Intrinsic Value Assessment Of Autozone, Inc. (AZO)

By Robert Leonard From The Investor’s Podcast Network | 25 February 2021

INTRODUCTION

AutoZone, Inc. (“AutoZone”) (Ticker: AZO) is a relatively simple business in today’s world — it has brick and mortar retail operations and an ecommerce presence where it sells aftermarket automotive parts, accessories, and tools to commercial and do-it-yourself customers. It is primarily based in the United States, with 90% of its stores domestically, and the remaining stores spread across Mexico (9.5%) and Brazil (0.5%), as of the end of its most recent fiscal year.

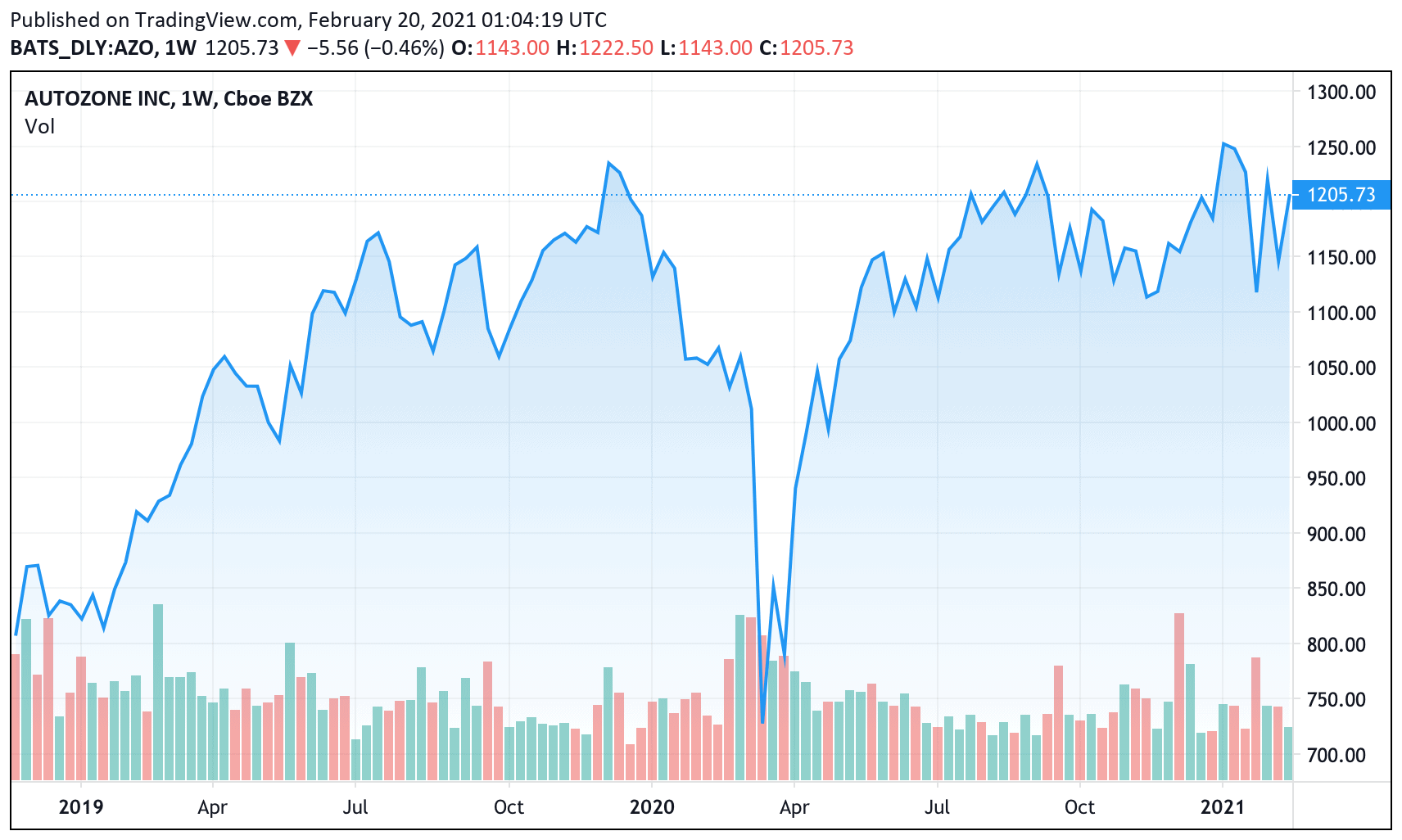

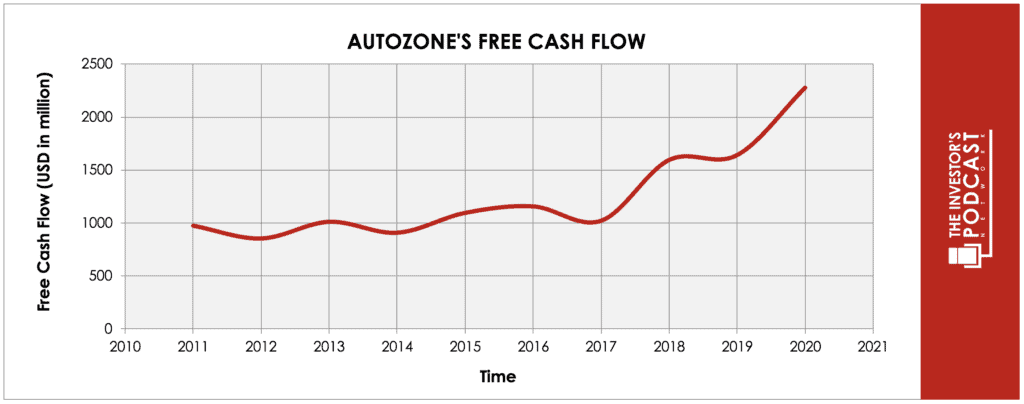

At the time of writing, AutoZone’s market capitalization is about $26.7 billion and its revenue and cash flows for the 2020 fiscal year were $12.6 billion and $2.3 billion, respectively. Currently trading at $1,205.63, the stock has hit a 52-week low of $684.91 and a 52-week high of $1,297.82.

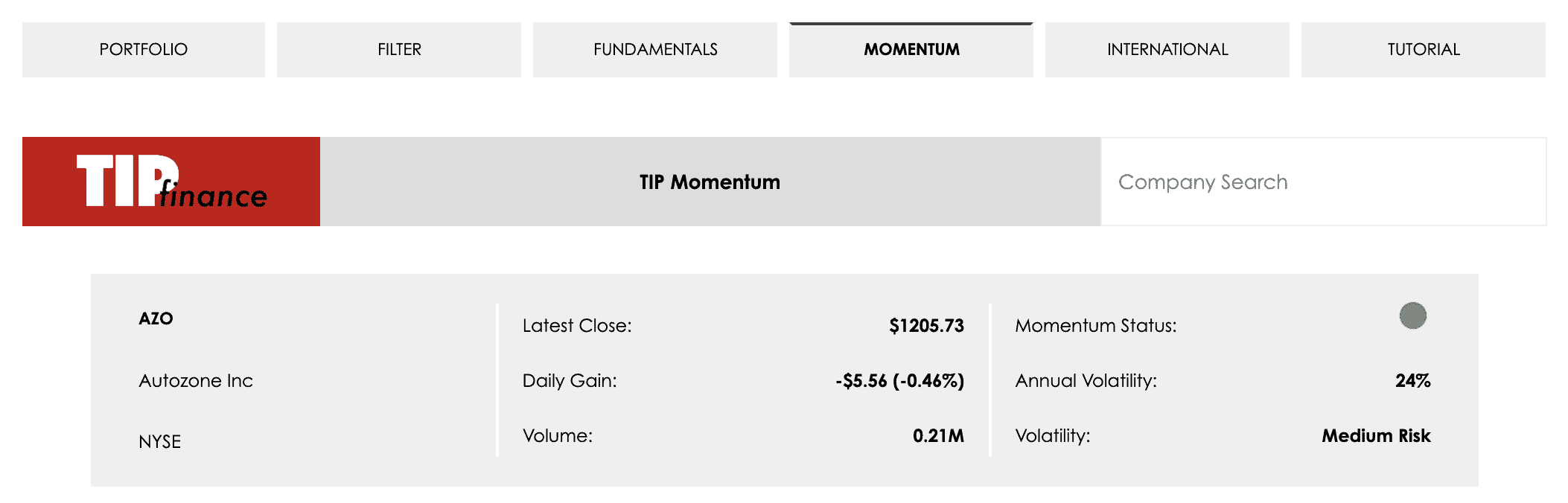

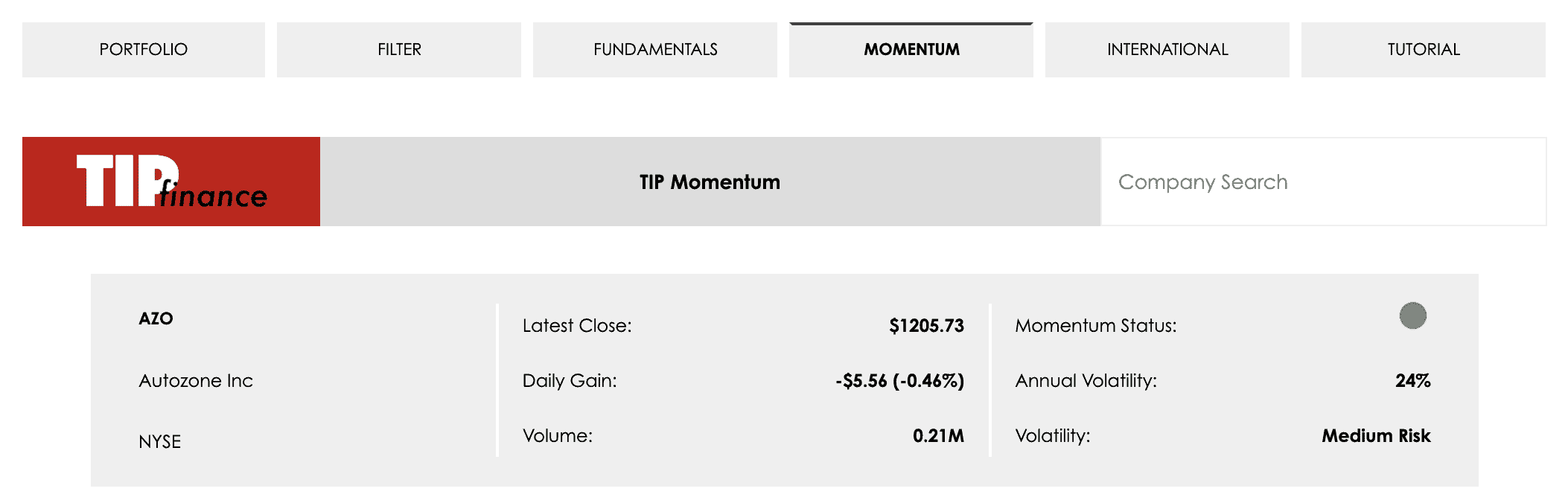

I had heard of AutoZone, and even shopped there quite a few times as a customer, but I hadn’t considered it for an investment. Then, the other day, I was using the TIP Filter function in TIP Finance tool as I researched for potential investment ideas when I came across AutoZone trading at an attractive TIP Multiple, TIP Median Multiple, and a satisfactory Potential Yield, all with a green Momentum Status. This intrigued me and was the catalyst for further research — ultimately resulting in this research report.

Now the question is, at today’s price of $1,205.63, is AutoZone’s stock undervalued?

INTRINSIC VALUE OF AUTOZONE, INC.

In our last Intrinsic Value Assessment, I analyzed a company that is about as far away from a traditional “value pick” as you can get. This analysis here is far more similar to the traditional analysis many of you are familiar with.

Why is that? Square is a high-growth technology company looking to disrupt an industry by continuing to innovate, whereas AutoZone is a much older company, with far more stable and consistent results. Each of these investments can work, but they’re very different strategies and approaches.

In the analysis about Square, I wrote, “DCF models are often associated with value investing because they can be great to value a more mature company, which, historically, has been the focus of value investors. However, in the case of a company like Square, which is still growing rapidly and far from maturity, DCF models are far less useful. As investors, we must be a bit more creative in our valuations to accurately model these types of companies.

In the case of Square, it is a relatively early-stage company, making it difficult to use historical data, as well as traditional profitability numbers, to forecast its future results.”

On the other hand, AutoZone fits perfectly into the “box” for using a DCF model. In the below image, we can see just how stable, and consistently growing, AutoZone’s Free Cash Flows have been.

Let’s look at three potential DCF models for AutoZone below.

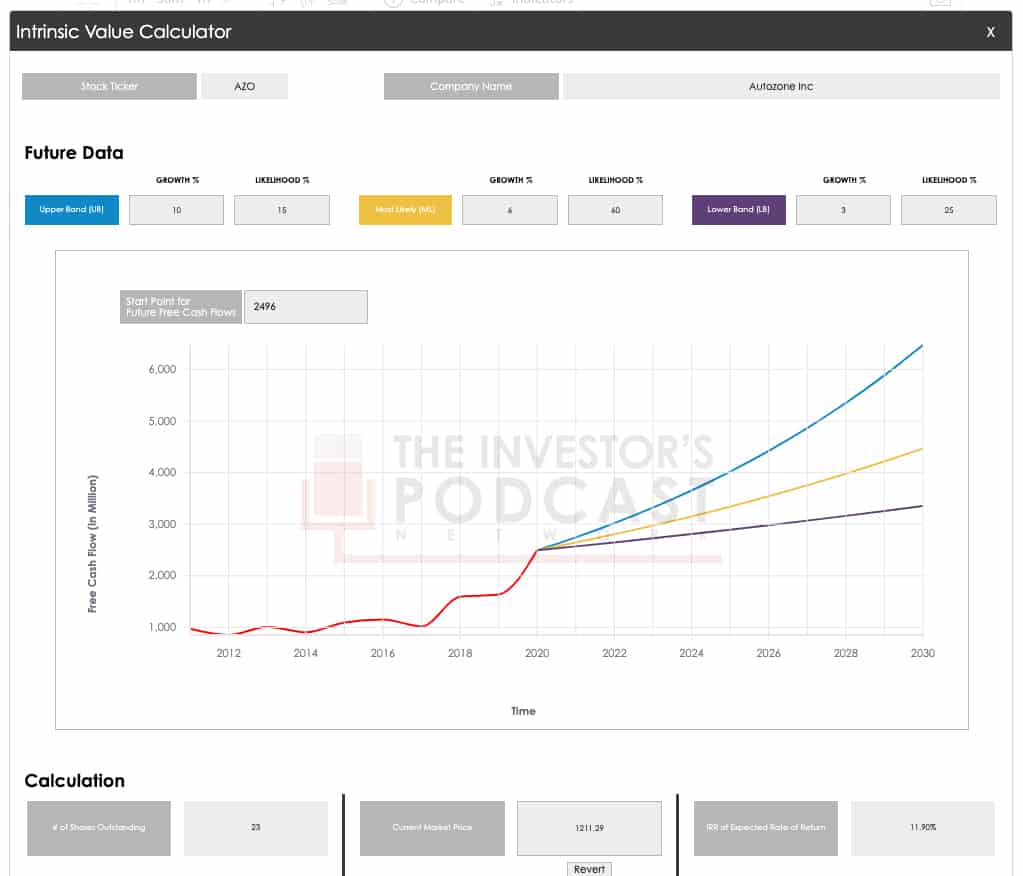

The first DCF model run in our TIP Finance tool is by far the most optimistic. It is plausible and based in sound logic, but AutoZone would need to fire on all cylinders, with minimal impact from competitors and other risks, which we’ll discuss below, in order to achieve these returns. In this model, three potential outcomes for AutoZone’s Free Cash Flow were modeled, each with a different percent chance of occurring, to arrive at the expected annual rate of return over the next 10 years at today’s price. For the Upper Band (“UB”), a 10% growth rate was assumed with a 15% chance of occurring. For the Most Likely (“ML”), a 6% growth rate was assumed with a 60% chance of occurring. For the Lower Band (“LB”), a 3% growth rate was assumed with a 25% chance of occurring. At today’s price, that results in an expected annual rate of return over the next 10 years of 11.90%.

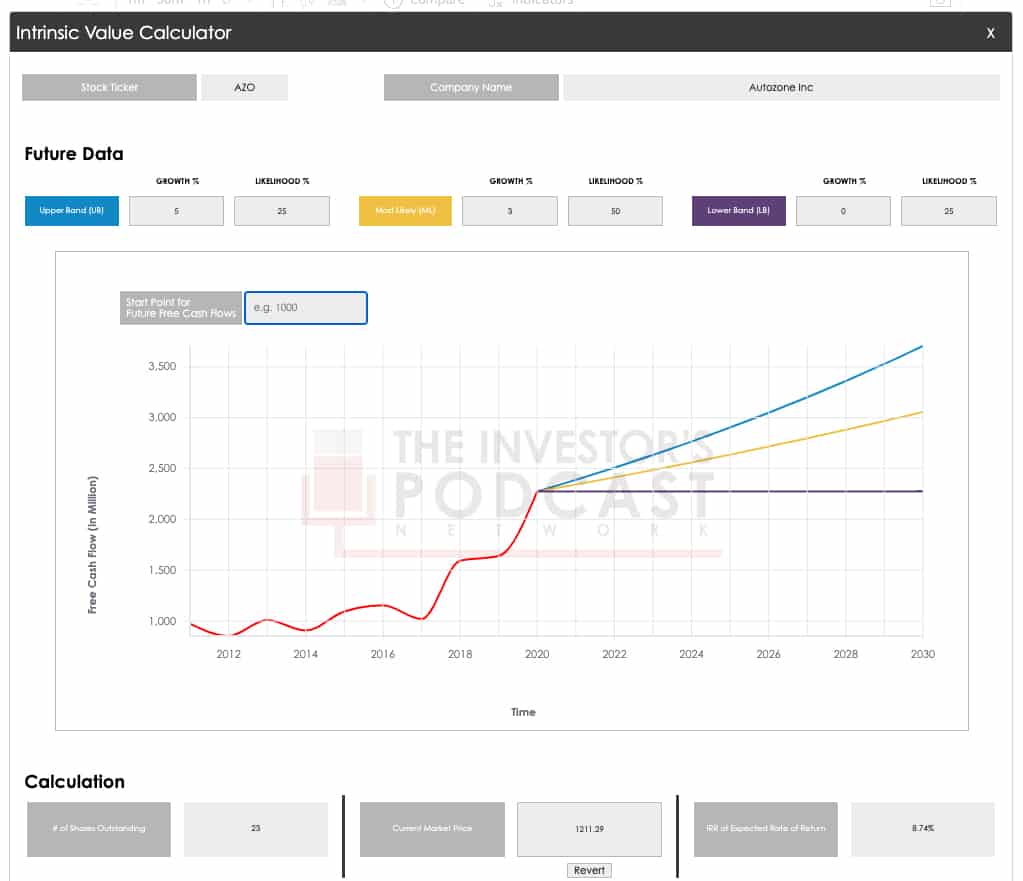

The second DCF model run in our TIP Finance tool is what I would consider to be the most likely scenario. It takes into consideration both the opportunities and risks facing AutoZone with the assumption that it could, but not too significantly, have its business eroded away by competitors. In this model, three potential outcomes for AutoZone’s Free Cash Flow were modeled, each with a different percent chance of occurring, to arrive at the expected annual rate of return over the next 10 years at today’s price. For the Upper Band (“UB”), a 5% growth rate was assumed with a 25% chance of occurring. For the Most Likely (“ML”), a 3% growth rate was assumed with a 50% chance of occurring. For the Lower Band (“LB”), a 0% growth rate was assumed with a 25% chance of occurring. At today’s price, that results in an expected annual rate of return over the next 10 years of 8.74%.

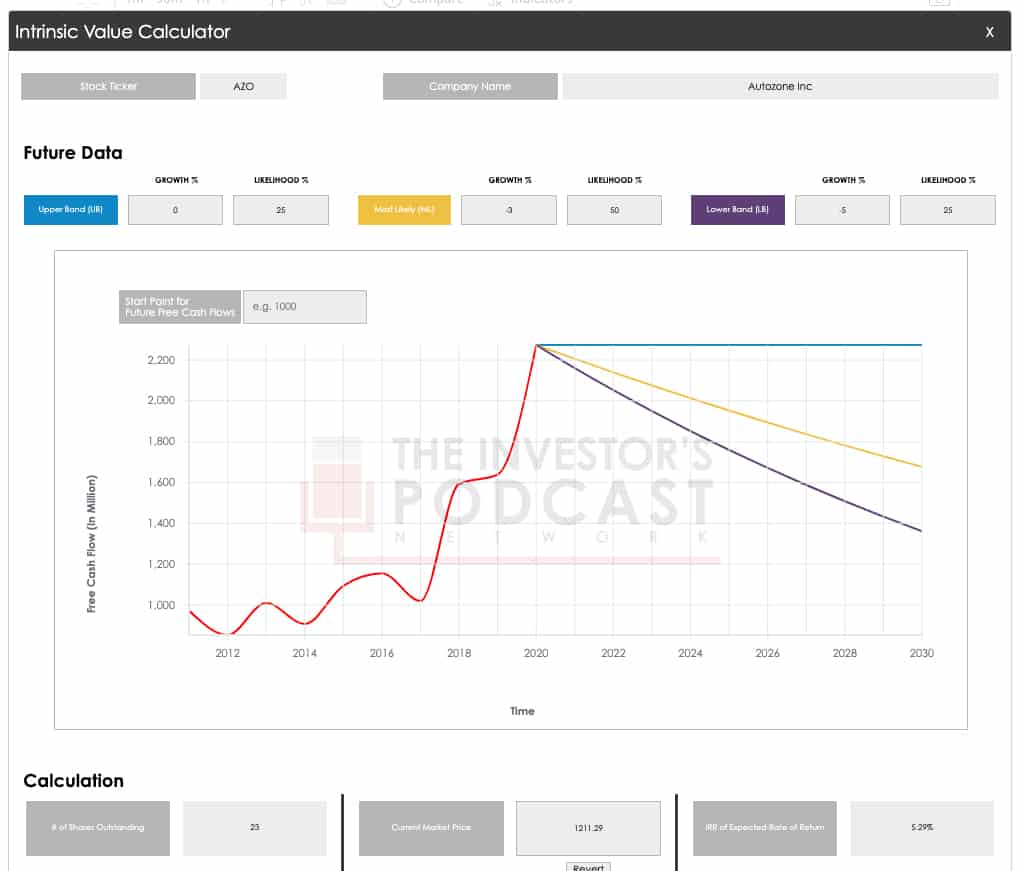

The final DCF model run in our TIP Finance tool is what I would consider to be close to, if not, the worst case scenario for AutoZone. It gives little value to its opportunities and competitive advantages, and heavily leans on expectations that its business model and industry will be disrupted by competitors and technology. In this model, three potential outcomes for AutoZone’s Free Cash Flow were modeled, each with a different percent chance of occurring, to arrive at the expected annual rate of return over the next 10 years at today’s price. For the Upper Band (“UB”), a 0% growth rate was assumed with a 25% chance of occurring. For the Most Likely (“ML”), a -3% growth rate was assumed with a 50% chance of occurring. For the Lower Band (“LB”), a -5% growth rate was assumed with a 25% chance of occurring. At today’s price, that results in an expected annual rate of return over the next 10 years of 5.29%.

DCF models are often associated with value investing because they can be great to value a more mature company, which, historically, has been the focus of value investors. Again, AutoZone fits perfectly into the requirements for input into a valuable DCF model.

Why did I use three different DCF models? It’s highly unlikely that my assumptions in one model will prove perfectly accurate. The reality is that the future annual rate of return will likely fall within a range — in this case, I am more confident in saying the annual return for AutoZone over the next 10 years will be between 5.29% and 11.90% than I am saying it is a specific number, for any of these three models.

AUTOZONE, INC’S COMPETITIVE ADVANTAGES AND OPPORTUNITIES

In order for companies to not only maintain their market share, but also grow it, they must have durable competitive advantages. In the case of AutoZone, there are four competitive advantages that will help them grow over the next five to ten years:

- Customer service and experience. With many automotive parts being hyper-specific to a vehicle’s make and model, it can often be difficult for customers to know exactly which part or tool is needed for their job, but they are cost-conscious or DIYers who don’t want to pay full retail for a mechanic shop to do the work for them. That’s where AutoZone steps in and makes a difference. AutoZone has a reputation for being very helpful with customer’s questions. They also offer free diagnostic and troubleshooting services, as well as free Loan-A-Tool programs allowing customers to borrow specialty tools for free. They also offer step-by-step guides for nearly all skill levels. There is significant competitive pressure from retailers like Walmart and Amazon, as well as fears of industry disruption, both of which we’ll talk about in the Risks section below. However, what Walmart and Amazing can’t, or haven’t, offered is the one-on-one, focused customer service and help that AutoZone has been able to provide. These interactions build brand loyalty and increase customer retention, benefiting AutoZone’s same-store-sales.

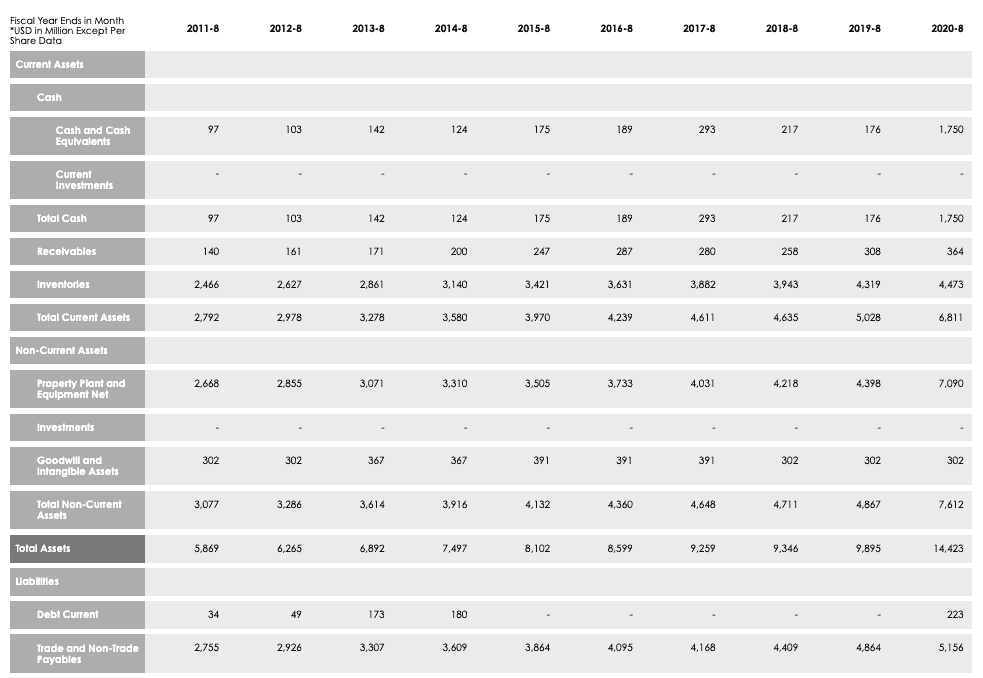

- Relationships. Other than the typical retail customer relationships we just discussed in the “customer service and experience” competitive advantage, AutoZone has two additional relationships that are significantly valuable to its business — vendors and commercial customers. Its relationships with its vendors is quite important and material to its business because it allows AutoZone to manage its working capital efficiently by carrying a large Accounts Payable balance (“Trade and Non-Trade Payables in image below), meaning it can wait to pay its vendors, while carrying a small Accounts Receivable balance (“Receivables” in image below), meaning it can try to receive cash quickly from customers. In AutoZone’s Q1 2021 earnings call, management stated, “Historically, we have negotiated extended payment terms from suppliers, reducing the working capital required and resulting in a high accounts payable to inventory ratio. We plan to continue leveraging our inventory purchases … extended payment terms from our vendors have allowed us to continue our high accounts payable to inventory ratio. Accounts payable, as a percentage of gross inventory, was 114.1% at November 21, 2020, compared to 110.3% at November 23, 2019.”

Source: TIP Finance

AutoZone has also been successful in building, and maintaining, relationships with commercial customers, with nearly 75% of its 2020 revenues coming from commercial customers. As the industry continues to evolve over the coming years, relationships with commercial customers are going to become increasingly important. As it currently stands, AutoZone has been able to derive a competitive advantage from its ability to build and maintain these relationships more than its competitors. While no competitive advantage is set in stone, this is a specific competitive advantage that must continue to be a focus if it wishes to maintain its success with commercial customer relationships.

- Size and scale. AutoZone currently has more retail locations than other similar retailers and this number is continuing to grow. From 2010 to 2020, its store count grew 4% compounded annually, from 4,627 to 6,549. This provides AutoZone a competitive advantage by giving it a broader reach to connect with DIYers in local communities. As ecommerce is this industry continues to evolve, it will also provide a competitive advantage by allowing these retail locations to act as distribution hubs for online orders, reducing the time for packages to get to customers.

- Management. Many of AutoZone’s executive team have been with the organization for over 15 years, providing significant experience and expertise to the company. The management team has done a masterful job of managing the headwinds its industry and business has faced over the previous decade. While it’s impossible to say, it is my expectation that with a lower quality management team in place, AutoZone likely would’ve been gone by the wayside, similar to other brick and mortar businesses in competitive, narrow-moat industries (think Sports Authority and BlockBuster). AutoZone has opportunities ahead, as we will discuss below, but it won’t be without its fair share of challenges. That said, it is going to be facing those challenges with an experienced and talented management team at the helm. As long as this management team is in place, it provides a competitive advantage for its business.

-

Having competitive advantages is critical for any business to have sustainable success. In the case of AutoZone, it is the four main ideas we just discussed previously. However, competitive advantages are not a set-it-and-forget strategy — they are something that must be deepened by continuing to successfully implement new growth opportunities. Without future growth opportunities, a company’s competitive advantage is likely going to be something of the past. For AutoZone, there are three opportunities that exist for it to continue to expand and grow:

- Expand distribution. We discussed AutoZone’s focus on opening new stores above. While they have done a good job of this so far, there is still more room to grow. It’s not always wise to grow, just for growth’s sake, but with a talented management team, AutoZone can continue to grow strategically in domestic markets where it will be beneficial to the business. This expanded distribution opportunity comes not only from an increased store count providing more retail opportunities, but also by providing more areas for distribution hubs, further improving AutoZone’s ecommerce presence.

- International expansion. In addition to the domestic expanded distribution, there is a significant opportunity for AutoZone to expand internationally, both in its existing international markets, as well as in new markets. With only 10% of its stores in two international markets, there is room to grow its store count significantly in both those markets, learn from scaling in those markets, and expand to other markets across the world.

- Financial engineering. Financial engineering isn’t so much an opportunity for the business itself, rather it’s an opportunity for investors in AutoZone to potentially benefit from. Over the last decade, one financial engineering lever AutoZone has pulled is that it has bought back nearly half of its stock. Many successful investors have spoken publicly about what this means for investors, but in general, if a company buys its stock back at too high a price, that is eroding shareholder value, whereas if it is purchased back at a discount to its intrinsic value, it can increase shareholder value. In the case of AutoZone, management has done a satisfactory job to date, which gives me confidence in their ability to continue to do so. In addition to share buybacks, the management team has strategically managed its net working capital, debt, accounts payable, and accounts receivable successfully over the last decade, and has the opportunity to continue to do so into the future.

-

RISK FACTORS

Although AutoZone has competitive advantages and opportunities ahead, it is not without risks that could negatively impact the company and/or prove our financial models to be inaccurate. The major risks for AutoZone going forward are:

- Electric vehicles. The risk of electric vehicles (“EV’s”) is one that is widely known for AutoZone and its industry as a whole. The expectations for this risk are likely already priced into the stock, but if the risk is worse than expected by investors currently, AutoZone’s stock could be negatively affected. EV’s are a risk to AutZone because they generally require less maintenance than internal combustion engines. EV’s do not have oil changes, fuel filters, spark plugs, timing belts, differential and transmission fluid, and many other parts than traditional cars do. There are of course still parts that AutoZone can provide to EV owners. For example, it currently provides struts, brake pads, various glass replacements, air filters, windshield wipers, and headlights for Tesla vehicles. However, the issue is the quantity of repairs and parts required. With EV’s, it’s likely significantly less than traditional cars. Also, as EV’s improve, manufacturer warranties are likely going to lengthen, whether it be in terms of miles or years, with the potential of being forever as a selling point, which could significantly cut into AutoZone’s business.

- Competition. The risk of competition is also another risk that many market participants are aware of. It’s no secret that Amazon, Walmart, O’Reilly Automotive, Advanced Auto Parts, and many others are competitors to AutoZone. There are ways for AutoZone to potentially beat these competitors, but there is significant competition and the industry is ripe for disruption.

- Fewer DIY’ers. This can come from a variety of reasons, but one of the most common is Millennials. Today, fewer people than ever before are going into trades and learning skills related to those careers. This could translate into fewer and fewer people being able, and willing, to do automotive repairs themselves. If this trend continues, there would be fewer DIY’ers buying parts from AutoZone. Also, newer cars are being significantly more complex, making it difficult to work on for everyday people. New vehicles are hitting a point where it is sometimes difficult for independent repair shops to work on them due to the new technology and computer systems. This does not bode well for the future of automotive DIY’ers, independent repairs shops, and therefore this segment of AutoZone’s business.

- Lack of individual’s automobile ownership/travel. There is no concrete evidence, research, or reports showing that individual’s automobile traveling is, or is going to, decrease. However, if we remove ourselves from strictly data and think a bit more intuitively, it makes logical sense that as Millennials and Gen Z become a larger percentage of the population, and ridesharing apps like Uber and Lyft become more popular, there is the possibility for there to be less individuals traveling via automobiles they own (and therefore would be required to fix). In addition, there is the looming possibility that autonomous vehicles will be here in the near future. We will have to wait and see what those vehicles look like and the maintenance required, but if it leads to less individual vehicle ownership and more commercial ownership, this may not bode well for AutoZone.

- Change in vendor relationships. We discussed previously AutoZone’s ability to extend its accounts payables balances due to its strong relationships with its vendors. This has a large impact on AutoZone’s business and capital structure. If these relationships deteriorate, or change due to reasons outside its control, such as changes in the economic or financial markets, AutoZone’s business could be materially negatively impacted. Management stated in its Q1 2021 earnings call, “We plan to continue leveraging our inventory purchases; however, our ability to do so may be limited by our vendors’ capacity to factor their receivables from us. Certain vendors participate in arrangements with financial institutions whereby they factor their AutoZone receivables, allowing them to receive early payment from the financial institution on our invoices at a discounted rate. The terms of these agreements are between the vendor and the financial institution. Upon request from the vendor, we confirm to the vendor’s financial institution the balances owed to the vendor, the due date and agree to waive any right of offset to the confirmed balances. A downgrade in our credit or changes in the financial markets may limit the financial institutions’ willingness to participate in these arrangements, which may result in the vendor wanting to renegotiate payment terms. A reduction in payment terms would increase the working capital required to fund future inventory investments.”

-

SUMMARY

AutoZone is a brick and mortar retailer and an ecommerce company that sells aftermarket automotive parts, accessories, and tools to commercial and do-it-yourself customers. It is a relatively stable company that generates strong cash flows, profits, and is growing, but it does not come without significant risks. It is possible that AutoZone successfully expands its distribution network and improves its ecommerce operations by opening new stores, it continues to successfully expand internationally, and management is financially savvy with both its stock and its balance sheet. However, it is also possible that EV’s erode AutoZone’s business, competition steals material market share, less individual’s and independent repair shops are interested, or able, to fix vehicles themselves, fewer people own vehicles, and there is a relationship deterioration between AutoZone and its vendors, resulting in a less optimal capital structure and inventory management. This is why investing is more often an art than a science.

After reading all of this information, you’re probably wondering – so, do I buy AutoZone stock? Well, it’s not quite that simple, and of course, I cannot give specific investing advice, but I will walk you through how I am personally thinking about AutoZone as an investment.

I have shared a personal story on our Millennial Investing podcast many times about how I was so wrongly approaching value investing when I first got started. In short, I thought I was a value investor by strictly buying companies that looked “cheap” based on my DCF models. I assumed, if my DCF models said the stock was cheap, it was a buy, and I was buying an “undervalued company”. I quickly learned this was not true value investing and that just because I input my assumptions into the DCF model, that didn’t mean they were right or that the market would agree with me.

I also didn’t take into account the momentum of the stock I was considering. Oftentimes, I would buy a company in which I thought was undervalued, then the stock would fall, fall, and continue to fall, with negative momentum indicators being clear. I missed the clear negative indicators, causing me to buy into a “falling knife” situation.

As I analyzed AutoZone, it brought me back to those days in my investing career. On paper, AutoZone seems undervalued and like a potentially great investment. If you input certain growth numbers into your DCF models, it can even look significantly undervalued. However, that is purely quantitative and does not take into consideration the future of the business and its qualitative aspects. What I did wrong early in my investing career was exactly that — I did not look at non-financial aspects of the business, nor did I try to think logically about the future of the company and its industry.

Having learned from those experiences and growing as an investor over the past eight years, I am now cautious when considering a business like AutoZone. Quantitatively, I don’t have many reservations about the company, but qualitatively, I am far more skeptical about the future of its industry.

In addition, it is not enough to simply analyze a company in a vacuum and make an investment decision. Investors must compare their expected return of one investment to that of another option available. Your dollar can only be invested in one place at a time — choosing the optimal place for that dollar to be invested is equally as important, if not more important.

According to our TIP Finance Momentum tool, AutoZone is currently green, meaning it has positive momentum. This helps alleviate my concern for a potential falling knife situation. However, from a qualitative perspective, I am not convinced that AutoZone will be able to continue to thrive in this industry, nor am I convinced that AutoZone is the best place to invest my dollar. Would our dollar be better invested in our previously analyzed company? Maybe the S&P 500? Maybe a different asset class altogether?

Nearly all companies have a price in which it is a good buying opportunity. At today’s price, I personally am not purchasing AutoZone stock. However, if the stock declined enough to provide a significant margin of safety to my calculated intrinsic value, without any deterioration to its business or my thesis, I would consider allocating a portion of my portfolio to a position in AutoZone.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclosure: The author, Robert Leonard, as of this writing, of the companies mentioned, only holds a long position in Square, Inc. (SQ), with no intentions of initiating a position in any other company mentioned in this article within the next 72 hours. The article was written himself, and it expresses his own opinions. He is not receiving compensation for it (other than from The Investor’s Podcast Network). He has no business relationships with any company whose stock is mentioned in this article. The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. Robert is not a financial advisor. Please always do further research and do your own due diligence before making any investments.