Intrinsic Value Assessment Of Schaeffler (SHA)

By Christoph Wolf From The Investor’s Podcast Network | 22 May 2019

INTRODUCTION

Schaeffler is a German supplier for automotive and industrial companies. Their products include parts and systems for engines, gearbox, chassis, as well as ball bearing, and friction bearing. Their business is divided into three units.

Automotive OEM is by far the largest segment. This unit creates solutions for all major automotive companies. Besides the traditional combustion engine, hybrid and electric propulsion systems are also developed here. Automotive Aftermarket is a new unit, which deals with all aspects of automotive spare parts. The Industry unit sells various components and systems for rotative and linear movement to multiple different industrial companies.

Schaeffler has recently run into problems and issued several profit warnings and reduced its guidance. Due to declining margins and a generally harsher business environment, Schaeffler’s stock price has fallen from its high of more than €16 at the end of 2017 to a price of only €7.26 euros today. Is this a bargain or do the increased risks outweigh the stock’s cheap price?

THE INTRINSIC VALUE OF SCHAEFFLER

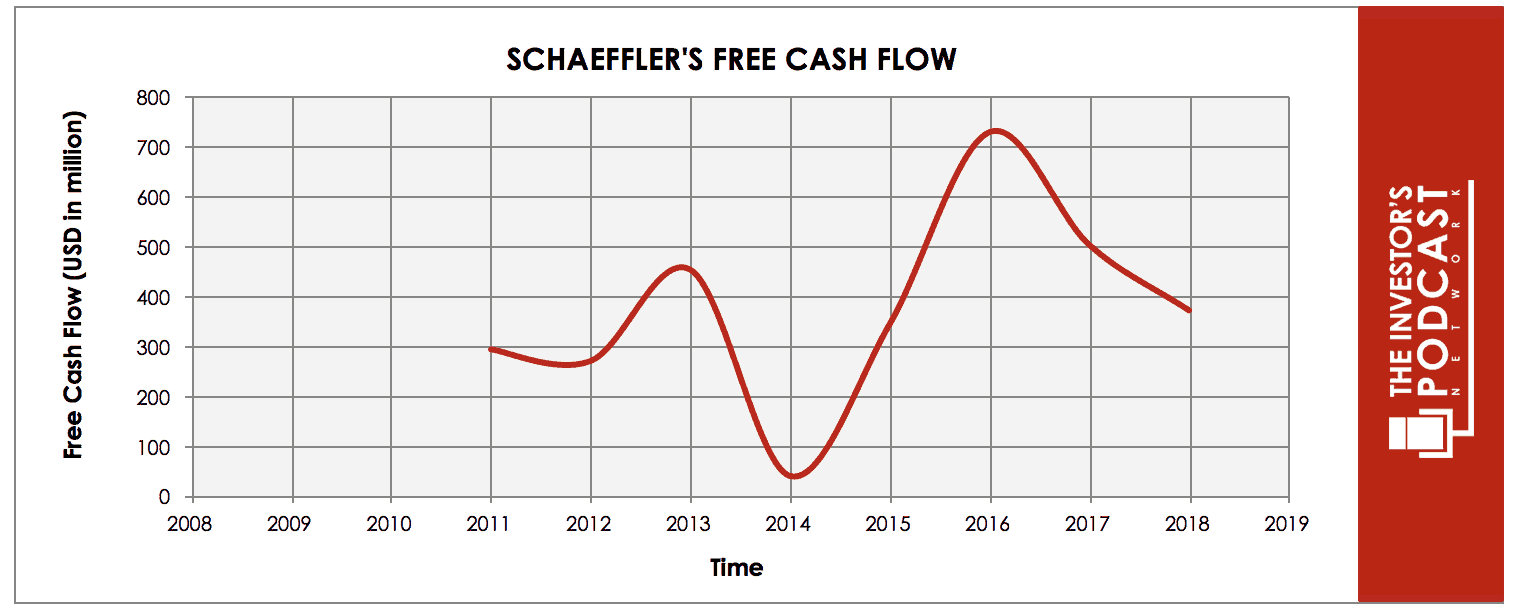

To determine the value of Schaeffler, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of Schaeffler’s free cash flow over the past years.

As one can see, the cash flows have been trending upward with a high volatility. This is due to the cyclical business it is operating in. As a consequence of this additional risk, we will use a conservative estimate for Schaeffler’s future cash flows.

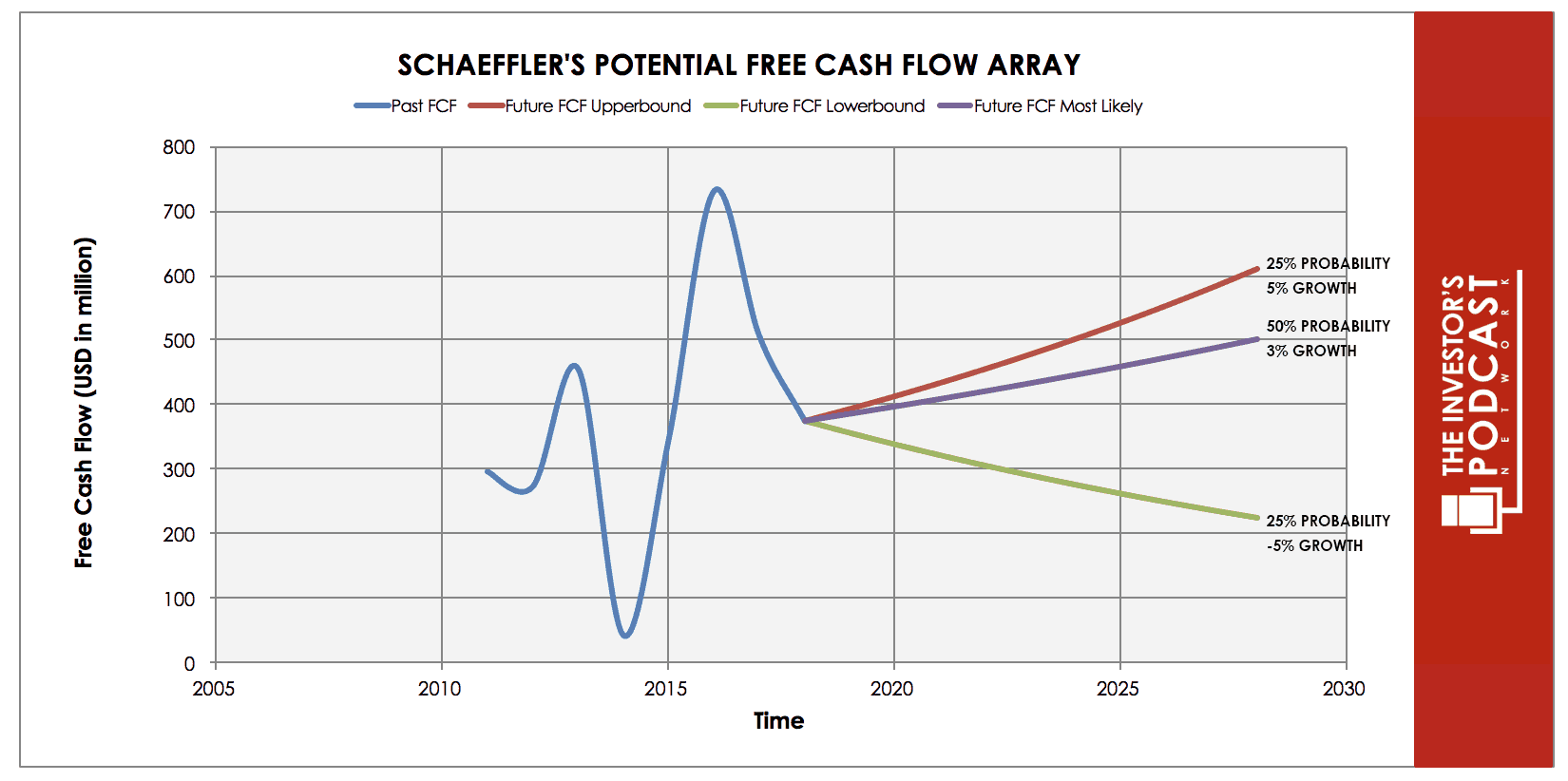

Each line in the above graph represents a certain probability for occurring. The upper growth rate of 5% is slightly higher than the approximate annual growth during the last seven years and is given a 25% chance. As most probable, we consider a small annual increase of 3%, which is in line with expected GDP growth. For this scenario, we assigned a probability of 50%. The worst case is assumed to be a sharp decline of 5% annually, which might be caused by a severe recession or if Schaeffler’s current problems cannot be resolved. We estimate the chance for this happening at 25%.

Assuming these growth rates and probabilities are accurate, Schaeffler can be expected to give a 7.6 % annual return at the current price of 7.26 euros. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF SCHAEFFLER

Schaeffler possesses some unique advantages that should allow it to be successful in the future:

- Consistent Revenue Growth. Over the last seven years, Schaeffler increased revenue consistently by an annual average of more than 4%. While the current stronger focus on profitability should limit this vast growth, the company is growing its sales even during this period of uncertainty.

- Innovative Company. For the last five years, Schaeffler has been the company with the second-most claimed patents in Germany. This is very impressive for such a small firm and is vital due to the rapidly changing business environment that Schaeffler is operating in. The company is strong both in e-mobility and autonomous driving. Its “Space Drive” system is a unique adaptive drive and steering system, which enables severely disabled persons to drive.

- Crucial Link in Worldwide Supply Chains. Another reason for the company’s moat is its position in the global supply chains. Since these structures are highly complex and globalized, replacing Schaeffler with another company would result in high switching costs for a customer. This further stabilizes Schaeffler’s position.

- Solid Balance Sheet. Although Schaeffler’s business is capital-intensive and the company has strongly expanded over the last years, its debt load remains manageable and even has vastly declined over the last few years. This was possible due to consistently positive and strong free cash flows.

OPPORTUNITY COSTS

When looking at various investment opportunities on the market today, let’s compare the expected return of Schaeffler to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.43% return. Considering the bond is completely impacted by inflation, the real return of this option is likely only around 1%. Currently, the S&P 500 Shiller P/E ratio is 29.86. According to this valuation metric, the US Stock market is priced at a 3.4% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

As a car supplier, Schaeffler is deeply ingrained in the global car supply chains, which is a double-edged sword. On the one hand, the company is a vital part of the chain, which gives it a high barrier of entry. Its business is capital-intensive, relies on long-established connections and includes much know-how that would be costly to replicate. But while Schaeffler’s position within the current supply chain seems safe, there are two major threats.

Firstly, the health of the current supply chain can come under threat. This might happen because of increased trade barriers and cooling of the world economy. Secondly, the nature of the chain itself is expected to change dramatically in the next years. The traditionally-used combustion engine will be replaced by electric or hybrid propulsion systems, and also autonomous driving adds a completely new element to the development of cars. While Schaeffler is engaged in all of these new technologies, this is a new business environment for the firm, which includes high costs and risks.

RISK FACTORS

Several risks might limit the growth prospects of Schaeffler:

- Dependency on Global Car Sales. Car sales are very cyclical and closely connected to the state of the world economy. If another global recession strikes or if car sales drop because of other reasons, demand for Schaeffler’s products would fall. Also, imposed tariffs could increase the price of cars, which adds pressure to car sales.

- Increased trade barriers pose multiple threats to Schaeffler. It can increase its production costs, make it costlier to ship its products to its customers, and also dampen car sales in general.

- Dramatically changing the car sales market. Cars in twenty years will very likely be quite different than the one we see today. Electric cars or autonomous driving will have a vast impact on the industry, which adds uncertainty. Schaeffler is already investing in electric and hybrid propulsion systems, but this undertaking is costly, and the exact direction the car market will take is yet unclear.

SUMMARY

Schaeffler is a very interesting company. The firm possesses a strong position in the global car supply chain – which also makes it vulnerable to the health and nature of this chain. If global car sales fall or electric propulsion systems and autonomous vehicles change the nature of driving, Schaeffler’s business model is under threat.

Reassuringly, the company has invested heavily in these new technologies, but this incurs high costs and risks – and forces Schaeffler to operate in a new and yet relatively unknown business environment. If the current price of 7.26 euros and an expected annual return of 7.6% adequately compensate for this risk should be further investigated before buying this stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.