The Changing World Order

Hi, The Investor’s Podcast Network Community!

💭 We’re back from Omaha, brimming with insights from the Oracle himself, aka Warren Buffett (and Charlie Munger, too). To the readers we met there, it was a pleasure — hope to see you, and more, next year!

We missed King Charles III’s coronation and the Kentucky Derby. Anything else happen while we were gone? Reply to let us know.

A few reflections from Berkshire’s shareholder meeting:

- We can all only hope to be as spry and cogent as Buffett is at 92: He, with Munger at his side, riffed on audience questions for about five hours Saturday

- Buffett, as always, remains unwaveringly optimistic about America, and Munger is unsurprisingly skeptical of many things, namely AI

— Shawn

Here’s the rundown:

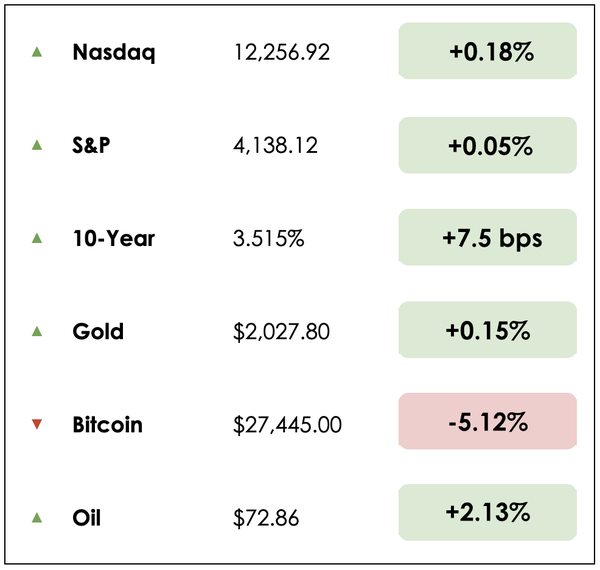

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- Why gold prices are soaring

- Berkshire Hathaway’s shareholder meeting

- Plus, our main story on the changing world order

All this, and more, in just 5 minutes to read.

Today’s trivia: A defunct check from Steve Jobs for $175, signed in 1976, is expected to fetch how much at auction?

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

💲 Gold Sits Near All-Time High (FT)

Gold is sitting near an all-time high as resurgent Chinese demand and fears over the health of regional U.S. banks have helped fuel a six-month rally in the precious metal.

- Consumers in China rushed to buy more jewelry, bars, and coins in the first three months of the year after Beijing lifted its zero-Covid policies, per the World Gold Council, an industry body.

- The failure of three regional U.S. banks has also prompted investors to turn to the yellow metal, which acts as a store of value in times of uncertainty.

Other spikes in the price of gold include the Great Depression, the Great Financial Crisis, and the 2020 pandemic.

Why it matters:

The rally has extended further on a belief that the Federal Reserve is done raising interest rates this cycle.

- Expectations of interest rate increases diminish the attraction of gold for investors as they miss out on the yield from bonds by holding bullion, which doesn’t generate cash flows.

John Reade, chief market strategist at the WGC, told the Financial Times that whether gold could push higher would depend on whether investors saw signs of a worsening banking crisis and a weaker dollar.

- “There’s push and pull from different sides but what we’ve yet to see unleashed is widespread financial investment in gold,” he said. “It should from here certainly take it to the all-time high. The question is can it go on from here and make significant gains.”

📢 Buffett & Munger Sound Off (WSJ)

At Berkshire’s annual shareholder meeting on Saturday, Warren Buffett and Charlie Munger offered career and life advice, and insights into some of their holdings. Here are a few takeaways.

- “You should write your obituary and then try to figure out how to live up to it,” Buffett said. “It’s not that complicated.”

Munger directed his ire at wealth managers. “Having a huge proportion of the young and brilliant people going into wealth management is a crazy development in terms of its natural consequences for American civilization. We don’t need as many wealth managers as we have.”

- He added a reference to the recent banking crisis: “I don’t think a bunch of bankers, all of whom are trying to get rich, leads to good things…Bankers should be more like engineers…avoiding trouble instead of trying to get rich.”

- Later, Buffett encouraged those in attendance to resist criticizing or vilifying others. “I’ve never known anybody that was basically kind that died without friends. And I’ve known plenty of people with money that have died without friends.”

Why it matters:

Buffett also addressed Berkshire’s big bet on oil stocks, making it the biggest shareholder of both Occidental Petroleum and Chevron.

- “We’re not going to buy control (of Occidental). We’ve got the right management running it, and we wouldn’t know what to do with it.”

Buffett praised Apple, Berkshire’s biggest stock investment, with CEO Tim Cook in attendance. “It just happens to be a better business than any we own,” Buffett said, adding that he doesn’t understand the phone’s technology but fully understands consumer behavior.

- While Munger is skeptical, Buffett maintains his bullishness on America. If he could start life and pick when and where he would be born, he would undoubtedly pick the U.S. today.

- “The world is overwhelmingly short-term focused. I’d love to be born today and go out with not too much money and hopefully turn it into a lot of money.”

MORE HEADLINES

🤕 Over 700 banks face unrealized losses of more than 50% of their capital

⛽ Crude oil prices rally as recession fears fade, for now

📝 Everything Warren Buffett & Charlie Munger said at the Berkshire annual meeting

What to know

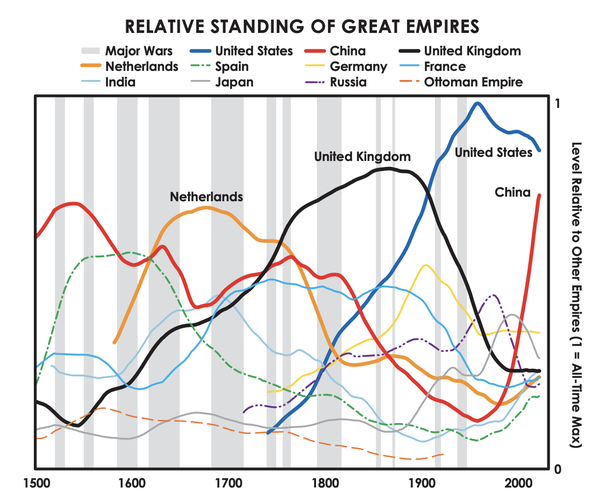

In his latest book, The Changing World Order: Why Nations Succeed and Fail, the legendary investor Ray Dalio studies the rise and fall of major global empires over the last 500 years to understand what causes shifts in power over time and whether the same factors cause history to repeat itself.

Turns out, they do. Let’s discuss

The current World Order

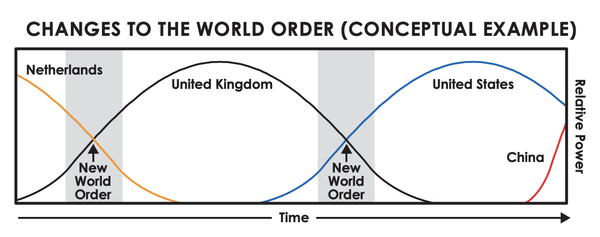

“The Changing World Order” refers to the shift in power balances between nations, where one empire falls, and a new one takes over. This has occurred throughout history, with the cycles lasting about 250 years for great empires.

The current world order — the American World Order — formed after the Allied victory in World War II. In 1944, the Bretton Woods agreement laid out a new global monetary system, making the dollar the world’s de facto reserve currency for saving wealth and settling global trade.

Measuring power

Dalio identified eight key metrics to measure an empire’s power.

Those metrics are: education, inventiveness and technology development, competitiveness in global markets, economic output, share of global trade, military dominance, financial power, and currency strength.

After quantifying these metrics, Dalio determined: “For the first time in my life, the U.S. is encountering a true rival power…If trends continue, China will be stronger than the United States…Or, at the very least, it will be a worthy competitor.”

This threatens the U.S. dollar as the world’s primary reserve currency, with the Chinese yuan gaining traction over the past few years, becoming the fifth most-traded currency.

Studying world orders

Dalio observed three things in recent years that pushed him to study changing world orders throughout history:

- First, countries didn’t have enough money to pay their debts, even after lowering their interest rates to zero. Because of this, central banks began printing a lot of money.

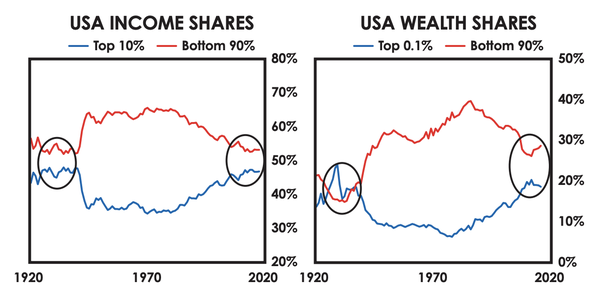

- Second, big internal conflicts emerged due to growing gaps in wealth and values. This showed up in political populism between the left and right.

- Third, increasing external conflict between a rising great power and the leading great power, as is now happening with China and the U.S.

The Big Cycle

He realized that all these events had happened together many times before. Almost every time, it led to changing domestic and world orders in a cyclical pattern he calls the “Big Cycle.”

The Big Cycle typically begins after a major conflict establishes the new leading power to build its world order. This leads to the second stage of the cycle, where international resource allocation and governing systems are built and refined.

Then, because no one can or wants to challenge the new world power, there’s usually a period of peace and prosperity — the third stage.

However, as the cycle progresses to the fourth stage, people get used to this peace and prosperity, increasingly betting on it continuing, so they borrow more money than they earn. The empire’s share of trade grows, and its currency becomes a reserve currency, which enables even more borrowing.

At the same time, this increased prosperity distributes wealth unevenly, so the wealth gap typically grows between the rich and the poor. All of this eventually leads to a financial bubble.

Eventually, the financial bubble bursts, spawning painful economic conditions and intense conflict between the rich and poor. This spurs the printing of money to ease financial conditions at the expense of the reserve currency’s value (inflation).

When a new rising power gets strong enough to compete with the prevailing world power, they challenge each other economically (tariffs, trade restrictions, etc.), financially (limiting capital flows, blocking private investments, etc.), and even militarily.

Out of these external and internal conflicts emerge new winners and losers. The winners then create the next world order, and the cycle begins again and continues to repeat across time, according to Dalio.

Final thoughts

He shares two important principles that investors can use to navigate these cycles:

- Principle 1: When central banks print a lot of money to ease pain after bubbles burst, buy stocks, gold, and commodities to protect your wealth and its purchasing power

- Principle 2: To understand the fallout from changing world orders and where we are in the Big Cycle, you need to be a diligent student of history

Dive deeper

For examples of how world orders have changed and the principles for navigating them, check out this excellent write-up from our colleague Rebecca Hotsko.

And if you find it helpful, make sure to share it with others!

TRIVIA ANSWER

The check from Apple’s founder Steve Jobs, featuring the company’s first address, is expected to sell for more than $25,000 at auction 😅

Last year, an original Apple-1 computer prototype from the mid 1970s went for $677,000.