Air Jordan

02 February 2023

Hi, The Investor’s Podcast Network Community!

Stocks continue to climb thus far in 2023 📈

After the close, Apple, Amazon, and Alphabet all reported earnings, with Amazon and Alphabet posting so-so results. Their stocks fell after hours, while Apple earnings came in below Wall Street’s expectations, though CEO Tim Cook said iPhone production is back where they want it to be.

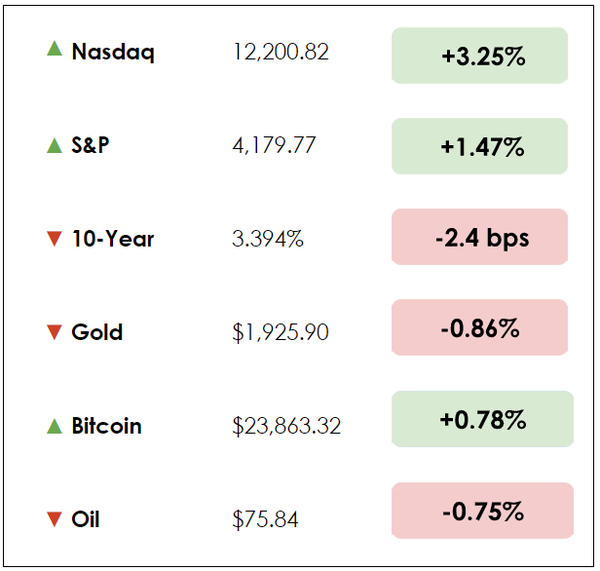

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: why Meta’s stock is surging, and how Pakistan’s economy is on the brink, plus our main story on arguably the greatest athlete endorsement deal ever.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

- The FOMO is real — traders continued piling into Facebook’s parent company (META) following an after-hours price jump spurred by a few things, including better-than-projected revenues, chief executive Mark Zuckerberg’s verbal commitments to cutting costs and boosting efficiencies in 2023, and last but not least, a $40 billion to program to buyback shares.

- Share buybacks are generally a more tax-efficient way to return profits to shareholders than dividends, which are treated as income as opposed to capital gains. For Meta shareholders, it’s a welcome reward for sticking with the company despite a 64% fall in value that eliminated roughly $600 billion in market capitalization.

- Touching gains as high as 25%, it was the best day in nearly a decade for the tech giant.

- Optimism around an approaching Fed policy pivot towards looser monetary policy has powered a broader rally this year, particularly in tech stocks, which are typically the most sensitive to changes in long-term interest rates. After the fastest rate hikes since the 1980s last year, derivatives markets now reflect that investors believe the Fed will begin cutting rates later in 2023.

- For Meta, the combination of this euphoria over expected future Fed policy and a massive share buyback program has proven an explosive combination, even with concerns beneath the surface still mounting.

- The company reported a 55% decline in profits from last year amidst increasing competition from TikTok, a slump in the digital advertising market on top of privacy changes from Apple (AAPL) that have restricted its access to user data, and huge investments in the “metaverse” and virtual reality that have yet to pan out.

- Thousands of shipping containers are piling up at ports in Pakistan. Simultaneously, food and energy costs are skyrocketing, coming on the heels of an unexplained nationwide power outage last month that disrupted hospitals and transportation networks, and plunged residents into darkness.

- As conditions worsen, pressure is growing on Prime Minister Shehbaz Sharif to unlock billions of dollars in emergency funding from the International Monetary Fund.

- Pakistan’s currency, the rupee, has hit new lows against the U.S. dollar, sinking into a balance-of-payments crisis. In other words, the country has spent more on imports than it has earned selling goods/services to the rest of the world, draining down its foreign currency reserves in the meantime.

- As Pakistan’s currency weakens, foreign debts and their interest payments, typically denominated in U.S. dollars, are more expensive while pushing the cost of imported goods even higher due to less favorable exchange rates. It’s a devastating financial and economic crisis that compounds without dramatic intervention.

- Although some issues are unique to Pakistan, such as historically damaging floods last summer that caused nearly $16 billion worth of destruction, the situation reflects the headwinds facing hundreds of millions, if not billions, of people in developing countries. The IMF estimates that 15% of low-income countries are already in debt distress, with another 45% at high risk of failing to meet their financial obligations.

- Several years of pandemic-related challenges hit these countries the hardest, and global commodity and food shortages stemming from the war in Ukraine have only made things worse. Add to this slowing worldwide growth and higher interest rates that stifle previously ample capital flows. Consequently, many developing economies are trapped in acutely nightmarish, vulnerable situations.

*Note: February is Black History Month. Throughout the month, we’ll pay tribute to several African-American investors, starting with a global basketball icon.

“Some people want it to happen, some wish it would happen, others make it happen.” – Michael Jordan

In 2016, basketball star Michael Jordan, arguably the greatest player the sport has ever seen, became the first billionaire in NBA history.

That year, President Barack Obama awarded him the Presidential Medal of Freedom.

And now, his net worth has climbed to nearly $2 billion, making him the wealthiest athlete on the planet.

Though he won six NBA titles with the Chicago Bulls, nearly all his wealth has come off the court. (Jordan was the NBA’s highest-paid player for only two seasons during his 15-year playing career.)

A business is born

Jordan’s first contract with Nike, signed in 1984, was worth $500,000 per year, plus royalties.

Jordan’s mother, Deloris, has said the Nike deal was “unbelievable” at a time when sports endorsements weren’t nearly what they are today. Nike offered him 25% royalty well before anyone else in the shoe industry matched that.

The shoes were originally released to stores in April 1985 and were an instant hit. ESPN reported that Nike had sold $70 million worth of the shoes by May, just a month into the release, and that the Air Jordan brand had made Nike more than $100 million by the end of the year.

Nike initially projected a reasonable $3 million worth of Air Jordan sneaker sales at the end of the four-year term. In the first year alone, Nike sold $126 million worth of units – almost solely because of Jordan’s name, reputation, and sheer star power.

From the beginning, Jordan’s enormous success helped Nike vault itself from primarily a running shoe company into something much bigger.

Five NBA Most Valuable Player awards and six NBA Championships speak for themselves.

Monopoly on sneakers

Before 1997, you could find the two logos together on an Air Jordan sneaker. Michael Jordan’s signature shoe was created with Nike’s help, but the Air Jordan line became so popular that it eventually didn’t need the Swoosh to back it.

The Nike and Jordan partnership achieved a level of success that allowed Jordan Brand to become its own company in 1997, and it has never looked back. He now makes well over $100 million a year on his Nike contract alone.

Nike now has a “virtual monopoly” in the once-competitive basketball sneaker business.

Nike and the Air Jordan brand’s share of the performance basketball market is about 90%, and nearly every NBA player wears Nikes on the court today.

The cherry on top? In 2003, Nike acquired Converse for just $305 million.

Bargain hunting

Jordan bought the Charlotte Hornets in 2010 for $175 million. He agreed to sell a minority stake in a 2019 deal that valued the NBA team at $1.5 billion.

All together, Jordan’s salary during his career totaled $90 million, but he has earned about $1.8 billion (pre-tax) from such corporate partners as Nike, Hanes, and Gatorade.

And Nike’s Jordan Brand alone now brings in roughly $3.6 billion in revenue each year.

The popularity of Air Jordans has seen a resurgence in recent years, thanks to celebrity partnerships to connect to a younger audience and new versions of retro styles to reconnect to older fans.

When Jordan retired, people questioned whether the shoes and line of athletic clothing could survive without him being an active NBA star.

But his legacy endures, and Nike added stars like Ray Allen and Derek Jeter to continue marketing the Jordan brand to young audiences.

Warren Buffett has talked about the value of making money “while you sleep,” and Jordan embodies that mantra. Jordan became famous through the NBA, but sponsors made him rich.

The Jordan-Nike deal also could be considered the biggest endorsement bargain in sports. At the time, Nike was a relatively fledgling company that couldn’t yet compete with Converse or Adidas.

As Jordan rose to global stardom, so did Nike.

His Nike contract remains the richest athlete endorsement deal in history.

Dive deeper

Check out Shoe Dog by Nike founder Phil Knight.

The most popular Jordan biography came out in 2015. You can order it here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.