Beat the Pros

Hi, The Investor’s Podcast Network Community!

🍜 Our thoughts are with the country of Italy, which faces a devastating predicament: Pasta prices are up almost 18% year over year. The country has called a crisis meeting to deal with the matter.

Jokes aside, with headline inflation rates coming down in the U.S., price growth remains a more persistent problem across Europe.

Today, we learned that U.S. inflation, as measured by the Consumer Price Index, was at 4.9% in April, which sounds pretty good compared to the most recent 8.3% average in the European Union.

—Shawn

Here’s the rundown:

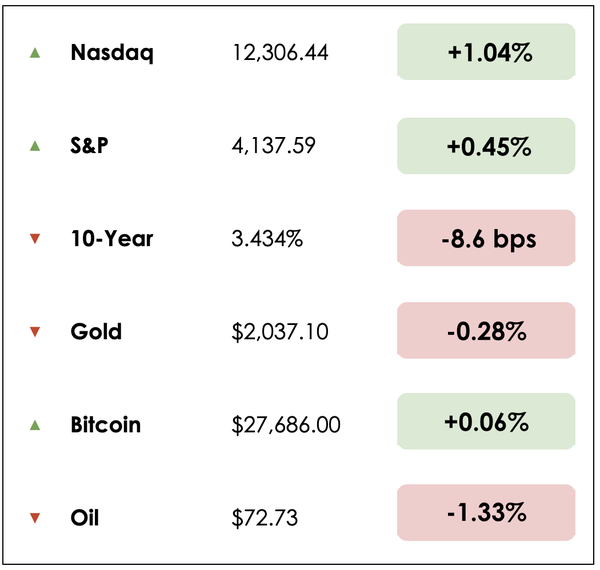

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- The surprising strategy that beat hedge funds

- Why businesses are flocking to the suburbs

- Plus, our main story on the Wall Street Journal’s origins

All this, and more, in just 5 minutes to read.

Today’s Trivia: Chairman of the Federal Reserve, Jerome Powell, faces the lowest public approval rating ever recorded — How low is it?

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🎯 The Strategy That Beat Hedge Funds (WSJ)

On Tuesday, famed investors David Einhorn and Stanley Druckenmiller spoke at the Sohn Investment Conference.

- They’ve each earned billions of dollars through investing but are far from perfect.

Inspired by Burton Malkiel’s book “A Random Walk Down Wall Street,” in which he quipped that “a blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by the experts,” the WSJ did just that. They dart-picked stocks.

- The result? The WSJ journalists’ dart-picks beat the Sohn Conference’s picks by a bruising 22 percentage points. That’s not a typo.

It conjures this Warren Buffett quote: “If you invested in a very low-cost index fund — where you don’t put the money in at one time, but average in over 10 years — you’ll do better than 90% of people who start investing at the same time.”

Why it matters:

Stock picking is incredibly difficult, and most professionals can’t outperform the S&P 500 over a decade or more.

- S&P Dow Jones Indices calculates that over 93% of stock mutual funds lagged behind a simple index over the decade through 2022.

- In one study, academics Laurent Barras, Olivier Scaillet, and Russ Wermers looked at thousands of mutual funds between 1975 and 2006. They determined that only 0.6% of managers had enough demonstrable skills to outweigh their funds’ costs.

- Another research paper by Hendrik Bessembinder, shows that most stocks tracked over decades don’t produce any return above risk-free Treasury bills.

About half of all positive returns were generated by 83 companies between 1926 and 2019, or less than one-third of 1% of all stocks tracked.

In other words, over long periods, only a few stocks push the market averages higher like Amazon, Apple, Microsoft, and Berkshire Hathaway. As for a redo, the WSJ has repeated the dart throws and will publish the results next May. Can they beat the pros again?

🏙️ Business Flocks to the Suburbs (WSJ)

“For lease” signs have been popping up in American downtowns since the pandemic accelerated remote work. That demand for office and retail space has shifted to the suburbs.

- Retailers in city office districts are relocating their businesses to the suburbs, where visits to shopping centers are on the rise as fewer people commute to downtown workplaces.

Average office usage rates are still only around half of where they stood before the pandemic in many major cities. Thus, bars, restaurants, and other retailers catering to the five-day-a-week office crowd have struggled.

Why it matters:

Pedestrian foot traffic in U.S. urban downtowns was down about 25% in April compared with the same month in 2019, per real-estate software provider MRI Springboard. Nordstrom’s announcement last week that it was closing two stores in San Francisco was the latest sign of retailers’ discontent with declining sales and rising property crime in big cities.

- “I think we’re in for quite a challenging time for downtowns and retail in downtowns,” said Diane Wehrle, marketing and insights director for MRI Springboard.

- In New York, “it’s still a real struggle” to attract the business crowd, said Sam Lipp, president of Tortazo, which has two Mexican eateries in Manhattan. His outlet near Madison Square Park sees about 250 customers for weekday lunch, about 60% of pre-pandemic demand.

“It used to be, you had to go downtown for dining, for the theater,” one real estate CEO said. “Those options have now moved out to some of these well-developed suburban areas.”

MORE HEADLINES

💲 Inflation is cooling, but everyone feels its effects differently

⌨️ How Google is bringing A.I. to search

💰 The lender that made nearly $10 billion from SVB’s failure

Serving Wall Street

The American corporate media space is a tangled web of financial interests, subsidiaries, and journalistic history.

As investors, we find one storied media giant’s origin story particularly interesting: The Wall Street Journal (WSJ). The name is telling, as the newspaper sprung from Wall Street itself, specifically the New York Stock Exchange.

Dating back to the 1880s, the Dow Jones & Company earned a reputation for hand-delivering imprinted carbon tracing papers to traders featuring financial news and, later, the iconic Dow Jones Industrial Average, which launched in 1896.

The first edition

Eventually, these notes for traders were compiled into two-page daily summaries. In July 1889, they were converted into the first edition of the Wall Street Journal by Charles Dow, Edward Jones, and Charles Bergstresser.

Dow, the editor, offered a simple mission statement for the paper: “Its object is to give fully and fairly the daily news attending the fluctuation in prices of stock, bonds, and some classes of commodities. It will aim steadily at being a paper of news and not a paper of opinions.”

The paper expanded considerably by the end of the 19th century, covering more traditional news stories while adhering to its core fact-based style.

Origins of modern financial journalism

In 1902, Charles Dow, consumed by health issues, wrote his last editorial. He and Bergstresser sold their ownership shares to Clarence W. Barron for $130,000.

Under Barron’s steward, the Journal’s readership grew from 7,000 to about 50,000 after more than two decades. Barron sought to modernize operations, introducing modern printing presses and expanding the team of reporters.

Notably, in 1921, he founded the Dow Jones financial Journal known as Barron’s National Financial Weekly, later renamed to just Barron’s Magazine.

Barron would later be remembered as “the founder of modern financial journalism” for his commitment to scrutinizing corporate financial records. He and his predecessors pioneered fearless, independent financial reporting — something quite uncommon then.

For example, in 1920, he investigated Charle Ponzi, the Ponzi Scheme’s namesake, for The Boston Post. His hard-hitting questions and reasoning proved instrumental to Ponzi’s arrest and conviction.

Barron remained in charge until he died in 1928 when ownership was transferred to his descendants, the Bancroft family.

Going mainstream

The Journal took a more recognizable form in the 1940s, with the company’s CEO Bernard Kilgore architecting its iconic front-page design and a national distribution strategy.

Under Kilgore’s tenure, the newspaper’s circulation grew to 1.1 million by 1967, and it won its first Pulitzer Prize.

For years, the paper has lived up to its commitment to fact-based reporting and political neutrality.

At least, except for 1928, when the Journal publicly supported Herbert Hoover, who would win but oversee the infamous Wall Street Crash of 1929. Since then, the paper has declined to explicitly endorse political candidates.

New ownership

The Bancroft family maintained control of Dow Jones and the Wall Street Journal for almost 80 years after Barron’s death.

That is, until 2007, when Rupert Murdoch, the founder of News Corp, the media empire overseeing outlets from the New York Post to the UK’s The Times, and Fox Corporation (including Fox News and related businesses), offered a takeover bid at nearly twice the company’s stock price.

Three months later, a $5 billion sale added the WSJ to the media tycoon’s list of brands.

Controversy strikes

According to Ballotpedia, Murdoch’s leadership marked a sharp turn in the paper’s approach: Coverage of international affairs increased by 7% while business reporting declined 16%, and politics went from comprising 5% of the newspaper’s content to about 18%.

After a phone-hacking scandal at British newspapers owned by Murdoch indicated that journalists were tapping phone lines to get inside scoops on stories, ultimately resulting in the closure of Britain’s top-selling newspaper, the Bancroft family expressed regret for having given up control of the Journal.

Though the WSJ wasn’t implicated, concerns spread that the association would tarnish its image.

Final thoughts

Today, the Wall Street Journal is the second-most circulated print newspaper in the U.S., and its online version, first offered in 1996, boasts over three million digital subscribers.

For more, you can read about the history behind Wall Street’s most famous newspaper here.

TRIVIA ANSWER

According to a recent Gallup poll, only 36% of Americans have a “great deal” or “fair amount” of confidence that Fed Chairman Powell will make the right decisions for the economy 😅

SEE YOU NEXT TIME!

Enjoy reading this newsletter? Forward it to a friend.