Bed Bath & Bankrupt

Hi, The Investor’s Podcast Network Community!

There are few things we can count on except death and taxes. But maybe we should add demand for Coca-Cola to that list.

💪 In an uncertain global economy, Coke is a bastion of stability: the company trounced expectations, hitting nearly $11 billion in revenue after sales rose 5% globally last quarter.

You can see why Buffett loves the stock so much…

The rest of this week is when earnings season really starts to pick up. Tomorrow we get Alphabet, Microsoft, Visa, McDonald’s and Verizon, with Boeing and Meta on Wednesday, Amazon on Thursday, and Exxon Mobil and Sony on Friday.

Plus many, many more (35% of the S&P 500 reports this week).

Buckle up 🎢

— Shawn

Here’s the rundown:

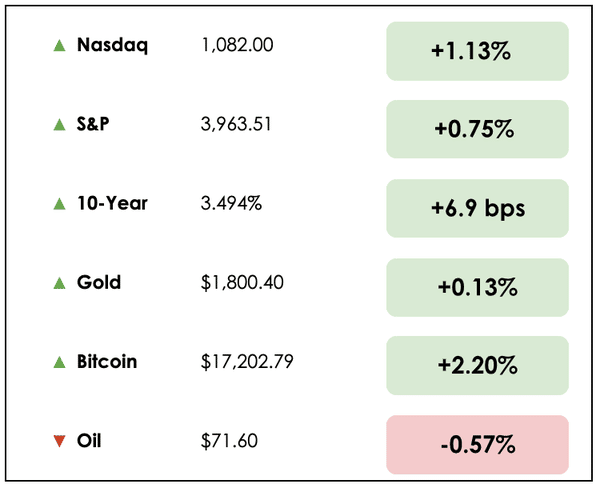

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- Who’s betting big on fusion energy

- Bed Bath & Beyond’s bankruptcy filing

- Plus, our main story on the benefits of small cap investing

All this, and more, in just 5 minutes to read.

Trivia: How did the term “buck” come to mean a dollar?

(Scroll to the end for the answer).

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

💡 Tech Billionaires’ Big Bet On Fusion (WSJ)

Explained:

In addition to artificial intelligence, could fusion be the next big business opportunity?

Jeff Bezos, Bill Gates, Sam Altman, Peter Thiel, and Marc Benioff think so. They’re among the tech founders and billionaires who hope to harness nuclear fusion. They’re betting that the decades-long goal of building fusion reactors is now within years of being reality.

- Benioff calls fusion a “tremendous dream,” saying: “It’s the holy grail. It’s the mythical unicorn,” said Benioff, the CEO of Salesforce, who invested in the Massachusetts Institute of Technology spinout called Commonwealth Fusion Systems, which aims to create compact power plants. Gates is also an investor.

- Altman, among Silicon Valley’s top investors for over a decade, is a lead man behind ChatGPT. He’s now placing one of the biggest bets of his career on a nuclear-fusion startup called Helion Energy. He’s invested $375 million so far.

Why it matters:

Fusion has long been seen as a clean-energy alternative to sources that burn fossil fuels and release greenhouse gasses. Other technologies and applications being developed in the race for fusion power include powerful magnets, better lasers or radiation therapy for cancer research.

- Fusion, Benioff added, “has no limits if you can get it to work.”

Big payoff: Investors believe if even just one nuclear fusion design works, the planet will be much better off. There could be significant rewards for investors, too. “Financially either you lose one times your money or you can make a thousand times your money,” one investor said. “That’s the math of fusion.”

🛋️ Bed Bath & Bankrupt (NYT)

Explained

The days of big stores and 20% coupons in the mail are over. Bed Bath & Beyond (BBBY) filed for bankruptcy on Sunday largely because it failed to fully reckon with the rise of online shopping. Amazon ate their lunch.

- The 52-year-old retailer will begin closing its 360 Bed Bath & Beyond stores and 120 Buy Buy Baby locations on Wednesday and seek to sell parts of its business. Its chapter 11 filing said it expected to close all stores by June 30, ending a tough, slow decade. In 2000, the company had 311 stores. A decade later, it had grown to 1,100. But as of this spring, it had less than 500.

- To help fund its operations in bankruptcy, Bed Bath & Beyond has raised $240 million from the investment firm Sixth Street Specialty Lending.

Interestingly, Bed Bath & Beyond was fairly early to the internet when it launched its website in 1999. But management focused on acquiring other brick–and–mortar brands rather than investing more in e-commerce.

Why it matters:

The company’s decline speaks to broader trends in the post-pandemic economy.

- For companies like Bed Bath & Beyond, whose financial problems were masked as consumers rushed to spend their stimulus money, the economic concerns of the past few months are exposing those weaknesses. It’ll become even more crucial for retailers to adapt as shoppers cut back on discretionary spending.

- “We are going to see the Darwinism of retail” play out in 2023, said Michael Lasser, a retail analyst at UBS.

The past several years have been tumultuous for retailers. In 2020, JCPenney, Neiman Marcus, and J. Crew all filed for bankruptcy. Bed Bath & Beyond is the latest casualty, and analysts expect more large retailers to follow amid tighter economic conditions.

MORE HEADLINES

📺 Cable media takes a hit: CNN’s Don Lemon, Fox’s Tucker Carlson out in same day

🏦 Smaller U.S. banks say the crisis is contained, but fears persist

💵 Investors flock to one-month bills on U.S. debt ceiling jitters

What to know

Small-cap stocks, companies with market capitalizations roughly between $300 million and $2 billion, can offer significant growth potential and higher returns than the market over time.

Today’s main story pulls from our colleague Rebecca Hotsko’s complete guide to small-cap investing.

Let’s break it down.

Large Cap vs. Small Cap

About 1,769 small-cap stocks trade in the U.S., representing around 3% of the total market.

Small-cap companies are often younger, less established, and less well-known than the large-cap companies that comprise the S&P 500 index.

Many investors favor large-cap names, as these companies are more well-known and might have more stable cash flows, seemingly reducing risk. However, this is also why, as a market segment, large-cap stocks tend to offer comparatively lower returns.

Long-standing academic research shows that small-cap stocks tend to outperform large-cap stocks over time.

This size premium has been persistent over time, and since 1926, small-cap stocks have returned 12% on average, compared to around 10% for large-cap stocks.

Looking at a comparison of SPDR’s ETF (SPY), which tracks the S&P 500 index and iShares (IJR) ETF, which tracks the S&P Small Cap 600 Index, an investor would have earned nearly 350% more by investing in small-cap stocks since 2000.

There’s also some interesting research by Dimensional showing that once stocks become among the largest in the market, they tend to underperform the market averages over time.

More risk, more returns

With thousands of small-cap stocks to choose from, how does an investor know which ones have the best chance of outperformance?

In his book 100 Baggers: Stocks that Return 100-to-1, Chris Mayer delved into the performance of stocks with a staggering 100-fold return from 1962 to 2014.

According to Mayer’s study, the average market capitalization of these exceptional performers was approximately $500 million.

This isn’t surprising when considering how many successful large-cap companies we know today, such as Amazon, Tesla, and Apple, started small.

Meaning, if you want to find the next Amazon, it’s likely to be relatively small at present, not a household name.

But picking individual small-cap stocks is no easy feat. This approach is risky, time-consuming, and may not lead to higher returns if you concentrate on only a few small-cap names and their growth doesn’t pan out.

Investors seeking to increase their exposure to small-cap stocks while minimizing the time and effort involved may want to consider investing in an exchange-traded fund (ETF). With this approach, investors can potentially boost their returns without making individual picks.

A different twist on small caps

Another way investors can enhance their returns is by investing in small-cap value stocks.

When combining these two factors, you can further increase your expected returns. (Learn more about factor investing here).

But the results speak for themselves.

Since July 2000, the iShares small cap value fund (IJS) has returned 680%, turning an initial $10,000 into $68,060. While the small-cap ETF (IJR) returned 595.3%, turning a $10,000 investment into $59,530.

These results dwarf the returns earned by investing in an S&P 500 index fund over the same period, which turned your $10,000 investment into only $29,960, roughly half of what could be earned by investing in either small-cap ETFs.

Buyer beware

It’s important to note that not all small-cap stocks are expected to outperform the market. Particularly, small-cap growth stocks are an exception to this rule.

Small-cap growth stocks are characterized as companies with high prices compared to their earnings, book value, or cash flow, and rapid asset growth, yet poor profitability.

These stocks have historically been one of the worst-performing market segments.

If their long-term track record is so bad, why would investors buy into these funds?

- Some investors opt for unprofitable small-cap growth companies, because they’re more likely to experience a surge in popularity from an exciting development or promising story, resulting in speculative buying and a brief period of exceptional returns.

Dimensional Fund Advisors studied the performance of different small-cap stocks from 1974 to 2017.

They found that small-cap stocks in the highest decile of asset growth (aka growth stocks) only returned 2.2% per year, which was lower than what less risky Treasury bills paid per year over the 40 years.

These stocks also underperformed small stocks in general in 81% of the years.

Since July 2000, the iShares small-cap growth ETF (IJT) has significantly lagged both the total small-cap ETF (IJR) by 82.7%, as well as the small-cap value ETF (IJS) by a staggering 168%.

Readers, what do you think — how do you feel about investing in small caps?

Dive deeper

For more on small caps, check out our colleague Rebecca Hotsko’s excellent guide on small-cap investing (and share it with your friends, too).

TRIVIA ANSWER

“Buck” originally referred to a deerskin or buckskin, which was commonly used as currency during the American colonial era.