Bear-Market Trap

22 November 2022

Hi, The Investor’s Podcast Network Community!

The World Cup feels a bit like March Madness: Saudi Arabia (ranked 51st) pulled off one of the greatest upsets in the tournament’s history by beating Argentina (ranked 3rd) 👀

🕶️ Coming as perhaps an even greater shock, the clothing retailer Abercrombie & Fitch (ANF) channeled its early-2000s popularity into surprising Wall Street with stronger-than-expected earnings. The stock was up more than 20% on the news.

And just a reminder, our stock pitch competition ends soon. Get your submissions in by Sunday to win $1,000 and a one-year subscription to our signature TIP Finance tool.

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Rising stakes in the railroad labor strike negotiations and why Wall Street believes we’re stuck in a bear-market trap, plus our main story on portfolio building blocks.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🚂 Railroad Strike Concerns Return (Politico)

Explained:

- The two largest freight rail labor unions recently split their votes to agree on a new contract, which adds another complication to the high-stakes labor negotiations that could spark a shutdown of the U.S.’s important freight rail network.

- The Association of American Railroads’ President, Ian Jeffries, stated: “if the remaining unions do not accept an agreement, Congress should be prepared to act and avoid a disastrous $2 billion a day hit to our economy.”

- Freight rail companies and unions had hashed out a deal with the Biden administration’s help back in September. Still, some union members believe it doesn’t go far enough to address working conditions concerns, such as having sick leave in contracts.

Why it matters:

- Although three unions have already voted no on a deal, negotiations are continuing, and another vote could be called again over the next two weeks. If an agreement can’t be reached by December 5th, lawmakers will most likely be forced to step in with new legislation to fend off an economic crisis stemming from a rail network shutdown.

- With railroads transporting loads of agricultural items, e-commerce goods, fertilizers, and even chemicals for purifying drinking water, any disruptions would shift these shipments to waterways and trucks.

- This, however, would only further strain supply chain networks, as one expert said that a lack of resolution would “undoubtedly add to the inflationary pressures already hitting the U.S. economy.”

🐻 Hedge Funds Bet Bounce Back Is A Bear-Market Trap (Bloomberg)

Explained:

- Despite a recent equity rally that’s forced hedge funds to unwind some of their short trades, speculators have largely avoided adding new long positions that bet on stocks to continue rising.

- According to JPMorgan’s (JPM) data on client funds, investors have largely reduced both their long and short exposure to minimize risk in a highly uncertain environment. Additionally, hedge funds saw their combined trading flows fall for a fifth straight week.

- One poll by RenMac of its clients suggested that 88% believed that stocks are in a bear-market bounce — a false recovery that doesn’t actually precede a period of lasting positive performance in stocks.

Why it matters:

- Weak demand for risky bets indicates that the “smart money” reckons the equity recovery is a so-called “bear-market trap.” In other words, greater defensive portfolio positioning reflects concerns that this year’s correction has yet to fully run its course.

- The S&P 500 is up approximately 10% since mid-October, and its price-to-earnings ratio has recovered to 19 after falling to 17.3.

- Venu Krishna, head of U.S. equity strategy at Barclays, believes stocks will close the year 7% lower, saying: “Though we’re likely past the inflation peak, it doesn’t mean we’re past the equity market trough.”

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

THE MAIN STORY: PORTFOLIO BUILDING BLOCKS

Overview

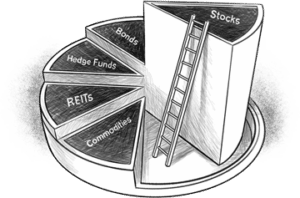

According to Louis-Vincent Gave, CEO of Gavekal, a financial services firm that provides research for institutional investors, there’s a simple six-building-block framework for creating strong portfolios.

Naturally, we were curious to learn more, so we listened to his recent interview with Rebecca Hotsko on our Millennial Investing podcast.

Your portfolio is a sports team?

Like an American football or rugby team with different players who fulfill specialized roles, your portfolio should rely on unique assets that perform a similar function by working in unison to preserve and grow your wealth.

To begin, Gave explains that the first block in a portfolio should be your anti-fragile block which is like your offensive line. Its one job is to protect the “quarterback,” and historically, government bonds have filled that role.

The challenge now, though, is that with bonds offering pitiful yields for over a decade, it’s like your offensive line “went off on holiday weighing 350 pounds, and they came back weighing 150 pounds.”

You don’t have to be a passionate football fan to realize that it will probably cause problems if your team’s foundation has significantly weakened. Fortunately, with bond yields rising this year in response to rising interest rates and inflation, this part of your team is “gaining weight again.”

Changing your offensive line

Any good sports or portfolio manager knows when to sub out a player who’s not doing their job properly, so the question is really about what to replace bonds with.

Gave argues that energy is an option for your first building block due to its negative correlations with most other asset classes and recent outperformance. He believes energy stocks are both undervalued and have positive momentum, so he buys the dip with these companies.

Asset classes typically have one of these traits, not both simultaneously.

Another option, to a lesser extent, is emerging market bonds, which offer higher yields and have generally held up well this year despite tough financial conditions.

Building block #2

The second building block includes your defensive positions. These are stocks in stable, low-growth industries such as utilities, healthcare, infrastructure, and consumer staples.

However, in today’s inflationary environment, Gave emphasizes owning stocks in this building block that have as little to do with the government as possible because governments may try to interfere with their ability to raise prices.

So health care companies, he suggests, could face patent-protection risks if they price too aggressively, but the government can’t stop Proctor & Gamble from raising deodorant prices in response to inflation.

Portfolio stabilizer

Your third block should be focused on income. Having some high-income-producing assets in your portfolio is a great way to stabilize returns over time.

This block is mostly for mental health purposes. Gave says, “(It’s) about helping you not panic at the bottom,” since you still have positive cash flow, even if your portfolio is down on paper.

As examples, Gave cites high-yield bonds, high-dividend stocks, and real estate.

Growth stocks

If you can’t tell, the order is progressing from most conservative to most aggressive. He splits the fourth and fifth building blocks into two types of growth stocks.

One set is price-sensitive businesses, such as those in the commodity space, which may make a lot when copper is at $5/pound and a lot less when prices are below $3/pound.

The other set is software and tech businesses like Microsoft that rely more heavily on volumes than price: “What matters to Microsoft is, perhaps, not as much the price which they sell their licenses, but the numbers at which they’re going to sell them.”

Last block

And then, in the last building block, which is an optional addition, Gave uses it for his contrarian bets.

He elaborates, “markets are manic depressives…It might be a given company because they’re disgusted with the management. It might be a given country because of poor leadership. It might be a commodity. But sometimes, it can’t be given away cheap enough. Just like the market wants absolutely nothing to do with it.”

These forsaken opportunities are the riskiest but also the most exciting.

Takeaways

For Gave, whenever he makes a purchase, he labels which building block the asset falls into.

Evidently, you don’t want to have too much of any one block in your portfolio. If your football team had eleven Tom Bradys, it probably wouldn’t do well, despite him being one of the best players of all time, because he wasn’t meant to fill other roles besides quarterback.

Gave’s analogies resonate with us, and whether you follow his specific outline is less important than it is just to have your own framework.

Every investment decision you make should serve a purpose, and a clearly thought-out approach to portfolio construction like this one helps organize and focus your thinking.

Dive deeper

Tell us, readers, what do your portfolio building blocks look like?

To hear the rest of the interview and learn Louis-Vincent Gave’s four-quadrant framework for investing across various macroeconomic environments, you can listen to it here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.