Warren Buffett AI

Hi, The Investor’s Podcast Network Community!

😬 Defaults and vacancies are rising once again at high-end office buildings, the latest signs that remote work and rising interest rates are impacting all corners of the real-estate market.

Elsewhere, in the latest FTX drama, founder Sam Bankman-Fried (SBF) has been charged with conspiring to bribe Chinese officials to regain access to more than $1 billion in frozen cryptocurrency.

Just another Tuesday for the embattled crypto exchange and its fallen hero.

Here’s the rundown:

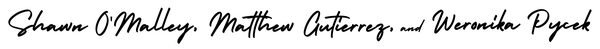

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- What’s behind big changes at Alibaba?

- A Warren Buffett AI tool does the grunt work

- Plus, our main story on why layoffs can be a long-term positive

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

💭 Alibaba to Break its Empire into Six Pieces (Reuters)

Explained:

- Alibaba, the Chinese e-commerce conglomerate once valued at more than $800 billion, announced plans to split into six units with new fundraisings or listings for most of them. Its U.S.-listed shares, down nearly 70% since 2020 following regulatory crackdowns from the Chinese government, rose over 11% in response.

- The 24-year-old firm will split into the following areas: cloud computing, Chinese e-commerce, global e-commerce, digital mapping and food delivery, logistics, and media and entertainment. We wrote a longer profile on the “Amazon of China” in January.

- Alibaba’s CEO commented, “The original intention and fundamental purpose of this reform is to make our organization more agile, shorten decision-making links and respond faster” so the company can “return to the mindset of an entrepreneur.”

Why it matters:

- China’s tech industry has cowered in the past few years, aiming to appease the Communist Party’s increased oversight, which dried up deals and dampened appetites for risk. But this restructuring marks one of the largest recent corporate undertakings for a major tech firm in the country, as authorities have softened their tone toward the private sector to, in part, spur growth after three years of strict Covid-19 lockdowns.

- Interestingly, the restructuring plans come just one day after Alibaba’s charismatic founder, Jack Ma, who was targeted for speaking out against the Chinese government’s regulators and accused them of stifling innovation, returned to China after moving overseas for more than a year.

- One macroeconomist remarked, “It does seem something of a coincidence that this is happening just as Ma seems comfortable returning. To me, it suggests something that Alibaba has been wanting to do for some time, but has been waiting for the opportunity.

🤖 “Warren Buffett” AI Tool Quickly Parses Corporate Filings (Decrypt)

Explained:

- As many know from firsthand experience, the business and legal world is filled with wordy documents and contracts that can take hours to review.

- But Mayo Oshin, a UK-based artificial intelligence (AI) engineer, is working to change that. His latest project, named after Warren Buffett, targets financial filings.

- Oshin adds, “There have been many complaints about how long it takes to read annual reports. For example, investors in Tesla may want to make sense of current risk factors or how management is performing, but the annual reports can be hundreds of pages long.”

Why it matters:

- The project illustrates how AI can assist in analyzing lengthy documents, enabling investors to extract the most important takeaways. Think of it like an AI-powered manifestation of Warren Buffett at your fingertips: The tool functions as a chatbot that doesn’t just fetch and synthesize data but, rather, can actually have conversations inspired by its findings.

- Oshin says, “I wanted to highlight that the demo can perform analysis over time using a time-series approach.” In a video, he demonstrates the bot’s analysis of cash flow performance over multiple years.

- You can imagine how financial analysts and lawyers alike might tremble at the idea of advanced chatbots replacing them. While that might be further away, Oshin emphasizes, “Many people believe that AI is expensive, but in reality, it can be cost-effective.” And if you can use AI to save a few hours of reading, or if companies can minimize their reliance on expensive white-collar consultants, then cost-effective AI may be an understatement.

LAYOFFS CAN BE LONG-TERM POSITIVE

Introduction

Layoffs aren’t fun. Almost anyone who’s been laid off can attest to the sting of receiving that ominous phone call or email. For people with children to care for and bills to pay, the implications can be frightening.

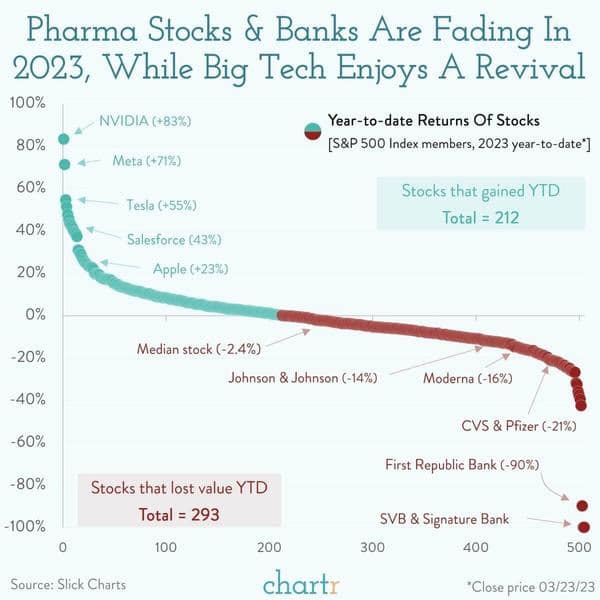

In the past year, as valuations have fallen and interest rates have risen, some of the world’s most well-known companies have laid off thousands of employees. Notably: Amazon, Tesla, Meta, and Microsoft. Still, unemployment in the U.S. remains very low.

But there can be long-term positive effects on a micro and macro level. Employees might benefit by taking time to refocus and find a more fulfilling career – a silver lining amid the chaos of layoffs.

As Ray Dalio, founder of Bridgewater Associates, often says: “Pain + Reflection = Progress.” Dalio believes experiencing setbacks can lead to valuable reflection and growth, fostering progress.

This piece isn’t meant to sugarcoat what is undeniably one of the most painful parts about business. Simply, it’s meant to better understand the potential long-term impacts of such decisions.

Said Reid Hoffman, co-founder of LinkedIn: “A layoff is one of the most traumatic things that can happen in a company, but it’s also an opportunity for change.”

Notable benefits

The benefits of layoffs include—

Increased Efficiency: Layoffs can help companies become more efficient by removing redundant positions or underperforming employees. This can result in a leaner and more productive workforce, which helps companies be more competitive in the long run.

Cost Savings: Layoffs can help companies reduce their expenses, including salaries, benefits, and other costs associated with employment. This frees up resources for companies to invest in other areas of their business, such as research and development, new equipment or technology, or marketing and advertising, which may create new types of jobs in the future.

Industry Restructuring: Layoffs can signify larger industry changes or a shift in demand for certain products or services. Companies that adapt to these changes and restructure their operations accordingly can become more profitable and competitive in the long run.

Entrepreneurship: Some people who are laid off may choose to start their own businesses or pursue other entrepreneurial ventures. Many wonderful companies, like Apple, have started amid widespread layoffs or economic slowdowns.

Labor Market Flexibility: Layoffs often create a more flexible labor market, benefiting both employers and employees. Employers can adjust their workforce in response to changing economic conditions, while employees seek new opportunities or skills to remain competitive in the job market.

“Change before you have to,” said Jack Welch, the former CEO of General Electric: Welch advocated for constant restructuring and change within organizations, including layoffs when necessary, to stay competitive and profitable over long periods.

Jeff Bezos has said, “Invention requires a long-term willingness to be misunderstood.” Bezos has often emphasized the importance of taking risks and making bold decisions, even if they are initially unpopular or misunderstood. That includes layoffs when there are no other options.

Examples

There have been instances where layoffs have had long-term positive effects on the economy. Examples include:

The 1980s U.S. Manufacturing Industry: In the 1980s, the U.S. manufacturing industry underwent significant restructuring, which included mass layoffs. This was a difficult time for many workers and communities, but it led to a more efficient and competitive manufacturing sector, with companies focusing on innovation and technology.

The 2008 Global Financial Crisis: The 2008 global financial crisis led to mass layoffs across various industries, particularly in finance and real estate. While the immediate effects were negative, the crisis spurred entrepreneurship and innovation as people sought solutions to economic challenges.

This spawned new businesses and industries, and helped drive economic growth. The decade following the GFC was one of the most stable for Americans, with low inflation, moderate interest rates, and steady job growth.

The 2020 COVID-19 Pandemic: The COVID-19 pandemic drove mass layoffs, particularly for jobs relying on in-person interactions, such as hospitality and retail.

While the pandemic had significant negative effects on the economy, it also accelerated the shift towards remote work and e-commerce, which has the potential to drive innovation and efficiency in the long term.

Dive deeper

Check out Howard Marks’ Mastering the Business Cycle, which isn’t about layoffs, but rather how the business and investing worlds operate in similar cycles over and over. Those cycles always include a period of layoffs and restructuring.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.