Elon Musk Did What?

12 August 2022

Hey, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

The weekend is nearly here, and we have some good news and bad news.

There’s good news if you happen to be a pharmacist. Walgreen’s is offering a $75,000 signing bonus to you if join them to help fill their pharmacist shortage.

The bad news is there may be 87,000 new IRS agents released upon the land wanting to take a look at that bonus if the Inflation Reduction Act is passed by the House.

Nonetheless, it’s the weekend, and we plan to celebrate!

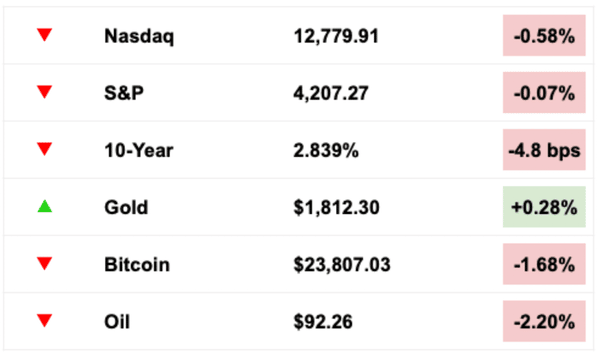

Here’s the rundown from yesterday:

*Equities as of 4pm EST on prior day’s close, Bitcoin, bond, and oil prices as of this morning

Today, we’ll discuss Elon lightening his load of Tesla shares, the Fed’s hammering of the housing market, the potential of Seritage Growth Properties, and the role of dividends according to Phil Fisher.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🧠 Elon Musk Sells $7 Billion Worth Of Tesla Stock Before Twitter Court Fight (FT)

Explained:

- If you’ve been selling Tesla stock recently, you’re in good company. Tesla’s controversial founder Elon Musk has sold a sizable share of his stock holdings, in light of a recent bounce in the stock, after previously selling $8.5 billion worth in anticipation of purchasing Twitter.

- While the Twitter deal has been sidelined and will be settled in court, Musk is still committed to raising cash apparently.

What to know:

- Musk acknowledged on Twitter that he’s done selling for now, and he attributed his actions to proactively building reserves should Twitter’s lawsuit prove successful in forcing him to buy the company. In that case, he would be forced into an emergency sale of stock which would likely come at a meaningful discount.

- At the end of last year, Musk used a Twitter poll to seemingly determine whether he would sell Tesla stock, which he did to the tune of $16.5 billion.

- Even if Musk can prove in court that Twitter materially misled him on its number of active users (non-bots), he would still have to pay a $1 billion breakup fee to cancel the deal. Ouch.

💵 Asset Managers Dive Into The Digital Asset Space (FT)

Explained:

- A number of huge firms have recently dipped their toes into cryptoland, and the effects are rippling throughout the industry, despite recent price declines and dismissing the emerging asset class for years.

- Charles Schwab recently announced an ETF that will invest in in companies participating in the blockchain space, and BlackRock will not only offer a Bitcoin trust to institutional investors, but it’s also linking it’s popular Aladdin platform with Coinbase in a new partnership (we’ve discussed this previously).

- On the other side of the pond in the UK, large asset manager Abrdn has recently purchased a stake in digital asset exchange Archax.

What to know:

- Senior research analyst at DA Davidson, Chris Brendler says, “Large asset managers are starting to consider this a real investment…I think it’s a major data point in terms of traditional asset management companies embracing what for years has really been ridiculed.”

- For Larry Fink, founder of BlackRock, the company’s pivot towards the space is quite remarkable, given his past comments suggesting that the rise of Bitcoin simply indicates the, “demand for money laundering” globally.

🏡 Has the Fed Damaged the Housing Market? (Bloomberg)

Explained:

- Existing home sales are down more than 14% from last year as interest rates have increased and now hover at around 5%. Many potential buyers are sitting on the sidelines, hoping rates, or prices, or both decline.

- The Case-Schiller index, which measures housing prices, increased 30% between March 2020 and December 2021. This was partly due to people moving during the pandemic but primarily because the Fed drastically reduced rates to prevent another 2008 financial crisis. The 30-year mortgage rate was a paltry 2.65% in the spring of 2021.

What to know:

- Don’t count on rates going back to where they were during the pandemic, which resulted from extraordinary market intervention from the Fed. Even though the Fed has ended QE, its role in fueling a red-hot housing market may be felt for the next decade according to some experts.

- Many are expecting a hangover from the very low rates of 2020 and 2021. Some buyers that bought during the pandemic may be stuck for a while. Rising mortgage rates and a slower housing market may prevent some of them from selling for the foreseeable future.

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine an rainbows. Learn about the red flags from PassiveInvesting.com.

DIVE DEEPER: SERITAGE GROWTH PROPERTIES

Some of our listeners may be familiar with Seritage Growth Properties (SRG), which has been on the move for the past month and a half. The stock more than doubled in July, and yesterday, it climbed over 8.5% to close at $14.06.

Seritage has been a former darling of Mohnish Pabrai and continues to be a holding for other value investors, such as Guy Spier and Matthew Peterson, who maintain the stock represents a true Ben Graham value play.

After an initial burst of enthusiasm from investors when Seritage first launched, the stock has languished and been a bit of a disappointment for long-term holders.

The company started seven years ago as a real estate spin-off created from Sears Holdings after Sears went into bankruptcy. Seritage initially owned stakes in 266 properties after separating from Sears and had whittled the portfolio down to 212 properties by early 2020 to pay down debt obligations and to fund redevelopment costs of other assets.

The stock hit just above $56 in 2016 and began taking a nosedive at the start of 2020. Covid-19 hit, and the stock plummeted to $8 per share by the end of March 2020. By June 2022, it had fallen to barely above $5 per share.

Following lockdowns, the company’s plans to redevelop prime assets were severely disrupted and called into question its viability as a going concern (a business that’s expected to meet all financial obligations). Leasing activity dried up, and many prospective tenants canceled plans to rent space.

A new CEO, Andrea Olshan, joined in February 2021, and quickly responded with a plan to streamline operations and reduce its portfolio down to 120-130 properties.

The stock has rocketed to over $14 per share after recently announcing that the company intends to wind down its operations, sell its remaining assets, and return net proceeds to the shareholders. Even after the run-up in the stock price, many analysts expect Seritage to continue to move higher as the liquidation process continues.

The numbers

Seritage’s market cap is $614 million, and in May, reported they had already sold $75 million worth of assets in the first few weeks of the second quarter. It also had $85 million worth of properties under contract to be sold.

In June, the company put its multi-tenant retail portfolio on the auction block, which comprised 38 locations that could be worth up to $900 million.

In July, the board asked for shareholders to vote on a “plan of sale” to liquidate the entire company’s portfolio of holdings. If the proposal is approved, Seritage believes they could sell all assets off and shut operations down within 18-30 months.

The Seritage board believes after selling off all assets and paying off its debt, the total distributions to shareholders will be between $18.50 and $29 per share. Shareholders will likely not see any payouts until 2023 or 2024, though, after the liquidation process is complete so it makes sense that the stock is trading below its current Net Asset Value (NAV).

Extreme pessimism is applying further price pressure due to the stock’s poor long-term track record as well as negative sentiment about the retail real estate industry more broadly. Seritage needs to prove it can sell off its assets quickly and in line with management’s estimates for their portfolio.

Takeaway

While it is difficult to determine the book value of Seritage’s properties given a retail market that still is suffering from the effects of the pandemic, many of the former Sears locations are sitting on prime property which adds a nice margin of safety to the calculations.

One of the bigger risks for shareholders is the possibility of a negative outcome from a lawsuit by the Sears Holdings bankruptcy estate that claims Seritage underpaid for the Sears real estate holdings. How much it will cost to settle this litigation is a lingering red flag in estimating the company’s final liquidation value.

Another risk is the looming debt that the company owes with a total of $1.34 billion, and $540 million of that is due next July. While the company expects their asset sales will allow them to cover these payments, a hiccup in the macro environment could make real estate sales grind to a halt.

Tell us what you think.

Is Seritage a good value?

Our own Clay Finck did a great interview with Tom Botica here in which they discuss the potential value play.

TO DIVIDEND, OR NOT TO DIVIDEND?

Today, we wanted to highlight an interesting section from our book review written by Preston and Stig of Phillip Fisher’s Common Stocks and Uncommon Profits.

Let’s discuss.

Breakdown

In chapter 7, Fisher starts off by arguing that high dividend payments are not always preferential, as many people believe.

At the end of the day, the important factor is where the capital can be employed in order to provide the highest value to shareholders.

Earnings that are retained could be used for new plants, major cost savings initiatives over the long run, or product development.

Whether or not the highest value for the shareholder would be achieved through dividends or through the management retaining earnings is therefore an issue that must be examined from time to time.

And the decision about dividends is further complicated by the investor’s individual circumstances.

They might have a personal need for capital, for living expenses, or for additional investment in other assets. Simply based on optimizing each dollar of investment, Fisher emphasizes that it is not an easy task to find truly outstanding companies.

A received dividend that is invested in companies other than investors’ chosen outstanding company runs the risk of making a lower return—and if investors then wished to reinvest in the current company, they would have less funds with which to do so, since they will have been taxed when initially receiving the dividend.

Wrapping it up

Fisher further argues that the investor must consider the regularity and dependability of dividends.

Well-run companies have official dividend policies, and investors must scrutinize those. One suggestion is to look at the payout ratio (a measure of how much of the net income is paid out in dividends); however, this would leave investors vulnerable to fluctuations in the company’s net income.

Instead, stock investors should pay attention to the dividend rate (the absolute value of the dividend).

They should prefer a steady dividend that is paid out regularly. The management of the company should only decrease the payment in the case of a crisis, and only increase the rate if it can be maintained and does not sacrifice a profitable growth option.

For the full review, check it out here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later and enjoy the weekend!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.