Buffett’s Biggest Mistakes

Hi, The Investor’s Podcast Network Community!

Happy May, happy Monday, everyone. We bring you our inaugural “Berkshire Week” here at We Study Markets. In the leadup to the Berkshire Hathaway Annual Shareholders Meeting on Saturday, we’ll highlight something about Warren Buffett or Charlie Munger every day. You’re welcome 😄

First up: Buffett’s biggest investing mistakes and what we can learn from them.

— Matthew

Here’s the rundown:

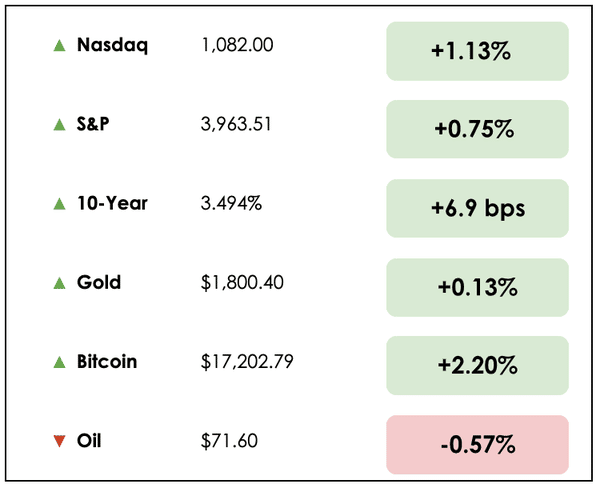

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- J.P. Morgan acquires First Republic Bank

- Fed set to raise rates to 16-year high

- Plus, our main story on Buffett’s biggest investing regrets

All this, and more, in just 5 minutes to read.

Trivia: When did Buffett first start adding Apple shares to the Berkshire portfolio?

(Scroll to the end for the answer).

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

💥 Second-Biggest U.S. Bank Failure Ends with JPMorgan Acquisition (Bloomberg)

After a frantic weekend, at 4:30 am EST on Monday, another page turned in the 2023 banking crisis storyline: JPMorgan (JPM) agreed to acquire First Republic Bank after regulators seized control of it, resolving the last major question mark from March’s banking crisis.

- JPM’s CEO Jamie Dimon added, “Our government invited us and others to step up, and we did.”

It’s a sweet deal for JPMorgan — it’ll share the cost of losses on First Republic’s loans with the FDIC while First Republic’s shareholders are wiped out. JPM stock rallied 3% on the news.

- Here’s a short video from the FDIC explaining loss-sharing arrangements — the FDIC expects to take a $13 billion hit to its insurance fund from First Republic’s failure.

The deal resembles those assembled in 2008. But this time, the government isn’t subsidizing losses on risky subprime mortgage loans.

- Instead, the losses that brought down First Republic stemmed from rising interest rates, which reduced the value of high-quality loans made and bonds purchased at lower interest rate levels.

Why it matters

JPMorgan will acquire roughly $173 billion of First Republic’s loans, $30 billion of its securities, and $92 billion in deposits, including the $30 billion in deposits that JPM and other big banks deposited into First Republic to stabilize it, which will be repaid when the deal closes.

- Under normal conditions, JPM’s considerable share of total U.S. bank deposits (more than 10%) would restrict it from growing by acquisition.

- Although regulators wanted to avoid making “too big to fail” banks bigger, those concerns were sidelined to finalize a deal before banking system worries spread further.

JPMorgan will also make a one-time $10.6 billion payment to the FDIC’s deposit insurance fund and incur an estimated $2 billion in restructuring costs from the acquisition.

- Still, the bank estimates the deal will add around $500 million to its annual earnings.

Interestingly, this isn’t the first time First Republic has been sold: Merrill Lynch paid $1.8 billion to acquire it in 2007, passing ownership to Bank of America in 2009. In mid-2010, investment firms, including General Atlantic and Colony Capital, purchased First Republic for $1.86 billion and then took it public.

💬 Fed Set to Raise Rates to 16-Year High (WSJ)

It’s well-known that a contributing factor to the banking crisis outlined above was the Fed’s rapid interest rate hikes to combat inflation which reduced the value of banks’ assets as depositors withdrew cash balances en masse.

- Yet, Federal Reserve officials are anticipated to carry on with at least one more rate increase this week before likely pausing.

Another 0.25% hike would bring the Fed’s benchmark rate to a 16-year high, with officials keen to see how markets react to First Republic’s sale to JPMorgan as a gauge of how jittery investors are about banking risks still.

Why it matters

While the Fed knows that hiking rates isn’t helping vulnerable banks, a sudden pivot from its commitments to slowing inflation might cause even more panic that troubles are brewing beneath the surface known only to regulators.

- In other words, the Fed has hoped to keep operating as usual to restore confidence.

But there are now harder limits on how far the Fed can hike before “breaking” more banks. After this week, the Fed is expected to watch and see whether its efforts can bring inflation down to its 2% target instead of pushing rates even higher.

- Philadelphia’s Fed President commented, “I don’t see why we would just continue to go up, up, up, and then go, ‘Oops.’ And then go down, down, down, very quickly.”

- The hope, then, is to hold rates steady after one more hike rather than being forced to cut rates dramatically to help the economy recover from a recession/extended banking crisis.

MORE HEADLINES

🏆 Survey shows investors still believe Warren Buffett & Berkshire will beat the market averages going forward

🥪 Deal to sell Subway to private equity firms for more than $10 billion looms

📃 Adidas sued by shareholders over its failed partnership with Kanye West

LEARNING FROM BUFFET’S MISTAKES

What to know

Warren Buffett has consistently identified extraordinary businesses, delivering outsize returns to Berkshire Hathaway. But we can learn quite a bit from his shortcomings, too.

In his 2022 annual letter, Buffett wrote that Berkshire’s results “have been the product of about a dozen truly good decisions” over the past 58+ years. That’s it. A few excellent businesses, such as American Express, Coca-Cola, and Apple, have driven most of Berkshire’s results.

Buffett knows there have been plenty of mistakes and bad investments.

“I have made many mistakes,” he wrote this year. “Consequently, our extensive collection of businesses currently consists of a few enterprises that have truly extraordinary economics, many that enjoy very good economic characteristics, and a large group that are marginal.

“Along the way, other businesses in which I have invested have died, their products unwanted by the public.”

Rather than sugarcoat or hide his mistakes, Buffett addresses them and uses them to fuel his decision-making process to prevent future mishaps.

Buying Berkshire

In 2010, Buffett said the “dumbest” stock he ever bought was Berkshire Hathaway. It was 1962, when Berkshire was a failing textile company. He thought he’d profit when more mills closed, so he loaded up on the stock.

In 2010, he called it a “$200 billion blunder,” sparked by a spiteful urge to retaliate against the CEO who tried to “chisel” Buffett out of an eighth of a point on a tender deal.

In other words, Buffett says his holding company would be “worth twice as much as it is now” if he had bought a good insurance company instead. More on that story tomorrow.

Missing on Google & Amazon

Buffett has admitted that he doesn’t have a good answer for missing Google and Amazon.

To Buffett’s credit, he preached caution in late 1999, warning reality would catch up to lofty stock valuations. A few months later, the Nasdaq began a 75% plunge, and Apple and Amazon shed over 80% of their market capitalizations.

Still, Buffett missed out on the last 20+ years of rapid growth for the mega-cap tech stocks that have left fingerprints all over daily life.

“Obviously, I should have bought it long ago because I admired it long ago,” he said of Amazon. “But I didn’t understand the power of the model as I went along. And the price always seemed to more than reflect the power of the model at that time. So, it’s one I missed big time.”

As for Google, Buffett told investors in 2017 that he made a mistake by not purchasing shares in the tech giant years ago when it was getting $10 per click from Geico — a wholly owned subsidiary of Berkshire.

The lesson: not to overlook investment opportunities in front of you.

ConocoPhillips

In 2008, Buffett bought a large stake in ConocoPhillips as a play on future energy prices. But he bought it too high, resulting in a multibillion-dollar loss to Berkshire Hathaway. The difference between a great company and a great investment is the price at which you buy stock.

Crude oil prices were well over $100 per barrel then, so oil company stocks were at high levels, leaving little room for price appreciation from the investment in ConocoPhillips.

Investors know crude oil prices have always been very volatile, and oil companies have long been subject to boom and bust cycles. For that reason, many long-term investors stay away from them altogether.

U.S. Air

Buffett bought preferred stock in U.S. Air in 1989, attracted by its high revenue growth. The investment quickly went South.

U.S. Air didn’t post enough revenues to pay the dividends due on the stock. With luck on his side, Buffett unloaded his shares at a profit. Despite this good fortune, Buffett realizes that this investment return was guided by luck.

Buffett wrote in his 2007 letter to Berkshire shareholders that sometimes businesses look good regarding revenue growth. Still, they require large capital investments all along the way to enable this growth.

This is the case with airlines, which generally require additional aircraft to expand revenues significantly. The trouble with capital-intensive business models is that they’re heavily laden with debt when they achieve a large earnings base. This can leave little left for shareholders. It also makes the company highly vulnerable to bankruptcy if business declines.

Buffett says: “Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it.”

Dexter Shoes

In 1993, Buffett bought a shoe company, Dexter Shoes. Buffett’s investment in Dexter Shoes became a disaster because he saw a durable competitive advantage in Dexter that soon disappeared.

“What I had assessed as a durable competitive advantage vanished within a few years,” he said. Buffett claims that this investment was possibly the worst he has ever made, resulting in a loss to shareholders of $3.5 billion.

The lesson: Companies can only earn high profits when they have a sustainable competitive advantage over other firms in their business area. Walmart has incredibly low prices. Honda has high-quality vehicles. Coca-Cola has an unmatched global presence and brand, and Apple has a highly integrated product ecosystem with unparalleled brand loyalty.

“A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital,” Buffett said.

The final word

Leave it to the Oracle of Omaha: “I’ve made plenty of mistakes in my life. And it’s precisely because of those mistakes that I’m successful today. Every mistake teaches you something new…. If you can’t make mistakes, you can’t make decisions.”

Dive deeper

For more, here’s The Snowball, the definitive biography of Buffett, which includes just about all of his investments up until its 2008 release.

TRIVIA ANSWER

Buffett first started buying Apple stock in the first quarter of 2016. The stock has grown to make up nearly half of Berkshire’s portfolio. He last added to the position late last year, just before Apple shares ran up another 30%.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

All the best,

![]()