Banking Paradox

Hi, The Investor’s Podcast Network Community!

Our heads are spinning from another busy day in markets. The banking crisis has spread to Europe, with the Europe Stoxx 600 Banks index falling 6.9% today.

Investors were concerned about Credit Suisse (CS) in particular, sending its shares down 24% (more on that below).

🇨🇭 The Nasdaq rallied back from a steep morning drop, though, on news that Swiss authorities were considering plans to rescue the bank.

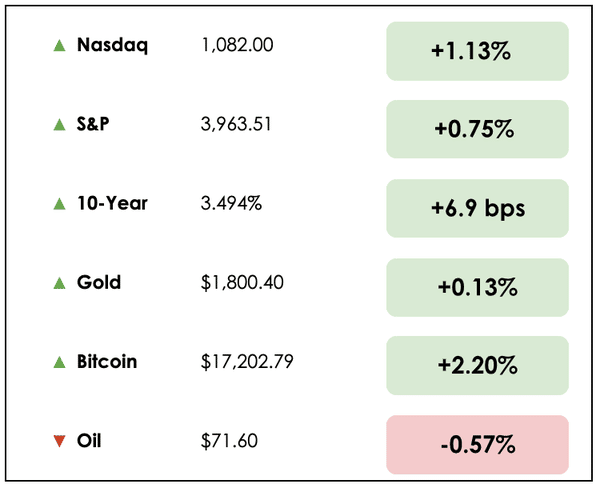

Here’s the rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Why all eyes are on Credit Suisse

- How campuses are going green

- Plus, our main story on why you’re earning so little on your bank deposits

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🗣️ Credit Suisse Worries (WaPo)

Explained:

- Shares of the Swiss banking giant, Credit Suisse, fell over 20% Wednesday, creating new uncertainty after Silicon Valley Bank’s collapse. Its biggest backer, Saudi National Bank, has said it won’t provide further financial help for the bank.

- The bank noted it had found “material weakness” in its financial reporting, adding uncertainty to the already jittery banking sector. European banking stocks tumbled on the news, and U.S. markets fell sharply.

- Credit Suisse delayed releasing its annual report after the Securities and Exchange Commission asked for more information last week about past cash flow statements. In its annual report, eventually released Tuesday, the bank said it discovered “material weaknesses in internal control over financial reporting” in 2021 and 2022.

Why it matters:

- The U.S. economy seemed strong, with a steady labor market, low unemployment, and inflation showing signs of cooling. That all changed Friday, when Silicon Valley Bank became the second-biggest bank failure in U.S. history.

- Credit Suisse is amid a big restructuring to make the bank profitable again. A bailout by the Swiss National Bank and financial regulator Finma, possibly with one or more other banks, is the “most likely scenario” facing Credit Suisse.

- Switzerland’s second-biggest bank is seeking to recover from a string of scandals that have undermined the confidence of investors and clients. Customer outflows in the fourth quarter rose to more than 110 billion Swiss francs ($120 billion).

🎓 Campuses Go Green (NYT)

Explained:

- OK, a break from the banking news: Campuses across the U.S. promote timber, the sustainable construction material and low-carbon alternative to steel and concrete.

- Mass timber, an engineered wood product, offers durability and sustainability benefits. “Our college and university clients have really embraced the imperatives of climate change,” said Ellen Belknap, president of SMRT Architects and Engineers in Portland, Maine. “I’m thrilled that universities are showing the way.”

- But significant barriers impede the widespread use of mass timber: Suppliers are mostly limited to Canada and the Pacific Northwest, and the upfront costs are higher than steel and concrete. Despite those challenges, developers find that mass timber goes up faster, helping them recover upfront costs faster.

Why it matters:

- Said a wood science major: “It is a material that should take off in the U.S. as long as we can convince people. Building sciences can play a large role in how we respond to climate change.”

- Mass timber construction has increased in the U.S. over the last few years, and universities have been a driving force. Most of the activity is in heavily forested states, including Arkansas, Idaho, Maine, Michigan, Oregon, and South Carolina, where widespread use of the material could help expand or revitalize the forest industry.

- There are cost benefits, too: Using mass timber in a library storage annex saved the University of Arkansas more than $1 million over the original steel-and-concrete plan.

RECOMMENDED READING

You know that friend who never shuts up about a new business idea?

Well that’s exactly what the BizBrainstorms newsletter is.

A short weekly newsletter with a simple goal: Give you new business trends, ideas & ways to make money in one send per week.

WHAT ELSE WE’RE INTO

📺 WATCH: Why 2% is the Fed’s magic inflation number

👂 LISTEN: Bank failures & Bitcoin with Steven McClurg

📖 READ: Ray Dalio’s thoughts on the Silicon Valley Bank crisis

Banking paradox

With talks of banking crises in the air, I (Shawn) wanted to explore why deposit rates remain so low.

You’ve certainly heard about how the Fed has been raising interest rates at the fastest pace in decades. Yet, most Americans are earning almost zero interest from their bank account. The average interest rate on savings accounts is just 0.23% nationally, according to Bankrate.

Banks are earning north of 4% annual rates on their overnight deposits with the Federal Reserve, but that isn’t rippling through into higher deposit rates for millions of people.

It’s a perplexing and frustrating conundrum for savers everywhere. Are banks ripping us off, or is the financial system not operating as it should?

Joseph Abate, a money market strategist at Barclays, has a few thoughts.

Industry dynamics

Abate explains that banks have a lot of pricing power over deposits. You could tap into money market funds or commit to a certificate of deposit (CD) to earn higher rates for, say, one year.

But there are no alternatives to our savings accounts that offer the same degree of accessibility and, importantly, federal deposit insurance.

The retail banking industry faces little competition, which slows the transmission effect between Fed policy and the rate you earn at your bank. In other words, when the Fed hikes its policy interest rate, banks don’t have to immediately undercut each other to raise deposit rates.

Switching costs

Why not? Because banking services are sticky.

You might have dozens of online accounts, rent, credit cards, etc., all linked to your bank with the familiarity of having used their services for years, so you’re unlikely to endure the hassle of switching banks to simply earn an extra 0.25% in interest annually.

On a $1,000 deposit, we’re talking about $2.50.

So there’s a time component that creates barriers to switching. Are you really going to switch banks to earn a couple of bucks more at a higher rate yearly? Probably not.

And banks, as an industry, know that.

Ripple through effects

Abate argues that rates will eventually rise for savers, but the lag we’re currently seeing between Fed hiking and deposit rates isn’t actually that shocking.

Early in the Fed’s tightening cycle, banks are flush with deposits typically, which is their primary financing tool. Over time, as depositors migrate to higher-yielding products, such as CDs or money market funds, banks “compete more aggressively with each other and try to poach deposits from one institution to the next.”

Abate suggests that in previous cycles, like the early 2000s, initial Fed hikes passed through to higher savings account yields at a rate of about 10%. Meaning if the Fed hiked rates by 1%, rates for your bank account might rise by 0.1%.

But as the tightening cycle continues, bank deposits become more scarce, and this pass-through effect can rise as high as 80%, averaging around 40% for the entire cycle.

If true, with Fed policy rates above 4.5% today, rising from near zero, we might expect deposit rates to eventually climb to about 2%.

That’s just a speculation, and things may prove different this time because quantitative easing (QE) programs have contributed to a significant excess in bank deposits relative to past hiking cycles. He says, “banks have a thicker cushion of deposits and, therefore, don’t have to compete as readily.”

Competing on services

Another dynamic often overlooked, states Abate, is that banks are increasingly “not competing specifically on explicit interest.”

Banks would rather compete on the services they offer. This could include the quality of their online app, security, ease of website use, connectedness with payments apps like Venmo and PayPal, and customer service, among other offerings.

And for institutional deposits, Abate thinks services may be an even more important factor. Corporations have stickier banking relationships due to the extra bureaucracy in switching accounts. If they also rely on the bank for investment banking advice, that’s one more reason not to go through the trouble of forging new banking ties.

Differences across banks

We should also note that the banking system isn’t a monolith. Deposit levels vary by region and bank size, and smaller banks are generally farther along in this process of needing to compete over deposits.

This discrepancy is, in part, thanks to QE, which disproportionately boosted reserves for larger banks. Now that the Fed is draining reserve, reducing its balance sheet, and pushing interest rates higher, smaller banks with relatively fewer deposits feel that sting first.

Still, small banks don’t seem to be competing on rates en masse, at least not yet. Instead, they’re focusing on services, which they may have an added advantage in being local operators. For example, they might know the local market better, so prospective borrowers can trust that their lender knows the ins and outs of housing in their area.

Final thoughts

The takeaway is that there are interesting competitive dynamics underpinning banks’ decisions to raise deposit rates. As we progress through this Fed rate hiking cycle, we should expect deposit rates to rise, likely in larger increments than they have been.

At least in theory. Fingers crossed that we all might soon earn better returns for saving away our hard-earned cash.

Dive deeper

To hear Abate’s complete thoughts on the relationship between Fed hikes and deposit rates, you can listen to his Bloomberg podcast interview.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.