Apple + Goldman

Hi, The Investor’s Podcast Network Community!

On this day in 1837, three weeks before the stock market crashed in the Panic of 1837, J.P. Morgan was born in Hartford, Connecticut.

The sickly baby would become the most powerful financier in American history and help rescue banks (and markets) from ruin in 1907. The bank that now bears his name is the world’s largest by market cap ($409.29 billion) 💰

By the way, Amazon gift cards and MacBook Pros are just two of the rewards you reap when you share this newsletter with friends and family. What else would you be interested in? Let us know by simply replying to this email.

—Matthew

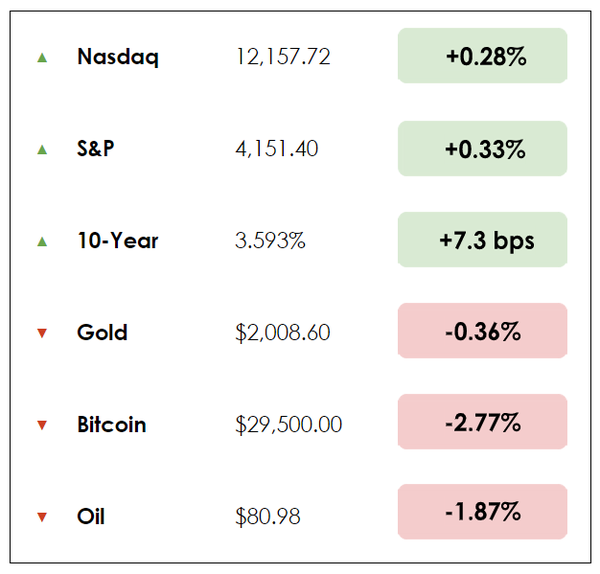

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Could your savings account be with Apple?

- Angry Birds’ developer could sell for $776 million

- Plus, our main story on our co-founder & our origin story

All this, and more, in just 5 minutes to read.

Today’s trivia question — Why is American currency green?

Read to the end of the newsletter to find the answer!

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

🍎 Will Your Next Savings Account be with Apple? (WSJ)

Explained:

On Monday, Apple (AAPL) announced a new high-yield savings account paying an annual 4.15% yield. Created in partnership with Goldman Sachs, the accounts will be available together with Apple Card, the tech company’s credit card.

To spend funds in these accounts, users can either transfer their money to a linked checking account or use Apple Cash. The account has no fees, minimum deposit, or balance requirements, and it can be set up directly in the Wallet app.

- The 4.15% rate is decent, but there are several online banks that pay as high as 5% APY. Still, it beats out Goldman’s own Marcus and Ally Bank, which offer 3.9% and 3.75%, respectively.

Why it matters:

Banks, particularly smaller ones, are fighting for deposits as interest rates rise and pull money into higher-yielding investments. Apple’s high-yield savings account and its broad reach across America make it a formidable competitor for increasingly scarce bank deposits.

- A decent interest rate, combined with Apple’s unparalleled brand recognition and product ecosystem, could be uniquely attractive to new customers, especially following a crisis of faith in banks after Silicon Valley Bank’s collapse.

- A finance professor at Columbia University added, “I think what is special in this case is Apple is Apple. Everyone knows what Apple is, and many people already have an Apple Card (roughly 6.7 million Americans as of 2022).”

The move also reflects Apple’s push into financial services, including its own “buy now, pay later” offering.

🎮 Japanese Gaming Firm Wants to Own Angry Birds in $776m Deal (Reuters)

Explained:

Japan’s Sega Sammy Holdings Inc. said Monday it wants to acquire Finland’s Rovio Entertainment for 706 million euros ($776 million) to boost its growth in the fast-expanding global mobile gaming market.

Sega Sammy will offer 9.25 euros for each share of the company behind the mobile game Angry Birds, a 19% premium over Friday’s closing price.

- Following the announcement, Rovio shares rose as much as 18.8% in early European trading. Investors in Sega Sammy were less enthusiastic, sending shares down 4.2% after it said it was considering acquiring Rovio.

Initially introduced as a rival to Nintendo’s Mario, Sonic the Hedgehog, Sega’s flagship franchise, has carved out its own success: on more than 70 Sonic games, Sega has sold over 140 million units and grossed over $5 billion.

Why it matters:

However, Rovio has yet to score a major hit since Angry Birds took flight over a decade ago, becoming the first mobile game to be downloaded more than a billion times.

- One gaming industry expert commented, “Angry Birds is known everywhere in the world. But the brand is already past its peak.” Saying further, “I think investors (in Sega Sammy) are disappointed by this use of 700 million euros.”

But the Angry-Birds maker is likely eager to accept the offer after a €683-million bid in January from an Israeli firm unexpectedly fell through.

“There’s considerable uncertainty at this point regarding the success of future games. All in all, I think the bid is good and Rovio’s shareholders will be happy to accept it,” said Atte Riikola, an equity research analyst.

MORE HEADLINES

🇨🇳 China will be the main source of global economic growth over the next five years, says the IMF

🚫 Montana lawmakers vote to ban TikTok in the state — its governor has 10 days to act before it becomes law

💬 Charles Schwab reports higher profits but a 30% fall in deposits, halts share buybacks

A serendipitous beginning

Some of the greatest businesses start by accident, and The Investor’s Podcast is no different.

It was 2013, and Stig Brodersen, an ex-commodities trader, wanted to pursue something meaningful. He started reading about Warren Buffett and was especially drawn to the billionaire investor for his simple, thorough investment strategy, and his ideas about living “the good life.”

While researching Buffett, Stig was an economics professor in Europe with his own investment firm. One day, he stumbled upon the work of a fellow Buffett enthusiast, Preston Pysh, who had an investing forum and a Buffett course on YouTube.

They got talking (during the Skype days), then met at the 2014 Berkshire Hathaway Annual Shareholders Meeting. On his flight home to Maryland, Preston was chatting with the investor Hari Ramachandra, who suggested Preston start a Buffett-related podcast.

“Preston was like, ‘Sure, that sounds great. Let me call my friend Stig in Denmark and be like, ‘Should we start a podcast?’” Stig recalled on a recent episode of We Study Billionaires.

“I was a bit worried. First of all, I wasn’t sure what it meant to make a podcast in the first place. Honestly, I don’t know if Preston knew that, either. But Preston always had a great attitude, and he was like, ‘Yeah, we are going to figure it out.’ He’s a quite technical person. So I was like, ‘Okay, if you just teach me how to set up equipment and stuff, we’ll figure it out.’”

Figure it out they did. While they initially planned on only talking about Warren Buffett, the podcast has since grown into a network of several shows discussing lessons learned from great investors, self-made billionaires, and much more. At the time, nearly a decade ago, Preston and Stig had no idea they’d exceed 100 million downloads and feature interviews with investing legends such as Ray Dalio, Howard Marks, and Bill Miller.

Without further ado, here’s our conversation with Stig.

You were early to the podcasting space. What about the audio medium piqued your interest?

It was a coincidence more than anything else. They say that luck is when preparation meets opportunity. I don’t feel I prepared much, and it’s likely not the most inspiring story of “audio” in particular, but it could be inspiring from another perspective.

When did you first become interested in markets and investing?

It’s a tricky question to answer. I remember having a calculator as my favorite toy when I was a kid. That must have been a tell….haha! I was backpacking in New Zealand and Australia in a gap year after high school, figuring out what I wanted to study in college.

I taught myself to count six decks of cards and toured local casinos playing blackjack. It was a wonderful time with no obligations and lots of spare time to fall into rabbit holes. Blackjack led me to poker, which put me through school as a semi-pro.

When I had gotten my Master’s in Finance and International Business, it was a natural transition to work as a commodities trader. What was interesting was that I didn’t learn about investing in school or as a trader, but when you work on a trading floor, you quickly learn that financial markets are not efficient.

Trading is a lot of fun and financially very rewarding, but for my wife and I (we met and married in college and both became traders in the same company), it wasn’t a sustainable way of life. That was when I learned about Buffett, which instantly resonated with me. It was about growing your net worth but without compromising on your personal values.

What are some of your favorite books?

This is a hard question to answer. I did a top 10 back in 2015.

I also have other books that I continue to read and reread. Poor Charlie’s Almanack is one of many. I also really like Sapiens, Homo Deus, and 21 lessons for the 21st century.

Reading is an integral part of my life. I’m sometimes lucky to read during my work day, and my wife and I have a “power hour” from 8 to 9 pm every night where we read just like we always read before we go to sleep. We also go to the library every Saturday to work and read and generally spend most of the weekend reading.

The Economist is great, and I read it every weekend. As I have gotten older, I practice learning to stop reading a book that is only “good” and not “great” due to the opportunity costs. For the same reason, I also like to reread as much as reading new books.

What’s a personal quirk our audience doesn’t know about you?

I walk for hours every day. A good day is 20,000 steps and sometimes more than 25,000, and seldom less than 15,000 steps. I spend the time thinking about business, and life, and listening to podcasts and audiobooks. Walking brings me into a state of “flow,” and I find it to be healthy for both mind and body.

What’s your favorite place to visit?

There are so many wonderful places. I recently counted 30 countries visited on five continents so far, and I’m super excited to explore many more. I always do consider opportunity costs, though, as one place you visit is another you don’t. It’s a little like deciding whether you want to read a new book or reread a book you know you love.

I recently came back from my fourth trip to the Philippines, which is one of many personal favorites of mine. Half of our wonderful team is located there, so it’s the perfect combination of vacation and work.

I also enjoy Southern Europe (Spain and Italy in particular) and go there whenever I can. Denmark is neither known for its good food nor for good weather, and I can testify that it’s true! Southern Europe has both in abundance!

What’s your favorite guilty pleasure?

Potato chips are a personal favorite of mine. I could say the same thing about pizza. It’s hard to beat! I would also like to show my hand on “pineapple on pizza.”

It’s a big no-no for me. My wife loves pineapple on pizza which is one of the most divisive topics you can think off :D Well, we have been married for 12 years, so let me say that it hasn’t been a deal-breaker!

What’s on your bucket list?

Traveling! I haven’t made it to South America just yet, and I look forward to going there soon.

It has also been a dream to play in the world championship in poker. Poker is like the stock market on steroids. You have to understand basic math and advanced psychology to succeed.

The game of business and the stock market is also super competitive, so unless you are dedicated, you won’t be successful. I hope to one day find time to take poker seriously again, although I hope it won’t be to pay the rent as I did back in the day!

If you weren’t listening to one of our podcasts, what podcast would it be?

I listen to a lot of football podcasts (Americans call football “soccer,” I’m told :D). My local team is absolutely terrible, and it’s both wonderful and horrible. Horrible for the obvious reason that we tend to identify with our team, and no one likes to lose.

But it’s also wonderful because I have to be so extremely rational to do my day job well. It’s nice to kick back and be emotional about football, which is intellectually completely unimportant, but when the game is on, I feel it’s more important than the air we breathe. I like how irrational football makes me because it allows me to blow off steam.

Dive deeper

Check out our company’s full story from Stig himself in this fantastic We Study Billionaires episode from October.

Enjoy reading this newsletter? Forward it to a friend.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!