Brick & Mortar

Hi, The Investor’s Podcast Network Community!

📈 S&P 500 sectors continue to be on divergent paths since the banking stress began. Investors have been piling into the tech behemoths that propelled the market’s advance since the 2008 Global Financial Crisis.

In turn, they’ve shunned cyclical stocks such as materials, real estate, and industrials, all of which have dropped at least 4% over the past month.

What probably helps the big tech companies like Apple and Microsoft? Cash. Both companies have tens of billions in cash already on hand. And should the Federal Reserve end its rate-hiking campaign sooner than expected at the start of the year, Big Tech is expected to perform well in a lower-rate environment.

Here’s the rundown:

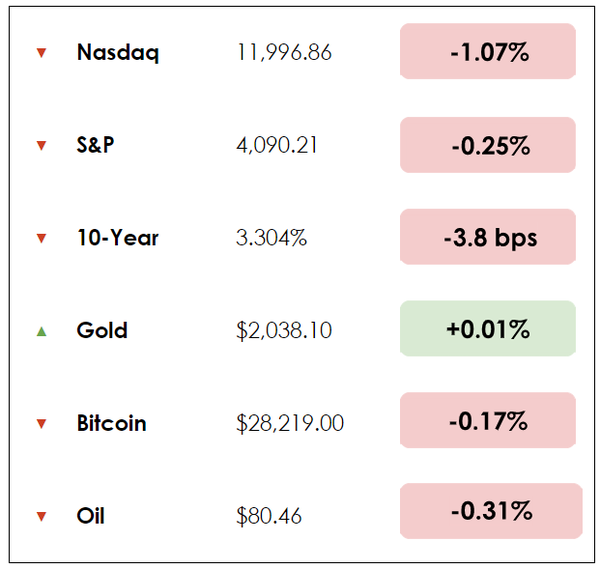

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- Money-market funds are pressuring banks

- Why Walmart wants to automate

- Plus, our main story on Barnes & Noble’s resurgence

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

In addition to being a good friend, Compounding Quality is one of the fastest-growing accounts on Substack and FinTwit.

He works professionally as an Equity Fund Manager and teaches people about investing for free with his wonderful newsletter.

Learn about Quality Investing from someone who manages roughly $200 million.

IN THE NEWS

💫 Fed Program for Money Market Funds Underlies Bank Outflows (WSJ)

Explained

Depositors’ embrace of money-market funds is pressuring banks, shining a spotlight on a financing program sponsored by the Federal Reserve.

- Flows into money-market funds are increasing rapidly, with much of that money being directed into the Fed’s overnight reverse repurchase facility.

The program borrows from money-market funds and other firms in exchange for securities like U.S. Treasury bills, and then the Fed pays back the loan the next day at a slightly higher price.

- On Wall Street, it’s known as a “reverse repo,” and over 40% of money-market fund assets utilize the Fed-sponsored program.

Others call it the “plumbing of the financial system,” as it enables financial firms with large cash balances to earn interest, and the Fed uses it to help set its policy interest rates. However, some contend it’s draining funds from the banking system, where the money could be invested or lent out.

Why it matters

As recently as Tuesday, $2.2 trillion sat in the Fed’s reverse repo facility, paying an attractive 4.8% annualized rate. Critics suggest that the Fed should change the terms of the facility to minimize bank distress, in light of recent failures, with the hope that some of that money would flow back into the banking system.

In other words, the Fed could cut the rate it pays on reverse repos to make the program less attractive, easing pressure on banks.

- Conversely, you could argue that banks should raise deposit rates to compete for needed funds.

One Fed Governor commented, “Every day, firms are handing us over $2 trillion of liquidity they don’t need.” Yet, bank deposits have declined by $363 billion since the beginning of March to $17.3 trillion. Assets in money-market funds have jumped $304 billion to a record $5.2 trillion.

- Others, like Noor Menai, the president and chief executive of CTBC Bank USA, emphasize that the deposit outflows are still “small potatoes” and “absent any more bad news, the banking system is stable.”

🛒Walmart Wants to Automate Service at 65% of Its Stores (Reuters)

Explained

Walmart (WMT) said Tuesday it anticipates around 65% of its stores will be serviced by automation by the end of 2026.

The announcement underlies the retail giant’s aim to increasingly use its massive stores to handle online-order deliveries and accelerate order processes at its e-commerce fulfillment facilities.

- Walmart, the country’s largest private employer with about 1.7 million U.S. workers, suggested the moves would reduce the need for lower-paid roles with lots of physical labor.

But, as the company said, “Over time, the company anticipates increased throughput per person, due to the automation while maintaining or even increasing its number of associates as new roles are created.”

Why it matters

About 55% of packages processed in fulfillment centers will be pushed through automated facilities by January 2026, improving unit cost averages by as much as 20%.

- One analyst wrote, “This increased efficiency will not only support better inventory management, but it will also support Walmart’s rapidly growing e-commerce business.”

Walmart has invested billions in technology for its online order facilities, from buying the grocery robotics company Alert Innovation to partnering with companies such as Knapp to minimize the number of steps for employees to process e-commerce orders.

MORE HEADLINES

🎬 Warner Bros. nears deal for a ‘Harry Potter’ HBO Max series

🛢️ Exxon’s multi billion-dollar wager on finding oil in Brazil comes up empty handed

🔌 Ram’s electric pickup truck can go 500 miles on a single charge

Introduction

A decade ago, few people would have bet on Barnes & Noble to be a viable, healthy business in 2023. Not amid the rise in e-commerce. Not given Amazon’s rise to control roughly 80% of all book distribution in the U.S.

Yet Barnes & Noble has orchestrated a turnaround worth studying.

CEO James Daunt inherited the bookseller in 2019 after the company’s sale (for $628 million) to hedge fund Elliott Management, often a perilous development. At the time, few thought positively about B&N’s growth prospects. Many believed it’d have the same fate as Borders, which liquidated in 2011.

Four years ago, Barnes & Noble was “not quite there but pretty darn close,” Daunt said earlier this year in an interview. The bookseller thrived in the 20th century, but the digital age surprised it.

Right now, the 136-year-old retailer is profitable. It will open 30 new stores this year.

Near collapse

In 2018, the company was floundering. It lost $18 million that year and fired 1,800 full-time employees, shifting most store operations to part-time staff. Same-store sales were down, online sales were down, and the share price was down more than 80%.

Enter Daunt, a veteran in the bookselling space. He got to work right away by cutting corporate staff in half, exiting two large, expensive leases in Manhattan, and empowering local managers to make decisions about the books they carry and the layout of stores. He also removed many of the products they were selling that had nothing to do with books.

“I love bookstores,” Daunt told The Verge. “I think bookstores have a real importance within communities and a value in their own right, and therefore keeping them alive and prospering is really important.”

Small changes

When Daunt joined, B&N still accepted publisher payments in exchange for displaying and promoting certain books. But 70% of those copies weren’t sold, and it corrupted the system in service of short-term profits, so he ended the practice.

Daunt also encouraged managers to put the best books in the window and display the most exciting books by the front door. During the pandemic lockdown, he asked employees to take every book off the shelf and re-evaluate whether it should stay. Every store section needed to be refreshed, questioned and made more appealing.

A recently-opened bookstore in New York features full-height bookshelves arranged in a layout more analogous to an independent bookstore “maze” than the supermarket-style layout of the chain’s standard big-box locations.

In other words, Daunt made Barnes & Noble stop trying to emulate Amazon with online sales. Instead, they do what Amazon can’t do: provide an incredible in-person experience where people can stroll, talk to other readers, ask a bookseller for suggestions, and benefit from hand-picked curation.

Other lessons

In 2022, book sales totaled 788.7 million units, according to NPD Bookscan. That was down 6.5% from 2021 but up 11.8% from pre-pandemic 2019.

It’s still Amazon’s game. But Barnes & Noble’s turnaround is inspiring for other brick-and-mortar retailers trying to regain their footing.

There are business lessons here that apply beyond books. They put the customer first, and other stuff second. They have a good leader who isn’t a corporate junkie; he’s a book lover who understands the business, the customer, and his employees. And he’s continuing to improve the quality of the business.

Next up: The company’s café business and newsstand sales “are still suffering,” he said, but they’re trying to revamp both, as well as their loyalty program.

Rather than fear Amazon, Daunt has come to appreciate how the behemoth has reshaped the bookselling industry for decades to come.

“I think they do a completely brilliant job and they are particularly good at democratizing books,” Daunt said. “If you want a book and you don’t have access to a bookstore, Amazon will get it to you. They’ve driven down the price of books, they’ve made it really competitive, and they’ve forced bookstores out of their complacency to become really good places that justify their existence. So I think all of that is very positive.”

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!