Blue-Collar Cash

06 February 2023

Hi, The Investor’s Podcast Network Community!

Stocks fell on Monday after strong jobs data last week raised the prospect of more interest-rate hikes by the Federal Reserve.

In Turkey and Syria, devastating earthquakes killed at least 3,000 people, according to The Wall Street Journal. The death toll is expected to keep rising this week. The U.S. has promised swift aid in the recovery effort.

Also, some housekeeping. You’ll notice tweaks to how this newsletter looks, with a focus on simplicity and flow. Let us know what you think of the changes by replying to this email 😁

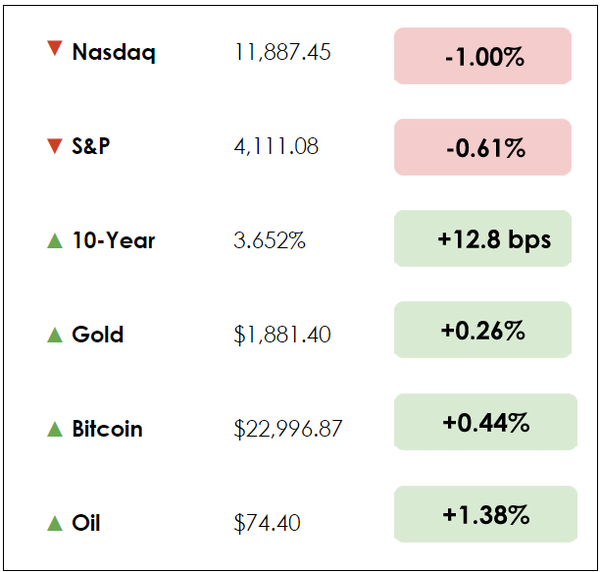

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- The Yen weakens on report of new BOJ Governor

- The Adani Group crisis continues with unrest

- Plus, our main story on the blue-collar economy

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🇯🇵 Yen Weakens on Report of Next BOJ Governor (WSJ)

- Japanese stocks rose while the yen weakened following a report that Masayoshi Amamiya might serve as the next Governor for Japan’s version of the Federal Reserve, the Bank of Japan (BOJ).

- “Amamiya is seen as the continuity candidate and the least likely to move away” from the country’s famously ultra-easy monetary policies.

- For decades, Japan has relied on massive quantitative easing programs and extremely low interest rates to stimulate economic growth. And it did so with little inflationary consequences until 2022.

Why it matters:

- The BOJ is now staring down inflation rates double their target level. At the same time, the yen has fallen considerably against the dollar in the last year, only further diminishing Japanese citizens’ purchasing power.

- Although the yen had started rallying over the last three months on hopes that the BOJ would finally begin hiking interest rates, speculation about Amamiya’s selection for the Governor role is dampening that outlook. The Japanese central bank has engaged in what’s called ‘yield curve control’ by setting interest rate limits for longer-dated government bonds.

- 10-year bond yields are capped at 0.5% — considerably lower than the approximately 3.6% levels for 10-year government bonds in the U.S., 2.3% in Germany, 2.9% in China, and 3.5% in Australia. These low interest rate policies help the Japanese government fund itself with cheaper debt issuances. However, the rate differential with peer countries threatens to continue weakening the yen and stoking inflation.

😅 Adani Crisis Sparks Social Unrest (Reuters)

Explained:

- The crisis engulfing the Adani group intensified on Monday, with dozens of members of India’s main opposition party being detained by police during related protests, while parliament was suspended again due to disruptions over the ongoing financial saga and its spillover effects.

- The Adani conglomerate has now seen cumulative market losses top $110 billion following a report from the short-seller Hindenburg Research on January 24th that accused the Adani group of stock manipulation, unsustainable debt, and use of tax havens.

- While the conglomerate, one of India’s most systemically and politically important group of businesses, rejected the claims of wrongdoing in detailed rebuttals, this has done little to ease the loss of faith in its shares and debt.

Why it matters:

- Beyond just paper losses, Adani Group’s flagship company was forced to abandon a $2.5 billion fundraising effort to sell stock last week due to rapid share price declines. This has triggered a series of warnings from the major credit ratings agencies, with S&P cutting its outlook on two Adani companies.

- Despite efforts from the Reserve Bank of India and India’s top regulators to assure investors that financial markets remain stable, panic has continued to spread as shares of Adani Enterprises sank another 9.6% today.

- Gautam Adani, chairman of Adani Group, has now lost his crown as Asia’s richest person, and he’s playing defense against allegations that he inappropriately benefited from close ties with India’s Prime Minister Narendra Modi and his government. The whole story reads like a Netflix series, with fraud accusations rocking India’s financial system and government, spurring social unrest, and taking down one of the country’s biggest business icons.

WHAT ELSE WE’RE INTO

📺 WATCH: Catch up on recent news including US vs. China GDP, the Eurozone, and whether market resilience in 2023 will continue 👂 LISTEN: Investing amid uncertainty with legendary investors on Richer, Wiser, Happier with William Green 📖 READ: The man who moves markets, from The Atlantic

Ken Rusk’s high school was located next to an industrial yard. One day, he asked the workers: What do you do here?

“We’re ditch diggers,” they told him. They finished basements and built home foundations.

Rusk asked for a summer job for extra cash. By 18, he was opening new franchises, eventually turning it into a larger company: Rusk Industries, a concrete construction business based in Toledo, Ohio.

In the decades since, Rusk has observed the power of blue-collar jobs for many Americans who either cannot afford college or simply want to work with their hands in a skilled trade.

He turned that knowledge and experience into a book: Blue Collar Cash, a Wall Street Journal Bestseller that covers the opportunities for those who pursue blue-collar jobs and how working with your hands can lead to peace, freedom, and wealth.

Let’s dive in.

College isn’t for everyone

In some areas, there’s a shortage of “blue-collar” jobs, which have traditionally been the economic foundation of this country—be they builders, welders, plumbers, pipefitters, miners or mechanics.

Rusk senses this is an opportunity for young adults or people looking to make a career change.

He believes college is a wonderful opportunity for many. But it’s not for everyone, and entering the workforce with enormous debt isn’t the best path for all.

Rusk reminds us to challenge assumptions that all high school graduates should go to college. Many young adults may find a passion for working with their hands, such as a plumber, mechanic, electrician, welder, or general contractor.

There are opportunities to work for others or start your own company from a young age, with no college education required. Rusk also hopes to lessen the stigma that blue-collar work is simply for uneducated or unmotivated people.

Rusk notes that the U.S. (and world) is built on blue-collar jobs. On the way to work, you might come across the work and products of hundreds, if not thousands, of blue-collar jobs. The work of skilled tradespeople is critical to our health, business, and economy.

Rusk adds that the supply-demand dynamic is out of rhythm: We don’t have enough young Americans replacing retiring workers.

He also observes that a four-year degree and office culture isn’t for everyone, and blue-collar careers can give students freedom, less debt, and a fulfilling hands-on career.

Blue collar workers are sometimes more in demand than white-collar workers and can earn six-figure salaries without debt. Plus, there are opportunities to work up in an organization or start your own.

Sketch out the life you want

Some of Rusk’s advice has little to do with one’s field. Whether you have three degrees or none, he advises people to draw out exactly how they envision their ideal future.

As a mentor and coach, Rusk has encouraged people to map out their vision. He suggests grabbing a pen or crayon and paper, then being specific about everything from exercise routine to financial planning and goals to family and relationships.

By writing this down in detail, Rusk believes that habits and dreams are more likely to stick.

Studies have shown that writing down habits, ideal routines, and goals leads to higher chances of success. A key is being as specific as possible.

Top trades in 2023

Rusk notes several trades have seen increased demand. Even if artificial intelligence becomes mainstream soon, all the trade jobs likely won’t be replaced overnight.

Plus, as we transition to a cleaner economy, we’ll need more electricians and mechanics with specific knowledge and expertise. Here’s a short list of in-demand jobs, according to Rusk:

Electricians: We need electricity for just about everything. The Bureau of Labor Statistics estimates that nearly 80,000 electrician jobs will be open annually for the next decade. In some states, electricians are one of the top-earning trades.

Construction equipment operators: Minimal training or experience is required to run bulldozers, excavators or other heavy equipment.

Solar installers: As the world transitions to clean energy, solar power requires installers and maintenance workers.

Of course, there’s an investing piece to this, too: Businesses such as Caterpillar (CAT), Waste Management (WM), and Deere & Company (DE) have given investors exposure to industrials.

Wind turbine technicians: Similarly, wind turbines require maintenance and technicians. Wind remains the leading non-hydro-renewable technology.

Dive deeper

Rusk’s book is a nice overview on the blue-collar industry and relates to many fields, even if you aren’t interested in finding blue-collar employment.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.