, and financial risks.

Check out our full explanation of freedom investing here.

First Things First

In recent weeks, we debuted weekend editions for this newsletter which focused on the bigger picture behind both life and investing.

From inspirational quotes to reflections on our organization’s core values to optimizing for happiness and deep relationships, we’ve had a ton of fun putting these together.

On December 3rd, we wrote about the significance of valuing your time appropriately and prioritizing more meaningful tasks like relationship-building over the nauseating barrage of messages we get daily that feel urgent but are hardly so.

We argued, “This concept underpins the effective allocation of time, which parallels effective capital allocation in investing…In business, you’re measuring return on invested capital. In your life, you should be measuring return on invested time.”

Read the full piece here.

Wrapping up

Let us know, readers — Did we miss any of your favorite newsletter from 2022?

If so, which one was it?

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.