Bear Market Rally?

31 January 2023

Hi, The Investor’s Podcast Network Community!

Stocks roared into the close today thanks in part to stellar earnings from General Motors (GM) and Exxon Mobil (XOM).

The oil giant posted record profit as it capitalized on high commodity prices ⛽

All told, the S&P 500 gained nearly 7% this month, its best January since 2019. The Nasdaq Composite rose 11.53%, its best month since 2001.

Generally, a good January means a good year for stocks. And, of the five instances in which the S&P gained more than 5% in January after a negative year, the benchmark rose 30% for the year on average.

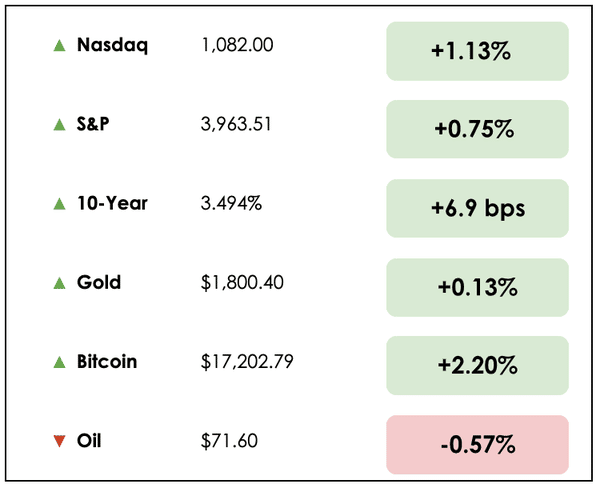

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: what construction equipment demand means for the global economy, and the data point underpinning the Fed’s inflation fight, plus our main story on the frequency bear market rallies.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

- Caterpillar Inc. (CAT), the construction equipment maker, posted a 20% increase in quarterly sales, with demand holding up despite higher prices and recession fears.

- While sales topped expectations at $16.6 billion, adjusted earnings fell short due to foreign-exchange headwinds that weighed on profits. Higher prices boosted sales by $1.74 billion year-over-year, while higher sales volumes added another $1.56 billion.

- Sales of the company’s iconic yellow construction equipment, including bulldozers and excavators, rose globally, with sales in Asia being the only weak spot.

- Given Caterpillar’s critical role in supplying the equipment that powers worldwide economic growth, continued demand for its products across almost all geographic markets validates Wall Street’s hopes for a ‘soft landing,’ where central banks can raise rates without crushing the global economy.

- Growing investments in oil and natural gas production contributed to the demand for Caterpillar’s equipment, particularly for engines used at drilling sites and pipelines. As we waded deeper into an energy crisis last year, there was considerable frustration that companies weren’t investing more to boost production in response to spiking oil and gas prices.

- Caterpillar’s earnings offer hope that this may change as firms purchase the equipment necessary to boost energy production, potentially alleviating the supply shortages that pushed up fuel prices and, correspondingly, inflation indexes.

- One reason the Federal Reserve has been so aggressive raising rates is to suppress what economists call a ‘wage-price spiral.’ The concern is that workers will see prices rising, causing them to demand higher wages, which drives more spending and even higher inflation, necessitating even greater salary bumps.

- It’s a feedback loop that ultimately destabilizes inflation rates and the economy. Fortunately for policymakers, new data out today reiterates that the surge in worker compensation in late 2021 and early 2022 was a one-off event, not the beginning of an upward wage spiral.

- Growth in the Employment Cost Index, the “gold standard” of measuring workers’ pay, rose only 1% in the last quarter of 2022, below expectations of 1.2%. Growth in total compensation peaked in the first quarter of 2022, rising 1.4%, only to slow in each following period. In other words, compensation rose at a 5.8% annual rate to start the year but fell to a 4% annual rate by the end of it.

- What’s intriguing about the slowdown is that it occurred when the job market remained shockingly tight. Traditional economic models would typically suggest that wage growth should accelerate in a tight labor market, as companies are more desperate to retain existing workers and pay up for new ones. Yet, our post-pandemic economy increasingly displays anomalies that challenge conventional thinking.

- Nick Bunker, head of economic research at Indeed Hiring Lab, says, “The debate about wage growth is over: it’s coming down.” For the Fed, this is a great relief, providing more breathing room in its inflation response.

- Trends like these give credence to the prospect of pausing rate hikes this year, as financial markets currently anticipate. Such a policy pivot would support both the stock market and the economy but will only come when the Fed is confident that inflation risks are broadly under control again.

RECOMMENDED READING: EIGHTBALL

Economic news you’ll actually want to read: Eightball delivers the latest stories shaping the economy and financial world — without BS, clickbait, and jargon.

Real world and economic insights based on real money prediction markets. It’s the next best thing to having a relative at the Fed.

Subscribe to get smarter about the economy and how it affects your money in 5 minutes.

Is this another bear market rally or the start of a new bull run?

Nobody knows. Whatever this January rally will turn into, it’s worth recognizing the bear market rally phenomenon: what it is, why it happens, and what we can do about it.

There were several sharp rallies last year as the market ultimately ground lower to its mid-October low, notably the drastic upswing in July and August. Of course, it didn’t last.

These rallies during broader downtrends are nothing new. What gives?

Dead cat bounces

A bear market rally is a stock market advance of about 10% to 25% following a bear market decline that fails to capture the previous peak. It signals a brief period of optimism, but it’s often short-lived and followed by a continuation of declining prices.

Sometimes, it may be referred to as a sucker’s rally, bull trap, or dead-cat bounce. It can last a few days or even months.

Bear market rallies are dangerous because they tend to be dramatic moves that entice investors to go long equities despite a lack of validation by fundamentals or technical analysis (or both).

2022 wasn’t alone. While the S&P fell 49% during the tech bubble and 57% during the Global Financial Crisis, there were five rallies between 18-21%. Each time, people were quick to call the bottom despite the fundamentals getting worse.

Even in 2022, the S&P rallied seven times with an average gain of 9% and still finished down 19% on the year.

They are tempting, and they can play with investors’ emotions. According to Bloomberg, during the 14 bear markets from 1927 to 2020, there were 20 bear market rallies of 15% or more, lasting from two days to several months.

Only in retrospect

Bear market rallies are like bottoms: You can only know for sure that they occurred in retrospect. Still, they entice investors because investors know that the silver lining of a bear market is that it sets the stage for a robust new uptrend.

For long-term investors like Warren Buffett, who focus on years and decades over weeks and months, bear market rallies aren’t all that important.

Generally, long-term investors don’t have to worry about bear-market rallies. They tend to stick to their established strategy without regard for short-term fluctuations based on news or sentiment, which varies widely from month to month.

They usually occur because of temporary bullish sentiment and positive news events. Herding mentality and FOMO are powerful psychological forces. After prices have fallen, panic selling generally subsides, and prices stabilize to a degree.

Classic examples

The 2007-09 bear market included four 10%+ rallies and eight 5% bounces. There was even one bounce of 24% relatively late in the bear market (late 2008) before the ultimate March 2009 low.

In the 2000-02 bear market, a 19% rally unfolded in April 2001. Then there were four 10% rallies and another eight 5% bounces. There were three rallies of at least 19% alone.

Like the current environment, the 1973-74 bear market was driven by high inflation and consistent rate increases by the Federal Reserve. During the 48% peak-to-trough decline, the market rose 5% or more nine times.

In 1939, the market rallied 29%, yet investors weren’t out of the woods. The worst of the late 1930s bear market was yet to come.

The granddaddy of all bear markets, the 1929-32 Great Depression, had five 20%+ rallies. By the spring of 1930, after the crash of 1929, stocks had recovered over half of their losses.

Yet far more damage was in store as investors had to endure a brutal 86% peak-to-trough decline.

The final word

There’s no telling what markets will do in the coming months. Only time will tell. Smart investors know that bear markets are a test of patience and discipline. No matter how many news headlines ask, “Is this a bear market rally?” truly nobody knows what the future holds.

If history is any indication, another leg lower wouldn’t be anything out of the ordinary. The best action for most long-term investors is to simply stick to their plan and stay the course.

Dive deeper

While not directly about bear market rallies, Howard Marks’ Mastering the Market Cycle is an excellent look at the ups and downs of markets.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.