Intrinsic Value Assessment of Civeo Corporation (CVEO)

By Christoph Wolf From The Investor’s Podcast Network | 21 July 2023

INTRODUCTION

Civeo Corporation (CVEO), which was founded in 1977, provides workforce accommodations and hospitality services to various industries such as energy, mining, and construction. The company specializes in offering remote site accommodations in the US, Canada, and Australia, namely temporary housing, catering, and other essential services, to support the needs of workers in remote or challenging locations. CVEO’s offerings range from traditional camps to modern lodges, featuring comfortable living quarters, dining facilities, and recreation areas.

CVEO’s strategic location selection, efficient operations, and ability to scale their accommodations based on customer demand contribute to their competitiveness in the industry. By partnering with clients, the company provides tailored solutions to meet specific accommodation needs.

The company completed its spin-off from Oil States International Inc. in 2014. Unfortunately for CVEO, just at that time global oil prices slumped. Since the energy business is one of the largest customers of the company, its stock price dropped sharply from its all-time high of $330 in 2014 and today stands at a paltry $19.87. Is this now a good entry level or should investors remain cautious?

INTRINSIC VALUE OF CVEO

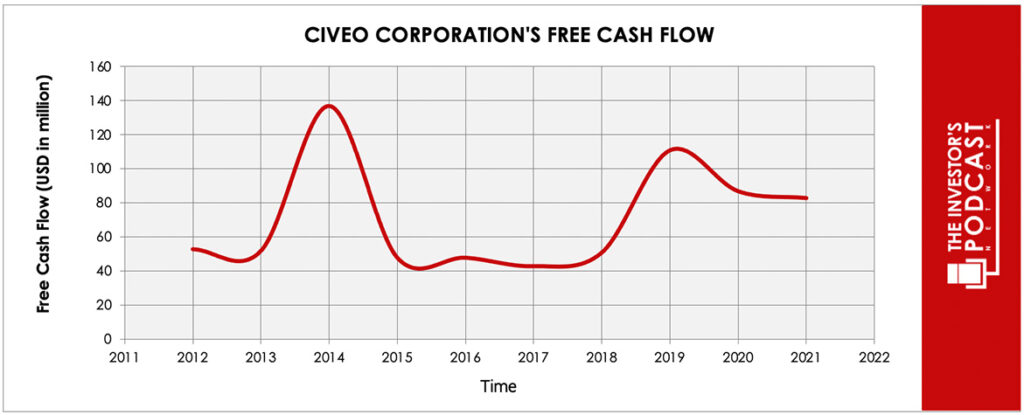

To determine the intrinsic value of CVEO, let’s start by looking at the company’s history of free cash flow. The free cash flow is important because it represents the company’s ability to retain earnings and grow the business. Most importantly, it demonstrates a return on the principal that might be invested into the ownership of equity of the business. Below is a chart of CVEO’s free cash flow over the past years.

As one can see, the free cash flow is quite volatile and has recently turned sharply negative. To construct a model of the intrinsic value of CVEO, we will use the ten-year average of the FCF-values as starting point. Based on this value, we then assume three different scenarios for the future.

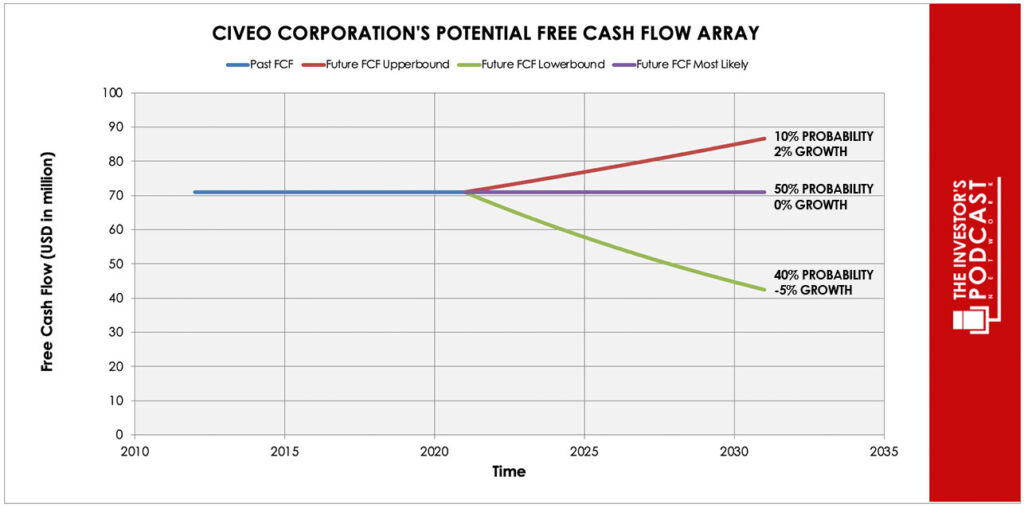

Each line in the above graph represents a certain probability for occurring. Due to the company’s recent headwinds, a conservative estimate is used. We assume a 10% probability for the upper growth rate of 2% per year. The baseline scenario is zero growth, which we assign a 50% probability. The worst-case scenario is an annual decline of 5% and is assigned a 40% probability.

Even with these conservative assumptions, CVEO can be expected to give a 23.5% annual return at the current price of $19.87. Now, let’s discuss how and why those free cash flows could be achieved.

THE COMPETITIVE ADVANTAGE OF CVEO

- Extensive experience and industry expertise. CVEO has a long history and deep expertise in providing workforce accommodations and hospitality services. Their extensive experience allows them to understand the specific needs and challenges of their customers in the energy, mining, and construction industries. This expertise enables CVEO to deliver tailored solutions and superior customer service to their clients.

- Strategic location selection. CVEO strategically selects locations for their accommodations, considering factors such as proximity to project sites, transportation infrastructure, and access to resources. This enables them to offer convenient and efficient accommodations, which reduces travel time and costs for workers and clients.

- Scalable and flexible operations. CVEO’s business model is designed to be scalable, allowing them to adapt to changing customer demand. They can rapidly expand or reduce their accommodation capacities based on project requirements. This flexibility provides CVEO with a competitive edge, as they can efficiently align their resources with client needs and capitalize on market opportunities.

When looking at various investing opportunities in the market today, let’s compare the expected return of CULP to other ideas. First, one could invest in the ten-year treasury bond which is producing a 3.8 % return. Considering the bond is completely impacted by inflation, the real return of this option is likely negative. Currently, the S&P 500 Shiller P/E ratio is 31.8. As a result, the US Stock market is priced at a 3.15% yield. If one were to invest in the S&P 500, they might purchase a low-cost ETF to take advantage of this return.

MACRO FACTORS

For the business of CVEO, the overall economic conditions play a significant role. These include variables such as GDP growth, employment levels, and industry investments. These factors directly impact the demand for workforce accommodations and hospitality services provided by CVEO.

Additionally, industry-specific trends have a big influence on CVEO’s macro environment. Changes in oil prices, mining activities, or infrastructure development can significantly impact the demand for accommodations and related services in sectors such as energy, mining, and construction.

The global energy transition and sustainability efforts also have implications for CVEO’s business. As the world shifts towards cleaner and renewable energy sources, the demand for accommodations may undergo changes. CVEO needs to align its services with sustainability goals and adapt to emerging trends in the energy sector to remain competitive.

Market competition is also a constant factor in CVEO’s considerations. The company operates in a competitive landscape where other providers offer similar accommodations and services. CVEO must continuously monitor competitors’ strategies, pricing, and value propositions to maintain its market position and competitive advantage.

Furthermore, technological advancements play a crucial role in shaping CVEO’s business. Innovations in remote communication, digital platforms, and automation influence how workforces operate, and which accommodations are needed.

In summary, CVEO’s macro environment includes economic conditions, industry trends, sustainability efforts, market competition, and technological advancements. One can easily see that handling and planning CVEO’s business is quite complex.

RISK FACTORS

- Shaky financials. CVEO’s book value has steadily decreased over the last 10 years. Additionally, the company’s consistent negative profits raise concerns about its ability to generate sustainable earnings and achieve profitability in the long term, posing a risk to potential stock investors.

- Economic downturns. CVEO’s financial performance is vulnerable to economic downturns that can impact industries like energy, mining, and construction. During periods of economic contraction, companies may reduce capital expenditure and workforce, leading to lower demand for accommodations and hospitality services provided by CVEO.

- Industry volatility. CVEO’s business is closely tied to industries that can experience volatility due to factors like commodity price fluctuations, regulatory changes, and geopolitical events. These industry-specific risks can negatively affect the demand for accommodations and related services.

- Operating risks. CVEO operates in remote and challenging environments, which present operational risks such as logistical challenges, security concerns, and environmental risks.

SUMMARY

As a potential investor in CVEO’s stock, there are multiple opportunities to highlight. CVEO operates in the workforce accommodations and hospitality services industry, providing essential services to industries such as energy, mining, and construction, which have long-term demand. Additionally, CVEO’s expertise, strategic location selection, and scalable operations position the company to benefit from recovering industries and capitalize on new project opportunities.

Unfortunately, the risks are even more obvious. CVEO is exposed to economic risks due to its dependence on the industries of its customers, which are susceptible to cyclical downturns and fluctuations in commodity prices. This is highlighted in the company’s constantly eroding book value and its consistent inability to generate a profit.

While the expected annual return of 23.5% looks very juicy, investors should strongly bear these risks in mind before buying the stock.

To learn more about intrinsic value, check out our comprehensive guide to calculating the intrinsic value of stocks.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.