WeWork, WeFailed

Hi, The Investor’s Podcast Network Community!

Could YouTube keep eating TV streaming market share? It sure does seem like it.

YouTube has become the most popular TV streaming service. That doesn’t even include all our time spent on YouTube via our laptops and phones.

💭 And given kids, teens (and, let’s be real, many adults) spend more than an hour daily on the YouTube app — separate from YouTube TV — that’s a lot of minutes…even more than Netflix!

— Matthew & Shawn

Here’s today’s rundown:

POP QUIZ

What has been the most downloaded app each of the past two years? (Scroll to the bottom for the answer)

Today, we’ll discuss the three biggest stories in markets:

- It’s Fed Day, but what about the U.S. Treasury?

- WeWork shares plunge on bankruptcy report

- Private equity dealmaking dries up

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Photographs in the Carol M. Highsmith Archive, Library of Congress, Prints and Photographs Division.

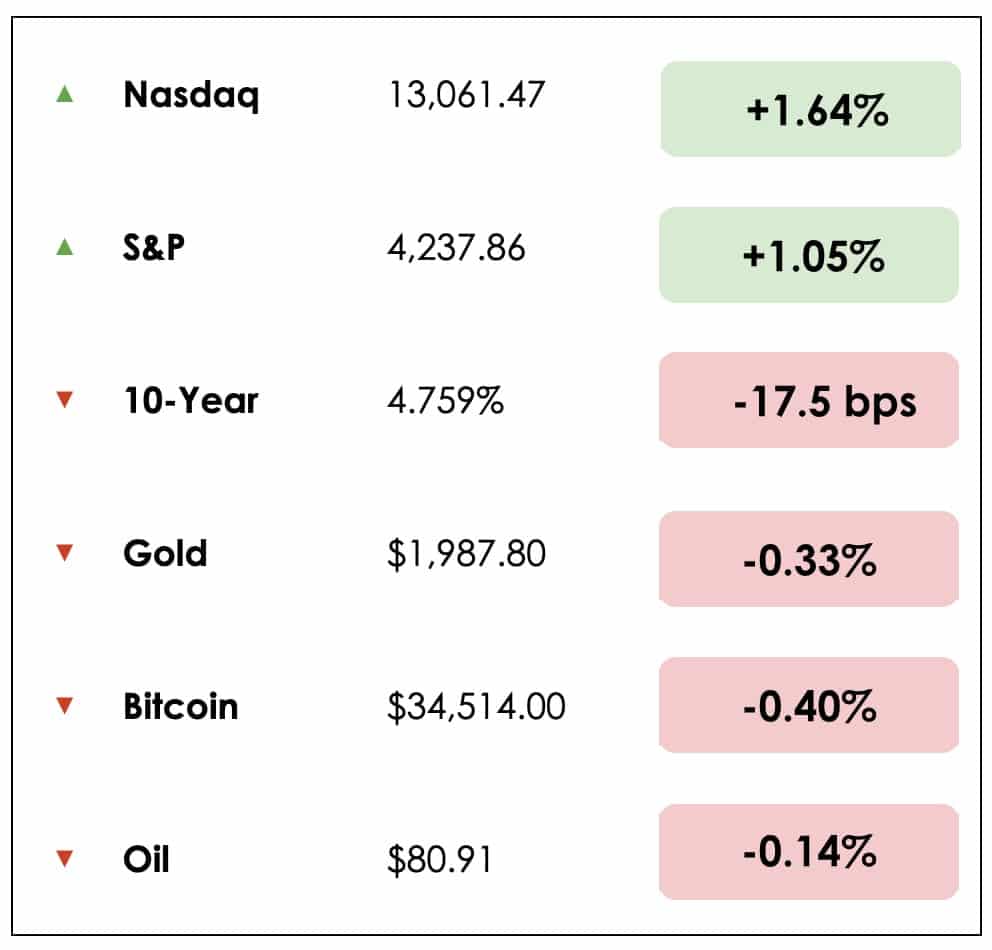

Rarely does anything steal the Fed’s thunder, but Wednesday was one of those moments. As the Fed affirmed its widely expected decision to keep interest rates unchanged, Wall Street watched a different D.C.-based institution: the Treasury Department.

While Fed decisions, and even hints about Fed decisions, would normally be the biggest markets story, Bloomberg called it “the No. 2 event on Wednesday.”

- Instead, investors were keen to learn more about the Treasury Department’s new borrowing plan.

- We often hear about the Treasury bond market’s importance generally, but what’s often overlooked is that the supply of these bonds is always in flux (not just the demand).

Supply & demand: As the issuer of Treasury bonds to finance federal spending deficits, the Treasury Department shapes the supply of Treasury bonds in markets and gives investors advance notice.

- The question, then, is whether there’s enough ‘demand’ from investors to fund this borrowing at current prices (for bonds).

- If not, prices must go lower to attract investors, which means higher yields on Treasuries.

Although Wall Street roughly knows how much the government is spending and, therefore, how much money the Treasury Department must borrow from investors, it’s the composition of this supply issuance that’s noteworthy.

Why it matters:

Talkin’ composition: Different types of investors buy Treasury bonds of different maturities. In other words, buyers of 30-year Treasuries are often different people/funds/institutions than those buying 2-year Treasuries.

And the Treasury Department has discretion over what types of Treasury bonds it sells to investors to cover deficits and keep the government functioning.

- Instead of operating as one big, singular market, the Treasury market is like a series of smaller markets correlating to each type of Treasury bond (from 3-month bills to 10 and 30-year bonds.)

- Consequently, investors want to see which Treasury bond types will face the most disruption from new issuances.

Where we’re at: This summer, the Treasury Department leaned into selling more bonds that don’t come due for decades, which weighed on long-term Treasury bond prices and pushed yields higher.

- But now that issuing 10 and 30-year bonds is more expensive (higher yields), the Treasury may increasingly turn to selling Treasuries that come due sooner, which just means refinancing is needed sooner.

- Hundreds of billions of dollars ($776 billion, to be precise!) must be raised in the fourth quarter. The blend of short-term and long-term bonds that the Treasury Department issues will ripple through financial markets.

COMING SOON…

Gif by kevlavery on Giphy

We first teased this yesterday, but there’s still a chance to get on the list.

We’re launching something new that hasn’t been offered in years but was very popular when we offered it before — And it’s back again.

Click the button below to ensure you’re on the list for more details, special offers, updates, and the release date.

Photo by Austin Distel on Unsplash

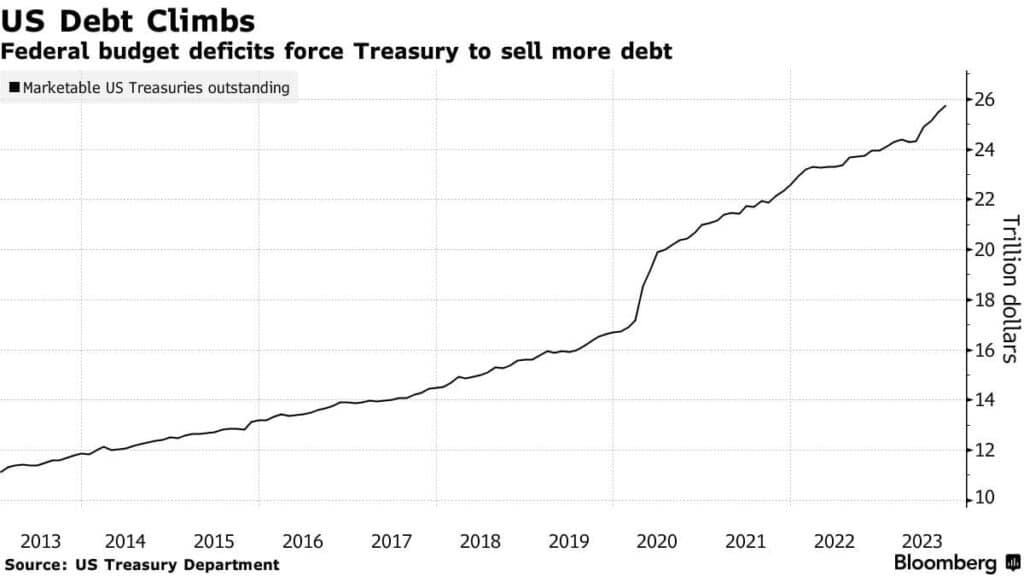

The days of WeWork might be numbered after a Wall Street Journal report this week signaled the end for the coworking spaces provider.

WeWork could file for bankruptcy as early as next week, which sent its stock down 50% Wednesday to a record low $1.10 per share, or 98% year-to-date.

- WeWork agreed with creditors to extend a 30-day grace period to make interest payments on its debt, but that “forbearance agreement” ends Nov. 6.

- In 2019, WeWork was one of the world’s most valuable startups at $47 billion. Now it’s worth about $100 million. Among the biggest losers is SoftBank, which invested billions in the once highly-touted startup led by Adam Neumann.

- “WeWork looks as if it could be coming to a messy end,” said one investment director. “Its major backer, SoftBank, must have reached a point where it can no longer justify bailing the business out.”

Chapter 11 bankruptcy lets a company stay open while it tries to repay its debts. Legal tools for a turnaround are also available, which might help WeWork abandon big leases in expensive city centers like Manhattan, Chicago, and San Francisco.

- In June, WeWork had about $3 billion in long-term borrowings and $13 billion in long-term lease obligations.

- No, the pandemic didn’t help WeWork as firms fled offices. But mismanagement and a shaky business model — take long-term leases and rent them out to companies for short periods — didn’t hold up.

As of this summer, WeWork had about 777 locations in 39 countries, including 229 in the U.S. The company blew through $530 million in the first half of 2023 alone, with only about $200 million in cash as of June.

Why it matters:

Trickle-down effect: Said one New York senior portfolio manager: “WeWork remains a significant tenant in some major urban office markets, and its failure or restructuring may further weigh on industry fundamentals.”

- WeWork has been working on a restructuring plan throughout the year. It also shook up its board and tried renegotiating leases with landlords because of how much the office real-estate market has changed in the past few years.

- Hotshot no more: Venture capitalists and techies loved hyping up WeWork, known for its trendy, flexible office environments with fun whiteboards, free coffee, and team-building events.

- In theory, it was a good idea that attracted big investment money. But in practice, it failed. Neumann, the co-founder, was pushed out after concerns about his management style, and it spiraled downward from there.

It’s yet another cautionary tail of a high-flying, over-valued tech company that has fallen sharply over the past two years.

MORE HEADLINES

😎 Breaking down the perks of being a Hollywood CEO

💬 The infant mortality rate in America just rose for the first time in decades

📖 One in 10 Americans don’t own a single physical book

🏠 Adjustable-rate mortgage demand jumps nearly 10%

💨 Massive windfarm project to be built off Virginia coast

⚽️ Saudi Arabia set to host 2034 World Cup

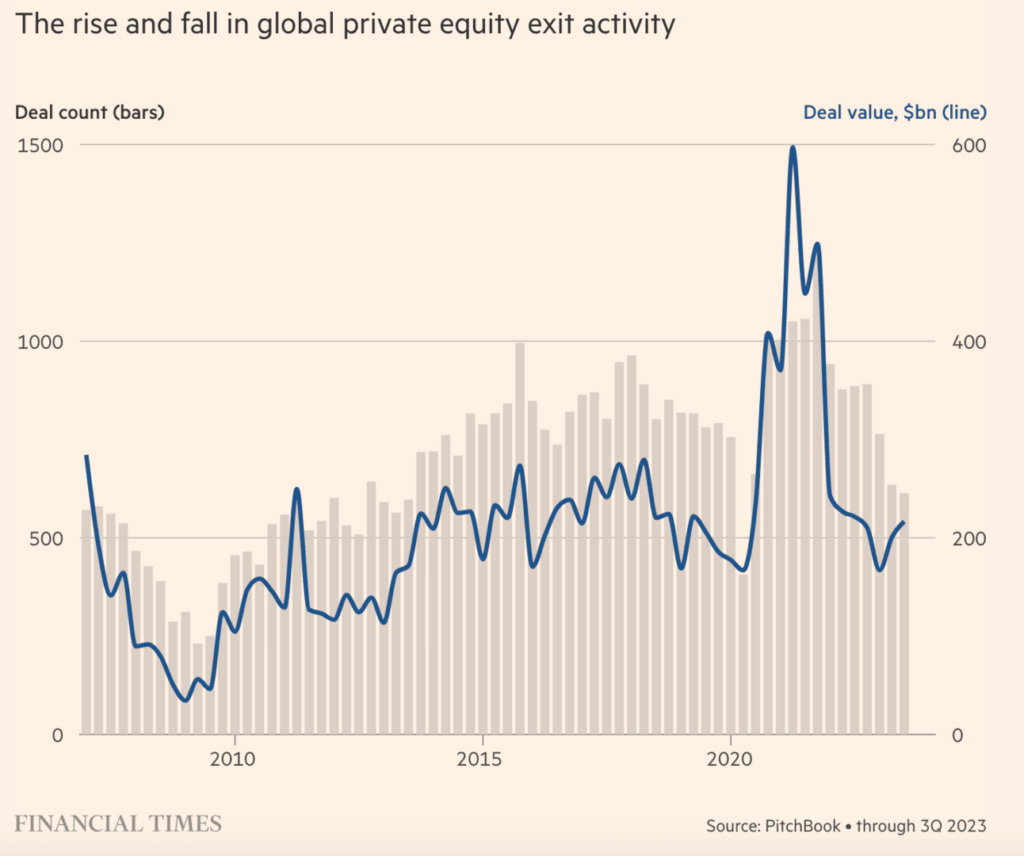

🛑 For Private Equity, Higher Rates Pummel Dealmakers

Gif by mostexpensivest on Giphy

See that guy? He’s sitting pretty, closing another deal from his boat. But that was so 2021, the pinnacle of private equity: a record $1.2 trillion in deals were struck.

The days of cheap money are long gone, and there’s no telling when they’ll return. The private equity firms that relied on easy money to get rich are now grappling with rising interest costs. In a way, it’s like playing an entirely new ballgame.

Take Carlyle, one of the world’s top private equity firms. In March, it couldn’t raise the $3 billion equity commitment from investors that it needed to ink a record $5.5 billion private loan, which would have put it in control of Cotiviti, a healthcare software company valued at $15 billion.

- It was March, so some in the industry blamed the banking crisis. Others blamed company-specific factors.

But really, it was all about rising interest rates over the past 18 months. Rates being “higher for longer” has dried up a lot of big deal-making after a banner year for many top players in 2021.

Wind in your face: Private equity benefited greatly from a decade-plus of low interest rates. Executives used cheap debt to buy companies, grow their wealth, and dominate the finance space.

- Here’s one managing director: “Many of the reasons these guys outperformed had nothing to do with skill. Borrowing costs were cheap and the liquidity was there.”

- “Now, it’s not there…Private equity is going to have a really hard time for a while…The wind is blowing in your face today, not at your back.”

Why it matters:

The Federal Reserve wanted to bring down inflation by raising rates. But it also wanted to slow down other stuff, like private equity dealmaking. Mission accomplished.

- Top players insist that the challenges won’t last much longer. They say some of the best deals happen during times of stress, similar to how Warren Buffett made a fortune buying undervalued businesses during times of panic.

- A few big firms, like Blackstone, say they have a lot of “dry powder,” or investor cash available.

But they’re outliers. Most in the industry know they’ve never had to play with these new rules, and heavily indebted companies with their borrowings at or near maturity are left out to dry.

“The tide has gone out,” says a private equity institutional adviser. “The rocks are showing and we are going to figure out who is a good swimmer.”

QUICK POLL

How closely do you like to follow Jerome Powell and the Fed’s moves?

Yesterday, we asked: How do you store most of your cash?

—34% of readers store cash in a high-yield savings account. Another third stores cash in money market mutual funds, and roughly 27% of readers store their cash in regular checking/savings accounts.

— “Split between high-yield savings account and money market funds while interest rate returns remain elevated,” one reader said.

—Then there’s the ~6% of readers who apparently keep their cash under the mattress!

TRIVIA ANSWER

TikTok has been the most downloaded app each of the past two years. Instagram, Facebook, and WhatsApp follow.

See you next time!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

All the best,

P.S. The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more!

Join our subreddit r/TheInvestorsPodcast today!