Intrinsic Value Assessment Of Foot Locker (FL)

By Christoph Wolf From The Investor’s Podcast Network | 23 September 2017

INTRODUCTION

Foot Locker has experienced strong price growth in the stock market for the past decade, trading as high as $78 in May 2017. But in the wake of Amazon’s rising power, a whole army of retail stocks have been crushed during the past year – dragging Foot Locker down to attractive price levels. An announced deal in June 2017 between Nike and Amazon added further pressure on Foot Locker’s price. Despite all these headwinds, the company’s current price of $36 per share, potentially offers value investors an entry point.

THE BUSINESS

Foot Locker is a leading retailer of sports shoes and athletic apparel. The company focuses on high-end athletic footwear and includes all the key brands in its product line. It operates 3,363 stores in 23 countries located in North America, Europe, Australia, and New Zealand. Nike is by far the most important brand sold by Foot Locker – accounting for 68% of all sales last year. Foot Locker also organizes many events featuring famous sports stars or special product launch activities.

THE INTRINSIC VALUE OF FOOT LOCKER

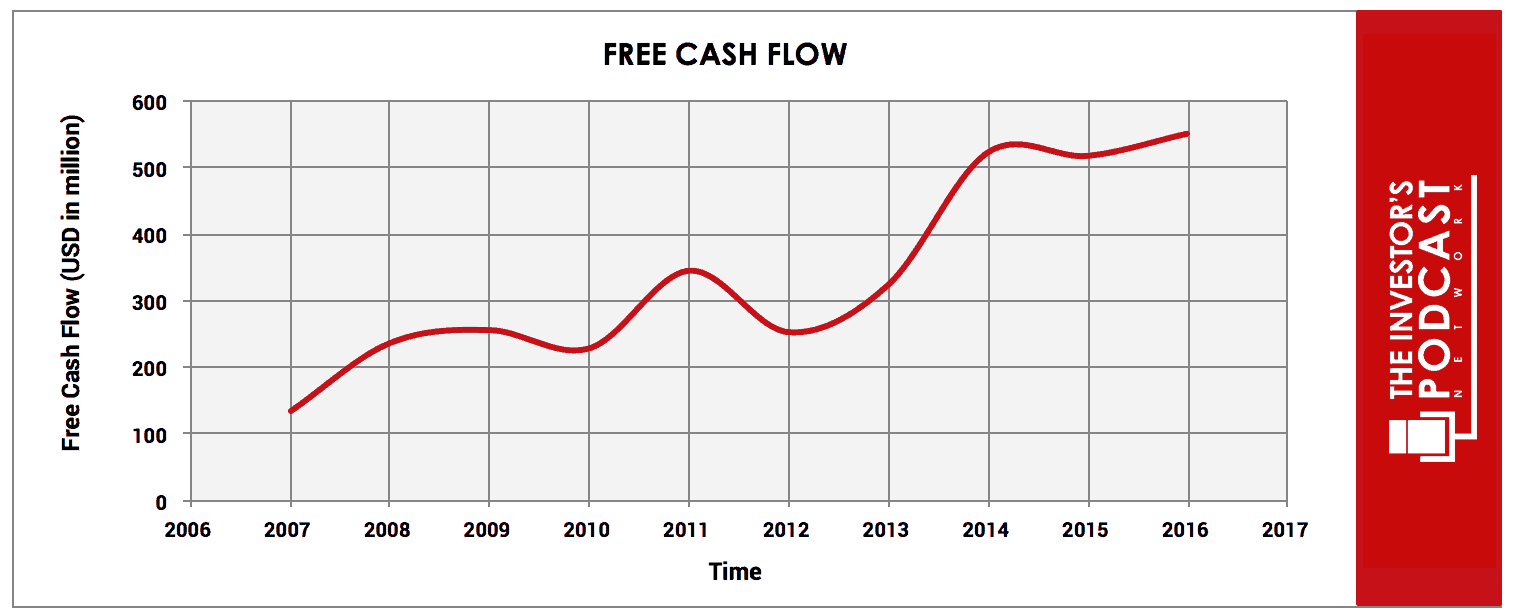

To determine the value of the stock, let’s start by looking at the company’s history of free cash flow. The free cash flow is significant because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be reinvested back into the business. Below is a chart of Foot Locker’s free cash flow over the past ten years.

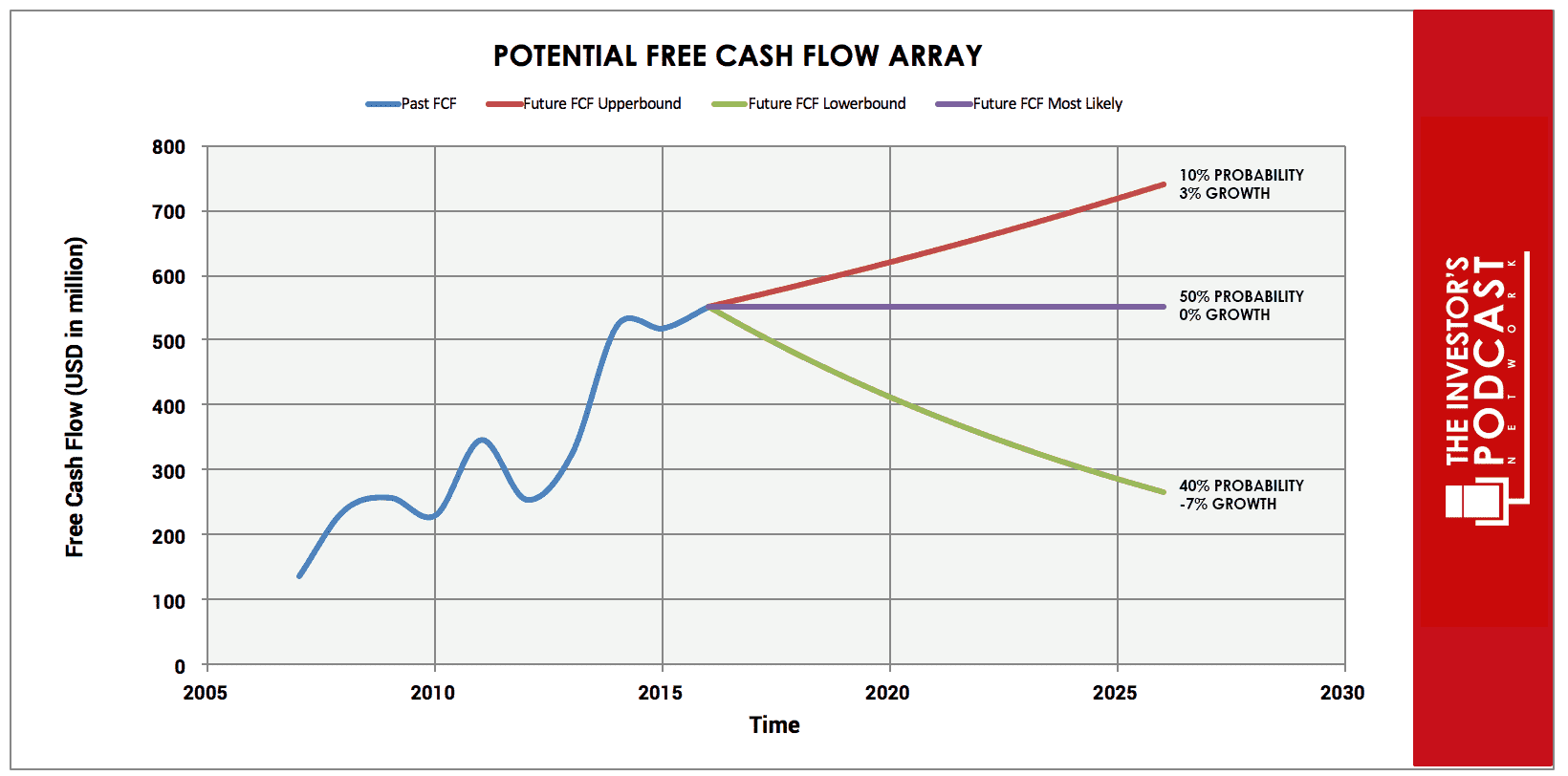

As one can see, the results in the past ten years have been reasonable. When looking at the potential for the company to make future free cash flow, conservative estimates are used. To build this estimate, an array of potential outcomes is averaged based on the magnitude of their corresponding probabilities.

Assuming there is a 10% chance for the upper growth rate of 3% per year, a 50% chance for zero growth and a 40% chance for the worst-case scenario of -7% annual growth, a cumulative free cash flow projection was produced. Assuming these growth rates and probabilities are accurate, Foot Locker could potentially produce an 8.9% annual return at the current price of $36. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF FOOT LOCKER

Considering that the net profit margins have been between 6-8% during the last five years (which is high for a retailer), it is clear that Foot Locker must possess several unique advantages, which should enable it to remain competitive into the future:

- Quality/branding. Foot Locker itself is well-known and trusted name, and the brands it sells are the who-is-who of the athletic footwear and apparel segment: Nike, Adidas, Jordan’s, Puma, Reebok, Under Armour and much more. Due to its long-term relationship with these companies, Foot Locker has access to the newest models.

- Pricing power. Due to its large size and well-established connections, Foot Locker has leverage with suppliers, which allows it to get special deals and offer competitively priced apparel.

- Financial strength. Cash & short-term investments alone are equal to its total liabilities. With a current ratio above 5 and a quick ratio of 2, the company has a very strong balance sheet. Add high margins and historically very strong free cash flow rates, and the financials look great.

- Stickiness. Foot Locker’s vast presence enables it to provide a unique experience to the customers. While Amazon and other online sellers can be dangerous competitors for low-end products, the high-end segment requires a personal element. When a T-shirt is $20, or a pair of Sneakers cost $50, customers will likely buy online– but before investing $220 in the new “Nike Kobe 11 Elite Low QS 4B”, most customers prefer to buy in a physical store. The impact of the Nike-Amazon deal seems, therefore, to be limited to the lower end products and might provide a layer of protection for Foot Locker.

Regardless of the positive attributes listed above, Foot Locker will struggle to retain market share. The retail sector is becoming extremely competitive, and it is unknown how much revenue will be lost in the coming years. As a result of this concern, the intrinsic model accounted for a decreasing cash flow moving forward.

OPPORTUNITY COSTS

When looking at various investing opportunities on the market today, let’s compare the expected return of Foot Locker to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.1% return. Considering the bond is completely impacted by inflation, the real return of this option is likely below 1%. Currently, the S&P 500 Shiller P/E ratio is 30. As a result, the U.S. Stock market is priced at a 3.3% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

RISK FACTORS

The risks for Foot Locker are definitively real, which can be seen in the recent disappointing numbers. During the first six months of 2017, revenue has decreased by 1.7%, and comparable-store sales were even 2.6% lower compared to the first six months in 2016. Also, earnings and margins were compressed. Foot Locker’s CEO Richard Johnson blamed this on a lack of new innovative products. If true, these headwinds might turn out to be temporary. Nevertheless, the management has decided to take action in cost reductions, larger online presence and increased communications with vendors to find and capitalize on new trends. These are the major risks:

- The threat by Amazon and other online sellers

- Competition by other brick-and-mortar sports stores

- The lack of innovative products might last longer than expected. This is a real risk, which would hurt all sellers of sports shoes. Since demand can be expected to remain strong in the future – no technology will make sports shoes redundant in the foreseeable time – we can expect innovation to catch up sooner or later. Foot Locker’s financial strength allows it to wait a little longer, if necessary.

- Foot Locker is highly dependent on sales of Nike products – which make up 68% of its overall sales. If Nike ever pulled out of Foot Locker, this would be disastrous for there’s ability to sustain projected cash flows. Still, this is considered highly unlikely, since Nike also strongly benefits from a close relationship with the world’s leading seller of athletic footwear.

SUMMARY

Foot Locker has some interesting attributes that might make it a good value investing pick. The Amazon-Effect is currently impacting the price of the stock. Although many of the reasons why investors are selling the stock are based on growth concerns, it appears the stock might be oversold. Even after assuming the future free cash flow might contract at a sizable amount, the business could still produce a return that’s three times higher than the rest of the S&P 500.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.