INTRINSIC VALUE ASSESSMENT OF BED BATH AND BEYOND, INC. (BBBY)

By Christoph Wolf from The Investor’s Podcast Network | 03 January 2018

INTRODUCTION

Bed Bath & Beyond Inc. (BBBY) is a retailer selling products mostly for the bedroom, bathroom, kitchen, and living room. It has stores mostly in the United States, as well as in Canada, Mexico, and Puerto Rico. BBBY not only operates under “Bed Bath and Beyond,” but also under the names Cost Plus World Market (household products), buybuy Baby (items for babies and small children), Harmon (cosmetics & beauty products), and many more. At the end of the last quarter, the company had a total of 1550 stores.

Bed Bath & Beyond Inc. has experienced multiple headwinds recently. The company operates in the highly competitive and cyclical retail industry, which has led to stagnating sales and compressed margins. Also, questionable management decisions weakened the balance sheet and shattered investors’ trust. As a result, the share price of BBBY has plummeted from its high of $80 in 2014 to a current value of only $23. Is BBBY undervalued at this depressed level as the company has finally beaten consensus estimates?

THE INTRINSIC VALUE OF BED BATH & BEYOND INC.

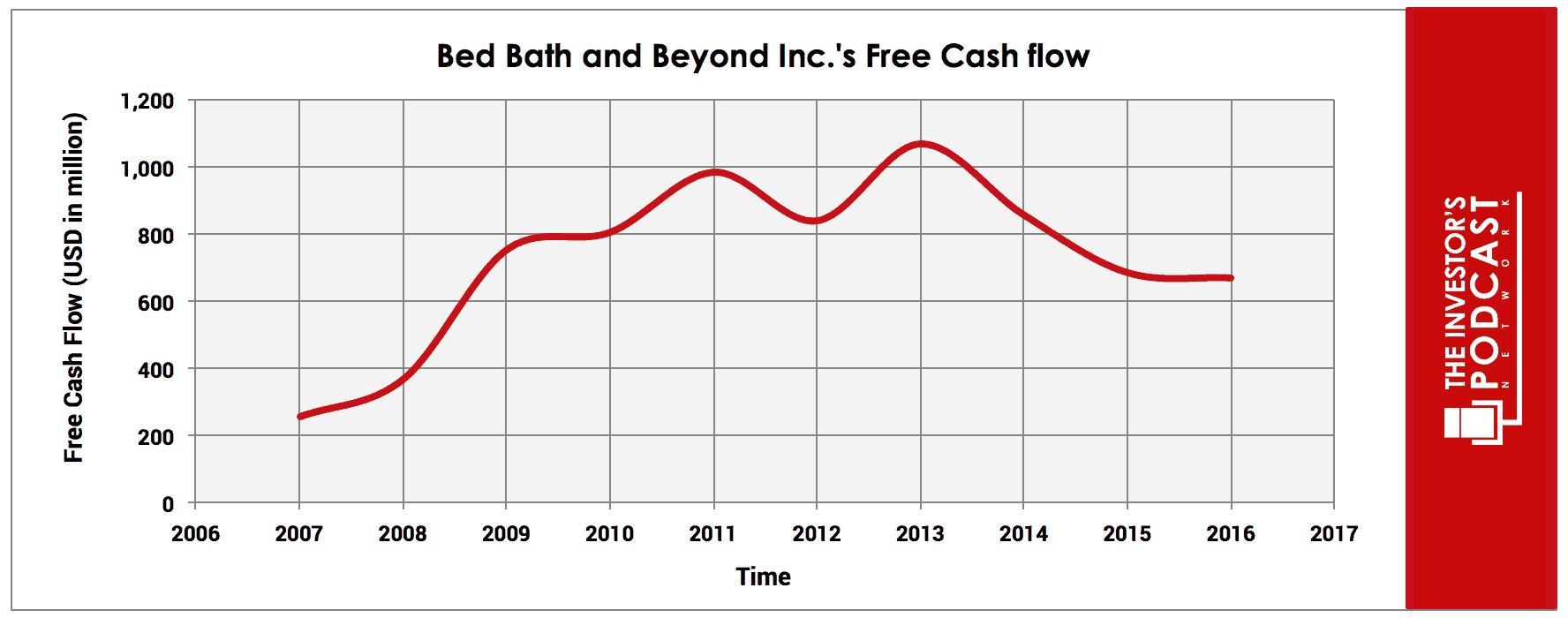

To determine the value of Bed Bath & Beyond Inc., let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return that might be invested in the ownership of equity of the business. Below is a chart of BBBY’s free cash flow over the past ten years.

As one can see, the results have been disappointing recently. This is due to stagnating sales and declining margins, which were caused by multiple factors. Firstly, there is currently an immense competition in the retail sector right now, and this trend can be expected to continue. This is caused by increased online shopping on Amazon and also by many other competitors like IKEA, Williams-Sonoma, Walmart, Target, and JCPenney. Its 20% discount coupons are widely known and are deployed to increase traffic, but at the same time this cuts deep into margins. Since BBBY is currently trying to grow its online sales, many resources flow into developing its electronic platform. This creates both headwinds for the gross margins as the products are sold at more competitive prices and also for the capital expenditures that are directly reflected in the operating margins. Given the many unknowns for the company, we will use an extremely conservative estimation of its future cash flows.

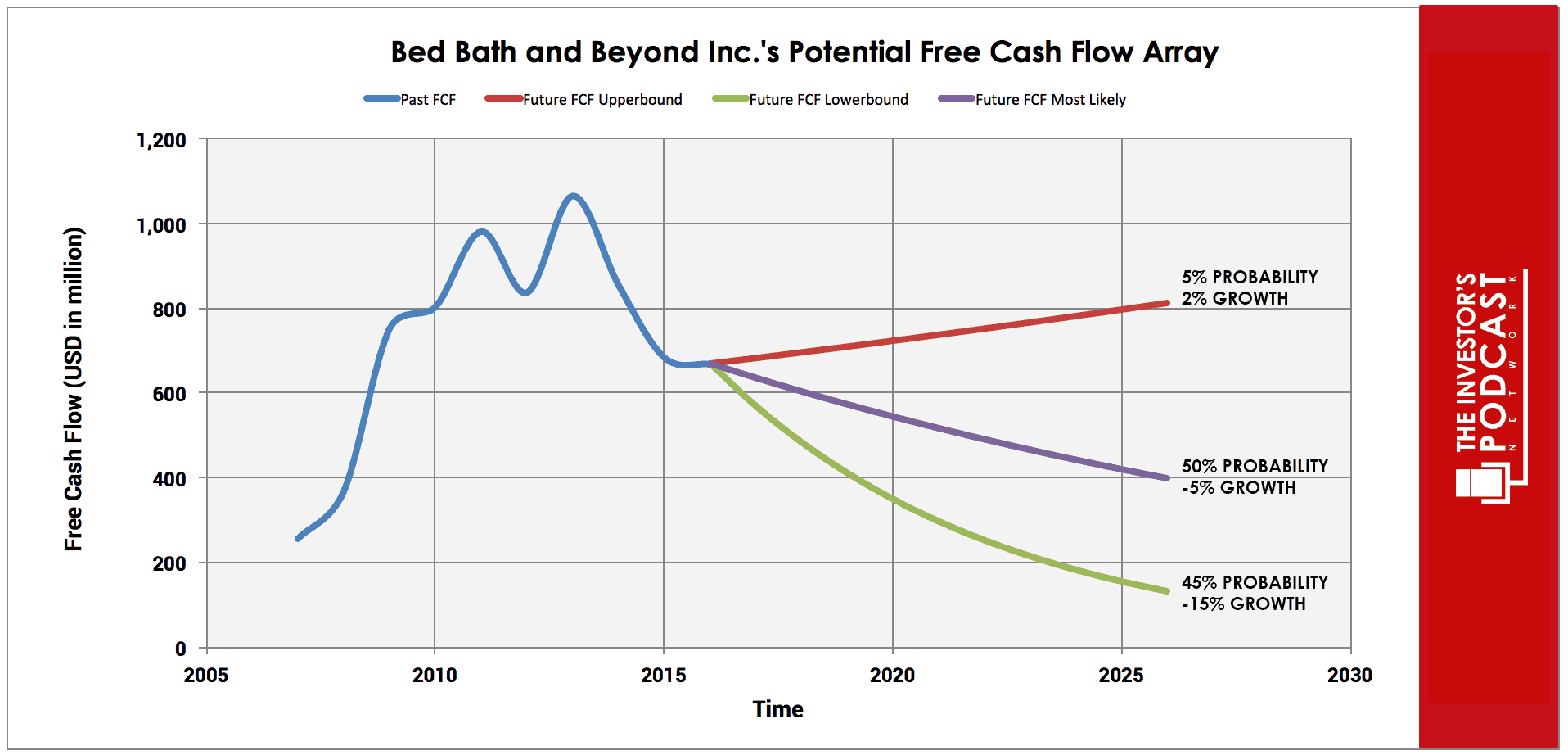

Each line in the above graph represents a certain probability for occurring. We assume a 5% chance for the upper growth rate of 2% per year, a 50% chance for a decline of 5%, and a 45% chance for the worst-case scenario of -15% annual growth.

Assuming these growth rates and probabilities are accurate, BBBY can be expected to give an 11.2% annual return at the current price of $23. Even if the worst case becomes a reality, the annual return is still a solid 5.1%. This stock is valued as if the company is close to bankruptcy. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF BED BATH & BEYOND INC.

Bed Bath & Beyond Inc. possesses several advantages, though the moat – as with almost everything in retail – is not as wide as most investors would want.

- Lower prices for multiple products. Prices for its products are mostly lower than on Amazon. Multiple tests of large product baskets can be found on the internet – and all show that BBBY offers lower prices.

- Outstanding merchandising concept. BBBY has brought the so-called “big box” merchandising concept close to perfection. While others, like Toys “R” Us, have failed with this approach, BBBY superbly executes this strategy of massive space overloaded with products. As a result, consumers that came to buy only a towel often leave with products worth hundreds of dollars.

- Niche in massive warehouse space. In 2008, Linens ‘N’ Things filed for bankruptcy. This company was the only other 30,000+ square foot store company in this retail segment. All current competitors operate either online, have smaller warehouses, or do not have the same focus on bathroom and bedroom products. Consumers get an experience shopping in the good old fashion retail stores that you can’t imitate

RISK FACTORS

The risks for BBBY are impossible to overlook. Not only that same-store sales and margins have gone downhill for years, but even overall sales have started to decrease slightly recently. An ill-timed share buyback in 2015 financed by $1.5 billion long-term debt has not helped either. Here is a list of the most important headwinds:

- The immense competition by Amazon, other online sellers, and multiple brick-and-mortar companies.

- Mediocre management. Besides the immense share buyback at elevated stock prices, the excessive compensation of CEO Steven Temares also weakens trust in the leadership of BBBY. After having received almost 20 million dollar annually for several years, which is significantly more than comparable companies, his pay was cut by 13% due to shareholder pressure in 2017.

- While its finances are still solid, the $1.5 billion long-term debt has significantly weakened the balance sheet. Investors should carefully track if the management continues to take on more debt.

OPPORTUNITY COSTS

When looking at various investing opportunities in the market today, one should compare the expected return of BBBY to other ideas. First, one could invest in the ten-year treasury bond which is producing a 2.1% return. Considering the bond is completely impacted by inflation, the real return of this option is likely below 1%. Currently, the S&P 500 Shiller P/E ratio is 30. As a result, the U.S. Stock Market is priced at a 3.3% yield. If one were to invest in the S&P500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

The retail sector is currently experiencing a major disruption– not only because of Amazon but also because of demographic factors and changed shopping behavior. That being said, furniture and related products are still mostly sold in physical stores since they are large and heavy and therefore harder and more expensive to ship than books or T-shirts. The business model of BBBY, therefore, can be expected to remain relevant for the foreseeable future.

SUMMARY

Bed Bath & Beyond Inc.’s stock has been crushed alongside many other struggling retailers. Sales and margins are under pressure, and its management has committed unforced errors, which resulted in self-inflicted wounds. Despite all of these negatives, the company can still generate solid profits and cash flows. Since it is very hard to see the company going out of business anytime soon, the expected annual return of 11.2% should adequately compensate for these uncertainties.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.