Beating Expectations

25 October 2022

Hi, The Investor’s Podcast Network Community!

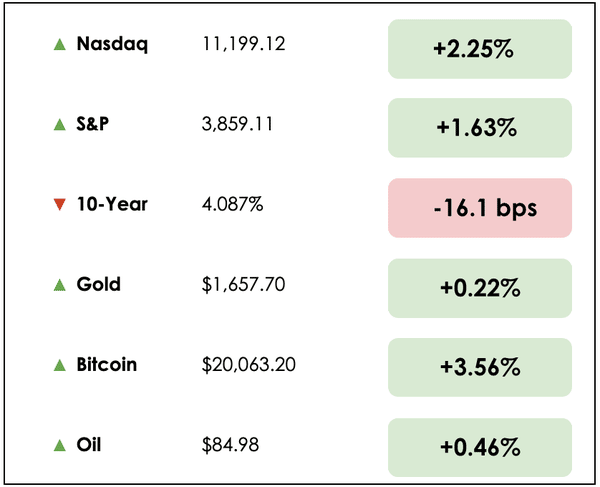

👀 Feels like 2021 again, at least in financial markets. Stocks boomed and were led higher by the tech-heavy Nasdaq index, while Bitcoin finally broke back above $20,000 as Treasury yields fell.

Big names like Coca-Cola (KO), Sherwin Williams (SHW), and UPS beat quarterly Wall Street estimates which helped fuel the rally.

Feeling inspired by the thrill of earnings season?

🧠 Send us your top stock pick, and you could win $1,000.

Competition ends November 27th, and the winners will be announced at the top of this newsletter.

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: The U.K’s new Prime Minister, and General Motors’ excellent third quarter, plus our main story on investing opportunities in the world’s largest democracy.

All this, and more, in just 5 minutes.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🇬🇧 10 Downing Street Gets Its First Billionaire Prime Minister (Bloomberg)

Explained:

- Rishi Sunak officially became Britain’s 57th prime minister on Tuesday and vowed to fix his predecessor’s (Liz Truss) mistakes. The Truss administration imploded following a failed rollout of unfunded tax and spending plans.

- Sunak is the youngest prime minister in more than 200 years, the first Hindu, and the wealthiest to ever hold the office.

- His rise in British politics has been meteoric. He entered Parliament in 2015 after a career in banking and was appointed just five years later as Boris Johnson’s finance minister (the chancellor of the Exchequer).

What to know:

- Sunak’s wealth comes largely from his wife, Akshata Murty, whose $1 billion net worth is due largely to her stake in Infosys, Ltd., the software giant founded by her father.

- Murty’s net worth is significantly larger than the roughly $400 million fortune of the late Queen Elizabeth II.

- Sunak is taking charge during a time of what he called “profound economic challenge,” as many residents enter into winter worrying about how to pay for heating or even groceries.

🚘 General Motors Posts $3.3 Billion Net Profit (WSJ)

Explained:

- General Motors (GM) easily beat Wall Street’s earnings expectations in the third quarter and stressed that demand for its products remains strong despite outside economic concerns and rising interest rates.

- Third-quarter net profit for the company increased 37%, as production bounced back from last year’s supply-chain issues and car buyers remained willing to purchase new vehicles.

- GM reaffirmed its full-year profit outlook of $13 to $15 billion in adjusted pretax profit. Its shares rose 3.7% in premarket trading due to the positive news but are down 39% for the year.

What to know:

- Investors are questioning how GM will fare next year as rising interest rates and inflationary pressures typically are a recipe for weaker vehicle sales.

- Investors are closely watching the auto industry’s earnings and forecasts for signs of weakness in consumer demand amid looming recession fears.

- There is growing pressure on GM’s management to prove to investors that the company can emerge as a contender in the growing electric vehicle (EV) market. Their EV sales have fallen behind not only Tesla (TSLA) but also rivals Ford (F) and Hyundai.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: SHOULD YOU BE INVESTING IN INDIA?

Overview

India is home to nearly 1.4 billion people and boasts the 5th largest economy in the world (recently surpassing the UK) which is expected to grow by 7% this year.

Ray Dalio has even said it’s the country he’s most optimistic about globally.

It’s also the largest democracy on earth with extremely favorable demographics due to its young and growing population. Yet, its financial markets are often overlooked in favor of its neighbor, China (at least until yesterday).

But China’s aging population is expected to decline for the first time in 60 years, and investing in its financial assets comes at considerable legal and political risk, as we detailed previously.

So, we asked ourselves whether we should be exploring more opportunities in India.

For this, we read research from Michael Gayed, author of the Lead-Lag Report.

Breaking it down

The signature proxy for Indian markets is the iShares S&P India Nifty Fifty Index ETF (INDY). It’s defined by the country’s fifty largest stocks, and it has considerably outperformed its peers in 2022.

While it’s down on the year, its losses are about half as much as the broader emerging markets space, as captured by the ETF: EEM.

Gayed explains that Indian stocks have proven resilient because of their advantageous growth landscape.

He adds further that when a country’s economy is doing well, it positions companies to deliver comparatively superior earnings which is a key determinant of stock performance.

What to know

Banks dominate the Nifty Fifty at 37% of the index and are particularly leveraged to economic growth.

Gayed notes that loan growth for these sizable banks has been strong this year, and credit card use in the developing country is on the rise.

Currency

Of course, when investing in emerging market countries, there’s concern about currency risks.

And in a year where the U.S. dollar has steamrolled currencies ranging from the British pound to the Chinese yuan and Japanese yen, it’s reasonable to wonder how the Indian rupee fares.

Unlike China and Japan, which have maintained stimulative monetary policies that have fueled currency weakness, India has largely taken its cues from the U.S. Federal Reserve in fighting inflation with higher interest rates (restrictive monetary policy).

The Reserve Bank of India (RBI) recently hiked rates by 50 basis points for the fourth time, bringing interest rates to 5.9% in response to elevated inflation levels of around 7%.

Gayed says, “The RBI’s desire to not switch to an accommodative stance should help arrest the weakness in the Indian rupee and bring some capital flows back to the markets.”

The rupee has still fallen against the U.S. dollar this year, but for the adventurous investor who happens to invest with dollars, it represents a chance to buy Indian financial assets at a discount.

Performance

Despite being an index fund, the INDY ETF sports a high expense ratio at 0.89%.

Over the last decade, the fund has offered investors a decent 6.68% total return per year. This comes, in part, from substantial dividends. Over the past twelve months, INDY investors saw a 7.56% yield paid out to them.

Other Indian-focused ETFs like INDA have greater diversification (more holdings) while carrying a cheaper but still expensive 0.64% expense ratio.

Takeaway

We also shouldn’t overlook country risk, a topic we wrote about a few weeks back.

Investing in India comes with many economic, social, and political risks, as the country reshapes itself rapidly and hopes to become a world power over the course of this century.

Such developments set the stage for tremendous internal and external strife, ranging from corruption and authoritarianism to regional military conflicts with its rivals in Pakistan or China.

That said, given the country’s tremendous runway for growth and modernization, it’s hard to imagine that over a several decade-long time horizon, a conservative allocation to its equities won’t prove to be a prescient decision.

Your authors aren’t invested in Indian stocks directly or through concentrated ETFs, but we are intrigued, and the country’s equities sit high on our watch list.

For those looking to play the broad growth trends in India, the best bet would be in ETFs with many holdings given the high levels of uncertainty, rather than trying to make specific stock bets.

Dive Deeper

We read about investments in India using Seeking Alpha, an excellent crowd-sourced financial content platform.

You can use our link here to receive a special $140 discount and discover other great investing ideas.

David Stein, host of the Money for the Rest of Us podcast, did a great episode several years back overviewing the pros and cons of investing in India.

For more Michael Gayed, check out our recent Millennial Investing podcast interview with him.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.