$110 million

18 August 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

U.S. stocks finished lower on Wednesday as investors sorted through more retail earnings reports and tried to decipher the Fed’s signals about future interest rate hikes. More on this below.

In other news, twenty-year-old university student Jake Freeman, a mathematics and econ major at the University of Southern California, may be wondering if he should head to class this fall. Jake was reported to have made $110 million after selling his Bed Bath & Beyond stake. Find out more here.

By the way, we’d love to get to know you better. If you’re a fan of The Investor’s Podcast, please let us know how we can improve your user experience by filling out our listener survey.

Thanks for being a member of our community!

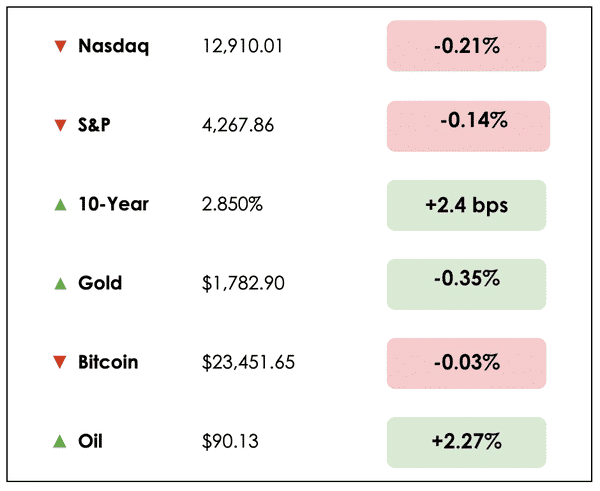

Here’s the market rundown for today:

*All prices as of this morning

Today, we’ll discuss hints from the Fed’s minutes, Tencent’s slowdown in growth, Alphabet’s intrinsic value, and the importance of yield spreads.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

😵 U.S. Natural Gas Prices Hit 14-Year High (CNN)

Explained:

- Natural gas prices have rocketed this year, closing 7% higher on Tuesday to hit their highest level since August of 2008. As scorching temperatures pressure Americans to blast the AC, this drains on much-needed energy supplies. And things might get worse this winter, since, in addition to being the leading fuel source for the country’s electric grid, natural gas is also the most popular way to heat homes.

- Prices are considerably worse in Europe though, as much as seven times higher. This is largely due to reduced gas flows from Russia in response to sanctions. European countries now face drastic plans to ration gas usage, while seeking substitutes, such as burning oil.

What to know:

- One would typically expect large price discrepancies for essential commodities to be quickly arbitraged away globally, but natural gas is quite difficult to transport and deliver across continents.

- The U.S. has dramatically stepped up exports to the Eurozone, though there are limits to how much can be delivered, and greater exports abroad are likely to drive further domestic price increases.

- U.S. natural gas production is lagging behind where global markets need it to be, and inventory levels are meaningfully below historical averages for this time of year. Natural gas prices are a key piece to the geopolitical puzzle in the struggle against Russia, as well as in the fight against inflation.

🤨 Fed Minutes Show More Rate Hikes Coming, But The Pace Could Slow (Reuters)

Explained:

- According to the notes from a recent meeting, it appears that Fed officials believe there’s little reason to expect that inflation has started to subside even in light of a more favorable July inflation rate.

- The general sentiment reflected in the minutes highlighted that officials remained committed to raising interest rates as much as necessary to combat inflation, while also acknowledging that for this to happen, spending and growth in the economy will have to decline.

- On the bright side, the Fed appears to also remain committed to reacting in real-time to economic data, without tying itself to explicit plans for future rate hikes. This means that should inflation cool faster than expected, the central bank would consider adjusting its expectations for rate hikes correspondingly.

What to know:

- Fed members noted that, although some parts of the market, namely real estate, had started to feel the pressure of higher rates, the effects are still yet to be seen in labor markets.

- Until we see employment drop significantly, it remains unlikely that inflation will become muted, as lower employment is an expected precondition for reduced spending. Americans love to spend money, and it appears that they won’t stop unless they’re literally out of work.

- Lower gas and commodity prices may provide a temporary reprieve for consumers, but to fully pull inflation down to the Fed’s goal of two percent, households and businesses must feel the crunch of higher borrowing rates, according to the minutes.

😲 Tencent Posts First-ever Drop in Quarterly Revenue (CNBC)

Explained:

- More bad news for Chinese stocks. First, we hear of Ray Dalio dumping his Alibaba shares, and now the Chinese internet giant Tencent posted its first-ever drop in quarterly revenue.

- Strong headwinds from tighter tech regulation, Covid’s resurgence, and the overall economic weakness in China weighed heavily on the company’s performance last quarter.

What to know:

- Chinese regulators have given Tencent a headache with their nearly year-long freeze on new game approvals. The freeze was lifted in April, but officials have yet to approve a single title this year, causing the company to rely on existing games for growth.

- The company’s online ad revenue fell by 18%, and profit collapsed by 56% as China’s economic slowdown has caused a significant pullback in ad spending.

- Tencent runs the popular messaging app called WeChat which has a short video platform built within it for their 1 billion users. In July, the company began serving ads on the platform and believes this will grow into a substantial revenue source over time.

FEATURED SPONSOR

Enjoy the ups and downs of roller coasters, but not when it comes to your money? Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

DIVE DEEPER: ALPHABET’S INTRINSIC VALUE

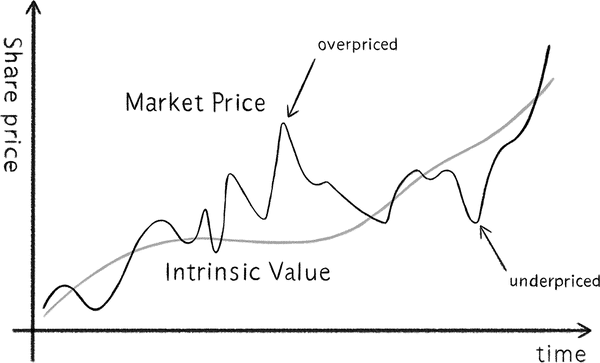

Today’s Deep Dive is inspired by a discussion our own Clay Finck recently had on Millenial Investing regarding Alphabet’s intrinsic value.

According to Clay, Alphabet (GOOGL) checks all the boxes of a great stock to hold for the long-term. It has a growing free cash flow base, a nearly impenetrable moat, a great management team, and it’s trading at a reasonable price of $120 per share after falling off nearly 18% year-to-date.

Clay is a big fan of Adam Seessel and his book Where the Money Is. In Adam’s interview here, they discuss what to look for in a tech company and how to think of value investing in the digital age.

By the numbers

Alphabet generates a significant portion of its revenue from advertising from both Google search and YouTube. Ad revenue for Google was $79 billion in 2016 and exploded to $209 million in 2021, representing an annualized growth rate of 21%. YouTube’s ad revenue grew at an annualized rate of 37%, from $8 billion in 2017 to $28 billion in 2021.

In addition, the digital ad space is expected to grow 11% through 2026, and the total addressable market is projected to mushroom to $876 billion by then. So, not only is Google gaining market share, but the overall pie is growing larger and larger, as increasingly, advertisers are moving away from traditional advertising methods towards digital advertising.

According to our TIP Finance tool, the company’s return on invested capital has been over 20% for the past decade. If Google can maintain these strong returns on capital, long-term investors can likely expect to do very well.

Google’s balance sheet is exceptionally strong, with $134 billion in cash or cash equivalents, while its long-term debt is only $14 billion. This gives them the ability to weather any downturn in revenue or earnings. It also gives them the ability to make strategic purchases of companies that could add to the company’s bottom line, which they’ve done many times in the past. One of their best purchases was of YouTube for the bargain price of $1.65 billion in 2005.

With over 4.3 billion users worldwide and a market share of 92.24%, Google dominates the global search market. Even Charlie Munger has said, “Google has one of the strongest moats he has ever seen.” Adam Seessel mentioned that Microsoft spent $15 billion on Bing just trying to get a piece of the Google pie, and was completely unsuccessful.

Moonshots

Google’s management is strong and keeps shareholders best interests in mind. Their investment in moonshot projects that have the potential to be massive revenue generators is an exciting aspect of the business.

Waymo, which develops the technology behind self-driving cars, and Google Fiber which provides fast internet access, are two examples of moonshot bets that could pay off nicely and increase the company’s bottomline.

Related to its venture capital-like projects, Google continues to pour money into research and development. R&D spending was $7 billion in 2013, and it’s now up to $31.5 billion in 2021, which is more than Facebook and Apple spent combined.

Looking at our TIP Finance tool, we can see many legend investors own the stock, including Guy Spier, Bill Miller, and Bill Nygren, who holds 10% of his portfolio in Alphabet. Seeing that many of the world’s greatest investors own the stock is a great sign for the retail investor.

Using our IRR Calculator, which stands for internal rate of return, Clay expects an estimated return on the stock between 7% to 10%. Given that the 10-year Treasury rate is 2.85%, this seems like a fairly attractive return.

Let us know what you think. Is Google a stock you’d hold in your portfolio for the long-term?

YIELD SPREADS — EXPLAINED

We often hear extensively about interest rates, and we’re certainly guilty of writing about them frequently, but there’s good reason for this.

In financial theory, and in practice, much of the economy and financial markets, are driven not only by real interest rates, but also by the spread, or difference, between yields on different types of bonds.

A savvy investor then will track yield spreads as an indication of the economic assumptions and sentiment baked into financial assets by other market participants.

A simple example of a yield spread is the difference between interest rates on corporate bonds and the rate on U.S. government debt of the same tenor (time to maturity) which is seen as the benchmark in fixed-income markets.

High-Yield Spreads

Of course, not all corporate borrowers are the same, and there are a myriad of potential credit ratings for these companies ranging from ratings that indicate being essentially guaranteed to payoff all existing debts to those that show the issuer is at imminent risk of default.

For companies with better credit ratings, their spread (additional interest cost) over corresponding government bonds will be smaller, while less financially stable companies will have to pay a greater premium to borrow capital.

When spreads between corporate bonds and U.S. Treasuries narrow, this is typically during a period of economic growth with low default risks.

As credit spreads widen though, this can be seen as an indication that investors expect turbulence ahead and rising defaults, so they demand greater compensation for their lending.

Time Spreads

There are all different types of yield spreads though.

You’ve probably heard of yield curve inversion as an indicator that the economy is heading towards recession, and this is calculated by comparing the yields on government bonds with varying times until maturity.

For bonds with longer payback periods, for example, the 10-year Treasury yield versus the 2-year Treasury yield, investors typically demand a higher interest rate for locking up their money for a greater period of time.

This is in part due to the time value of money and risks that inflation will steal your future purchasing power, but it’s also because of what’s known as interest rate risk.

This refers to the possibility that your bond’s price will deteriorate should interest rates rise further and make its yield less appealing.

Sovereign Spreads

There are also sovereign spreads, which refers to the differences in interest rates for countries’ bonds. For the U.S. and other robust economies with debt denominated in their own currency (which they can print), risks to investors of not being paid back are seen as lower.

But for developing countries, that cannot issue debt in their own currency, they’ll likely see their interest rates trade at a meaningful spread compared to, say, the United States.

Sovereign spreads can fluctuate for a number of reasons ranging from social instability, to war, to economic growth and levels of inflation, and much more — essentially, anything that alters the government’s solvency.

For More

There’s a lot more learn to learn about yield spreads, but this is hopefully a useful primer on the topic. For more on bonds and yield curves, check out our resources here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.